A life insurance quote is a personalized estimate of what you'll pay to keep your policy active. This payment is called your premium. Think of it as the starting point for any serious life insurance quotes comparison—it's your first look at what different insurers might charge you for the exact same amount of coverage.

Decoding Your Life insurance Quote

Getting a life insurance quote is the first real step toward protecting your family’s future. It’s like a preliminary price tag, calculated based on the personal details you share. Insurers use this info to make an initial guess about their risk.

But here’s the key: that first number isn't final. It’s an educated estimate that can—and often does—change after the official underwriting process is complete.

Understanding what goes into that first number is powerful. It helps you compare offers intelligently and spot why one company’s quote might look so different from another’s. You'll move from just collecting prices to making a smart, informed decision.

Core Elements of an Initial Quote

Every quote is built on four main pillars. Since each insurance company weighs these factors differently, the quotes you get can vary—sometimes by a lot.

- Age and Gender: It’s simple statistics. Younger applicants are generally seen as lower risk, which usually means lower quotes.

- Health Status: Your personal and family medical history is a huge piece of the puzzle. Things like high blood pressure or a family history of heart disease can nudge your estimated premium upward.

- Lifestyle Choices: Insurers look at your daily habits to gauge risk. Smoking, high-risk hobbies like flying, or even a spotty driving record often lead to higher quotes.

- Coverage Amount and Type: This one’s straightforward. The more coverage you want (the death benefit), the higher the cost. The same goes for the policy type—a term life policy will cost less than a whole life policy.

A quote is not a guarantee. It's a snapshot of your potential cost based on the data you provide, before the deep dive of medical underwriting begins.

Why Do Quotes Vary Between Insurers?

Ever wonder why you can give three different insurance companies the exact same information and get three wildly different quotes? It's not a mistake. It’s a direct reflection of how each company views risk and runs its business. For a deeper look at how these payments are calculated, our guide on what is an insurance premium is a great resource.

Each insurer relies on its own internal math and underwriting rules. One company might be more forgiving of a well-managed chronic condition, while another gives the best rates to people with a perfect health record. This is why shopping around is so critical.

Let's look at how two different insurers might see the same person:

| Factor | Insurer A's Approach | Insurer B's Approach |

|---|---|---|

| Health Focus | More lenient on controlled chronic conditions | Stricter health standards, but rewards excellent health |

| Lifestyle Risk | Offers better rates for non-smokers | Heavily penalizes any tobacco use, even occasional |

| Underwriting Speed | Traditional, more detailed process | Uses accelerated underwriting for faster decisions |

This difference is exactly why a thorough life insurance quotes comparison is a non-negotiable step. It helps you find the provider whose model best fits your life, ensuring you don't end up overpaying for the protection your family needs.

Key Factors That Drive Your Premium Costs

When you start a life insurance quotes comparison, you’ll quickly see that the rates you get back are based on a pretty complex look at your personal risk. Insurers are essentially running the numbers on how likely it is they’ll have to pay out your policy. This process, called underwriting, goes a lot deeper than just your age and health.

The little details matter. A lot. Two people of the same age and gender could get wildly different quotes because of small nuances in their medical history, lifestyle, or even their job. Knowing what these factors are is key to understanding the process and figuring out what your final premium might be.

Your Health Profile Under the Microscope

Your current health and medical history are, by far, the biggest drivers of your premium. Insurers will ask to see your medical records and often require a medical exam to get the full picture. They’re looking for clues about your longevity and any potential health risks down the road.

Here are the key things they’ll be looking at:

- Chronic Conditions: Things like diabetes, high blood pressure, or heart disease will get a close look. But how an insurer sees them can differ. One company might give you a great rate if your condition is well-managed, while another might see it as a higher risk no matter what.

- Family Medical History: If conditions like cancer or heart disease run in your immediate family, it can affect your rates—even if you're perfectly healthy. It’s all about potential future risk.

- Height and Weight: Your Body Mass Index (BMI) is a quick way for insurers to gauge your general health. Being significantly over or underweight can lead to higher premiums.

