Let's be honest—in the world of contracting, things can go wrong. No matter how careful you are, accidents happen. A tool gets dropped, a client trips, or a finished project has an unexpected flaw.

That’s where contractor liability insurance comes in. Think of it as your business’s financial bodyguard. It’s the essential coverage that steps in to pay for legal fees, settlements, and medical bills when your work accidentally causes an injury to someone or damages their property.

Without it, one slip-up could cost you everything.

What Contractor Liability Insurance Actually Does

Imagine your business is a house you've built from the ground up. Liability insurance is the foundation. It keeps the whole structure from collapsing when a storm—like an unexpected lawsuit—hits.

A single incident, like a client tripping over your equipment or a ladder falling on their car, could lead to a legal battle that drains your bank accounts and even puts your personal assets at risk. This insurance is specifically designed to handle claims from third parties—which is just a technical term for anyone who isn’t your employee, like clients, vendors, or the public.

To give you a clearer picture, let's break down the core protections you get with a standard contractor liability policy.

Core Protections of Contractor Liability Insurance

| Risk Category | What It Covers | Real-World Example |

|---|---|---|

| Bodily Injury | Medical bills, legal fees, and settlement costs if someone (not an employee) is injured because of your work. | A visitor to your job site trips over a power cord and breaks their arm. Your policy helps cover their hospital bills and your legal defense if they sue. |

| Property Damage | The cost to repair or replace someone else’s property that you or your team accidentally damaged. | While painting an interior, you accidentally knock over a can of paint, ruining an expensive antique rug. Your insurance would cover the replacement cost. |

| Personal & Advertising Injury | Legal costs related to claims of slander, libel, copyright infringement, or false advertising. | You run a marketing campaign that unintentionally uses an image too similar to a competitor's, and they sue you for copyright infringement. |

| Completed Operations | Damage or injury that occurs after you’ve finished the job, caused by faulty workmanship. | Months after you install a new deck, it collapses due to a structural error, injuring the homeowner. This part of your policy would respond to the claim. |

As you can see, this coverage isn't just a "nice-to-have." It's a fundamental part of running a responsible and sustainable contracting business.

The Two Main Types of Liability Protection

It’s important to know that "liability" isn't just one big, all-encompassing shield. For most contractors, it boils down to two key types of coverage:

- General Liability: This is your everyday protection. It’s for the physical "oops" moments—like dropping a hammer on a client's hardwood floor or someone getting hurt on your job site. It covers bodily injury and property damage.

- Professional Liability: Also known as Errors & Omissions (E&O), this is for mistakes in your professional services or advice. If you're a designer and your flawed blueprint leads to a costly structural rebuild, this is the policy that kicks in to cover the client's financial losses.

In a nutshell, General Liability covers physical accidents, while Professional Liability covers financial fallout from your expertise and mistakes. Knowing the difference is the first step to making sure you’re truly protected.

Of course, insurance is just one piece of the puzzle. Strong business practices are your first line of defense, and that starts with effective contractor management. When you manage your operations well, you naturally reduce the very risks that insurance is there to cover.

Keep in mind, most clients and general contractors won't even let you on-site without seeing your certificate of insurance. It’s often a non-negotiable requirement to land bigger, better jobs. For a closer look at what you might need, our guides on insurance for independent contractors can help you make sure every angle is covered.

Decoding Your General Liability Policy

Cracking open a general liability policy can feel like trying to read another language. It's packed with industry terms that don't exactly pop up in day-to-day conversation. But getting a handle on these core components is non-negotiable—they spell out exactly when and how your business is protected. Let’s translate the jargon into real-world scenarios you might actually face on the job.

At its core, your policy is built on a few key pillars of coverage. These are the specific types of mishaps your insurance company agrees to cover, keeping you from having to pay for costly mistakes out of your own pocket.

