When it comes to health insurance, the choice between a PPO and an HMO is one of the biggest decisions you'll make. It’s not just about acronyms; it’s a fundamental choice between flexibility and cost.

At its core, the difference between a PPO and an HMO is simple. PPO (Preferred Provider Organization) plans give you the freedom to see almost any doctor you want, including specialists, without needing a referral. The trade-off? This freedom usually comes with higher monthly premiums.

On the other hand, HMO (Health Maintenance Organization) plans are designed to be more budget-friendly. They keep costs down by using a specific network of doctors and requiring you to get a referral from your Primary Care Physician (PCP) before you see a specialist.

Understanding the Core Trade-Offs

Picking between an HMO and a PPO isn't just checking a box during open enrollment. It’s about choosing a healthcare philosophy that actually fits your life, your budget, and how you prefer to manage your health.

These two models have been the bedrock of the health insurance market for years, and each one approaches your care differently.

- Managed Care vs. Direct Access: Think of an HMO as having a team captain for your health—your Primary Care Physician (PPCP). They coordinate everything and act as a gatekeeper, referring you to specialists when needed. A PPO offers "direct access," which means you're in the driver's seat. You can book an appointment with a specialist whenever you feel it's necessary, no referral required.

- Cost Control vs. Freedom of Choice: HMOs are all about keeping your out-of-pocket costs predictable and low by having you stick to their network of doctors and hospitals. PPOs offer the ultimate freedom to go out-of-network, but that flexibility comes at a price—you’ll pay a lot more for any care you get outside their preferred list of providers.

This infographic does a great job of showing the main differences at a glance.

As you can see, the HMO path is more structured, with your PCP guiding your care. The PPO path is wide open, giving you more routes to get the treatment you need.

Key Differences Between HMO and PPO Plans at a Glance

To make the choice even clearer, let's put the most important features side-by-side. This table breaks down the factors that will have the biggest impact on both your healthcare experience and your wallet.

This is a great starting point, and for a deeper dive, you can learn more about how to compare health insurance plans in our detailed guide.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) |

|---|---|---|

| Primary Care Physician (PCP) | Required. Your PCP is your main point of contact for all healthcare needs. | Not Required. You can see any doctor, including specialists, without a designated PCP. |

| Specialist Referrals | Required. You must get a referral from your PCP before seeing a specialist. | Not Required. You can self-refer and schedule appointments directly with specialists. |

| Out-of-Network Coverage | Not covered, except for true medical emergencies. | Covered, but at a higher cost-sharing (higher deductible, copay, and coinsurance). |

| Typical Monthly Premiums | Generally lower than PPO plans. | Generally higher than HMO plans. |

| Overall Flexibility | Lower. You must stay within the plan's network and follow its rules for care. | Higher. You have the freedom to choose providers both inside and outside the network. |

Ultimately, understanding these core distinctions is the first step toward picking a plan that gives you confidence and peace of mind.

Comparing Network Rules and Provider Access

This is where the real difference between PPOs and HMOs comes into play: how you actually get medical care. It's not just about a list of doctors. This is the heart of it—defining whether you navigate your healthcare journey yourself or have a trusted coordinator guiding your path.

Getting this distinction right is the key to picking a plan that truly fits your life.

HMOs are all about coordinated care, and it all revolves around one central person: your Primary Care Physician (PCP). Think of your PCP as your healthcare "gatekeeper." They aren't just for annual check-ups; they manage your overall treatment and point you to the right specialists when you need them.

PPOs, on the other hand, are built for direct access. There’s no gatekeeper. You decide when you need a specialist and you book the appointment yourself. For many, that autonomy is priceless.

The HMO Experience: The Coordinated Care Model

With an HMO, your relationship with your PCP is everything. Before you see a dermatologist for a rash or a cardiologist for your heart, you’ll almost always need to get a referral from your primary doctor first. The system is designed this way to make sure your care is connected and necessary, which helps keep costs down by avoiding redundant specialist visits.

This structure gives your PCP a complete picture of your health. They know your history and can coordinate effectively between different specialists, making sure everyone is on the same page.

