When you decide to work for yourself, you become the CEO, the marketing department, and the HR manager all in one. That last role is a big one, because it means you're now in charge of your own benefits—especially health insurance.

The good news? You've got options. The not-so-good news? It can feel like a maze. Let’s clear the confusion and map out your best paths forward.

Your Guide to Self Employed Health Insurance

Going solo is one of the most freeing career moves you can make. But that freedom comes with a new set of responsibilities, and figuring out health coverage can feel like a full-time job on its own. It’s easy to get overwhelmed when you’re already busy building your empire.

Think of this guide as your personal roadmap. We're going to break down the main ways to get covered—from the official Health Insurance Marketplace to private plans and a few other creative options. My goal is to give you the clarity you need to pick a plan that protects your health without wrecking your budget.

Understanding Your Primary Pathways

Before we get into the nitty-gritty, let's look at the landscape from a 30,000-foot view. Each route is designed for different situations, incomes, and health needs.

Here are the big three:

- ACA Marketplace Plans: This is the best place to start, hands down. If your income fluctuates or is on the lower side, you could get significant financial help to lower your costs.

- Private Off-Marketplace Plans: A great choice if you earn too much for subsidies and want more plan options or a wider network of doctors.

- Alternative Coverage: This bucket includes things like short-term plans for temporary coverage gaps or association health plans that might be available through your industry.

To make things even simpler, here's a quick cheat sheet to get you started.

Quick Overview of Self Employed Health Insurance Paths

This table gives you a snapshot of your main choices, highlighting who they’re best for and how they’re typically paid for. It's a perfect starting point before we dive deeper into each one.

| Insurance Option | Best For | Typical Cost Structure |

|---|---|---|

| ACA Marketplace Plan | Solopreneurs and families with variable or lower incomes who can get a hand with costs through subsidies. | Monthly premium that’s often lowered by income-based tax credits, making it much more affordable. |

| Private Off-Marketplace Plan | Higher earners who don't qualify for financial help and want more flexibility in choosing doctors and hospitals. | A fixed monthly premium paid straight to the insurance company. What you see is what you pay. |

| Alternative Options | People who just need temporary coverage for a few months or have access to a group plan through a professional association. | Costs vary a lot. Premiums are often lower, but you might face higher out-of-pocket costs or coverage limits. |

Now that you have the basic lay of the land, let's explore what each of these paths really looks like for a self-employed person like you.

Navigating the ACA Health Insurance Marketplace

If you're a freelancer or running your own business, the Affordable Care Act (ACA) Marketplace is often the best place to start your search for health insurance. Think of it like a Kayak or Expedia for health plans—it’s one central hub where you can compare all your options side-by-side.

This is a game-changer, especially since traditional job-based coverage isn't on the table for independent workers. In the U.S., about half of all people get insurance through an employer, which leaves everyone else to figure it out on their own. For many, these government-run exchanges are the most direct path to solid, affordable coverage. You can see just how much of a global outlier the U.S. is when it comes to health coverage on Statista.com.

Understanding Enrollment Periods

One crucial thing to know is that you can't just sign up for an ACA plan whenever the mood strikes. There are specific windows to enroll, which helps keep the insurance market stable for everyone.

- Open Enrollment: This is the main sign-up period every year, usually in the fall. It's when anyone can pick a new plan or make changes to their current one. To get the full picture, check out our guide on what Open Enrollment is and why it matters.

- Special Enrollment Period (SEP): Life happens. If you go through a major change—like getting married, having a baby, moving to a new zip code, or losing other health coverage—you might qualify for an SEP. This gives you a 60-day window outside of the main enrollment period to get covered.

Decoding the Metal Tiers

As you browse the Marketplace, you’ll see plans grouped into "metal" tiers: Bronze, Silver, Gold, and Platinum. This isn't about the quality of care you receive—it’s all about how you and your insurance company split the costs.

Key Takeaway: Think of the metal tiers as a seesaw. When your monthly premium is low, your out-of-pocket costs (like your deductible) are usually high. When your premium is high, your out-of-pocket costs are much lower.

Here’s a simple breakdown:

- Bronze: You'll pay the lowest monthly premium, but you'll have the highest costs when you actually need care. It's best for catastrophic coverage.