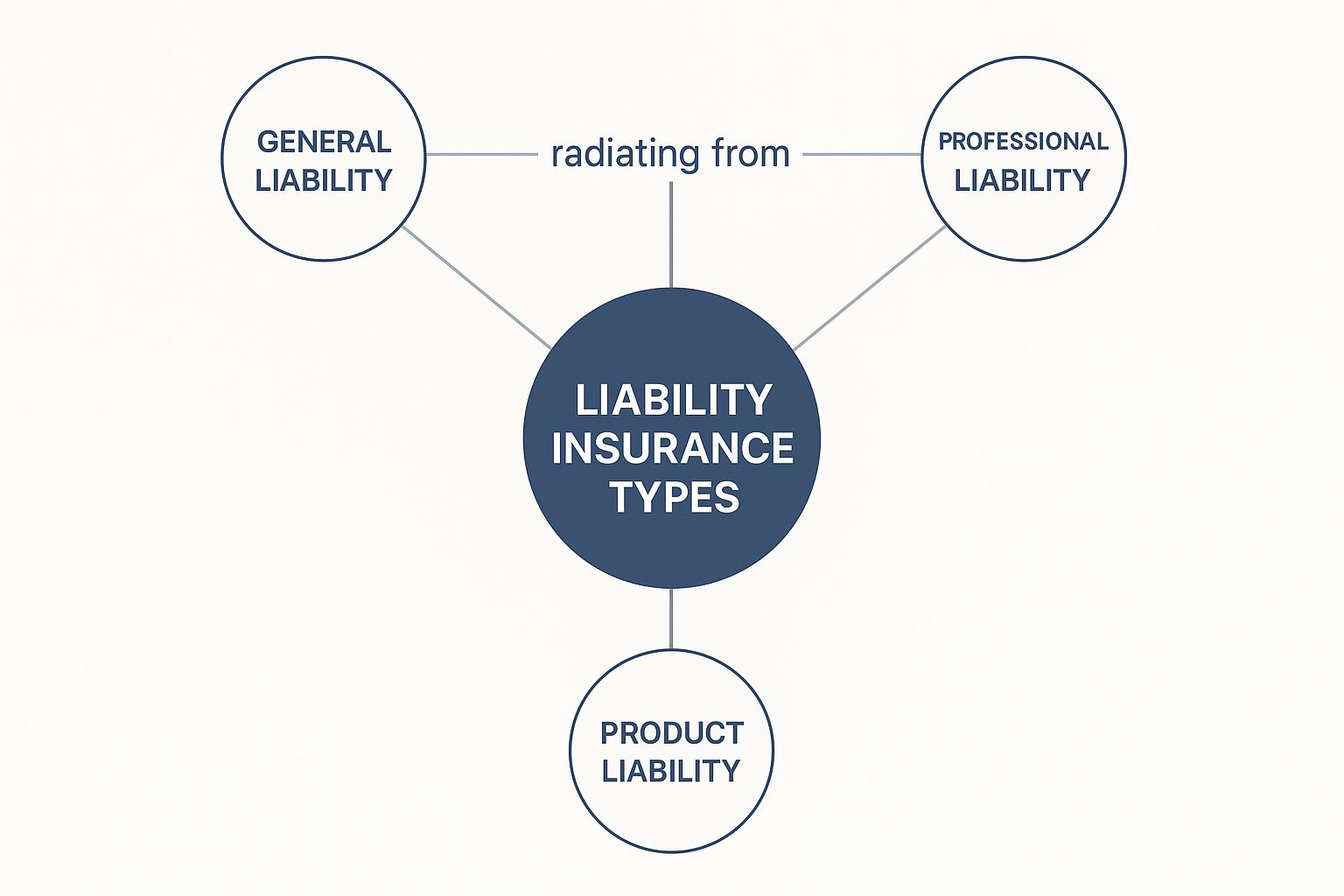

The infographic below breaks down the main types of liability insurance that create a protective shield around your business.

As you can see, different coverages tackle different risks, but General Liability is the foundation for handling those common job site accidents.

Bodily Injury Coverage

This is one of the most frequent reasons contractors need to use their insurance. Bodily injury coverage kicks in when a third party—think a client, a visitor, or even just a passerby—gets physically hurt because of your work.

Picture this: a client stops by your job site to check on the progress. They trip over a power cord your crew left out and end up with a broken wrist. This is exactly where your coverage would step in, helping to pay for their medical bills and your legal fees if they decide to sue. It’s the part of your policy that handles the human cost of an accident.

Property Damage Coverage

Just as important is property damage coverage. This has your back when you or an employee accidentally damages something that doesn't belong to you. Let's be real, mistakes happen, and this coverage ensures a small slip-up doesn’t snowball into a financial disaster.

For example, say one of your team members is carrying a ladder through a client's house and accidentally shatters an expensive custom window. Your policy would pay to repair or replace it. It covers those tangible "oops" moments that are just an unfortunate reality of the job.

Key Takeaway: Bodily injury covers harm to people, while property damage covers harm to things. Both are absolute essentials in a standard general liability policy for any contractor.