- Tobacco and Substance Use: This one is huge. Premiums for smokers can be three to five times higher than for non-smokers. A history of substance abuse will also push your costs up.

This whole evaluation is part of what’s known as underwriting. To get a better handle on what it involves, you can learn more about what is underwriting in insurance and how it really shapes your final offer.

Lifestyle Choices and Associated Risks

Beyond your medical chart, insurers want to understand the risks you take every day. Your habits and hobbies give them a window into your personal risk profile, and certain activities will definitely impact your life insurance quote.

Think about it this way: a 40-year-old non-smoker in great health with a desk job and a clean driving record will get a fantastic quote. But if another 40-year-old with the exact same health profile is an avid skydiver or has a stack of speeding tickets, their premium is going to be noticeably higher.

Key Takeaway: Insurers don't just assess who you are today; they assess what you do. High-risk hobbies and jobs signal a greater chance of an early claim, which translates directly to a higher premium.

Getting familiar with insurance processes, like in a guide to medical underwriting, can also help you understand how your health history plays into your premiums. This knowledge helps you put your best foot forward during the application.

The Policy Itself Influences the Price

Finally, the details of the coverage you actually choose have a direct impact on your quote. The structure of the policy is a major cost factor, which is why it’s a core part of any life insurance quotes comparison.

Here’s how your policy choices shake out in your premium:

- Type of Insurance: Term life insurance, which covers you for a set period (like 20 years), is way more affordable than whole life insurance, which lasts your entire life and builds cash value.

- Coverage Amount: This one’s straightforward—the bigger the death benefit, the higher the cost. A $1,000,000 policy will always cost more than a $250,000 policy for the same person.

- Term Length: With term policies, a longer term means a higher premium. A 30-year policy will be more expensive than a 10-year one because the insurer is on the hook for a much longer time.

Comparing Term vs. Whole Life Insurance Quotes

When you start comparing life insurance quotes, the first big question you’ll hit is: term or whole life? These two aren’t just different—they serve completely different life goals, and their prices show it. Forget a simple pros and cons list; let's look at this choice through the lens of what you’re actually trying to accomplish.

At its core, the difference is straightforward. Term life is temporary protection, like renting. Whole life is permanent coverage with a built-in savings account, more like buying. This one distinction causes a huge gap in cost and decides who each policy is really for.

Comparing their quotes without this context is like trying to decide between leasing a car and buying a house. They both involve payments, but they solve entirely different problems.

The Starter Family Scenario

Let's meet Sarah and Tom. They're both 32, have a new baby, and just took on a 30-year mortgage. Their biggest worry? If something happens to one of them, the other will be left juggling childcare, bills, and that huge mortgage payment alone.

What they need is the biggest safety net possible for the lowest cost, especially while their kids are young and their debts are high.

For them, a term life insurance policy is a no-brainer. They can get a $1,000,000, 30-year policy for a predictable, affordable monthly payment. It lines up perfectly with their life stage. By the time the policy ends in 30 years, the mortgage will be gone and their child will be independent.

Here’s why term quotes are so appealing for a family like theirs:

- Maximum Affordability: Term life is pure insurance. You’re only paying for the death benefit, which makes it worlds cheaper than whole life.

- Targeted Protection: Their need for that massive coverage amount is temporary. Term lets them protect their most vulnerable years without paying for lifetime coverage they don't really need.

- Financial Flexibility: The money they save by choosing term can go into retirement funds or a college savings plan, building wealth much more effectively.

Choose term life for affordable protection during your highest-need years; select whole life for permanent coverage combined with a tax-deferred savings element.

For Sarah and Tom, a 30-year term policy might run them about $50-$70 per month. A whole life policy with the same $1,000,000 benefit? That could easily top $800 per month. For a young family watching every dollar, that difference changes everything. Our complete guide offers a deeper look into the specifics of term versus whole life insurance policies to help you weigh these costs.

The Legacy Builder Scenario

Now, let's think about David. He's 55, a successful business owner with grown kids and a paid-off house. His retirement is already secure. He isn't worried about replacing income; he's focused on estate planning.

