Buying life insurance for your adult child might feel a little strange at first, but it's one of the smartest financial moves you can make for their future. Think of it as planting a financial tree for them—one that will grow in value over time, providing both protection and opportunity.

This isn’t about worrying over a death benefit. It's about giving them a serious head start by locking in low rates and guaranteed insurability while they're still young and healthy.

Why Insuring an Adult Child Makes Financial Sense

It's a fair question: why buy life insurance for someone who is grown, independent, and in their prime? The answer is all about long-term strategy, not immediate need. By securing a policy now, you’re handing your child a powerful financial tool that could serve them for decades to come.

This proactive thinking is catching on. Recent studies show that 44% of Gen Z and 50% of millennials plan to buy life insurance within the next year, which points to a huge shift in how younger generations view financial security.

Here's a quick look at why this is such a powerful strategy.

Core Benefits of Insuring an Adult Child

| Primary Reason | Immediate Family Protection | Long-Term Child Advantage |

|---|---|---|

| Lock in Low Rates | Premiums are permanently low for the family. | The child benefits from affordable coverage for life. |

| Guarantee Insurability | The family knows coverage is secure. | Your child can't be denied coverage later for health issues. |

| Cover Shared Debts | Protects co-signers (parents) from financial liability. | Relieves the child's estate of debt burdens. |

| Build a Financial Asset | Provides peace of mind knowing a safety net exists. | The policy's cash value grows into a flexible asset for their future. |

Ultimately, it’s about creating a foundation of security that benefits everyone involved, both now and in the future.

Lock in Low Rates and Future Insurability

The biggest reason to get life insurance for an adult child is simple: it's incredibly cheap. Premiums are almost entirely based on age and health. A healthy 25-year-old can lock in a permanent policy for a tiny fraction of what they’d pay at 45, especially if a health issue pops up down the road.

When you buy a policy early, you freeze their excellent health rating for life. This guarantees they’ll always have coverage, even if they later develop a condition that would otherwise make them uninsurable.

Protect Your Family from Shared Debts

Did you co-sign a student loan, a car loan, or maybe even their first mortgage? Many parents do. But if the unthinkable were to happen, those co-signed debts don't just vanish—they land squarely on your shoulders.

A life insurance policy is the safety net that catches this burden. The death benefit can be used to pay off those financial obligations, protecting you and other family members from sudden hardship. It also covers final expenses like funeral costs, which are often surprisingly high and difficult to manage during an emotional time.

Key Takeaway: Insuring an adult child is a protective measure for the whole family. It shields you from co-signed debts and ensures final expenses don't turn into a financial crisis for those left behind.

Establish a Lasting Financial Asset

Certain policies, like whole life insurance, do more than just provide a death benefit. They build a tax-deferred cash value over time, which works a lot like a forced savings account. This growing fund becomes a financial resource your child can tap into later in life.

They can borrow against the cash value for huge life milestones, like:

- Putting a down payment on a home

- Launching a new business

- Helping fund their own kids' education

- Boosting their retirement income

This feature turns a simple policy into a flexible tool that can help create generational wealth and provide real financial stability.

Understanding Insurable Interest

Before you can buy a policy for someone else, you need to have what's called an "insurable interest." It’s a legal concept that just means you would face a financial loss if that person passed away. As a parent, this is easy to show through co-signed loans, ongoing financial support, or even the potential cost of final arrangements.

Figuring out the right amount of coverage can be tricky. Our life insurance needs calculator can help you get a clearer idea of what makes sense. Just remember, your adult child must agree to the policy and be part of the application process.

Choosing Between Term and Whole Life Policies

When it comes to life insurance for your adult child, you’ll quickly run into two main options: term and whole life. Think of it like renting an apartment versus buying a house. Neither one is automatically better—they just serve different goals for different stages of life.

The right choice really depends on what you want this policy to do. Are you looking for a simple, affordable safety net for a specific period? Or are you trying to build a permanent financial asset that will be there for your child decades from now?

Term Life Insurance: The Renter’s Approach

Term life insurance is a lot like renting. You pay for protection over a specific period—usually 10, 20, or 30 years. If your child passes away during that term, the policy pays out. Simple as that. But once the term ends, the coverage is gone, just like moving out when a lease is up.

This approach is incredibly straightforward and easy on the wallet, making it perfect for covering temporary, but significant, financial risks.

A term policy is a great fit for things like:

- Covering Co-signed Student Loans: A 10 or 15-year policy can perfectly match the timeline for paying off those educational debts.

