Term life insurance is the financial backstop every parent needs. Think of it as a safety net, designed to catch your family financially if you’re suddenly not there to provide for them. It’s a surprisingly affordable way to make sure the big things—like the mortgage, day-to-day bills, and future college tuition—are taken care of, giving you peace of mind while your kids are growing up.

Why Parents Need A Financial Safety Net

The moment you become a parent, your world shifts. Suddenly, another human being depends on you for everything. That incredible responsibility is exactly why term life insurance for parents is so crucial. This isn't about just covering funeral costs; it’s about replacing your income and all the other contributions you make, ensuring your family's life can go on with stability and security.

It’s like having a financial 'stand-in' ready to go. If the worst happens, your policy provides a tax-free lump sum payout to your loved ones, allowing them to keep up with their standard of living without immediate financial panic. It's a promise that the dreams you have for your children can still come true, even if you’re not there to see them happen.

Securing Your Family's Biggest Goals

The real purpose of life insurance is to shield your family from the financial chaos that your absence would create. The death benefit from a policy is a versatile tool that can tackle several critical needs at once, keeping your long-term plans for them right on track.

To help you see how this works in the real world, here’s a breakdown of what a term life policy can do.

Key Protections Term Life Insurance Offers Your Family

| Financial Need | How Term Life Insurance Helps |

|---|---|

| Income Replacement | Replaces your lost salary for years, covering daily expenses from groceries to utility bills. |

| Debt Repayment | Wipes out major debts like the mortgage or car loans, freeing up cash flow for your family. |

| Childcare Costs | Covers the cost of childcare or household help, a huge expense if a stay-at-home parent passes away. |

| Future Education | Earmarks funds for college tuition or vocational school, protecting your children's educational dreams. |

This protection gives your family the breathing room to grieve without the added stress of financial ruin.

The need for this kind of protection is massive. The global life insurance market is valued at around $3.1 trillion, and the U.S. makes up nearly 27% of that, driven largely by parents planning for the future. Still, a shocking 40% of households with children are underinsured, leaving a dangerous gap in their financial security.

A term life insurance policy is one of the most selfless purchases a parent can make. It's a plan for a future you won't be in, ensuring the people you love most are cared for financially.

For a deeper dive into protecting your family, the ultimate guide to life insurance for parents is an excellent resource.

Ultimately, understanding why life insurance matters when you have kids is the first and most important step toward building a financial plan that truly protects your family’s future.

How Term Life Insurance Actually Works

Think of term life insurance less like a complicated financial product and more like a straightforward promise. It’s an agreement you make with an insurance company to protect your family during the years they depend on you most—when the kids are young, the mortgage is new, and your income is the engine that keeps everything running.

You choose a set period of time—the “term”—when those financial responsibilities are at their absolute peak. It's designed to be simple, affordable, and there for your loved ones if you're not.