Products and Completed Operations

This is where things can get a little confusing for contractors, but it’s a critical piece of your protection. Products and completed operations coverage protects you from claims that pop up after you’ve finished the job and packed up your tools. The truth is, some construction defects don't show up right away.

Let's walk through a scenario:

- You finish a full plumbing installation for a bathroom remodel.

- Six months down the road, a pipe fitting you installed fails. It causes a slow leak that completely ruins the drywall and flooring in the room below.

- The homeowner sues you for the cost of all the new repairs.

Even though you weren't on-site when the damage happened, your completed operations coverage would respond to the claim. Without it, you’d be on the hook personally for fixing the long-term consequences of your past work. This coverage acts as your financial safety net long after you've cashed the final check, which is crucial since some states give homeowners up to 10 years to file defect lawsuits.

Before you ever have to file a claim, it's also smart to understand what a deductible is in insurance so you know what you’ll be expected to pay out-of-pocket first.

When Your General Liability Policy Is Not Enough

Think of your general liability policy as the foundation of your business’s financial protection. It’s solid, essential, and you absolutely can’t build without it. But a foundation alone won’t keep the rain out. For a contractor, relying only on general liability is like showing up to a complex job with just a hammer and a screwdriver. You’re leaving yourself dangerously exposed.

Many contractors face unique risks that a standard policy just wasn’t designed to handle. A single uncovered claim can be just as financially devastating as having no insurance at all. That’s why it’s so critical to see your insurance not as a single purchase, but as a customized toolkit built specifically for the work you do.

Expanding Your Coverage Beyond the Basics

To fill in those gaps, you’ll need to add specific policies or endorsements to your core coverage. Each one acts as a specialized shield, protecting you from liabilities that fall outside the lines of a general policy.

So, when is your general liability policy not enough? Here are a couple of all-too-common scenarios:

- A Lawsuit Exceeds Your Policy Limits: Imagine a catastrophic accident on your job site leads to a multi-million-dollar lawsuit. Your standard policy limits could be wiped out in an instant, leaving you on the hook for the rest. This is where an Umbrella Insurance policy saves the day. It provides an extra layer of liability protection that kicks in right after your primary general liability or auto liability limits are exhausted.

- A Mistake in Your Professional Advice Causes a Financial Loss: Do you provide design-build services, consulting, or professional recommendations? If a flaw in your architectural plans leads to a costly structural failure down the road, your general liability policy won't cover your client’s financial loss. For that, you need Professional Liability Insurance, often called Errors & Omissions (E&O). It’s designed specifically to cover claims of negligence or mistakes in your professional services.

Key Distinction: General liability covers physical things—bodily injuries and property damage. Professional liability covers financial losses that happen because of your advice or expertise.

Specialized Policies for Specific Trades

The type of work you do directly impacts the kind of specialized coverage you need. Certain risks are just part of the job for some trades, and you need policies designed to handle them head-on.

Commercial Auto Liability

This one is a biggie. Your personal car insurance almost never covers vehicles used for your business. If you or an employee gets into an accident while driving a work truck to a job site, you need a commercial auto liability policy to cover the damages and any injuries.

Pollution Liability

Do you work with potentially hazardous materials? Think HVAC contractors handling refrigerants or excavation crews disturbing contaminated soil. A standard policy won't touch the cleanup costs if something goes wrong. Pollution Liability Insurance is built to handle claims related to spills, contamination, and environmental damage.

Liability insurance is a massive part of the construction world, with the global market projected to hit $18.9 billion by 2025. In the U.S. alone, 61% of construction firms carry liability coverage because they know it’s essential for managing risk. Understanding all the specific contractor insurance requirements is the first step toward building a complete safety net that lets you work with confidence.

How Insurance Protects Contractors in Real Life

Theory is one thing. But seeing how liability insurance actually works on a real job site? That’s when it all clicks. The right policy isn’t just a piece of paper in a file cabinet; it's the only thing standing between a simple mistake and a business-ending disaster.

Let's walk through a few real-world scenarios that show this protection in action.

Imagine you're a roofer working on a two-story house. A sudden, unexpected gust of wind catches a stack of shingles and sends them sailing off the roof. They come crashing down on the neighbor’s brand-new car, leaving $8,000 in damage to the hood and windshield.

Without insurance, that $8,000 comes straight out of your pocket. Ouch. But with a standard general liability policy, this is exactly what it's for. You file a property damage claim, pay your deductible, and let the insurance company handle the repairs. What could have been a financial nightmare becomes a manageable business expense.