Let’s make it real. Say you twist your ankle playing basketball and think it might be serious.

- First Step: With an HMO, your first call is to your PCP.

- The Assessment: They'll examine your ankle to figure out if you need a specialist.

- The Referral: If you do, they’ll issue a formal referral to an orthopedic specialist in their network and send your medical notes over.

This process ensures the specialist has all the background info they need, but it does add an extra step to the process.

Key Insight: The HMO model is built on the idea that a good primary doctor can handle most health needs efficiently, only referring out when specialized expertise is truly required. This managed approach is a big reason why HMOs have lower costs.

The PPO Experience: Direct Access and Freedom to Choose

A PPO plan puts you in the driver’s seat. You don’t have to pick a PCP, and you never need a referral to see a specialist. That freedom is a huge selling point and the core of the difference between a PPO and an HMO.

Let’s go back to that twisted ankle. With a PPO, the experience is way more direct.

- First Step: You can look up orthopedic specialists on your own and book an appointment directly.

- In-Network vs. Out-of-Network: You can choose a doctor inside the PPO's "preferred" network to keep costs low, or you can go to an out-of-network doctor. Your plan will still cover some of the out-of-network cost, but your share will be much higher.

This flexibility is perfect for people who want total control over their doctors or already have specialists they trust. But that freedom comes with a financial catch. Going out-of-network means you’ll face higher deductibles, copays, and coinsurance. You could even be "balance billed," where the doctor charges you the difference between their fee and what your insurance pays. It’s always smart to know what to do if your doctor doesn’t accept your health insurance to avoid getting hit with surprise bills.

Ultimately, the choice comes down to a simple trade-off. An HMO gives you a structured, affordable system where a trusted PCP coordinates everything for you. A PPO offers total freedom and direct access to specialists, but it comes with a higher price tag and more financial risk if you step outside the network.