David wants to leave a guaranteed, tax-free inheritance and cover any potential estate taxes so his assets can pass to his family smoothly.

For David, whole life insurance is the right tool for the job. Yes, the premiums are much higher, but the policy will never expire. It also builds cash value at a guaranteed rate, acting like a stable, conservative asset in his portfolio. He isn't just buying protection; he's buying a financial instrument designed for wealth transfer.

Let’s look at how the quotes look from David’s point of view:

| Feature | Term Life Quote Perspective | Whole Life Quote Perspective |

|---|---|---|

| Cost | Low initial premium, but coverage could expire before he passes. | High, fixed premium, but a guaranteed payout no matter when he dies. |

| Coverage Length | Temporary (e.g., 20 years), which doesn't fit his lifelong goal. | Permanent, aligning perfectly with his estate planning goals. |

| Cash Value | No cash value component; it's a pure expense. | Builds a guaranteed, tax-deferred cash value he could tap if needed. |

A whole life quote gives David something priceless: certainty. He knows that as long as the premiums are paid, his family will get the death benefit. That guarantee is exactly what he’s paying for—a feature that term life simply can't offer. For him, the life insurance quotes comparison is less about the monthly bill and all about long-term value and peace of mind.

How to Compare Quotes from Top Insurance Providers

So, you have a few life insurance quotes in hand. Now the real work begins. A smart life insurance quotes comparison is about so much more than just grabbing the lowest price you see. The cheapest option isn't always the best, and a great deal on paper might come from a company that just isn't the right fit for you.

To do this right, you need to look at the companies themselves. Think about their financial stability, what other customers are saying about them, and how they approach underwriting. These are the things that tell you the real story and ensure your family is protected by a company you can count on for the long haul.

Beyond the Premium Price Tag

That monthly premium is the first thing everyone looks at, but it's just one piece of the puzzle. Two insurers could offer similar prices but deliver completely different experiences. A truly solid comparison means digging into the details that define a company's stability and how they treat their customers.

Here’s what you should be looking at for every insurer on your list:

- Financial Strength Ratings: Check their rating from agencies like A.M. Best. You want to see an "A" rating or higher. This is a clear signal that the company has its finances in order and can be trusted to pay a claim when your family needs it most.

- Customer Satisfaction Scores: Look at studies like the J.D. Power U.S. Individual Life Insurance Study. These scores give you a glimpse into what real policyholders think, from the application process all the way to filing a claim.

- Underwriting Turnaround Time: Some companies are fast. Thanks to accelerated underwriting, you could get approved in a matter of days. Others can take weeks. If getting coverage in place quickly is a priority for you, this can be a huge factor.