The Plumber and the Delayed Disaster

Sometimes, the real trouble doesn't show up until long after you’ve packed up your tools and cashed the check. This is where "completed operations" coverage becomes a lifesaver.

Think about a plumbing contractor who finishes a massive repiping job on a historic home. The work looks flawless, the client is happy, and everything is signed off. But eight months later, a small fitting hidden behind a wall fails. A slow, persistent leak goes unnoticed for weeks, causing massive water damage, drywall rot, and a serious mold infestation.

The total bill for remediation and repairs balloons to $45,000. The homeowner's insurance pays for it, but their next move is to sue your business to get that money back—a process called subrogation.

This is a textbook "completed operations" claim. Your general liability policy is designed to step in, covering the legal fees to defend you and paying the final settlement if you're found liable. Without it, you'd be on the hook for a bill that could easily shut your business down for good.

The Electrician and the Unforeseen Injury

Accidents involving people are almost always the most expensive—and stressful—claims a contractor will ever face. Let's look at an electrician's story.

While an employee is running new wire in a retail store, he leaves a toolbox in a busy walkway for just a second. A customer, looking down at their phone, trips over it, suffering a severe concussion and a broken hip.

The situation spirals fast:

- Medical Bills: The hospital stay and follow-up physical therapy add up to over $70,000.

- Lost Wages: The injured customer can't work for months and files a claim for all that lost income.

- Lawsuit: The customer sues your business for $500,000 to cover pain and suffering, medical bills, and lost wages.

This is a classic bodily injury case. Your contractors liability insurance is built for this exact moment. It covers the sky-high legal fees to defend your business and pays for any settlement or judgment up to your policy limit.

A situation that would instantly bankrupt an uninsured contractor becomes a process your insurance carrier manages for you. These examples prove that insurance isn't about if something will go wrong—it’s about what happens when it does.

So, How Much Is This Going to Cost Me?

When it comes to liability insurance for contractors, there’s no magic number. It's not like buying something off the shelf. Think of it more like a custom quote for a big project—the final price depends entirely on your specific business. Getting a handle on these factors is the first real step to keeping your costs in check.

The biggest piece of the puzzle? The type of work you do. Insurers live and breathe risk, and a roofer balancing on a steep pitch three stories up is in a completely different risk category than an interior painter. It’s just common sense. High-risk trades like roofing, demolition, or electrical work will pretty much always see higher premiums than lower-risk gigs like landscaping or drywall.

The Big Things That Drive Your Premium

Beyond your trade, a few other key details give insurers a clearer picture of what they’re getting into by covering you. Each one helps them calculate your potential for a claim.

- Your Annual Revenue: The more jobs you do, the more chances there are for something to go wrong. A company pulling in $500,000 a year has a lot more exposure than a one-person shop making $50,000.

- How Many People You Employ: Your crew size matters. More boots on the ground means more opportunities for accidents, which naturally bumps up the risk.

- Your Claims History: This one’s huge. A clean record shows you run a tight ship, and insurers will reward you with better rates. On the flip side, if you’ve had a string of claims, get ready for your costs to climb.

At the end of the day, it's a simple formula: the more risk an insurer sees in your business, the higher your premium will be. Everything from your operations and size to your track record goes into that calculation.

Insurance companies are essentially weighing the odds. They look at your business through a lens of risk, and every detail helps them decide what price to put on your policy. Below is a quick breakdown of the main factors they consider.

Key Factors That Influence Your Insurance Premium

| Cost Factor | Why It Matters | Impact on Premium |

|---|---|---|

| Type of Work | A roofer faces far more on-the-job hazards than a painter. | High-risk trades (electrical, demolition) mean higher costs. |

| Annual Revenue | More projects and higher earnings equal more potential for claims. | Higher revenue typically leads to a higher premium. |

| Number of Employees | A larger crew increases the likelihood of accidents or mistakes. | More employees will raise your insurance costs. |

| Claims History | A history of claims signals to insurers that you are a higher risk. | A clean record lowers your rates; multiple claims will raise them. |

| Policy Limits | Higher limits mean the insurer is on the hook for more money per claim. | A $2M policy will cost more than a $1M policy. |

| Deductible | This is the amount you pay first. A lower deductible shifts more risk to the insurer. | A low deductible increases your premium; a high one can lower it. |

Basically, every choice you make, from the jobs you take to the crew you hire, plays a role in what you'll pay.

