When you're trying to figure out how much life insurance you need, throwing a random number at the wall just won’t cut it. To get this right, you have to go beyond simple guesswork and dig into a real needs-based analysis.

This just means adding up all your family’s future financial obligations—things like replacing your income, paying off debts, and funding college—and then subtracting the liquid assets you already have. The number you’re left with is the financial safety net your family would actually need if you were gone.

Why a Guess Is Your Worst Financial Bet

Staring at a life insurance application can feel totally overwhelming. It’s so tempting to just pick a nice, round number like $500,000 or $1 million and call it a day. But that's a huge gamble—one your family can't afford for you to lose.

Going with a gut feeling often leads to one of two problems: you’re either underinsured or overinsured.

If you’re underinsured, your loved ones could be left scrambling to cover daily bills, the mortgage, or their college tuition. But if you’re overinsured, you’re just wasting money on premiums that could be put to better use right now—investing, saving, or just enjoying life. Finding that sweet spot is everything.

Shifting from Guesswork to a Clear Plan

This guide is designed to move you away from arbitrary numbers and toward a clear, methodical calculation. Think of it as building a financial safety net that's perfectly sized for your family's unique situation. We'll walk through the key pillars of this calculation so you can land on a coverage amount with total confidence.

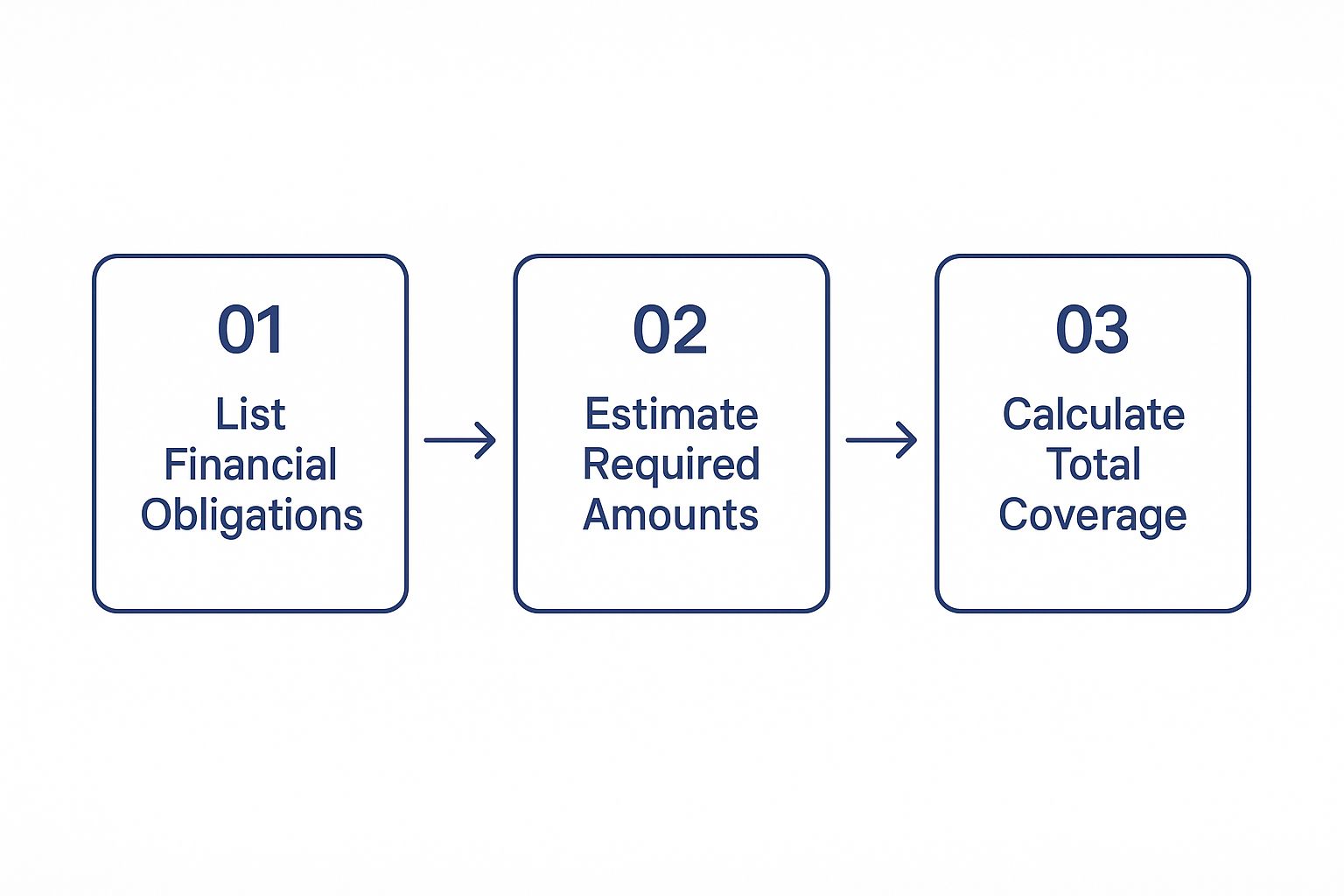

The process really boils down to three main areas:

- Replacing your income: Making sure your family can keep up their current lifestyle for a specific number of years.

