Yes, green card holders can absolutely get Medicare—but it’s not something that happens automatically the day you receive your permanent residency. Think of it as earning your way into the system, just like U.S. citizens do.

The path to eligibility really comes down to two key milestones: how long you’ve lived here and how long you’ve contributed through work.

The Two Pillars of Medicare Eligibility for Green Card Holders

Navigating healthcare in a new country can feel a bit overwhelming, but when you break it down, the rules for Medicare are pretty straightforward. For anyone with a green card, it all boils down to two non-negotiable pillars: your time in the U.S. and your contributions to the system via taxes.

Everyone's journey to permanent residency is different. For instance, some individuals with investment capital may arrive through the EB-5 Immigrant Investor Visa program. But no matter how you got your green card, the Medicare rules are the same for everyone.

Here’s a simple look at what you’ll need:

- The Five-Year Residency Rule: You must have lived continuously in the United States for at least five full years before you can even apply for Medicare. This is a mandatory waiting period.

- The 40 Work Credits Rule: You (or your spouse) need to have earned 40 "work credits" by working and paying Medicare taxes. This usually adds up to about 10 years of work.

To make this even clearer, let's put the core requirements into a quick summary table.

Medicare Eligibility for Green Card Holders at a Glance

| Requirement | Description for Green Card Holders |

|---|---|

| Residency | Must have lived continuously in the U.S. for at least 5 years. |

| Work History | Must have earned 40 work credits (roughly 10 years of work) by paying Medicare taxes. |

| Age | Must be 65 years or older (or qualify due to a disability). |

Meeting both the residency and work history requirements is the standard way to get premium-free Medicare Part A (your hospital insurance) when you turn 65.

Key Takeaway: The answer to "can green card holders get Medicare?" is a definite yes, as long as you meet both the five-year residency and 10-year work history rules.

In the next sections, we'll dive deeper into what these rules mean for you, how to check if you qualify, and what to do if you're coming up a little short on work credits.

Understanding How Medicare Works for Everyone

Before diving into the specific rules for green card holders, let's take a step back and look at how Medicare works for everyone, including U.S. citizens. Think of this as the foundation. Once you understand the basic framework, the path for lawful permanent residents becomes much clearer and a lot less intimidating.

At its heart, Medicare is the federal health insurance program for people aged 65 or older. That’s the most common way people get on board. However, it's not just about age—some younger folks can also qualify if they have certain disabilities or specific conditions like End-Stage Renal Disease (ESRD).

This system is a lifeline, ensuring millions of Americans have access to healthcare in their retirement years. But eligibility isn't just handed out; it’s earned. And that's where your work history comes into play.

The Concept of Work Credits

Imagine your Medicare eligibility is like a health savings account you pay into over your career. Throughout your time working in the U.S., a little bit of your payroll taxes gets funneled into Social Security and Medicare. With every paycheck, you're earning "work credits" that build toward your future benefits.

These credits are the key to getting Medicare Part A (your hospital insurance) without having to pay a monthly premium. It’s a system designed to reward consistent contribution. So, how many credits do you need to unlock this benefit?

The magic number is 40 work credits. For most people, this works out to about 10 years of work while paying Medicare taxes. Racking up these credits is the standard path to earning premium-free hospital insurance.

How Work Credits Are Earned

Earning these credits is pretty straightforward. For 2024, you get one credit for every $1,730 you earn. The amount changes a bit each year to keep up with inflation, but the structure stays the same.

You can earn a maximum of four credits per year. Here's how it breaks down:

- 1 Credit: Earned for a set amount of income ($1,730 in 2024).

- 4 Credits: The most you can earn in a single year.

- 40 Credits: The goal for qualifying for premium-free Part A.

This system means that even if you work part-time or seasonally, you can still steadily build toward your goal over the years. Once you hit that 40-credit milestone, you’ve essentially "paid in" enough to secure your Part A coverage when you need it.

For those getting close to retirement, our comprehensive Medicare planning guide can help you figure out the next steps. This contribution system is the backbone of Medicare eligibility, and it sets the stage for the specific rules that apply to green card holders.