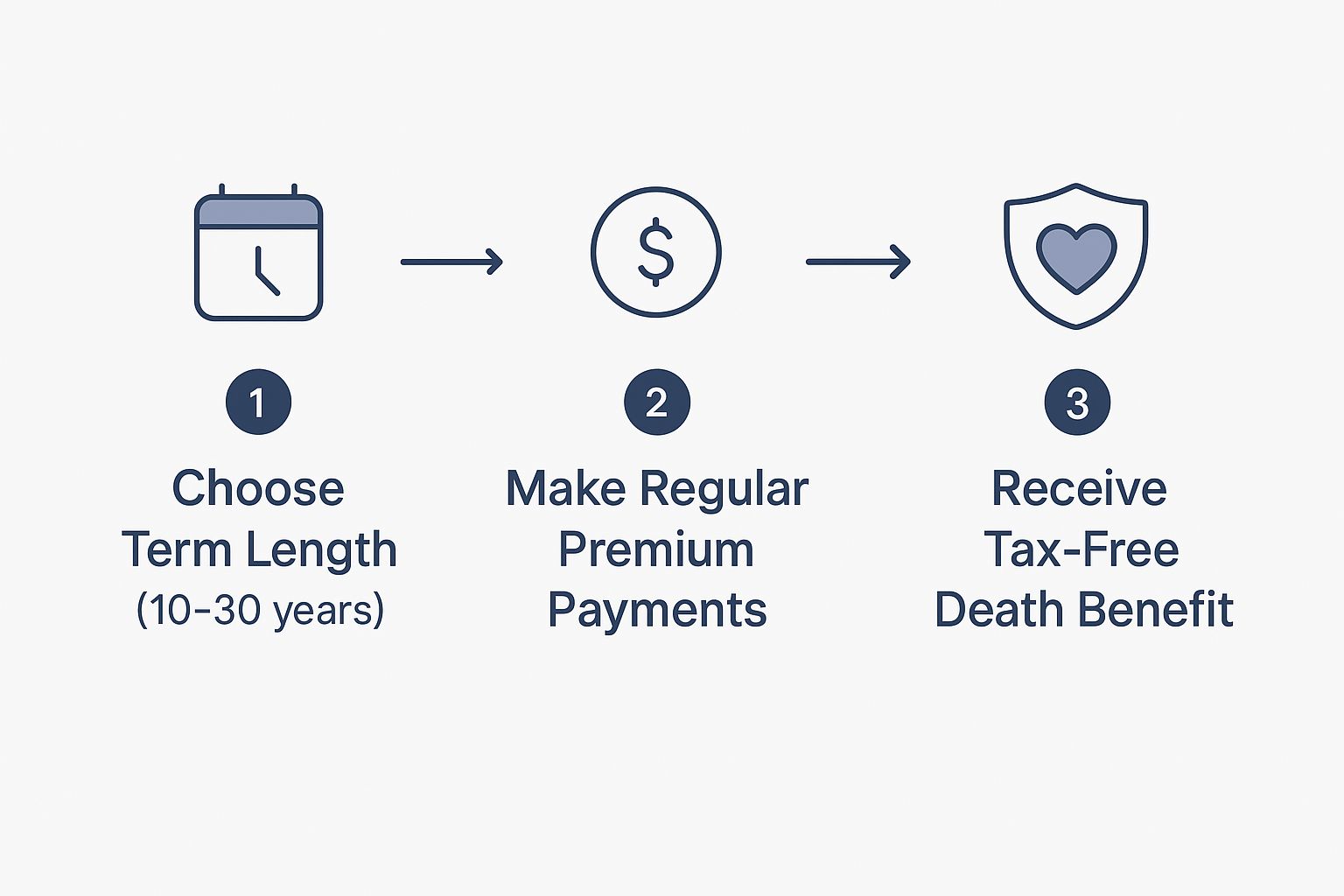

This infographic breaks down the basic idea perfectly.

As you can see, it's a clear, predictable path. You make your payments, and in return, your family gets a powerful financial safety net. No complex moving parts, just pure protection.

The Core Components of Your Policy

Every term life policy, no matter the company, is built on a few key pillars. Once you get these, you’ll be able to read any quote or policy with confidence.

-

The Term: This is simply the length of time your coverage is active. For parents, common terms are 10, 20, or 30 years. The goal is to pick a term that lasts until your biggest financial obligations are gone—like when the kids are through college or the house is paid off. New parents, for instance, often go for a 20- or 25-year term.

-

The Premiums: These are your payments to the insurance company, usually made monthly or once a year. The best part? Your premium is locked in for the entire term. It won’t go up as you get older or if your health changes, which makes it incredibly easy to budget for.

-

The Death Benefit: This is the heart of the policy. It’s the tax-free, lump-sum payout your family receives if you pass away while the policy is active. This is the money that replaces your income, pays off debts, and secures your family’s future.

It really is that simple: You pay your premiums for the term you chose. If you die during that time, your family gets the death benefit. If you outlive the term, the policy just ends, and you stop paying.

An Example in Action

Let's make this real. Imagine a 30-year-old parent, Alex, who buys a $500,000, 20-year term life insurance policy.