Analyzing Your Potential Healthcare Costs

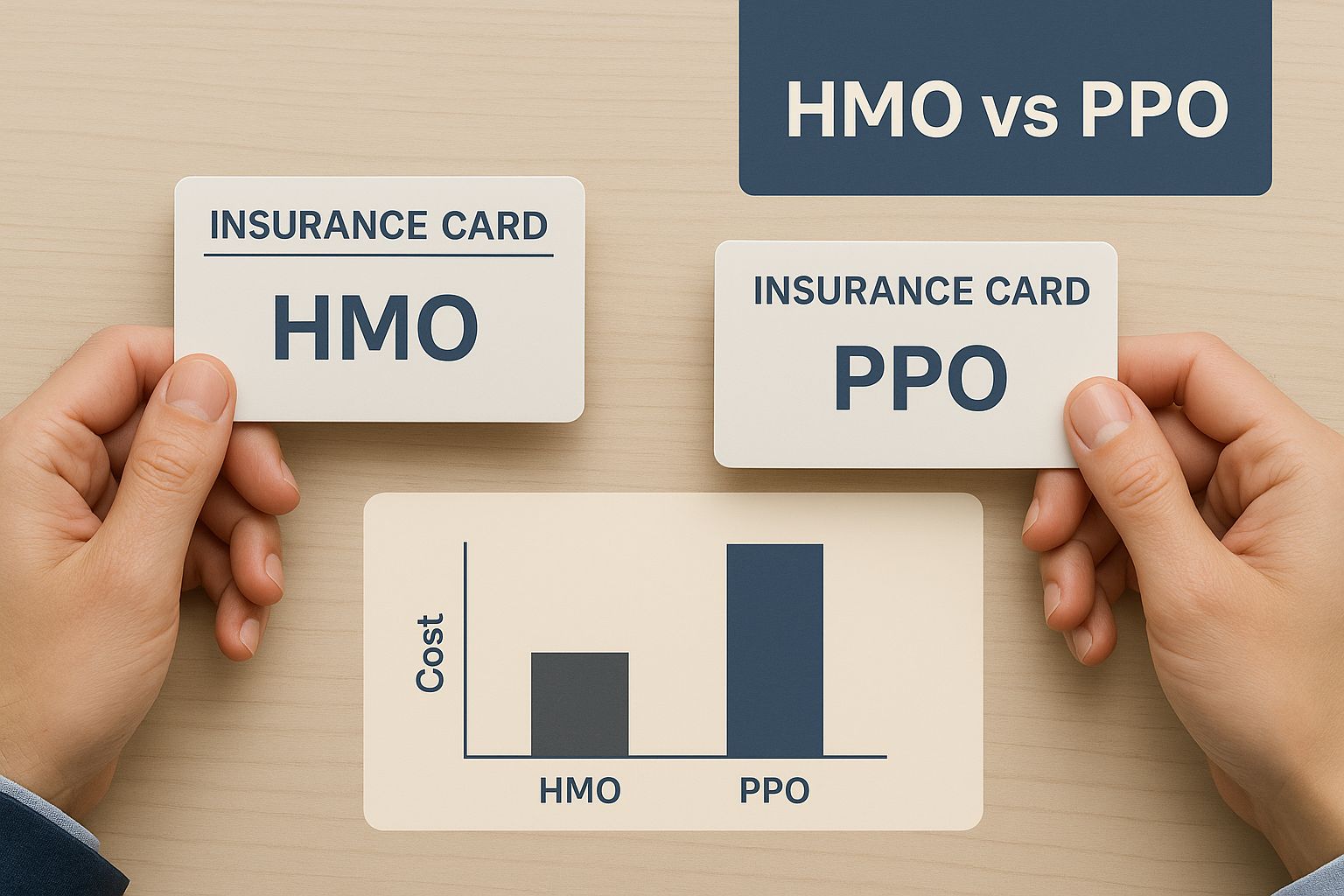

When you're trying to decide between a PPO and an HMO, the numbers are often what makes the choice clear. It’s not just about the monthly premium that comes out of your paycheck. It’s about the total cost you’ll face when you actually need to see a doctor or get a procedure done.

Getting a handle on this complete picture—from routine checkups to unexpected emergencies—is the only way to pick a plan that won’t leave you with surprise bills.

HMO plans are built for financial predictability. They almost always come with lower monthly premiums, which is that fixed amount you pay just to have coverage. This is a direct result of their tightly managed system—a limited network and required referrals help keep everyone's costs down.

PPO plans, on the other hand, usually have higher premiums. You're paying a premium for freedom. It’s the price for being able to see specialists whenever you want and having the option to go outside the network for care. That flexibility is a huge perk, but it definitely comes with a higher upfront cost.

Breaking Down the Out-of-Pocket Expenses

Beyond your monthly premium, the out-of-pocket costs are where you'll really feel the difference between these two plans. These are the expenses you pay when you actually use your insurance.

Here’s how they usually compare:

- Deductible: This is the magic number you have to pay for your own care before your insurance plan starts chipping in. HMOs are famous for their low or even $0 deductibles for in-network care. PPOs almost always have higher deductibles, and they often have a second, much higher deductible if you dare to go out-of-network.

- Copayments (Copays): This is that simple, flat fee you pay for a service, like a doctor's visit or a prescription. HMOs love copays because they're straightforward and predictable (think $25 for your primary doctor, $50 for a specialist).

- Coinsurance: Instead of a flat fee, this is your share of the cost, calculated as a percentage. It’s much more common with PPO plans, especially after you’ve paid your deductible. Our guide on coinsurance vs. copay breaks this down even further if you're curious.

As you weigh these costs, it’s also helpful to see the bigger picture of how various types of insurance, including private plans, fund different care services. Understanding this context can make it clearer why HMOs and PPOs are structured the way they are.

A Real-World Cost Scenario

Let's make this real. Imagine you need a minor, non-emergency surgery, like a knee arthroscopy. The hospital bills a total of $8,000.

Scenario 1: You Have an HMO Plan

With an HMO, your path is simple and clear. You visit your PCP, get a referral, and see an in-network surgeon at an in-network facility. No guesswork.

- Premium: Lower each month.

- Deductible: Let’s say it's $500. You pay that first.

- Copay: You might have a flat $250 copay for the surgery itself.

- Total Out-of-Pocket: Your cost is locked in. You’d pay around $750 ($500 deductible + $250 copay), and that’s it. The rest is covered.