- Silver: This is the middle ground, with moderate premiums and moderate costs for care. Heads up: Silver plans are the only ones where you can get extra savings called Cost-Sharing Reductions (CSRs), which can be a huge help.

- Gold: You'll pay a higher monthly premium, but your costs for doctor visits and prescriptions will be low.

- Platinum: This tier has the highest monthly premium, but it also means you’ll have the lowest out-of-pocket costs when you use your insurance.

The Power of Subsidies for the Self-Employed

For freelancers, the single biggest advantage of the Marketplace is the availability of subsidies. Your income might go up and down, and the ACA is built to handle that.

The main subsidy is the Premium Tax Credit. It’s designed to directly lower what you pay each month for your plan. When you apply, you’ll estimate your income for the year ahead, and the Marketplace uses that number to figure out how much of a credit you get.

This financial help is a game-changer. It can take a plan that looks way too expensive and drop the price dramatically—often to less than $10 per month for many people. This makes the Marketplace one of the most powerful health insurance options out there for anyone who works for themselves.

When to Consider Private Off-Marketplace Plans

While the ACA Marketplace is a fantastic resource for many self-employed folks, it's not the only game in town. You can also shop for health insurance by going directly to an insurance company or working with a broker. These are what we call private or "off-Marketplace" plans.

Think of it like buying a car. The Marketplace is like a huge, multi-brand dealership where you might get a government rebate. Going private is like walking directly into a specific manufacturer's showroom. The car models might look similar, but the features, the price tag, and the whole buying experience can be totally different.

This direct-to-carrier route is a massive part of the global health industry. In fact, the private health insurance market is expected to balloon from $1.2 trillion in 2023 to $2.4 trillion by 2032. That growth tells you one thing: a lot of people are finding the coverage they need outside of the government exchanges.

Who Benefits Most from Private Plans?

So, what's the biggest difference between Marketplace and private plans? It all comes down to one word: subsidies. You cannot use the Premium Tax Credits or any other ACA financial help to lower the cost of an off-Marketplace plan.

This makes private plans the perfect fit for a very specific group of self-employed people—those whose income is too high to qualify for government help. If you're not getting a discount on the Marketplace anyway, shopping privately can unlock a whole new world of options.

You might want to look at private plans if:

- Your income is above the subsidy limits. This is the number one reason people shop off-Marketplace.

- You need a bigger network. Some private plans, especially PPOs, offer a wider choice of doctors and hospitals that you just won't find on the exchange.

- You're looking for different features. Insurers sometimes save unique plan designs with different perks or coverage structures exclusively for their off-exchange customers.

The Bottom Line: If you've run the numbers and know you won't qualify for ACA subsidies, looking at private plans is a no-brainer. You're not losing any financial aid, and you might just gain access to a plan that fits your life and health needs much better.

Weighing the Pros and Cons

Going private is a clear trade-off. You're essentially swapping the potential for financial assistance for more flexibility and choice. It's a strategic move that really depends on your income and what you value most in a health plan.

And if you find yourself in a coverage gap—maybe you're waiting for your new private plan to kick in—it's crucial to have a safety net. It's smart to learn more about short-term health insurance as a temporary solution so you're never left unprotected.

Ultimately, the decision comes down to simple math. Does the better network or specific design of a private plan outweigh the subsidies you wouldn't have qualified for anyway? The only way to know for sure is to compare quotes from both the Marketplace and private insurers. See what makes the most sense for your health and your wallet.

Comparing Your Top Health Coverage Options

Deciding on health insurance when you're self-employed can feel like a huge weight on your shoulders. To make it easier, it helps to see everything laid out side-by-side, so you can compare what truly matters for your health and your bank account.