The Critical Five Year Residency Rule

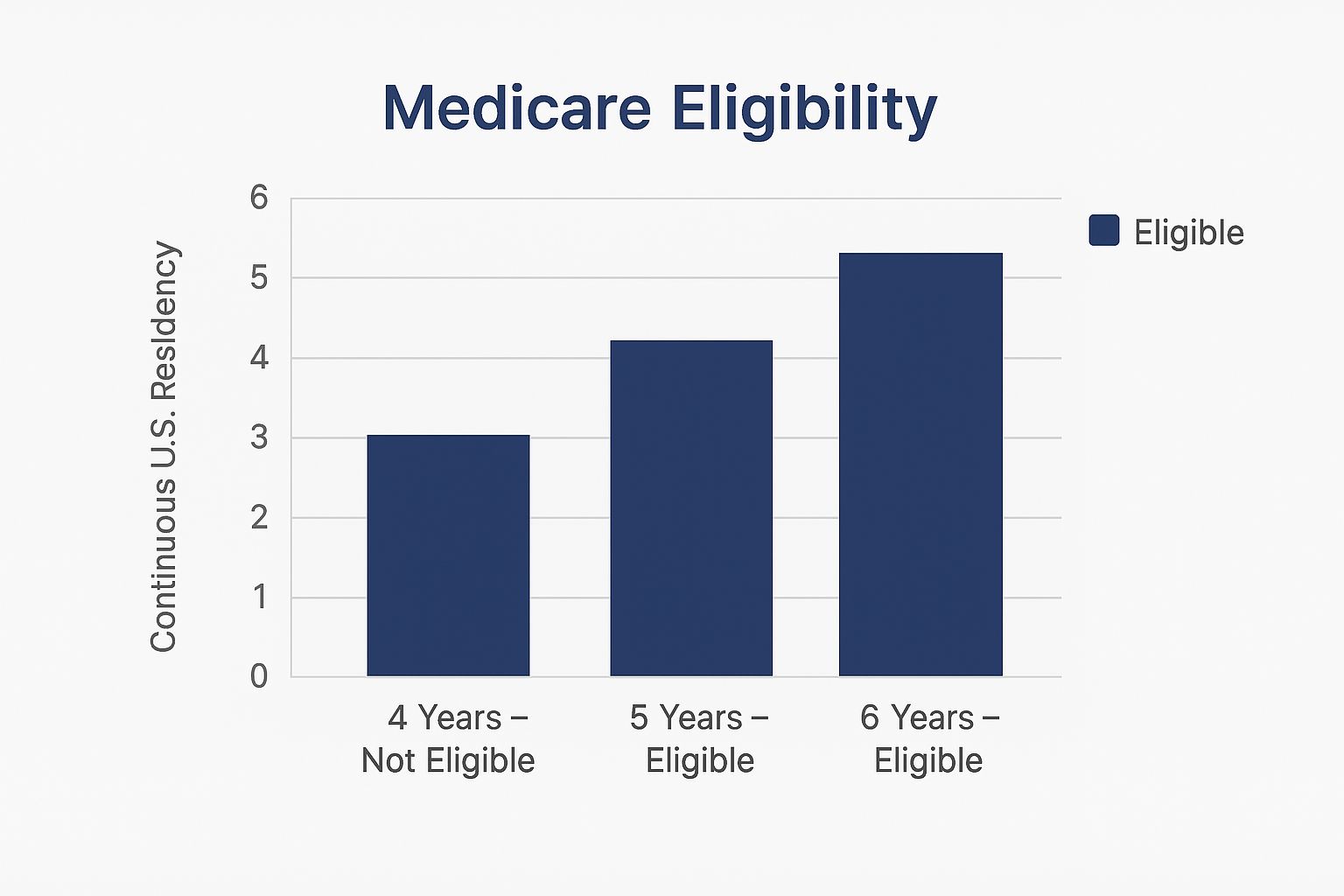

For many green card holders, the road to Medicare hits a major checkpoint right at the start: the five-year residency rule. This is the first, non-negotiable hurdle you have to clear, and getting it right is the key to a smooth application.

Think of it as a waiting period. Before you can tap into Medicare benefits, the U.S. government needs to see that you’ve established a real, consistent life here. It doesn't matter how old you are or how many years you've worked—this rule comes first.

Bottom line: you must have lived in the United States continuously for at least five full years as a lawful permanent resident before you can become eligible for Medicare.

This simple visual makes the cutoff crystal clear.

As you can see, there’s no gray area. Hitting that five-year mark is the essential first milestone on your journey.

What Does Continuous Residency Mean?

That word "continuous" trips a lot of people up. Does a month-long trip back home to see family reset the clock?

Generally, no. Short or temporary trips abroad for things like vacations or family emergencies usually won’t break your continuous residency. However, if you're gone for six months or more, that could be a red flag and might interrupt your five-year count.

It all comes down to your intent. U.S. Citizenship and Immigration Services (USCIS) is looking for proof that you’ve made the U.S. your primary home. This includes things like:

- Keeping a U.S. address

- Filing U.S. tax returns every year

- Maintaining U.S. bank accounts

This residency requirement stands completely separate from your work history. You could have worked and paid Medicare taxes for 10 years, but if you’ve only been a green card holder for four, you still have to wait. This is a common snag that gets otherwise qualified applicants denied—they just applied too soon.