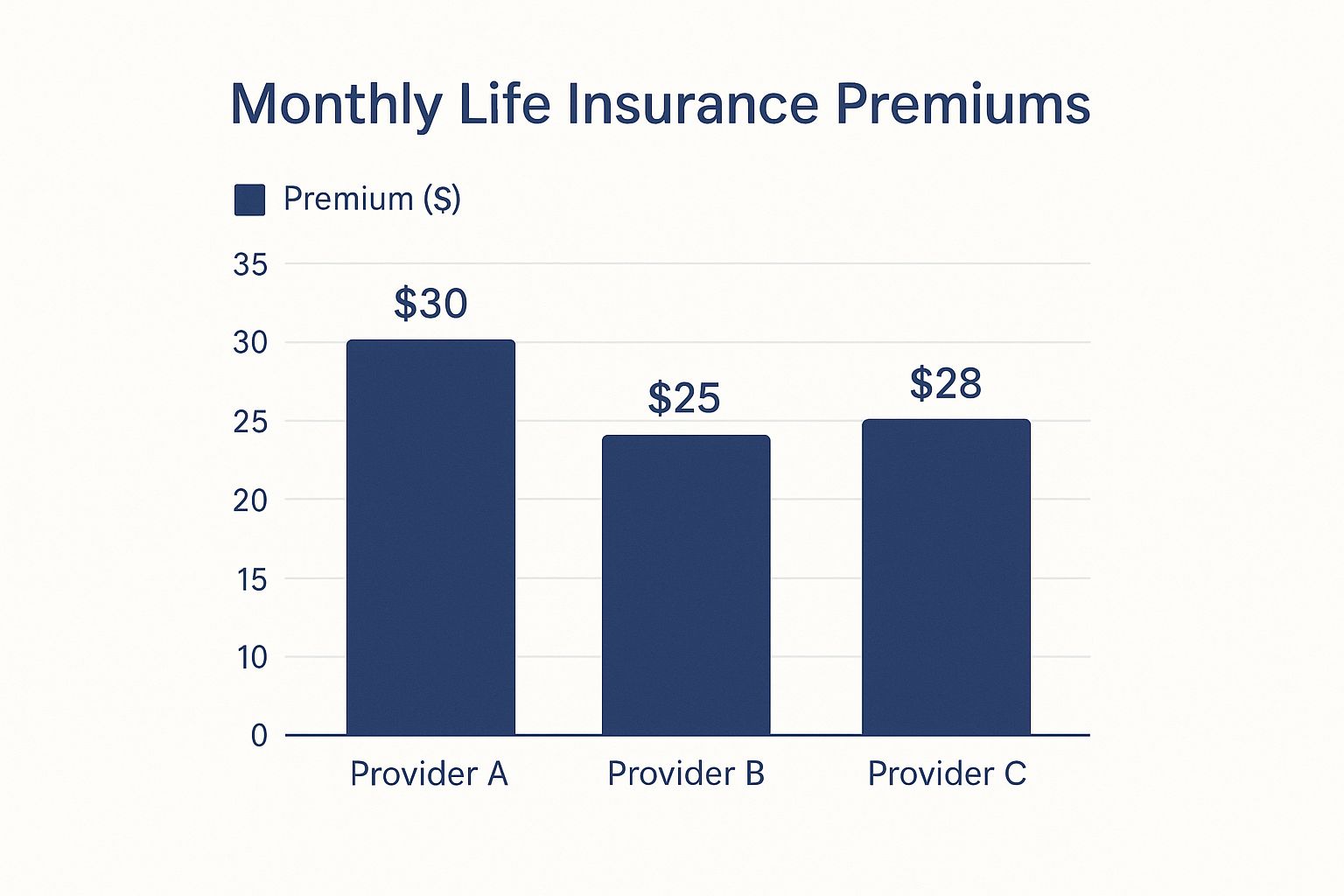

This chart shows just how much premiums can differ for the exact same person, all based on how each company weighs different factors.

As you can see, even though the prices are close, Provider B comes in the lowest. For someone focused purely on budget, that might be the most appealing option at first glance.

Uncovering Underwriting Specialties

Every insurance company has its own "sweet spot." Some are more understanding of certain health conditions, while others give better rates to people with specific hobbies or lifestyles. Figuring this out can literally save you thousands of dollars over the life of the policy.

For example, one insurer might be the go-to for people with well-managed diabetes, offering them rates no one else can touch. Another might be perfectly comfortable with private pilots or rock climbers, as long as you can show a history of safety.

Insider Tip: Never assume a minor health issue or a unique hobby will automatically mean sky-high rates. The trick is to find the insurer whose rulebook works in your favor.

This is exactly why a detailed life insurance quotes comparison is so critical. When you line up quotes from several different companies, you start to see which ones are a better match for your specific situation.

A Structured Comparison Framework

To feel truly confident in your choice, you need to get organized. A simple table can cut through the noise and show you which provider really offers the best all-around value for you.

Let’s take a look at a sample comparison table. It helps to see how the numbers and features stack up when you put them side-by-side.