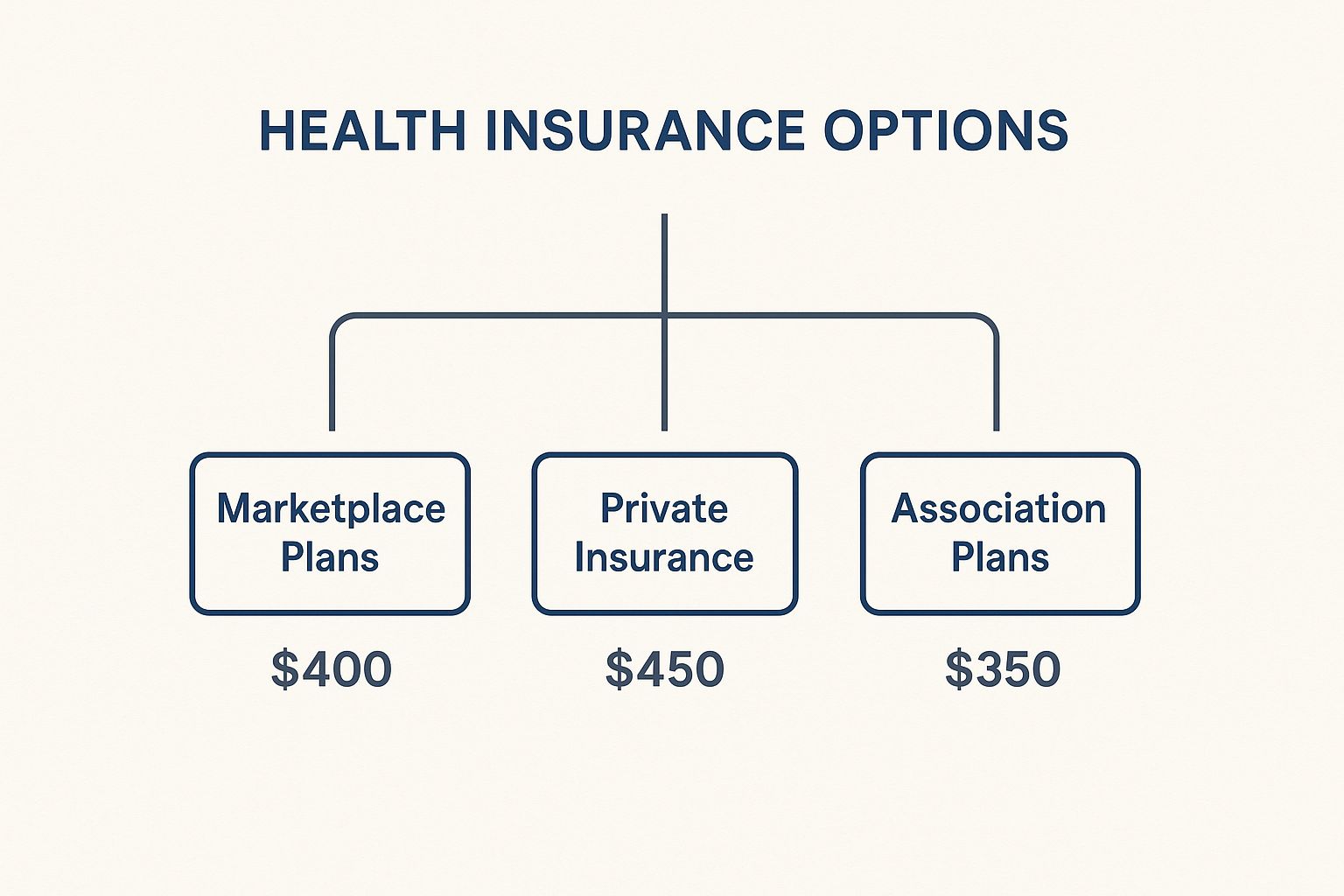

This diagram gives you a quick visual of the main routes you can take, along with some ballpark monthly premium averages to get you started.

While the average costs might look similar at a glance, the plans themselves are completely different under the hood. Understanding what sets them apart is the secret to making a smart, confident choice.

Key Factors in Your Decision

When you dig a little deeper, the real differences show up in four key areas. Focusing on these will quickly tell you which path is the right one for you.

-

Subsidy Eligibility: This is the big one. Only ACA Marketplace plans offer income-based Premium Tax Credits, which can slash your monthly costs. If your income qualifies, this is almost always the most affordable way to go.

-

Network Flexibility: Private, off-Marketplace plans often come with broader PPO networks. That means more freedom to see specialists without needing a referral first. ACA plans, on the other hand, frequently use more limited HMO or EPO networks to keep their prices lower.

-

Plan Variety: Since private insurance companies aren't bound by the exchange's rules, they sometimes offer a wider range of plan designs. You might find more options if you have specific needs that standard Marketplace plans don't quite cover.