- Clearing all debts: Wiping out outstanding loans, especially your mortgage, so they don't become someone else's burden.

- Funding future goals: Setting aside dedicated funds for big-ticket items like your kids' education or your spouse's retirement.

By breaking down the process, you transform a daunting task into a series of manageable steps. This isn't just about a policy; it's about providing stability and opportunity for the people you care about most.

Historically, figuring out life insurance needs always comes back to a detailed look at your financial obligations. A tried-and-true approach is the 'Needs Analysis,' where you add up current debts, future living expenses for your dependents, college costs, and final expenses like a funeral. This method ensures all your bases are covered.

You're about to learn the exact methods financial pros use, giving you a clear roadmap. The first step in avoiding common life insurance mistakes to avoid is getting this foundational calculation right from the start.

Your First Calculation With The DIME Method

When you're first trying to figure out how much life insurance you actually need, the jargon can feel overwhelming. A fantastic place to start is with a simple but powerful framework called the DIME method.

The acronym stands for Debt, Income, Mortgage, and Education—the four biggest financial pillars for most families. Forget vague guesses; DIME gives you a concrete number to work with.

Tallying Your Debts

First, let's tackle the "D" for Debt. This is where you'll list all your non-mortgage liabilities. Think of everything from credit card balances and car loans to personal loans and any leftover student debt.

It’s easy to forget things, so grab a notepad. If you've co-signed a loan for someone, add that too—your family could get stuck with it.

Let's imagine a family, Alex and Jamie, who have two young kids. Their debts look something like this:

- Car Loan: $18,000 remaining

- Student Loans: $35,000

- Credit Card Balances: $7,000

Their total for the "D" in DIME comes to $60,000. That's the first piece of the puzzle.

Accounting For Income And Mortgage

Next up is "I" for Income. The goal here is simple: replace your salary for a certain number of years so your family has time to adjust without financial chaos.

A common rule of thumb is to multiply your annual salary by 10, but you can adjust this. If your kids are very young, you might want to go higher. If Alex earns $75,000 a year, a 10-year replacement gives us $750,000.

Then, we have "M" for Mortgage. For most people, this is their single largest debt. Alex and Jamie still owe $225,000 on their home. Clearing this debt means the family can stay in their home, period. No foreclosure signs, no packing boxes, just stability when they need it most.

Planning For Education Costs

Finally, the "E" stands for Education. If you have kids, funding their college education is probably high on your priority list. This one can be a shocker.

The average cost for a four-year, in-state public college can easily top $100,000 per child. With two children, Alex and Jamie estimate they’ll need $200,000 to make sure that dream stays alive.

This infographic breaks down the logic visually.

It’s a straightforward process: list your major financial responsibilities, put a real dollar amount next to each one, and add them up.

Let's see how this all comes together for our hypothetical family, Alex and Jamie.

Sample DIME Method Calculation

| DIME Component | Example Amount | Calculation Notes |

|---|---|---|

| Debt | $60,000 | Includes car loan, student loans, and credit cards. |

| Income | $750,000 | Based on replacing a $75,000 salary for 10 years. |

| Mortgage | $225,000 | The remaining balance on their home loan. |

| Education | $200,000 | An estimate of $100,000 per child for college. |

| Total Need | $1,235,000 | The sum of all four components. |

By adding these four categories, Alex and Jamie get a clear picture: $1,235,000.

This isn't just a random number; it's a strong baseline built on their real-life obligations. While it doesn't factor in things like existing savings or funeral costs, it’s a detailed and incredibly useful first step.

If you want to plug in your own numbers, a life insurance needs calculator can give you a personalized estimate in just a few minutes.

Going Beyond a Simple Salary Multiplier

The old rule of thumb—multiplying your salary by ten—is a popular starting point. But let’s be honest, it’s a blunt instrument for a decision this important. Your financial life isn’t static, so why should your life insurance calculation be?

To get this right, you need a method that sees the big picture, like the Human Life Value approach. This isn't just about replacing a single paycheck; it's about protecting your entire future economic potential. It’s about thinking ahead.

Factoring in Your Financial Future

Your income today is just a snapshot in time. To land on a realistic coverage amount, you have to account for where your career is headed. A truly thoughtful calculation goes deeper than the simple multipliers.