Sample Monthly Premium Comparison Across Providers

Here's a breakdown of estimated monthly premiums for a $500,000, 20-year term life policy. Notice how each provider has a different focus, which is reflected in their pricing and approach.

| Applicant Profile | Provider A (Lenient Health) | Provider B (Speed-Focused) | Provider C (Budget-Friendly) | Key Underwriting Focus |

|---|---|---|---|---|

| 40-year-old, good health | $32/mo | $35/mo | $28/mo | Focuses on lowest cost for healthy applicants. |

| 50-year-old, good health | $78/mo | $85/mo | $71/mo | Remains competitive for older, healthy individuals. |

| 40-year-old, high BP | $42/mo | $48/mo | $55/mo | Best for those with managed health conditions. |

In this scenario, Provider C looks like the winner on price for healthy applicants. But for the person with high blood pressure, Provider A is the clear choice, even though it's not the cheapest for others. This shows why the "best" option really depends on your personal priorities—whether that’s cost, a specific health need, or getting approved quickly.

Using Online Tools for an Accurate Quote Comparison

Getting a life insurance quotes comparison started online is incredibly fast these days. With just a few clicks, comparison tools can pull up offers from dozens of different carriers, giving you a bird's-eye view of the market in a matter of minutes. These platforms are a fantastic starting point, but you have to know how to use them right to get a realistic idea of what you'll actually pay.

Think of an online quote tool as a powerful but simple calculator. You punch in your data—age, gender, health, and how much coverage you want—and it runs those numbers against each insurer's basic rate charts. What comes back is a quick, non-binding estimate meant to show you the range of what's possible.

Just remember, the accuracy of those first quotes is only as good as the information you put in. One small omission or mistake can create a huge gap between the instant quote you see on the screen and the final premium you’re offered.

Providing the Right Information for a True Estimate

To really get value out of an online comparison, you have to be honest and thorough. It’s tempting to downplay a health issue or a habit like smoking to see a lower number pop up, but all that does is set you up for disappointment and waste your time later.

Insurers will double-check everything you submit during the underwriting process, so being accurate from the get-go is the only way to go. When you fire up a quote tool, be ready with answers about:

- Personal Health History: Any chronic conditions (like diabetes or high blood pressure), previous surgeries, and medications you're currently taking.

- Family Medical History: Insurers want to know if close relatives had serious conditions like heart disease or cancer, especially before they turned 60.

- Lifestyle Habits: This is where you’ll share about tobacco or alcohol use, any high-risk hobbies (think scuba diving or rock climbing), and even your driving record.

- Coverage Needs: You'll need a solid idea of how much coverage you're after and for how long. If you're not sure, using a simple life insurance needs calculator can give you a great baseline to work from.

Key Insight: Your initial quote is a reflection of what you say about yourself. Your final offer is based on the verified facts discovered during underwriting. The closer you can get those two to match, the more reliable your initial research will be.

As you use these tools, you're sharing some pretty sensitive information. It's always smart to take a moment and understand how your data will be handled by reviewing data privacy policies before you start entering your details.

Instant Quote vs. Fully Underwritten Offer

One of the biggest points of confusion for people is the difference between an "instant quote" and a final, underwritten offer. They are not the same thing. Understanding this is key to managing your expectations as you move through the life insurance quotes comparison process.

An instant quote is that first estimate you get from an online tool. It’s spit out by an algorithm based on the answers you provided, with zero human review or medical verification. It’s a great ballpark figure, but it should never be treated as a guaranteed rate.

A fully underwritten offer is the real deal. This is the official premium the insurance company will charge after they’ve done their homework. This deep-dive process can include:

- A detailed review of your formal application.

- Pulling and analyzing your medical records from your doctor.

- Looking at results from a medical exam, which often includes blood and urine samples.

- Checking your driving record and other public databases.

Only after all that is done will the insurer put a firm offer on the table. If the facts they uncover line up with what you provided for the initial quote, the numbers will likely be very close. If they find new risks you didn't mention, your final premium could be higher.

Making an Informed Final Policy Decision

You’ve done the hard work, compared your life insurance quotes, and now the final offers are on the table. So, what's next? It’s tempting to just grab the one with the lowest monthly payment, but that's only part of the story.

The best choice is a balance. It’s about finding a policy that’s affordable but also comes from a reliable insurer and offers the flexibility your family might need down the road. This decision is about their future, after all. To make sure you get it right, run each offer through one last check.

Evaluating the Insurer’s Stability

Before you sign on for a policy that could be in place for decades, you have to know the company can hold up its end of the bargain. A great premium is completely worthless if the company can't pay a claim 30 years from now.