- Protecting a Mortgage: If they just bought a home, a 30-year term policy ensures their family wouldn't have to worry about losing it.

- Providing for Young Kids: It offers a huge amount of coverage for a low price, right when their own children are young and need the most support.

The biggest win with term life is its affordability. It delivers the most protection for the lowest cost, creating a powerful safety net during the years your child needs it most.

The catch? Once the term is over, there's no value left. The premiums you paid are gone, just like rent money. If your child still needs coverage, they’ll have to apply all over again at a much higher price based on their new age and health.

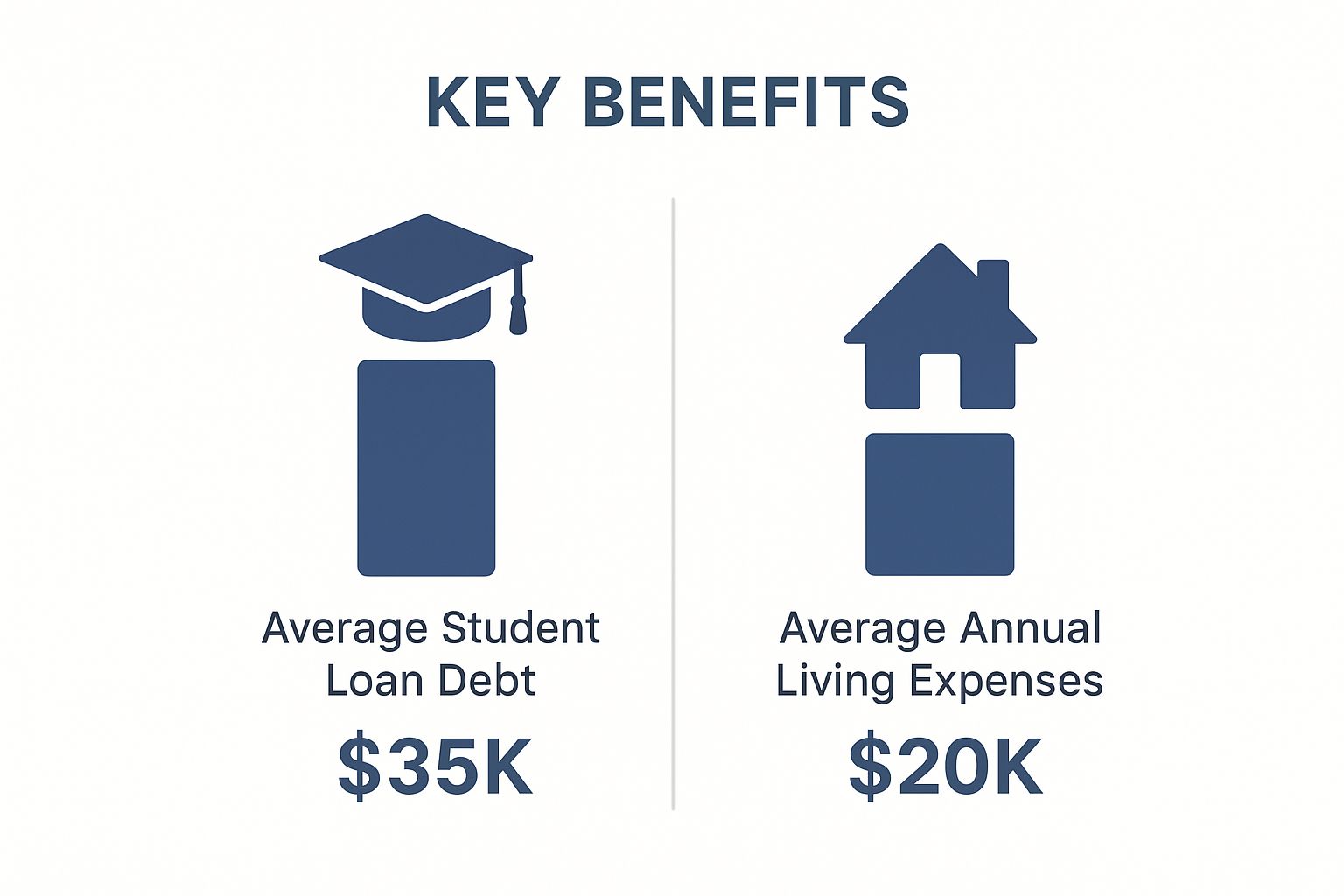

The image below shows some of the common financial burdens an adult child might face—the very things a term policy is designed to protect.