Alex pays a fixed $28 every month. For the next two decades, as long as that payment is made, the policy is active. If Alex were to pass away unexpectedly at age 45 (well within the 20-year term), their family would receive the full $500,000, completely tax-free.

That money could wipe out the mortgage, fund the kids' college education, and cover day-to-day bills for years, giving them stability during an impossibly difficult time.

Now, what if Alex is alive and well when the 20-year term ends at age 50? The policy simply expires. No benefit is paid out, and the monthly payments stop. Alex got two decades of priceless peace of mind for about the cost of a few coffees each month.

It’s a clear trade-off: you get a massive amount of protection for a low cost, but it’s for a specific window of time. This is what makes it so different from other types of coverage, and it’s worth understanding the difference between term and permanent life insurance to see what truly fits your family's needs.

Calculating the Right Coverage Amount for Your Family

Figuring out exactly how much term life insurance to buy can feel like a complete guessing game. You’ve probably heard the old rule of thumb: get 10 times your annual salary. But let’s be honest, that one-size-fits-all advice almost never fits. Your family is unique, and your coverage should be too.

Instead of pulling a number out of thin air, a much better way to think about it is as a simple math problem. If you add up your family’s actual financial needs, you’ll land on a number that provides genuine security—not just an industry average.

Step 1: Start with Debts and Major Expenses

First things first, let's create a clean slate for your family. The goal here is to identify all the big debts that would need to be paid off immediately, so your loved ones aren’t left scrambling.

Grab a notepad and list them out:

- Mortgage Balance: What's the total amount left on your home loan? This is usually the biggest number on the list.

- Other Loans: Tally up any other significant debts, like car loans, student loans, or personal loans.

- Credit Card Debt: Add up the total balance across all your cards.

- Final Expenses: It’s smart to set aside $15,000 to $20,000 for funeral costs and any final medical bills.

Adding these up gives you a baseline coverage amount. Think of it as the absolute minimum needed to ensure your family isn't burdened with your debts.

Step 2: Account for Your Children’s Future

Next up, let's think about the big dreams you have for your kids. For most parents, a college education is right at the top of that list, and it's a huge reason why we get life insurance in the first place.

The cost of higher education is no joke. You’ll want to estimate the future cost of tuition, room, and board for each child. A good starting point is to look up the average cost of a four-year degree and multiply that by how many kids you have.

Calculating future needs is about more than just numbers; it’s about making sure the opportunities you want for your children remain available to them, no matter what happens.

Step 3: Calculate Your Income Replacement Needs

This is probably the most important piece of the puzzle. Your income does more than just pay today's bills; it secures your family's entire lifestyle for years to come. The goal here is to replace that steady stream of income until your kids are grown and out on their own.

A simple approach is to take your current annual salary and multiply it by the number of years your family would need that support. For instance, if your youngest child is three, you’ll likely want to replace your income for at least 15 to 20 years. This ensures your family can maintain their standard of living—covering everything from groceries and utilities to soccer practice and family vacations.

And don't forget to factor in the incredible value a stay-at-home parent provides. Their work—childcare, home management, tutoring—has a massive economic value that would be very expensive to replace.

To make all this easier, you can get a clearer picture using our dedicated life insurance needs calculator, which walks you through everything step-by-step.

Putting It All Together: A Sample Calculation

Let's see how this works for a hypothetical family. Imagine two parents, both 35, with two young children. Here's a quick worksheet of what their calculation might look like.

Sample Family Coverage Calculation Worksheet

| Financial Obligation | Estimated Amount ($) |

|---|---|

| Mortgage Balance | $250,000 |

| Car Loans & Student Debt | $50,000 |

| Future College Costs (2 children) | $200,000 |

| Income Replacement ($75k/year for 15 years) | $1,125,000 |

| Final Expenses | $20,000 |

| Total Coverage Needed | $1,645,000 |

As you can see, their real need is far more specific—and much larger—than what the simple "10x salary" rule would have suggested. This detailed approach is what provides true peace of mind. It’s how you know your term life insurance for parents truly has your family covered, no matter what.