Key Financial Takeaway: The HMO’s strength is keeping costs under control. By staying within its managed system, your financial risk is clearly defined and limited. No scary surprises.

Scenario 2: You Have a PPO Plan

With a PPO, you have choices, and every choice comes with a different price tag.

-

You Stay In-Network: You find an in-network surgeon on your own.

- Premium: Higher each month.

- Deductible: Let's say it's $2,000. You have to pay all of this first.

- Coinsurance: After your deductible, your plan covers 80%, leaving you to pay the remaining 20%.

- Total Out-of-Pocket: You'd pay the $2,000 deductible, plus 20% of the leftover $6,000 bill (which is $1,200). Your total cost comes to $3,200.

-

You Go Out-of-Network: You decide to see a top-rated surgeon who isn't in your PPO network.

- Out-of-Network Deductible: This is a separate, higher deductible—it could easily be $5,000.

- Coinsurance: Your plan might only cover 50% of what it thinks the service should cost, not what the doctor actually bills.

- Total Out-of-Pocket: You could hit your $5,000 deductible and still owe thousands more. It’s easy to end up paying your out-of-pocket maximum, which could be $10,000 or more.

This example shows the fundamental trade-off perfectly. An HMO gives you predictable, lower costs as long as you follow the rules. A PPO gives you all the choices in the world, but it’s up to you to manage the much bigger financial risks that come with that freedom.

How Your Location Affects Your Insurance Options

When you’re weighing the difference between a PPO and an HMO, it’s easy to think the choice is all yours. But what if the biggest factor in your decision is something you can’t control at all? Your zip code.

Health insurance isn’t a one-size-fits-all product. The plans available to you are deeply tied to where you live, and this reality can come as a surprise. You could spend hours comparing the flexibility of a PPO against the affordability of an HMO, only to find out your local market has already picked a winner for you.

The Big Shift Toward Narrower Networks

In many parts of the country, the insurance game has changed. To get a handle on rising healthcare costs, insurers have started moving away from the broad, expensive PPO networks, especially for plans sold directly to individuals. Instead, they're leaning heavily on more restrictive—and more affordable—HMO and EPO (Exclusive Provider Organization) models.

This isn't random. It’s a strategy. By working with a smaller, hand-picked group of doctors and hospitals, insurers can negotiate better rates. Those savings get passed on to you as lower premiums. The trade-off? Fewer PPO plans on the shelf for individuals and families in many states. Your perfect plan might exist, just not in your county.

PPOs Can Be Hard to Find on the ACA Marketplace

The data shows a pretty clear divide. If you’re buying insurance on your own, finding a PPO can feel like searching for a needle in a haystack. In fact, 37% of Americans live in states with zero PPO options on the ACA marketplace. Another 33% are in states where PPOs make up less than 20% of the plans.

This isn’t just a rural issue; it’s happening in some of the biggest states. Major markets like New York and Texas currently have no PPOs available on the individual exchange. In places like Florida and Georgia, they’re incredibly rare. This pushes most people shopping on the marketplace toward HMO or EPO plans. You can dig into a more detailed health insurance market analysis to see how these trends look across the country.

The Takeaway: The idea that everyone has a choice between an HMO and a PPO is mostly a myth for the individual market. In many places, narrow-network plans are the only game in town if you want to keep your premiums down.

Why Your Friend Has a PPO and You Don’t

The story is completely different if you get your insurance through work, especially at a large company. The group insurance market still has a much healthier mix of plans, and PPOs are a very common and popular option.

Big companies have the leverage to negotiate better deals with insurers, which makes offering a flexible PPO plan financially realistic. This creates a huge gap between the two markets:

- Individual Market: Dominated by HMOs and EPOs, with a laser focus on keeping costs low.

- Group (Employer) Market: Often gives you the choice between HMOs and PPOs, offering more freedom.

This is why your friend across town might have a great PPO through their job, while you can only find HMOs on the marketplace. Their access comes from their employer’s buying power, not just their address. Knowing this helps set the right expectations when you start shopping. Your "best" choice is always limited to what’s actually available to you.