As you can see, covering even a single year of living expenses or a large student loan requires a serious financial backup plan.

Whole Life Insurance: The Homeowner's Strategy

Whole life insurance is more like buying a home. It's permanent—it lasts for your child’s entire life as long as you pay the premiums. It costs more than term, but that's because a piece of every payment goes toward building cash value. It’s a lot like how a mortgage payment builds equity in your house.

This cash value is a complete game-changer. It grows tax-deferred and becomes a living asset your child can use down the road. They can borrow against it for a down payment on a house, pull from it to start a business, or just let it grow.

A whole life policy makes sense if you want to:

- Build a Lifelong Financial Asset: The cash value becomes a flexible fund for life's big moments or unexpected emergencies.

- Cover Final Expenses: It guarantees that funeral costs and other end-of-life bills are taken care of, no matter when that day comes.

- Create Generational Wealth: The death benefit can be passed on to their own kids or a cause they care about, creating a true legacy.

Because it combines protection with a savings-like feature, whole life is a powerful tool for long-term financial planning. It’s a permanent solution that grows with them.

Comparing Term Life and Whole Life Insurance

This side-by-side comparison should help you understand the fundamental differences and choose the best fit for your adult child.

| Feature | Term Life Insurance (Renting) | Whole Life Insurance (Owning) |

|---|---|---|

| Duration | Temporary coverage for a set term (e.g., 20 years) | Permanent coverage that lasts a lifetime |

| Premiums | Lower, fixed for the term | Higher, but remain level for life |

| Cash Value | No cash value component | Builds a tax-deferred cash value asset |

| Primary Goal | Affordable protection for specific debts and timeframes | Lifelong protection combined with long-term wealth building |

So, which path is the right one? The decision really comes down to balancing cost, how long the coverage is needed, and your family's financial goals. You aren't just buying a policy; you're investing in a specific kind of security for your child's future.

For a deeper dive, you can learn more about term versus whole life insurance in our complete guide. At the end of the day, the best policy is the one that aligns with your child’s needs and your vision for their financial well-being.

Understanding What Drives Policy Costs

So, what actually determines the price of a life insurance policy? It's not just a number pulled out of a hat. Insurers look at a pretty predictable set of factors to figure out the risk involved, and that risk translates directly into your monthly payment, or premium.

If there’s one thing to remember, it’s this: the younger and healthier your adult child is, the less you will pay.

It’s a bit like car insurance. A driver with a spotless record pays way less than someone with a history of accidents. Life insurance follows the same logic. The lower the risk, the lower the cost. Getting a policy for your child in their 20s can lock in a rate that's dramatically lower than what they'd face in their 30s or 40s.

Core Factors That Impact Premiums

A few key variables come together to set the final price tag on a life insurance policy. Understanding them shows you why acting sooner is such a powerful financial move.

- Age: This one is huge—the single biggest factor. A 23-year-old is statistically much further from the end of their life than a 35-year-old, making them a much lower risk to insure.

- Health Status: A clean bill of health helps secure the best possible rates. On the other hand, chronic conditions like diabetes or high blood pressure will push premiums up.

- Lifestyle Choices: Insurers see things like smoking or high-risk hobbies (think skydiving) as red flags, and that will absolutely lead to higher costs.

- Coverage Amount: This is straightforward. A $500,000 policy will naturally cost more than a $100,000 one. The size of the death benefit is directly tied to the premium.

Want a deeper dive into how these payments work? Check out our guide on what an insurance premium is.

The Medical Exam Demystified

Don’t let the thought of a medical exam be intimidating. For most policies, it’s a standard part of the process. It's simply how the insurance company verifies your child's health information to give you an accurate, fair rate.

A paramedical professional will usually visit your child's home or office to:

- Measure height, weight, and blood pressure.

- Take small blood and urine samples.

- Ask a few questions about their medical history and family health history.

The results give the insurer a clear snapshot of your child’s health, which is then used to finalize the premium. A good exam locks in a low-risk classification and, you guessed it, the most affordable rates.

The Cost of Waiting: A healthy 25-year-old might qualify for a $250,000 whole life policy for a very low monthly premium. If they wait until 35 and develop even a minor health issue, that same policy could easily cost 50-75% more.

Some insurers are even making this process easier for young adults. For instance, certain providers allow parents to buy policies for their kids aged 18 to 25 without the child's direct involvement, even offering guaranteed rights to purchase more coverage later. It’s a unique way for families to secure affordable protection during a critical stage of life. By understanding these cost drivers, you're empowered to make a timely, cost-effective decision that will benefit your child for decades.