Key Takeaway: The five-year residency rule is a strict prerequisite. You must physically and lawfully live in the U.S. for five consecutive years before you can successfully apply for Medicare.

Getting the timeline right is step one, but it works hand-in-hand with your work history, which determines what you’ll pay. For example, to get premium-free Medicare Part A, a green card holder needs five years of residency and at least 10 years of work where they paid Medicare taxes.

If you meet the residency rule but have fewer work credits, the premiums can be steep—up to $518 per month for Part A in 2025. The standard Part B premium is $185, regardless of your work history.

Navigating insurance can feel complicated, but understanding these timelines is a great start. For a broader look at coverage, you might also find our guide on health insurance for immigrant families helpful.

How Work Credits Impact Your Medicare Costs

Once you’ve met the five-year residency requirement, the next big piece of the puzzle is your work history. Think of it this way: earning enough work credits is what flips the switch on your Medicare eligibility, turning it from a possibility into a real, affordable benefit.

These credits directly determine whether you’ll pay a monthly premium for your hospital insurance (Part A) or get it completely free.

Every year you work in the U.S. and pay payroll taxes, you’re doing more than just earning a paycheck. You're essentially making small deposits into your future healthcare bank. It’s a system that works the same for both U.S. citizens and green card holders.

The magic number is 40 credits, which most people earn after about 10 years of work. Hitting that target is your ticket to premium-free Part A—the foundation of affordable healthcare in retirement.

The Cost of Falling Short

So, what happens if you’ve lived here for five years but haven’t quite hit that 40-credit mark? You can still enroll in Medicare, but this is where the costs start to add up. You'll have to buy into Part A by paying a monthly premium.

The good news is that it’s not an all-or-nothing system. The amount you pay is tiered based on how many credits you have earned, so the work you've put in still counts for something.

Here’s a look at what you can expect to pay for Part A each month, depending on your work history.

Medicare Part A Monthly Premiums Based on Work Credits

The table below breaks down the monthly premium for Part A based on the number of work credits you or your spouse has earned. As you'll see, the difference is significant.

| Work Credits Earned | Monthly Part A Premium Cost |

|---|---|

| 40 or more credits | $0 |

| 30-39 credits | $278 per month (2024 rate) |

| Fewer than 30 credits | $505 per month (2024 rate) |

Falling short of the 40-credit goal could cost you over $6,000 a year for hospital insurance that others get for free. That’s why understanding where you stand is so critical.

Combining Credits with a Spouse

What if your own work history is a little thin? Don't worry—you may have another option. Medicare allows you to qualify for benefits based on your spouse's work record.

Important Insight: If you haven’t earned 40 credits, you can still get premium-free Part A if your spouse has the full 40 credits, is at least 62, and you've been married for at least one year. This spousal benefit is a crucial safety net for countless couples.

This is a huge help for families where one partner was the primary earner or maybe worked more consistently in jobs that paid into the system. For a long time, lawfully present immigrants—including green card holders, refugees, and asylees—have been able to earn these credits just like U.S. citizens. You can explore more about this in the KFF's analysis of health coverage for immigrants.

Taking a close look at your entire family's work history is essential for planning your retirement healthcare costs accurately.

Applying for Medicare as a Green Card Holder

So, you’ve confirmed you meet the five-year residency rule and have your 40 work credits. Congratulations! That's the biggest hurdle. Now you're ready to actually apply.

The good news is that the process for a green card holder is pretty similar to a U.S. citizen's. But here’s the key: timing and paperwork are everything. Getting this part right saves you from headaches, delays, and costly penalties down the road.

Don't Miss Your Window: The Initial Enrollment Period (IEP)

The most important timeline you need to know is your Initial Enrollment Period (IEP). Think of it as your personal, one-time-only window to sign up for Medicare penalty-free.

This window lasts for seven months. It opens three months before the month you turn 65, includes your birthday month, and stays open for three more months after.

Mark these dates on your calendar. Enrolling during your IEP is the absolute best way to avoid late enrollment penalties that can follow you—and increase your premiums—for the rest of your life. For a deeper dive into other enrollment timelines, it helps to understand what open enrollment means and how that’s different from your personal IEP.

Gathering Your Essential Documents

Before you start the application, do yourself a favor and get all your documents in one place. Having everything organized ahead of time makes the whole process faster and way less stressful.

Here’s what you’ll typically need to have on hand:

- Your Green Card (Form I-551): This is your non-negotiable proof of lawful permanent resident status.

- Proof of Age: A birth certificate or passport is perfect.

- Social Security Card: This connects your application to your official work record.

- Proof of Work History: The Social Security Administration (SSA) already tracks your work credits, but keeping recent W-2s or tax records nearby is a smart move in case there are any questions.