-

Pre-Existing Conditions: This one is simple and non-negotiable. Both ACA and private plans are legally required to cover your pre-existing conditions without charging you a penny more. But—and this is a big one—alternatives like short-term plans are not, which is a major risk to take.

The best way to start is by checking the ACA Marketplace. If you don't qualify for subsidies and really need more flexibility with your doctors, then exploring private plans is the logical next step.

To really see how these options stack up, a side-by-side comparison is a must. Here’s a table that breaks down the most important features.

Feature Comparison of Self Employed Health Insurance

This table gives you a clear, at-a-glance look at how the main insurance types compare on the things that matter most.

| Feature | ACA Marketplace Plan | Private Off-Marketplace Plan | Alternative Options (e.g., Short-Term) |

|---|---|---|---|

| Subsidy Eligibility | Yes, based on income | No | No |

| Pre-existing Conditions | Covered by law | Covered by law | Generally not covered |

| Network Type | Often HMO or EPO (more restrictive) | Often PPO (more flexible) | Varies, can be very limited |

| Essential Health Benefits | Must cover all 10 essential benefits | Must cover all 10 essential benefits | Does not have to cover essential benefits |

| Enrollment Period | Limited to Open Enrollment or Special Enrollment | Can enroll anytime | Can enroll anytime |

| Best For | Individuals qualifying for subsidies; guaranteed coverage | Those needing broader networks who don't qualify for subsidies | Temporary coverage gaps only |

Seeing the differences laid out like this makes it much easier to spot which column aligns with your personal situation.

To get the full picture, you need a solid framework. Our guide on how to compare health insurance plans walks you through a step-by-step process. It takes the guesswork out of it so you can choose your coverage with total confidence.

Thinking Outside the Box: Creative Strategies and Alternative Coverage

So, what if the standard ACA and private insurance plans don't quite fit? Or what if you just need something to hold you over for a little while?

Beyond the traditional routes, there are a few other options out there. These aren't one-size-fits-all solutions, and they come with some serious trade-offs. But for specific situations—like bridging a coverage gap or finding care in a less conventional way—they can be incredibly useful. Let's break down how they work, and more importantly, what to watch out for.

Short-Term Health Insurance: The Temporary Fix

Think of Short-Term Health Insurance as a temporary safety net. It’s designed to provide catastrophic coverage for a limited time, usually a few months up to just under a year.

This can be a lifesaver for freelancers who are between major plans, waiting for Open Enrollment, or just starting their self-employment journey and need some immediate, basic protection. They're quick, easy, and usually cheaper.

But that lower premium comes at a cost. These plans are not ACA-compliant, which is a big deal. It means they don't have to cover the ten essential health benefits.

Critical Warning: Here's the biggest catch: short-term policies almost never cover pre-existing conditions. If you have an ongoing health issue, this type of plan will likely deny any claims related to it, leaving you holding the entire bill.

Exploring Community-Based and Group Options

Another path you might come across is a Health Care Sharing Ministry. It's vital to understand what these are—and what they aren't. They are not insurance.

Instead, they're faith-based organizations. Members contribute monthly payments into a big pot, and that money is used to help pay for the medical expenses of other members. It’s a community-based approach.

For healthy folks who align with the ministry's values, they can seem like a lower-cost alternative. But you need to know the risks:

- No Legal Guarantee: They are not legally required to pay your medical bills. It’s a voluntary system.

- Coverage Limitations: They often have annual or lifetime caps on how much they'll share and may exclude certain treatments or pre-existing conditions entirely.

- Lifestyle Requirements: To join, you typically have to agree to specific religious principles and lifestyle rules.

A much more straightforward and secure strategy? See if you can get in on a group plan. If your spouse or partner has a plan through their job, joining it is often the simplest and most cost-effective solution out there. You might also find group coverage through a professional organization or trade association for your industry.

Don't Forget Modern Health Solutions

As you weigh your options, remember that healthcare itself is changing. Telemedicine has become a game-changer, especially for busy entrepreneurs.