Your best tool for this is checking their financial strength rating. Look for grades from independent agencies like A.M. Best, which rates an insurer's ability to meet its financial promises. An “A-” (Excellent) rating or higher is a great sign of a stable company you can trust. Anything lower should make you pause and dig a little deeper.

Understanding Policy Riders and Flexibility

This is where you can really tailor a policy to your life. Riders are optional add-ons that can seriously upgrade your coverage, and they're a huge part of what makes a policy valuable. They might add a little to your premium, but their benefits can be a lifesaver.

Some of the most common riders to look for include:

- Waiver of Premium: If you become totally disabled and can’t work, this rider makes sure your premiums are paid so your policy doesn't disappear when you need it most.

- Accelerated Death Benefit: This lets you access some of your death benefit while you’re still living if you get diagnosed with a terminal illness.

- Term Conversion Rider: Gives you the option to convert your term policy into a permanent one later on, without having to go through another medical exam.

Choosing a policy is about more than the monthly cost; it’s about securing a promise. A top-rated insurer with flexible riders offers a more dependable promise than a bare-bones policy from a less stable company.

A Real-World Decision Scenario

Let's imagine you're looking at two final offers for a $750,000, 20-year term policy.

| Feature | Offer A | Offer B |

|---|---|---|

| Monthly Premium | $45 | $52 |

| Insurer A.M. Best Rating | B+ (Good) | A+ (Superior) |

| Included Riders | None | Waiver of Premium, Accelerated Death Benefit |

| Customer Reviews | Mixed, complaints about slow claim processing | Overwhelmingly positive, praise for support |

At first glance, Offer A seems like a deal at $7 cheaper per month. But look closer. Offer B is from a top-rated company, comes with two incredibly valuable riders, and has stellar customer reviews.

Over 20 years, the extra cost for Offer B adds up to $1,680. For that price, you're buying protection against losing your policy if you become disabled and getting early access to funds if you face a terminal illness. All of that is backed by a rock-solid company.

In this case, paying a little more buys a whole lot more security and peace of mind. It’s the smarter choice for your family's future.

Still Have Questions After Comparing Quotes?

It's completely normal to have a few lingering questions, even after you've compared all the numbers. Getting these last few details ironed out is what gives you the confidence to make the right call. Let's tackle some of the most common ones we hear.

Will Shopping Around Hurt My Credit Score?

Nope. Getting multiple life insurance quotes will not hurt your credit score. When you're shopping for a policy, insurers might do what's called a “soft pull” on your credit report. This isn't the same as the “hard pull” that happens when you apply for a credit card or a loan.

Soft inquiries are invisible to lenders and have zero impact on your credit rating. So go ahead, compare as many quotes as you need to without a second thought.

What Happens if My Final Rate Is Higher Than the Quote?

This happens more often than you might think, and it's important to remember that the initial quote is just an estimate. It's based on the answers you gave upfront. The final, official offer only comes after the underwriting team has done a deep dive into your medical records, exam results, and other verified info.

If they find a risk factor that wasn't mentioned initially, your premium might go up.

The good news? You are never obligated to accept a policy if the final rate is higher than you're comfortable with. You can always walk away and keep looking for a better fit for your budget.

How Often Should I Re-Evaluate My Policy?

Life insurance is definitely not a "set it and forget it" kind of thing. Your life changes, and your policy should change with it. A smart move is to review your coverage every few years or anytime a major life event happens.

Think about re-shopping your policy if you:

- Get married or divorced

- Welcome a new child to the family

- Buy a new home

- Get a big promotion or salary increase

- Make a major health improvement (like quitting smoking for over a year!)

Checking in on your coverage makes sure it’s still doing its job for your family and that you’re not overpaying for it.

Finding the right life insurance policy is one of the most important things you can do to protect the people you love. At My Policy Quote, we cut through the confusion and help you find clear, competitive options that actually make sense for your life.

Ready to see for yourself? Explore your options and get a personalized quote today at https://mypolicyquote.com.