Having this paperwork ready to go allows the SSA to quickly verify you meet all the criteria.

Key Insight: Remember, the Social Security Administration is who handles Medicare enrollment, not Medicare itself. You can apply online at the SSA website, call them, or schedule a visit to a local office. The online application is usually the quickest and easiest route.

Common Mistakes to Avoid

The application process can feel a bit tricky, but knowing the common pitfalls can help you sidestep them entirely.

One of the most frequent mistakes is miscalculating the five-year continuous residency period. Any trip you took outside the U.S. that lasted for six months or more could potentially reset that clock, so be sure your dates are accurate.

Another classic error is assuming you’ll be enrolled automatically. Unless you're already drawing Social Security benefits when you turn 65, you have to take action and sign up yourself.

Finally, don't put it off. Start gathering your documents and plan to apply right when your IEP opens. This gives you plenty of breathing room and ensures your coverage kicks in right on time. No last-minute scrambles needed.

The road to getting Medicare as an immigrant hasn't always been a straight one. The rules have shifted over time, and understanding those changes really helps clarify why the current requirements for green card holders are so specific. In short, the path has gotten narrower, making a valid green card more crucial than ever.

A huge change came in July 2025 with the One Big Beautiful Bill Act (H.R. 1). This law hit the reset button on Medicare eligibility for many lawfully present immigrants. Before this act, a broader group of non-citizens, including refugees and asylees, could often qualify based on their work history alone.

But this new law tightened things up, making lawful permanent resident status a central piece of the puzzle. The result? An estimated 1.4 million lawfully present immigrants who might have qualified before were suddenly on the outside looking in. You can dig deeper into how this impacted older immigrants over at JusticeInAging.org.

How This Affects Green Card Holders Today

So, if you’re asking, "can green card holders get Medicare?"—this policy shift actually makes your status even more important. While it closed the door for some, it firmly established the green card as one of the main keys for non-citizens.

Your lawful permanent resident status is non-negotiable. Seriously. If you lose your green card or your status gets revoked for any reason, you’ll also lose your Medicare eligibility—even if you've been on the plan for years. It’s a reminder that maintaining your legal status is just as vital as meeting the residency and work rules.

Key Takeaway: Think of it this way: recent laws made a valid green card the non-negotiable ticket to Medicare eligibility. It's the key that unlocks the door, but only if you also meet the five-year residency and 10-year work history requirements.

Special Cases for Disabled Green Card Holders

It's also important to remember that Medicare isn't just about age. Just like for U.S. citizens, green card holders under 65 can qualify for Medicare if they have a qualifying disability.

If you’ve been receiving Social Security Disability Insurance (SSDI) benefits for 24 months, you can become eligible for Medicare, no matter your age. The five-year U.S. residency rule still applies, of course, but this is a critical safety net for lawful permanent residents who become disabled and can no longer work.

Frequently Asked Questions About Medicare

Sorting through Medicare details can feel like a maze, especially when you’re a green card holder. Let's clear up some of the most common questions and give you the straightforward answers you need.

What if I Haven't Lived Here for Five Years Yet?

This is a big one. If you're 65 but haven't hit that five-year residency milestone, you generally can't enroll in Medicare just yet. You’ll have to wait until you officially cross that five-year mark.

So, what do you do in the meantime? Many permanent residents in this situation turn to private health insurance or find a plan through the Health Insurance Marketplace to make sure they're covered.

Can My Work Outside the U.S. Count?

Unfortunately, no. Medicare work credits are earned one way and one way only: by paying into the U.S. Social Security and Medicare systems. Any jobs you held in another country before moving to the States won't count toward the 40 credits needed for premium-free Part A.

This is a really important point to understand, especially for immigrants who had long, successful careers before coming here. For Medicare, it’s your U.S. work history that matters.

Important Reminder: Only work where you paid U.S. payroll taxes contributes to your Medicare work credits.

Do I Have to Pay for Both Part A and Part B?

Yes, they're two different parts of the Medicare puzzle, and they come with separate costs.

- Part A (Hospital Insurance): This is usually premium-free if you’ve earned your 40 work credits. If not, you'll need to pay a monthly premium.

- Part B (Medical Insurance): Almost everyone pays a monthly premium for Part B. This cost applies regardless of how long you've worked.

Thinking about "can green card holders get medicare" means you have to account for both. Even if you qualify for free Part A, you'll still need to budget for that Part B premium. For a deeper dive into other common questions, check out our in-depth Medicare FAQ article.

Finding the right insurance plan can feel complicated, but you don't have to do it alone. The experts at My Policy Quote are here to help you compare your options and secure the best coverage for your unique needs. Visit My Policy Quote today!