Virtual consultations for everything from a primary care check-in to mental health support are now standard in most good plans. This offers a huge advantage in flexibility and affordability. It's a trend that's here to stay, and you can learn more about how it's shaping the future by checking out these healthcare trends for 2025 on The-Alliance.org. Making sure your plan includes robust telehealth options can make whatever coverage you choose feel that much more effective.

Making the Right Choice for Your Business

Choosing a health plan is a massive decision when you run your own business. After all, you're protecting your most valuable asset: you.

It’s easy to feel overwhelmed by all the choices, but let's break it down into a simple, strategic process. This isn't just about picking a plan; it's about making a smart business move.

First things first, get a clear picture of your finances. You need a solid estimate of your annual net income because that single number is the key to unlocking potential subsidies on the ACA Marketplace. Those tax credits can dramatically slash your monthly premium, putting great coverage well within reach.

Next, be honest about your health needs. What’s your medical history look like? Are there any ongoing conditions to manage? How often do you and your family actually go to the doctor? Answering these questions helps you decide if a plan with lower monthly payments but a higher deductible is a smart gamble, or if paying more upfront for lower out-of-pocket costs makes more sense.

Finalizing Your Health Plan Selection

Once you've got your financial and health needs mapped out, it's time to dig into the details and make a final call. Use this simple framework to guide you.

-

Check the Network: Do you need the freedom to see any doctor you want (that's a PPO), or are you okay with a more limited list of providers to save some cash (HMO)? Always, always check if your current doctors are in-network before you sign up.

-

Calculate Your Real Budget: Don't get fixated on just the monthly premium. You have to look at the whole picture—the deductible, copays, and especially the out-of-pocket maximum. That's the only way to understand your true potential costs for the year.

-

Think About Taxes: The right plan doesn't just protect your health; it can be a powerful tool for your business's bottom line. Make sure you read our guide on the self employed health insurance deduction to see how you can maximize those savings.

Remember, choosing health insurance is as much a financial decision as it is a health one. When you’re looking at your budget, be sure to explore all the key freelancer tax deductions available to you. Your insurance premiums and other medical costs can significantly lower what you owe come tax time. By following these steps, you can confidently pick a plan that secures both your well-being and your business’s financial future.

Burning Questions? We’ve Got Answers.

Even with the best road map, a few questions always pop up along the way. Think of this as your final pit stop, where we clear up those lingering uncertainties about health insurance when you're self-employed.

Can I Really Deduct My Health Insurance Premiums?

Yes, you absolutely can! It’s one of the best tax perks that comes with being your own boss.

If you show a net profit for the year, you can generally deduct 100% of the premiums paid for yourself, your spouse, and your dependents. This isn't just a regular itemized deduction, either—it's an "above-the-line" adjustment that directly lowers your adjusted gross income. That means you get the benefit even if you take the standard deduction.

One Big Caveat: You can’t claim this deduction for any month you were eligible to get on an employer-sponsored plan, like through your spouse's job. It pays to double-check this, so make sure you're clear on your eligibility.

What if My Freelance Income Jumps Up or Down During the Year?

This is a huge one. If you have an ACA Marketplace plan, you need to report any significant income changes as soon as they happen. Don’t wait until tax season.

Your subsidy is tied directly to your estimated annual income, and keeping that number current is everything.

- Income Spikes? If you land a big project, your subsidy will probably shrink. Updating your income prevents a nasty surprise at tax time where you have to pay back the difference.

- Income Drops? On the flip side, a slow month could mean you qualify for a much bigger tax credit or even other programs like Medicaid. You don't want to leave that money on the table.

Think of your Marketplace profile less like a static form and more like a living document. Keep it in sync with your financial reality.

Do Health Insurance Plans Usually Cover Dental and Vision?

Most of the time, no. Standard health plans—whether from the Marketplace or a private company—don’t typically include comprehensive dental and vision for adults.

While coverage for kids under 18 is a required benefit, adults usually need to buy separate, standalone policies.

The good news is that it’s pretty simple to find one. You can shop for dental and vision plans right alongside your health plan on the Marketplace or directly from an insurer. Adding them on is the final step to getting truly well-rounded coverage.

Finding the right plan isn't just about ticking a box; it's a foundational step in building a sustainable self-employment career. At My Policy Quote, we cut through the confusion to help you compare your best options and lock in the coverage that fits your life and your business.