Choosing the Right Plan for Your Life Stage

It's one thing to know the technical jargon of PPOs and HMOs. It's another thing entirely to see how that choice actually plays out in your day-to-day life. The truth is, your health insurance needs aren't set in stone—they shift with your career, your family, and your health. The best plan for you is simply the one that fits where you are right now.

So, instead of just another pros and cons list, let's look at a few real-world situations. Seeing how different people with very different needs make their choice can help you find your own path.

The Young Professional on a Budget

Let's start with Alex, a 28-year-old graphic designer. Alex is healthy and rarely sees a doctor besides an annual physical. The main goal here? Keep monthly costs down while still having a safety net for emergencies. Predictable bills are way more important than a huge list of specialists.

An HMO plan is a perfect match for Alex. The lower monthly premiums are a huge win for a tight budget, and the fixed copay structure means no financial surprises for routine care. Since Alex doesn't need to see specialists often, the referral process isn't a big deal. It’s reliable, cost-effective coverage that lines up perfectly with simple healthcare needs.

The Growing Family with Young Children

Now, meet the Millers. They have two young kids, ages three and six. That means frequent check-ups, the occasional urgent care visit for a mystery fever, and one child who regularly sees a pediatric allergist. Their priority is a strong bond with a pediatrician who can manage everything, but they also need to keep costs under control.

For the Millers, an HMO plan is often the smartest move. Having a dedicated Primary Care Physician (PCP) acts as the central hub for their kids' health, making sure care is coordinated seamlessly between regular visits and specialist appointments. That integrated model is gold for a family managing multiple health needs. While a PPO offers more freedom, the predictable costs and coordinated care of an HMO usually fit a family budget much better.

Key Insight: Don't just assume a PPO is automatically better for families. The HMO's focus on a strong PCP relationship can be a massive advantage for coordinating your kids' care, often at a much lower overall cost.

The Individual with a Chronic Condition

Let’s look at Sarah, who is managing a chronic condition like Crohn's disease. She has regular appointments with her gastroenterologist and sometimes needs to see other specialists, like a rheumatologist. She has built a team of doctors she trusts completely and wants to keep seeing them without jumping through hoops.

A PPO plan is almost certainly the right call for Sarah. The freedom to see specialists directly—without needing a PCP referral first—is critical for managing her condition effectively. Plus, if one of her trusted doctors were ever to leave the network, a PPO gives her the out-of-network coverage she needs to ensure her care isn't interrupted. That higher premium is a small price to pay for direct access and peace of mind.

The Frequent Traveler or Remote Worker

Finally, think about David, a consultant who travels for work three weeks out of every month. Or Maria, a remote worker who lives in a rural area. Their biggest worry is getting care, no matter where they happen to be. They simply can't be tied to a small, local network of doctors.

Here, a PPO plan is the clear winner. PPOs typically have much larger, often national, provider networks. This means David can find an in-network doctor in another state, and Maria has a much better shot at finding local providers who take her insurance. The out-of-network coverage is an essential backup, giving them confidence they can get care anywhere. For anyone on the move, that broad access isn't a luxury—it's a necessity.

Your life stage and health are unique, and your insurance should reflect that. This table breaks down which plan type generally aligns with different situations, helping you see where you might fit.

Which Plan Fits Your Life Stage and Health Needs

| Consumer Profile / Situation | Best Fit | Primary Reason |

|---|---|---|

| Young & Healthy Individual | HMO | Lower monthly premiums and predictable costs for basic, routine care. |

| Family with Young Children | HMO | Coordinated care through a single PCP simplifies managing multiple appointments and referrals. |

| Person with a Chronic Illness | PPO | Direct access to specialists and the flexibility to see out-of-network doctors for continuity of care. |

| Frequent Traveler / Remote Worker | PPO | A larger, often national, network and out-of-network coverage provide access to care anywhere. |

| Someone Prioritizing Low Premiums | HMO | Generally offers the lowest monthly costs in exchange for a more structured network. |

| Someone Wanting Maximum Choice | PPO | The freedom to choose any doctor or specialist without referrals is the main benefit. |

Ultimately, there's no single "best" plan—only the one that best supports your health, your lifestyle, and your budget right now.