A Step-by-Step Guide to the Application Process

Applying for life insurance for your adult child might feel a little intimidating, but it’s actually a pretty straightforward process. Think of it less like a chore and more like a collaborative project—a shared step you're taking to strengthen their financial foundation.

The whole thing is designed to be transparent and fair. The most important part? Open communication and a clear plan from the get-go.

Step 1: Confirm Consent and Insurable Interest

This is the non-negotiable first step. Your child is a legal adult, so their full, willing consent is an absolute must. Their signature is required on the application, which means this isn't something you can do for them in secret. It’s a partnership from day one.

You’ll also need to show what’s called “insurable interest.” It sounds technical, but it just means you’d face a real financial setback if they were to pass away. This is usually easy to prove if you’ve co-signed loans for them, provide regular financial support, or depend on their help in a family business.

Step 2: Gather All the Necessary Information

A little prep work here will save you and your child a ton of time later. Before you even start filling out forms, get all the required details and documents together in one place.

Here’s a quick checklist of what you'll probably need:

- Personal Details: Your child's full name, date of birth, Social Security number, and driver's license number.

- Medical History: A list of their doctors, any current health conditions, and any medications they take.

- Family Health History: Insurers will want to know about the health history of immediate family members, like parents and siblings.

- Lifestyle Information: Be ready for questions about their job, hobbies, and habits like smoking or drinking.

Step 3: Compare Quotes and Choose a Policy

Here’s a pro tip: never just take the first quote you see. Every insurance company looks at risk a little differently, so shopping around is the key to finding the best value. You can use an online comparison tool or work with an independent agent to see offers from several carriers at once.

Once you have a few solid options, sit down with your child and go over them together. Talk about the coverage amounts, the premium costs, and whether a term or whole life policy fits better with their long-term plans.

The goal isn’t just to snag the cheapest premium. It’s about finding that sweet spot—the right balance of cost, coverage, and a company you trust—that truly meets your family's needs.

Step 4: Complete the Application and Underwriting

Once you’ve picked a policy, it’s time to fill out the official application. This can often be done online or over the phone with an agent. Honesty is everything here—giving accurate information ensures the policy will be there when it's needed most.

Next up is underwriting. This is where the insurer reviews the application to verify all the details. It usually involves a simple medical exam and a look at their medical records. To get a clearer picture of what goes on behind the scenes, check out our guide to the life insurance underwriting process.

After the policy is approved and issued, you can breathe a little easier. You've just made their financial future—and your peace of mind—that much more secure.

Navigating Modern Challenges and Considerations

Securing life insurance for an adult child isn't just about filling out paperwork. It’s a conversation—one that needs to navigate modern financial realities, personal choices, and sometimes, some pretty delicate family dynamics.

The old-school triggers for buying life insurance—getting married, buying a house, having kids—just aren't happening on the same timeline anymore. This shift changes everything. Today’s young adults are often more focused on tackling student debt or building a career, making a long-term commitment like life insurance feel way less urgent.

The Impact of Delayed Milestones

Let's be real: the timeline for major life events has completely changed. One global study found that 63% of adults under 40 have no immediate plans to tie the knot, and a huge 84% aren't planning on having kids anytime soon.

And even though 68% of them agree that life insurance is important, there's a disconnect. Traditional insurance models often lean on those big life moments to get the conversation started. This means parents and their kids need a new way to talk about this—one that’s focused on future-proofing financial health, no matter what their relationship status or family plans look like.

Deciding on Policy Ownership

One of the first, and most important, decisions you'll make is who actually owns the policy. This isn't a small detail; the owner is the one who can make changes, pays the premiums, and can access any cash value.

- Parent as Owner: When you own the policy, you're in the driver's seat. You can make sure the premiums are paid on time and the coverage stays active. This is a great way to guarantee the policy stays in force, especially if your child is still getting their financial footing.

- Child as Owner: Handing ownership over to your adult child can be incredibly empowering. It gives them a sense of responsibility and control from day one. A popular strategy is for the parent to gift the money for the premiums, helping their child build smart financial habits early on.

Key Consideration: The person who owns the policy at the start doesn't have to be the owner forever. A really effective approach is for the parent to own the policy for a few years and then legally transfer it to the child once they’re financially stable and ready to take over the payments.

Having the Conversation with a Hesitant Child

Let's face it, your adult child might be skeptical. They’re young, they’re healthy, and thinking about life insurance can feel a little morbid or just… unnecessary. The trick is to frame the conversation around empowerment and legacy, not fear.

