Figuring out health insurance for temp workers can feel like trying to solve a puzzle with half the pieces missing. When you're in a temporary role, you often don't get the same built-in benefits as permanent employees. But here’s the good news: you have solid options. From ACA Marketplace plans that can come with subsidies to private insurance and short-term policies, quality coverage is within reach.

This guide will show you exactly how to find it.

The Temp Worker’s Health Insurance Challenge

Life as a temporary worker gives you incredible flexibility, but it often means giving up traditional, employer-sponsored health benefits. Full-time employees might get a benefits package on day one. But as a temp, contractor, or seasonal employee, you’re usually on your own.

This is the core challenge. The American healthcare system has long been tied to permanent jobs, creating a huge gap for anyone working on a contract-by-contract basis. Jumping from one gig to the next means you’re not just thinking about your next paycheck—you’re also worrying about how you’ll afford a doctor’s visit or prescription.

Why Stable Coverage Matters More Than You Think

This isn't just an inconvenience; it’s a major source of stress that can take a real toll. Research shows that temporary workers often face worse health outcomes than their permanently employed peers, largely due to job insecurity and a lack of benefits. It’s a clear sign that finding a reliable plan isn't a luxury—it's essential for your well-being.

Think of this guide as your map. We're going to break down the best health insurance for temp workers, step-by-step, so you can find a plan that delivers security without draining your bank account. The goal is to move from uncertainty to confidence, knowing you're protected no matter where your work takes you.

"For a temporary worker, health insurance isn't just about managing risk—it's about creating stability in a career defined by change. Finding the right plan is a foundational step toward professional and personal well-being."

Finding Solutions for Coverage Gaps

Ready for the good part? Real, practical solutions exist. Here are the main pathways to getting you covered:

- The ACA Marketplace: This is often the best place to start. It offers comprehensive plans, and you might qualify for income-based subsidies to lower your monthly cost.

- COBRA: This lets you keep your old employer's plan for a while, but be warned—it's usually expensive since you have to pay the full premium yourself.

- Private Insurance: Buying a plan directly from an insurer can give you more flexibility with doctors and hospitals.

- Short-Term Plans: These are a temporary fix for brief gaps in coverage, but they come with significant limitations you need to understand.

If you’re specifically worried about a health insurance gap between jobs, our detailed guide on that topic can give you even more strategies. By knowing your options, you can build a safety net that follows you from one gig to the next.

Comparing Your Top Health Insurance Options

As a temporary worker, you're not shut out of the health insurance world—you just need to know which doors to try. Each path offers a different mix of cost, coverage, and flexibility. Getting a handle on these trade-offs is the first step to picking a plan that actually fits your life.

Think of it like choosing a car for a road trip. Some are built for the long haul, while others are perfect for a quick trip around town. Let's break down your main options.

The ACA Marketplace: The All-Around Choice

The Affordable Care Act (ACA) Marketplace is usually the best place to start looking for health insurance for temp workers. These plans are the real deal, meaning they have to cover essential health benefits like check-ups, prescriptions, and mental health care.

The biggest win here is the financial help. Based on what you expect to earn, you could qualify for subsidies that bring your monthly payments way down. This makes solid coverage possible even when your income isn't steady.

COBRA: Continuing Your Old Plan

If you just left a job that gave you health insurance, COBRA lets you keep that exact same coverage. The main perk is that nothing changes—you keep your doctors and your plan just as it was.

But that convenience comes with a serious price tag. You’ll have to pay 100% of the premium yourself, plus a small admin fee. Since your old boss was likely covering a big chunk of that, the new monthly bill can be a real shock.

COBRA is a bridge, not a destination. It’s a great tool for maintaining coverage for a short period while you secure a more affordable, long-term solution, but it's rarely a sustainable financial choice.

Short-Term Health Plans: The Quick Fix

Short-term plans are exactly what they sound like: temporary coverage meant to fill a short gap. They’re usually much cheaper than ACA plans, and you can sign up whenever you want.

But there are major downsides. These plans don't have to cover pre-existing conditions and often skip essentials like maternity care or mental health services. A new federal rule also limits them to just three months, making them a temporary patch at best.