Understanding What Drives Your Insurance Costs

When you get a life insurance quote, that number isn't pulled out of thin air. It’s the result of a careful calculation by an underwriter, whose entire job is to figure out risk.

Think of it this way: the insurance company is placing a bet on how long you’ll live. The less risky they see you as, the lower your monthly premium will be.

Getting a handle on what they look for is a game-changer for parents. It helps you understand your quote and shows you where you have some control over the price. The big three drivers are your age, your health, and your lifestyle.

Your Age and Health Are the Biggest Factors

It's a straightforward truth in the insurance world: the younger and healthier you are, the less you'll pay. Insurers work with massive amounts of data, and a healthy 30-year-old is statistically far less likely to pass away than a 55-year-old with a chronic health issue.

This is exactly why getting a policy when you first become a parent is one of the smartest financial moves you can make.

When you lock in a term life insurance policy, your premium is fixed for the entire term. This means the rate you get at age 32 will be the same rate you pay at age 52, even if your health declines later on.

The insurance market itself is also changing. After seeing global premium growth of 10.4% recently, things are expected to slow down. This has pushed insurers to create more flexible, digital-first policies with simpler applications to appeal to busy parents who want a fast, no-fuss process. You can dig deeper into these market trends in this in-depth analysis of world insurance.

Lifestyle Choices and Your Occupation Matter

Beyond your age and health history, your daily habits and what you do for a living also play a big role in setting your premium for term life insurance for parents.

Here are some of the key things underwriters look at:

- Tobacco and Nicotine Use: This is a huge one. Smokers, and even people who use vapes or chewing tobacco, can expect to pay two to three times more than non-smokers for the exact same policy.

- Driving Record: A history of DUIs, reckless driving tickets, or a string of accidents sends a clear signal of high-risk behavior to an insurer, and your rate will reflect that.

- High-Risk Hobbies or Occupation: If your job is inherently dangerous (think pilot or logger) or your weekend hobby is something like skydiving or rock climbing, your premium will likely be higher.

The insurer's goal is to build a complete, honest picture of your life to price your policy fairly.

The Medical Exam Versus No-Exam Policies

Traditionally, getting life insurance meant scheduling a quick medical exam. A technician would visit your home or office to check your height, weight, and blood pressure and collect small blood and urine samples. This gives the insurance company a verified snapshot of your health.

But now, many companies offer "no-exam" or "simplified issue" policies. These are all about convenience and speed. You can often get covered in just a few days—or even hours—by filling out a detailed health questionnaire online.

So, which one is right for a busy parent?

Comparing Policy Application Types

| Feature | Traditional Medical Exam | No-Exam (Simplified Issue) |

|---|---|---|

| Process | In-person paramedical exam, blood/urine samples | Online health questionnaire, no physical exam needed |

| Speed | Approval can take several weeks | Often approved in minutes or a few days |

| Cost | Usually offers the most affordable rates | Tends to be more expensive for the same coverage |

| Best For | Healthy individuals who want the lowest possible premium | Parents who value speed, convenience, or just hate needles |

For most parents who are in pretty good health, the traditional medical exam route is the best bet for long-term value. That small inconvenience upfront can save you hundreds, if not thousands, of dollars over the life of the policy. But if speed is what you need most, a no-exam policy is an amazing way to get protected fast.

Navigating the Application Process From Start to Finish

Applying for term life insurance might sound like a massive undertaking, but it’s really just a series of small, manageable steps. Once you know what’s coming, the whole journey feels a lot less intimidating.

Think of it as a friendly conversation with the insurance company. Your goal is simply to give them a clear and honest picture of who you are. The process is designed to be pretty straightforward, whether you do it online, over the phone, or with an agent.

Let's walk through what you can expect, from the moment you decide to apply to the day your policy is officially active.

Preparing for Your Application

Before you even start filling out forms, a little prep work can make a world of difference. Having the right info handy saves a ton of time and helps you paint the most accurate picture of your health and finances.

Try to gather these key details ahead of time:

- Personal Information: Your Social Security number, driver’s license, and basic contact details.

- Financial Details: A good estimate of your annual income, net worth, and info on any other life insurance policies you have.