Your Final Health Insurance Checklist

You've done the reading, and you understand the core differences between a PPO and an HMO. But knowing the theory is one thing—making the right call for your family is another.

This isn't just a list. Think of it as your final reality check before you sign on the dotted line. It’s your last chance to catch any potential surprises, coverage gaps, or unexpected costs. Let's walk through it together.

Doctor and Hospital Network Verification

This is the most important step, period. Don’t just assume your doctors are covered. Networks shift, and a plan that worked for you last year might not include your trusted family doctor this year.

- Your next move: Go to the insurance company’s official website and use their “provider lookup” tool. Search for every single one of your must-have doctors, specialists, and hospitals by name. If you can't find them, pick up the phone and call the insurer. Confirm their network status for the exact plan you're considering.

Estimate Your True Annual Costs

The monthly premium is just the sticker price. A cheap-looking plan can become incredibly expensive once you actually need to use it. You have to look at the whole picture.

The real cost of a health plan isn't the premium; it's the premium plus what you'll realistically spend out-of-pocket. A plan is only "affordable" if it has your back when you're sick, not just when you're healthy.

To get a clearer picture, add up your monthly premiums for the whole year. Then, factor in the plan’s deductible, copays, and coinsurance based on the care you think you'll need.

Review Prescription Drug Coverage

Prescriptions can easily become one of your biggest healthcare expenses. A plan that covers your doctor visits but leaves you with a massive bill at the pharmacy isn't a good fit.

- Your next move: Find the plan’s Prescription Drug Formulary—it's the official list of all the medications it covers. Search for every prescription you or your family members take. Pay close attention to the "tier" each drug is in, as that will tell you what your copay will be.

Understand the Referral Process

Last but not least, be honest with yourself. How much do you value convenience? An HMO requires you to work through a Primary Care Physician (PCP) for referrals to see specialists. If you want direct access to any doctor you choose, that freedom is the core difference between a PPO and an HMO. For many, that flexibility is worth every extra penny in premiums.

Got Questions About HMOs and PPOs? We Have Answers.

Even after you've compared the big picture, a few specific questions always pop up. It’s the little details that often make the biggest difference. Here are some straightforward answers to the things people ask us most when deciding between an HMO and a PPO.

Can I Switch Plans Whenever I Want?

This is a big one. The short answer is usually no. You generally can’t jump from an HMO to a PPO (or vice versa) mid-year. Your main window to make a change is during the annual Open Enrollment Period.

However, life happens. If you experience a Qualifying Life Event (QLE), the rules change, and you’ll get a special enrollment window.

A few examples of a QLE include:

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new zip code where your current plan isn’t available

What Happens If I Have a Medical Emergency?

Picture this: you're on vacation and something goes wrong. It's a common fear, but here’s some good news. Both HMO and PPO plans are legally required to cover emergency medical services at in-network rates, no matter where you are.

So, if you’re facing a true medical emergency, you can head to the nearest hospital without worrying about getting hit with massive out-of-network bills. Just remember, once you’re stable, any follow-up care needs to go back through your plan’s network.

Here's a key detail: Your insurance plan gets the final say on what counts as a true "emergency," not just the hospital. It's always a good idea to contact your insurer as soon as you can after getting emergency care to keep them in the loop.

What Do All These Terms Mean?

If you find yourself getting tripped up by words like "prior authorization" or "network adequacy," you're not alone. The world of health insurance has its own language. Our comprehensive health insurance glossary is a great resource for quick, clear definitions. Getting comfortable with the lingo is the first step to feeling confident about your healthcare choices.

So, Which Plan Is Actually Better?

People always want to know if there's a clear winner. The truth is, there isn't one. The "best" plan is the one that fits your life. It all comes down to what you value most—lower costs and coordinated care, or total freedom to choose your providers.

Finding the right health insurance plan is a critical decision. At My Policy Quote, we specialize in helping individuals and families find coverage that fits their unique needs and budget. Explore your options and get a personalized quote today by visiting https://mypolicyquote.com.