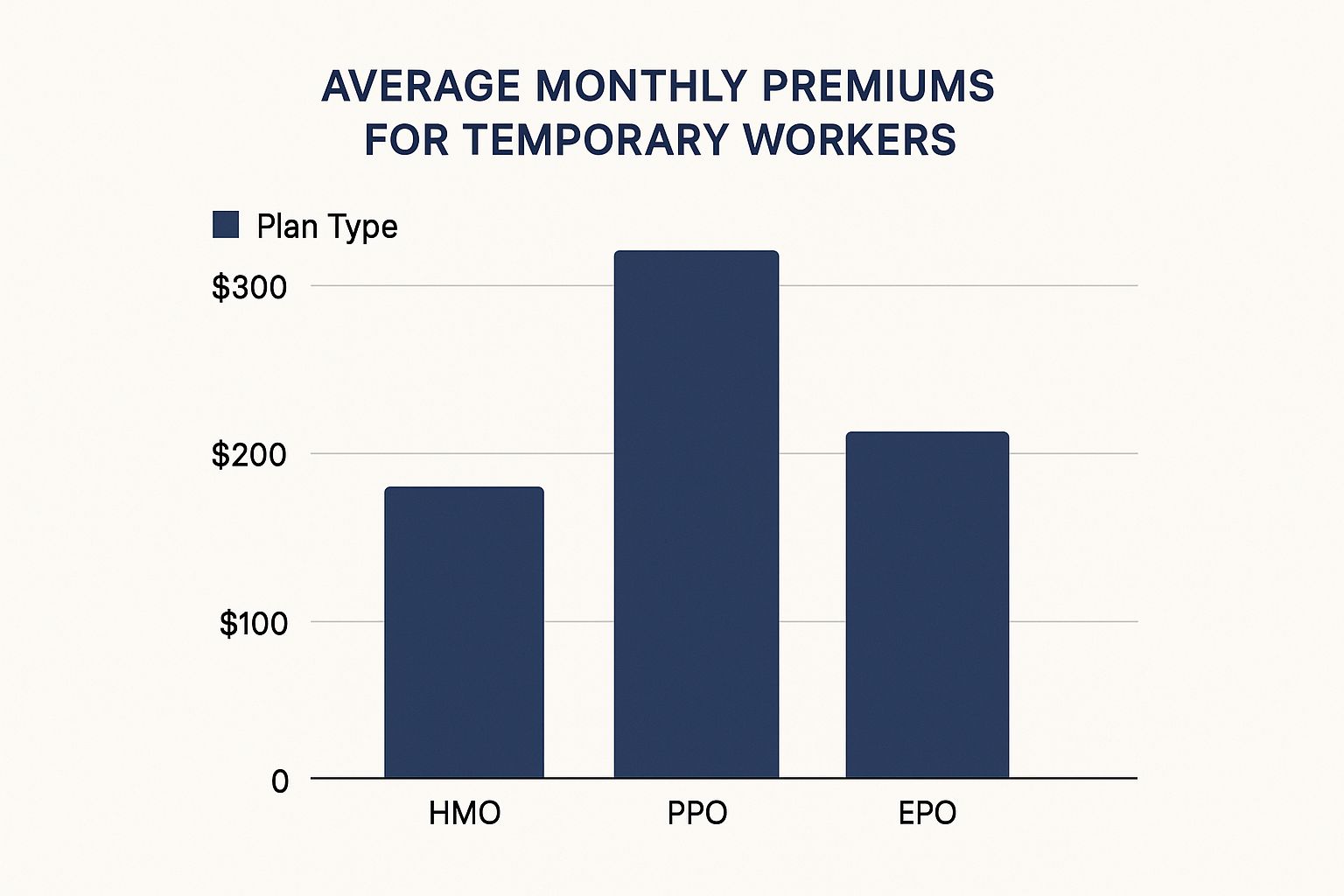

The image below gives you a rough idea of the average monthly costs for different plan types, so you can see how the numbers stack up.

As you can see, what you pay can vary a lot depending on the plan's structure and which doctors you can see.

Private Plans and Other Avenues

You can also buy a health plan straight from an insurance company. These "off-exchange" plans might offer more doctor choices, but you can't get the income-based subsidies that you would on the ACA Marketplace. For a deeper look at weighing your choices, take a look at our guide on how to compare health insurance plans.