Your Policy Choices and What’s Happening in the Market

The coverage you actually choose is a major cost driver, too. If you opt for higher policy limits—say, $2 million in coverage instead of $1 million—your premium will go up because the insurance company is taking on a bigger potential payout. The same goes for your deductible. If you choose a low deductible, you pay less out of pocket if a claim happens, but your monthly or annual premium will be higher.

It’s also worth remembering that some things are out of your control. We’ve all seen how inflation is pushing up the costs of materials and labor. Well, that also drives up the cost of insurance claims, and insurers are passing that on. General liability rates have already climbed by 5-15%, and we saw excess liability premiums jump by a whopping 8.6% in a single quarter of 2024.

By focusing on job site safety and understanding how these moving parts fit together, you can get a better grip on your expenses. For some practical tips, check out our guide on how to reduce insurance premiums.

Finding the Right Liability Policy for Your Business

Buying liability insurance for your contracting business isn't like picking something off a shelf. It’s about building a financial shield that actually fits your work. The process doesn’t start when you ask for a quote—it begins the moment you take a hard, honest look at the risks you face every single day.

Before you even think about calling an agent, take a walk through your operations. Are you a roofer working three stories up? An excavator digging near utility lines? Or a high-end remodeler trusted with expensive client property? Understanding exactly where your risks lie helps you figure out what you need to protect.

This isn’t just about saving money. It's about making sure you’re not paying for coverage you don’t need or, even worse, leaving a massive gap that could put you out of business.

Preparing for Your Insurance Application

Once you’ve got a clear picture of your risks, it’s time to get your paperwork in order. Being prepared makes the whole process smoother and helps you get quotes that are actually accurate. Insurers need to see the real you to price your policy correctly.

Get these key documents ready:

- Business Registration Details: Your official business name, address, and contractor’s license number.

- Payroll and Revenue Information: Your annual gross receipts and total payroll give insurers a sense of your business's size and scope.

- Employee Information: The number of full-time and part-time employees you have, plus any subcontractors you hire.

- Claims History: A record of any insurance claims filed against your business in the past. A clean history often gets you better rates.

Choosing Your Path to Purchase

So, how do you actually buy a policy? You’ve got two main routes: going directly to an insurance carrier or teaming up with an independent agent.

Going direct might seem straightforward, but an independent agent can be a game-changer. They don't work for just one company; they work with several. This means they can shop around for you, comparing different policies to find the best fit for your coverage needs and your budget.

Expert Insight: Think of an independent agent as your guide through a really confusing market. They can help you make sense of complicated quotes and point out the fine print in each policy, so you know exactly what’s covered—and what isn’t.

No matter which way you go, you need to understand what's happening in the market right now. Things like rising material costs are leading to more construction businesses failing, which makes insurers nervous. They’re becoming more cautious, and that can mean higher premiums and tighter coverage options for you.

This is why reading your policy documents is more critical than ever. You can learn more about how these trends are shaping the industry in this 2025 construction insurance market update. A little bit of reading now can save you from some very costly surprises down the road.

Common Questions About Contractor Insurance

Even after you get the hang of the basics, it’s completely normal to have a few more questions. Let’s tackle some of the ones that pop up most often for contractors.

Do I Need Insurance with an LLC?

Yes, absolutely. This is a big one. While having an LLC is great for protecting your personal assets (like your house or car) from business debts, it does not protect the business itself from a lawsuit.

If your company gets sued, all its assets—from bank accounts to equipment—are still on the table. General liability insurance is what steps in to cover those legal costs, so you don’t have to drain your business to pay for a claim.

What Is a Certificate of Insurance?

Think of a Certificate of Insurance (COI) as your proof of coverage, all packed into a simple one-page document. It's how you show clients, project managers, and general contractors that you’re financially responsible for any accidents that might happen on their property.

They need it to make sure you have your own back, which protects them from being held liable for your work. No COI, no job—it's that simple on most professional sites.

Is General Liability the Same as Workers Compensation?

Nope, they cover two totally different things.

- General liability is for claims from third parties, like a client who trips over your tools and gets injured.

- Workers' compensation is for your own team. It covers your employees if they get hurt while on the job.

Beyond traditional protection, effectively managing daily operations is key; you might also want to explore modern answering services for contractors. To get the right liability shield for your business, get your instant quote from My Policy Quote today! https://mypolicyquote.com