- Medical History: The names and contact info for your doctors, dates of recent visits, and a list of any medications you’re taking.

- Beneficiary Information: The full name, birthdate, and Social Security number for the person (or people) you want to receive the benefit.

With this information ready to go, you can fly through the application without having to stop and dig through files.

The Application and Phone Interview

The application itself is where you’ll lay out all the information you just gathered. This is usually followed by a quick phone interview, which is just the insurer’s way of verifying your answers and asking a few follow-up questions.

The single most important rule here? Be 100% honest. It can be tempting to fudge the details on a health issue or a risky hobby to get a lower rate, but that can lead to your family's claim being denied down the road—which completely defeats the purpose of the policy.

The interviewer will probably ask about your health, lifestyle, job, and your family's medical history. It's all a standard part of the process, designed to confirm what you've already shared.

Underwriting and Final Approval

Once your application and interview are done, your file moves on to underwriting. This is the behind-the-scenes part where the insurance company reviews everything to figure out your final rate. If you had a medical exam, the lab results go straight to the underwriter.

This is the step that takes the most time—anywhere from a few days to several weeks. The insurer will look at your medical records, prescription history, and driving record to build a complete picture of your risk profile. You can learn more about what happens during the life insurance underwriting process in our detailed guide.

After underwriting is finished, you’ll get an official offer. All you have to do is sign the final paperwork, make your first premium payment, and just like that, your family is protected. This final step turns a simple plan into a powerful financial safety net for the people you love most.

Common Questions Parents Ask About Life Insurance

Once you get the hang of term life insurance, it’s only natural for more specific questions to pop up. You start thinking about the “what ifs” and want to make sure you’re truly getting this right for your family. That’s a good thing.

Getting clear, straightforward answers is what turns uncertainty into confidence. Let's tackle some of the most common things parents ask so you can move forward feeling great about your decision.

Should a Stay-At-Home Parent Get Life Insurance?

Yes, a thousand times yes. This is one of the most critical—and most overlooked—pieces of the family’s financial puzzle. The value a stay-at-home parent brings to the household is immense, and it would be incredibly expensive to replace.

Think about it: childcare, home management, cooking, transportation, and so much more. A life insurance policy provides the funds for the surviving spouse to hire help for all those essential jobs, keeping the family afloat during an impossibly difficult time.

What Is a Rider and Should I Consider One?

Think of a rider as an upgrade or an add-on for your life insurance policy. It’s an easy way to customize your coverage to fit your family’s specific needs without buying a whole new policy.

A couple of popular riders for parents include:

- Child Rider: This adds a small death benefit for your children, usually just enough to cover final expenses. It’s a very low-cost add-on that offers extra peace of mind.

- Waiver of Premium Rider: If you become seriously disabled and can’t work, this rider has your back. It pays your policy premiums for you, so your life insurance stays active no matter what.

It’s always a smart move to ask which riders are available. A good agent can help you figure out if any make sense for your situation.

Can I Get Coverage with a Pre-Existing Health Condition?

In most cases, yes, you absolutely can. Having a health issue like well-managed diabetes or high blood pressure doesn't automatically mean you’ll be denied term life insurance for parents.

What insurers really want to see is that you're on top of it—that your condition is under control and you're following your doctor's orders. Being 100% honest on your application is non-negotiable. An independent broker is your best friend here, since they can shop your application around to different companies and find the one most likely to give you a fair offer.

The best time to secure life insurance is always now. Premiums are primarily based on your age and health, so the younger and healthier you are, the lower your rate will be—and you can lock in that affordable rate for the entire term.

Buying a policy as soon as you have kids, or even while you’re expecting, is the smartest way to lock in affordable, long-term protection. Waiting just means higher costs and the risk of a new health issue popping up, which could make coverage more expensive or harder to get. Taking action today gives you immediate peace of mind for all the years ahead.

Ready to find the right protection for your family? The team at My Policy Quote can help you compare quotes from top insurers to find an affordable policy that fits your needs. Get your free, no-obligation quote today at https://mypolicyquote.com.