Another option is to join a family member’s plan if you’re under 26 or if you get married. This coverage gap is a real issue—data from KFF shows that only 54% of part-time workers have insurance through their job, compared to 78% of full-time workers. This really highlights why knowing these other solutions is so important.

Comparing Health Insurance Options for Temporary Workers

Navigating these choices can feel a bit overwhelming, so let's put them side-by-side. This table breaks down the key features of each option to help you see which one might be the best fit for your situation.

| Insurance Option | Best For | Typical Cost | Coverage Level | Key Consideration |

|---|---|---|---|---|

| ACA Marketplace | Long-term, comprehensive coverage, especially if you qualify for subsidies. | Varies; can be very low with subsidies. | High; covers essential health benefits and pre-existing conditions. | You can only enroll during Open Enrollment or with a Special Enrollment Period. |

| COBRA | Short-term continuity if you want to keep your exact former employer plan. | Very high; you pay the full premium plus an administrative fee. | Same as your previous employer-sponsored plan. | The cost is often unsustainable for more than a couple of months. |

| Short-Term Plan | Filling very brief coverage gaps (1-3 months) when you need a quick, cheap option. | Low; premiums are much cheaper than ACA plans. | Low; doesn't cover pre-existing conditions and has many exclusions. | It's a temporary patch, not a long-term solution. Not real insurance. |

| Private "Off-Exchange" Plan | Individuals who don't qualify for subsidies but want more plan options than the ACA offers. | High; no subsidies are available to lower the cost. | High; plans are often similar to ACA plans but may offer different networks. | Can be more expensive than the Marketplace without financial assistance. |

Ultimately, the right choice depends on your budget, your health needs, and how long you expect to be in a temporary role. Take the time to weigh the pros and cons of each before making a decision.

A Practical Guide to the ACA Marketplace

For a lot of temp workers, the Affordable Care Act (ACA) Marketplace is the clearest path to getting solid health insurance. Think of it as a central hub for health plans, built to make shopping for and comparing coverage much simpler, especially when you don't have a plan through an employer.

The Marketplace, sometimes called the Exchange, is where you'll find comprehensive plans that cover all the essential health benefits. That means you’re protected for everything from routine doctor visits and prescriptions to emergency care and mental health services. Even better, it's the only place you can get financial help to bring your costs down.

Navigating Enrollment Windows

Here’s the thing: you can't just sign up for an ACA plan whenever you feel like it. There are specific times you can enroll, and as a temp worker with an ever-changing schedule, it's super important to know them.

- Open Enrollment: This is a fixed window every year, usually in the fall, when anyone can shop for and sign up for a health plan for the year ahead.

- Special Enrollment Period (SEP): This is your shot to enroll outside that main window. Losing a job—and the health insurance that came with it—is a Qualifying Life Event that unlocks an SEP. This gives you a 60-day window to find new coverage.

When a temporary gig ends and you lose your health coverage, that's a perfect example of a Qualifying Life Event. It’s a critical safety net for anyone making their way in the gig economy. The process is pretty similar for other independent contractors, and you can learn more about health insurance for gig workers to see how it all connects.

Estimating a Fluctuating Income

One of the trickiest parts for temp workers is guessing your annual income to qualify for subsidies. The goal is to make a realistic, good-faith estimate based on what you know. It’s a bit of an art.

Your estimated income is the key that determines how much financial help you get. Getting it right helps you avoid overpaying for your premium or having to pay back subsidies come tax time.

Start by looking at what you earned last year. Then, think about any contracts you have now and what you realistically expect to make for the rest of the year. It's an educated guess, and you can—and definitely should—update your income in your Marketplace account if it changes in a big way.

The official HealthCare.gov website is where millions of Americans start their search for coverage.

This site is your gateway to comparing plans, seeing if you qualify for subsidies, and getting yourself enrolled.

Decoding the Metal Tiers

Marketplace plans are sorted into four "metal" tiers: Bronze, Silver, Gold, and Platinum. These names have absolutely nothing to do with the quality of medical care you receive. Instead, they just signal how you and your insurance company will split the costs.

Think of it like a seesaw.