It should always include factors like:

- Future Promotions and Raises: A 30-year-old on a clear management track has a vastly different earnings potential than someone just a few years from retirement.

- Cost-of-Living Adjustments: Inflation is a silent thief. A $1 million policy today simply won't have the same buying power 20 years from now.

- Side Hustles and Bonuses: Your income is more than just a base salary. Are you accounting for commissions, freelance gigs, or that annual bonus you always count on?

This forward-thinking approach makes sure the safety net you build today is strong enough to handle tomorrow's challenges. Your stage of life plays a huge role, too. A young family with toddlers needs income replacement for a much longer horizon than a couple whose kids are already out on their own.

The goal is to insure your entire economic contribution over your working life, not just a single year's salary. This subtle shift in thinking makes all the difference in providing true long-term security for your family.

Valuing the Stay-at-Home Partner

One of the biggest mistakes I see families make is overlooking the need to insure a stay-at-home parent. Their contribution doesn't come with a W-2, but its economic value is immense.

Just imagine what it would cost to hire someone for all the roles they fill: childcare, home management, tutoring, and transportation. The price tag to replace that work could easily match a full-time salary.

It's crucial to assign an economic value to their contributions—say, $60,000 a year—to get a complete picture of your family's needs. Understanding the difference between term and permanent life insurance can also help you tailor the right policy for each partner's unique situation.

More and more people are recognizing the need for this kind of comprehensive planning. In fact, global life insurance premium income grew to around EUR 2.9 trillion in 2024, a 10.4% jump from the year before. You can dive deeper into these trends and other life insurance statistics over at feather-insurance.com.

Covering Debts and Funding Future Dreams

A life insurance policy should do more than just wipe the slate clean of existing bills. Its real power is in securing the future you’ve always wanted for your loved ones. It’s about transforming a simple financial calculation into a meaningful plan for their lives.

This means getting real about every single liability and long-term goal. To land on the right number, you have to look beyond just the mortgage balance.

Creating a Full Liability Inventory

First thing's first: let’s list out every outstanding financial obligation. The whole point of this exercise is to make sure no unexpected bills fall on your family's shoulders during an already heartbreaking time.

Your list should include things like:

- Personal and Auto Loans: Think car payments, home improvement loans, or any other personal financing.

- Business Debts: If you're a small business owner, any loans or credit lines you've personally guaranteed need to go on this list.

- Co-signed Loans: This one gets overlooked all the time. If you co-signed a student loan for a child or a personal loan for a relative, that debt could transfer to your estate or the other person on the loan.

- Credit Card Balances: Add up the total amount you owe across all your cards.

Once you have that complete list, you can dig into the specifics of does life insurance cover debts like mortgages and loans to understand exactly how the death benefit can be used to clear those balances.

The goal here is simple: leave a clean financial slate for your family. Wiping out debt removes a massive amount of pressure, letting them focus on grieving and adapting instead of dealing with collection calls or foreclosure notices.

Funding Future Life Events

Okay, with the debts handled, it’s time to fund the dreams. This part of the calculation is deeply personal. It’s about providing for the major life events you won't be there to see.

Think about the big milestones your family will face down the road and start estimating the costs. You don't need a perfect number, just a realistic one.

For example, consider what it might cost for:

- College Tuition: A quick search of current tuition rates will tell you a four-year degree can easily cost over $100,000 per child.

- Weddings: The average wedding is a huge expense. Factoring in even a modest amount can be an incredible final gift to your children.

- A Down Payment on a Home: Maybe you always wanted to help your kids buy their first house. Part of covering their future could include giving them that leg up. Of course, it’s always smart for them to determine how much house you can truly afford as part of their own financial planning.

By thoughtfully adding up both the debts and the dreams, you move past a generic formula. You create a precise, customized number that reflects what your family truly needs to live securely and chase their goals.

Fine-Tuning Your Number with Existing Assets

After you've tallied up all the debts and future goals, there's one last crucial step: subtracting what you already have. It seems obvious, right? Yet a shocking number of online calculators skip right over it.

This is a huge miss. If you don't account for your existing assets, you could easily end up overinsured—and that means paying for coverage you just don't need.

Think of it as a quick audit of your current financial picture. The goal is to see what your family could access quickly, without a headache or major penalties, to cover those immediate expenses.

What to Count in Your Audit

When you start subtracting from your total, you need to be realistic about which assets are truly available. Here’s what you should definitely include:

- Savings and Emergency Funds: This is the low-hanging fruit. Money in your high-yield savings or checking accounts is the first thing to deduct.

- Non-Retirement Investments: Got a brokerage account? Stocks, bonds, and mutual funds can be sold without triggering the harsh penalties that come with retirement accounts.

- Existing Life Insurance: Don't forget that group life insurance policy from work. It might not be a massive amount, but every little bit counts.