Instead of focusing on the death benefit, talk about the living benefits. Explain how a whole life policy can become a financial tool they can tap into later—maybe for a down payment on a house or to launch that business they've been dreaming of. Position it as a strategic head start you’re giving them. It's a gift that actually grows in value over their lifetime.

The Importance of Regular Policy Reviews

Life insurance is not a "set it and forget it" kind of deal. Think of it as a dynamic financial tool that needs to adapt as your child’s life changes. Plan to sit down together and review the policy every few years or after any big life event.

Here are a few things to check during a review:

- Beneficiary Designations: Did they get married? Have a baby? The beneficiary needs to be updated to reflect who they want to protect now.

- Coverage Amount: Did they buy a home and take on a mortgage? Get a major promotion? Their coverage needs might have gone up.

- Contact Information: This one’s simple but crucial. Make sure all addresses and phone numbers are current so there are no communication gaps with the insurer.

Sorting through all these details can feel like a lot. When you're ready to choose a policy, getting some professional guidance can make all the difference. You can learn more about finding an experienced insurance broker to walk you through the process. Regular check-ins will ensure the policy stays relevant and powerful for years to come.

A Few Common Questions

Even with the best intentions, it's normal to have questions pop up when you're navigating a big financial decision like this. Let's tackle some of the most common ones parents ask, so you can move forward with total confidence.

Can I Buy a Life Insurance Policy for My Adult Child in Secret?

The short answer is a hard no. Life insurance is a legal contract, and your adult child is a key party to that agreement. Anyone 18 or older has to give their full consent and sign the application themselves. It’s simply not possible—or legal—to get a policy for them on the sly.

This rule is there to protect everyone involved. The entire process is designed to be transparent, and it requires their active participation. They'll need to answer questions about their health, share their medical history, and probably complete a quick medical exam. Think of it as a team effort right from the get-go.

Who Should I Name as the Beneficiary?

When you first take out the policy, it makes a lot of sense for you, the parent paying the premiums, to be the primary beneficiary. This is a practical move that ensures any co-signed debts or final expenses you might have to handle are covered. It’s a direct financial safety net for you.

But a beneficiary isn't set in stone. In fact, it's really important to revisit this as your child's life changes.

Once they get married, have kids, or build a life with a partner, the beneficiary should almost always be updated to that new family. The whole point of the policy shifts from protecting you to protecting them. You can change the beneficiary anytime by filling out a simple form from the insurer, making sure the policy always serves the people who need it most.

What Happens if I Transfer the Policy to My Child Later On?

Transferring ownership to your child is often the end goal, and it’s a fantastic milestone in their financial journey. Once they’re on their feet and ready to take over, you can legally sign the policy over to them. It’s usually a straightforward process that just involves a bit of paperwork.

From that moment on, they’re responsible for the premium payments. If it’s a whole life policy, they also get full control of the cash value, turning it into a real asset they can manage. This transition is a powerful step, empowering them to take the reins of their own financial protection on the foundation you helped build.

This transfer marks a huge moment—the policy goes from being a gift you manage to a financial tool they control. It’s a true step toward independence and long-term security.

Is It Better to Just Give My Child Money for a Policy Instead?

Gifting your child the money to buy and pay for their own policy is another great way to go. This approach puts them in the driver's seat from day one and can be an amazing lesson in financial responsibility. They learn to manage the payments and truly understand the value of the coverage they own.

However, there’s a real advantage to you buying it for them at first. You guarantee the policy actually gets put in place and, more importantly, you lock in a super-low rate while they have other things to worry about, like student loans or a down payment.

Lots of families find a hybrid approach is the sweet spot. You buy the policy and handle the premiums for a few years. Once your child is more settled in their career, you can transfer ownership and the payment responsibility to them. It’s the best of both worlds—securing great coverage early while still setting them up for independence down the road.

Are There Tax Headaches From Gifting the Premiums?

When you pay the premiums on your child's policy or hand them cash for it, you're technically giving a financial gift. The good news? This almost never causes tax issues for parents, thanks to the annual gift tax exclusion.

For 2025, you can give any individual up to $19,000 in a single year without even needing to file a gift tax return. Since life insurance premiums are almost always well below that amount, you likely won’t have any tax reporting to worry about.

This lets you give your child a powerful financial boost without adding any complexity to your own finances.

Ready to give your adult child a financial head start? At My Policy Quote, we make it simple to compare your options and find the perfect life insurance policy for your family. Get a free, no-obligation quote today and see just how affordable it can be to protect their future.