- Bronze Plans: You pay a low monthly premium, but your out-of-pocket costs (like your deductible and copays) are high. It’s like sitting on the low end of the seesaw—your monthly weight is light, but you have a long way to go up if you need to use your insurance.

- Gold & Platinum Plans: You pay a high monthly premium, but your costs when you actually get care are much lower. Here, you’re on the high end of the seesaw—your monthly weight is heavy, but you have a short drop when you need to see a doctor.

Silver plans often hit that sweet spot in the middle, offering the best value for many. They come with moderate premiums and deductibles. Plus, if your income qualifies you for extra savings (known as cost-sharing reductions), you can only get them with a Silver plan.

Understanding the Real Cost of Your Health Insurance

When you're looking at health insurance plans, especially as a temp worker, it's so easy to focus on just one number: the monthly premium. But be careful. A super low premium can sometimes be a mirage, hiding much bigger costs that only show up when you actually need to use your insurance.

The real cost of a plan isn't just what you pay each month. It's the full picture—your premium plus what you pay when you actually get care. Getting a handle on this now can save you from a major financial headache down the road.

Decoding Your Out-of-Pocket Costs

Think of your health plan as a partnership. You pay your share, and the insurance company pays its share. These four terms are basically the rules that decide who pays what, and when.

- Deductible: This is the amount you have to pay for your medical care before your insurance plan starts paying anything. So, if your plan has a $3,000 deductible, you’re responsible for the first $3,000 of your covered medical bills.

- Copayment (Copay): This is a simple, fixed fee you pay for certain services. Think $30 for a doctor's visit or $15 for a prescription. You usually pay this even after you've hit your deductible.

- Coinsurance: Once you've paid your deductible, you enter the cost-sharing phase. Coinsurance is the percentage of the bill you're still responsible for. If your plan has 20% coinsurance, you’ll pay 20% of the cost, and your insurer covers the other 80%.

- Out-of-Pocket Maximum: This is your ultimate financial safety net. It's the absolute most you will have to pay for covered services in a year. Once you reach this limit, your insurance company pays 100% of the bills for the rest of the year. No more copays, no more coinsurance. You're covered.

Your premium is the ticket to get in the game. But your deductible, copays, and coinsurance determine how much it costs to play. The out-of-pocket maximum is your peace of mind, protecting you from a worst-case scenario.

A Real-World Example

Let's make this real. Imagine you twist your ankle and head to urgent care. The total bill comes to $500.

Your health plan has a $1,000 deductible, a $50 urgent care copay, and 20% coinsurance.

Because you haven't paid anything toward your deductible yet this year, you would have to pay the full $500 bill yourself. That payment now counts toward your deductible, so you have $500 left to pay before your insurance really starts to kick in and share the costs.

Budgeting on a Variable Income

Let's be honest—budgeting for these costs is tricky when your paycheck isn't the same every month. It’s not just about affording the premium; it’s about being prepared for everything else.

Getting your finances in order can make a huge difference. Exploring strategies for managing credit card debt can free up cash flow and reduce financial stress, making it easier to handle unexpected medical bills.

One smart move? Open a separate savings account just for healthcare expenses. Every time you get paid, try to tuck a little bit away. It adds up. And if you want to get back to basics on the first cost you'll see, take a look at our article on what is an insurance premium.

What to Do When Your Temp Agency Offers Benefits

While a lot of temp jobs leave you to sort out health insurance on your own, some staffing agencies actually offer benefits. If you get an offer, that’s a huge plus—but don’t just accept it blindly.

Think of it as one of several options on the table. Your first step? Dig into the details. It’s like being offered the "house special" at a restaurant. It might be a fantastic deal, or you might be better off choosing something else. You have to ask the right questions and compare it carefully to other choices, like an ACA Marketplace plan.

Key Questions to Ask Your Agency

Before you sign on the dotted line, you need to get crystal clear on what they’re offering. Your goal is to understand exactly what you’re getting and how much it will really cost you.

Start with these must-ask questions:

- Eligibility Rules: Is there a waiting period before I can enroll? Do I need to work a certain number of hours each week to even qualify?

- Plan Costs: What is the exact amount coming out of my paycheck for the premium? And what are the plan’s deductible, copayments, and out-of-pocket maximum?