It's no surprise that more people are taking this seriously. After the wake-up call of the pandemic, LIMRA reported record-high life insurance sales. People started reevaluating their financial safety nets, pushing premium volumes up to $15.9 billion in 2024.

What Not to Count

Just as important is knowing what to leave off your list. Forcing your loved ones to raid certain accounts can create a financial nightmare of taxes and penalties, which defeats the whole purpose.

Be very cautious about including retirement accounts like a 401(k) or IRA in your calculations. Your family would get hit with substantial income taxes and potential early withdrawal penalties, which could shrink the available funds dramatically. Those accounts are for retirement, not for covering today's bills.

Beyond just protecting your family, life insurance can play a role in more complex financial strategies. For those with significant assets, it’s a cornerstone of many advanced estate planning tax strategies designed to preserve wealth.

By carefully subtracting only the right assets, you’ll land on a final coverage amount that feels both precise and affordable.

Time for a Policy Check-Up? When to Recalculate Your Coverage

It’s easy to breathe a sigh of relief after you buy life insurance, file the paperwork away, and check it off your to-do list. Done. But your policy isn't a "set it and forget it" purchase. Life moves fast, and your financial safety net needs to keep up.

Think of your coverage as a living document. The amount that made perfect sense when you were single and renting a tiny apartment can become dangerously inadequate after you buy a home, get married, or start a family. The goal is simple: keep your coverage aligned with your life.

Major Life Milestones That Demand a Review

Certain moments completely change your financial picture, creating new responsibilities that your old policy might not cover. These are your built-in reminders to pull out your documents and see if your numbers still add up. A quick review can prevent a massive coverage gap from forming down the road.

You should plan to take a fresh look at your life insurance needs after any of these major changes:

- Getting Married or Divorced: Tying the knot means your financial lives are now intertwined, and protecting your new spouse becomes a priority. On the flip side, a divorce can completely change beneficiary designations and financial duties, making a policy update essential.

- Welcoming a New Child: This is probably the biggest trigger of all. You now have a tiny human who will depend on your income for at least 18 years. Suddenly, you need to account for everything from daycare and diapers to a college education.

- Buying a Home: A mortgage is often the largest debt anyone takes on. Adjusting your policy ensures your family can stay in their home, without the crushing weight of monthly payments, if you’re no longer there.

Your life insurance coverage should mirror your life's journey. Failing to update it after a major milestone is like using an old map to navigate a new city—you’re bound to get lost.

Don't Forget Career and Business Changes

It’s not just your personal life that impacts your coverage needs. Your professional world plays a huge role, too. A big promotion means your income-replacement needs have grown, while starting a business can introduce entirely new risks.

For instance, that significant salary increase means your family has likely grown accustomed to a higher standard of living—one that deserves protection. Or maybe you took out a business loan that you personally guaranteed. That debt needs to be factored into your total coverage calculation.

Staying on top of these changes ensures your financial safety net keeps pace with your success and ambitions. It’s about making sure the people you love are always taken care of, no matter what.

Answering Your Top Questions

When you start digging into how much life insurance you actually need, a few questions always seem to surface. Getting these sorted out is key to feeling confident about the financial safety net you're building for your family.

So, let's tackle them head-on.

One of the biggest questions is about taxes. The good news? The death benefit your beneficiaries receive is almost always tax-free. If you have a $1 million policy, they get the full $1 million. The IRS doesn't take a cut from that payout, which is a huge relief.

Another common concern is buying too much insurance. You want your family to be secure, but you don't want to overpay for coverage you don't really need. The trick is to subtract your liquid assets—like savings accounts or non-retirement investments—from the total need you've calculated. That helps you find the sweet spot.

What About My Life Insurance Through Work?

It's a great perk to have group life insurance through your job, but it's rarely enough to be your only safety net.

These policies are usually pretty basic, often just 1-2 times your annual salary. Plus, they're not portable. If you leave your job, that coverage almost always disappears, leaving your family unprotected.

Think of your work policy as a nice little extra, not the main event. A personal policy puts you in control and makes sure your family is protected no matter where your career takes you.

Do I Really Need to Insure a Stay-at-Home Parent?

This is a big one, and the answer is a firm yes.

It's a mistake to overlook the massive economic value a stay-at-home parent provides. Think about it: childcare, cooking, cleaning, managing the household, tutoring—the list is endless.

If you had to pay someone to do all of that, the cost would be staggering. Insuring a non-working spouse is absolutely essential for a family's complete financial protection. It's a non-negotiable part of a smart life insurance plan.

Figuring out life insurance doesn't have to be a headache. At My Policy Quote, we give you the tools and straightforward advice you need to find the right policy with total confidence.

Explore your options and get a personalized quote today at mypolicyquote.com.