- Coverage Details: Which doctors, hospitals, and specialists are in-network? Does the plan cover my specific prescriptions or any ongoing health needs I have?

- Coverage After Assignments: What happens to my insurance when this gig ends? Can I keep my coverage between assignments?

Getting these answers in writing is non-negotiable. Don't just rely on a verbal promise; ask for the official plan documents so you can see it for yourself.

Simply having a plan offered isn't enough. The real value is in the details—how much it costs, who it covers, and whether it’s stable between assignments.

Comparing an Agency Plan to the Marketplace

Once you have the details of the agency's plan, it's time to put it head-to-head with your options on the ACA Marketplace. An agency plan might feel convenient since the premium comes right out of your paycheck, but that doesn't automatically make it the best deal.

Look past the monthly premium. A cheap agency plan might come with a sky-high deductible, making it almost useless for anything short of a major emergency. This is a massive issue globally. In China, for example, around 140 million informal workers often lack employer-sponsored health insurance and have to cover the full cost themselves, creating huge financial hurdles. You can discover more about these global coverage gaps to see the bigger picture.

In the end, it all comes down to value. Tally up the total potential costs, make sure the doctor network fits your life, and decide which path gives you better financial security for your unique situation as a temporary worker.

Got Questions? We've Got Answers

Figuring out health insurance when you're a temp worker can feel like a maze. Let's clear up some of the most common questions with straightforward, practical answers.

Can I Get Covered if I Only Work for a Few Months?

Yes, absolutely. Your job title doesn't lock you out of getting good health insurance.

The ACA Marketplace is often your best bet. Eligibility for a plan and financial help isn't based on whether your job is permanent—it's based on your estimated income for the entire year.

You can sign up during the yearly Open Enrollment Period. Or, if you lose other health coverage (like when a temp contract ends), that’s a Qualifying Life Event, which opens up a special window for you to enroll.

Another option for super-short gaps is a short-term health plan. Just know they aren't a real substitute for comprehensive insurance. They offer much less coverage and don't have to cover pre-existing conditions.

Losing your job-based health coverage when a temp gig ends is a Qualifying Life Event. This is a game-changer because it opens a 60-day Special Enrollment Period for you to sign up for an ACA Marketplace plan. You don't have to wait, and you can avoid a risky gap in your coverage.

What Happens When My Temp Job Ends?

When your temporary assignment wraps up and your benefits go with it, you have a clear path forward. The moment you lose that coverage, a Special Enrollment Period (SEP) kicks in, giving you a 60-day window to enroll in a new plan through the ACA Marketplace.

Were you covered by your temp agency's plan? If the company had 20 or more employees, you might also qualify for COBRA. This lets you keep your exact same health plan, but there’s a catch—you have to pay the entire premium yourself, which can be incredibly expensive. The key is to act fast so you don't go a single day without coverage.

How Do I Estimate My Income for the Marketplace if It's Always Changing?

This is a big one for gig and temp workers. Estimating your income when it's up and down feels like trying to predict the weather, but the goal is just to make your best, honest guess for the year. This number is what determines how much of a subsidy you can get.

To get started, pull together a few documents:

- Pay Stubs: Gather them from your current and most recent jobs.

- Past Tax Returns: Last year's income is a great starting point.

- Contracts: Look at what you have lined up to project future earnings.

Just try to be as accurate as you can. If things change big time during the year—say, you land a long-term project that pays more—you need to log back into the Marketplace and update your info. This will recalculate your subsidy and help you avoid a nasty surprise at tax time.

Are Short-Term Health Plans a Good Idea?

Honestly? They’re risky. Short-term plans have a very narrow purpose: to act as a temporary patch for a known, very brief gap in coverage, like the month between one job ending and another one starting. Their biggest selling point is that they're cheap.

But here's what you give up for that low price. These plans are not considered real insurance under the ACA. That means they can turn you down for pre-existing conditions and often skip covering essentials like maternity care, mental health services, and prescriptions.

Think of them as a bandage for a small cut, not a solution for your long-term health.

Finding the right health insurance for temp workers is all about knowing your options. At My Policy Quote, we help people just like you compare plans to find affordable, quality coverage that actually fits your life.

Ready to see what's out there? Explore your options at https://mypolicyquote.com today.