Life has a way of changing. The person you are today—your health, your finances, your family’s needs—might look completely different in 10 or 20 years. That’s where convertible term life insurance comes in. It’s a smart, flexible tool designed to grow with you.

Think of it like this: you're renting a home you love. A convertible policy is like having a clause in your lease that gives you the guaranteed right to buy that home later, at a predetermined value, no matter what happens to the housing market or your personal circumstances. It’s security for today and an open door for tomorrow.

What Exactly Is Convertible Term Insurance?

At its core, convertible term insurance is a special kind of term life policy. It gives you affordable coverage for a specific period—say, 10, 20, or 30 years—just like standard term insurance. If you pass away during that time, your loved ones receive a death benefit. Simple enough, right?

But here’s the game-changer: it comes with a built-in “conversion privilege.” This powerful feature gives you the option to swap your temporary term policy for a permanent one (like whole or universal life) down the road.

The best part? You can do this without a new medical exam. This is the key. You get to lock in your health rating from the day you first bought the policy.

Why the No-Exam Conversion Is So Important

Life is unpredictable. A health issue that pops up a decade from now could make getting new life insurance incredibly expensive—or even impossible. Convertible term insurance completely sidesteps that risk.

By getting a convertible policy while you're young and healthy, you're essentially future-proofing your insurability. It’s a strategic move that protects you from the unknowns of your future health.

A convertible policy acts as a safety net. It guarantees you can secure lifelong coverage later, regardless of any health challenges you might face along the way.

To give you a clearer picture, let's break down the core differences between a standard term policy and one with this conversion feature.

Term Life vs Convertible Term Life At a Glance

| Feature | Standard Term Life | Convertible Term Life |

|---|---|---|

| Coverage Period | Fixed term (e.g., 20 years) | Fixed term, with a conversion window |

| Medical Exam | Required at application | Only required at the initial application |

| End of Term Options | Renew at higher rates or let it expire | Convert to permanent insurance, renew, or expire |

| Key Benefit | Maximum affordability for temporary needs | Affordability now, with guaranteed lifelong options |

This table shows how that one feature—the conversion privilege—adds a massive layer of flexibility and long-term security.

Getting the Best of Both Worlds

A convertible policy brilliantly balances today’s needs with tomorrow’s possibilities. It recognizes that what works for you now might not be enough later on.

Here’s how it delivers that balance:

- Affordable Now: You get a large amount of coverage for a low premium during the years you need it most—when the mortgage is high and the kids are young.

- Flexible for Later: When your income grows and you want to build a legacy, you have a guaranteed path to permanent coverage that can last a lifetime and even build cash value.

Understanding the difference between term and permanent life insurance is crucial to seeing the true value here. This policy is the perfect bridge, giving you strong, cost-effective protection today with an open door to permanent security when you're ready for it.

How the Term Conversion Process Works

So, you have a convertible term policy and are thinking about making the switch to permanent coverage. How does that actually happen? It’s not as complicated as it sounds, but you do have to take the lead. Think of it as cashing in on a valuable option you had the foresight to secure years ago.

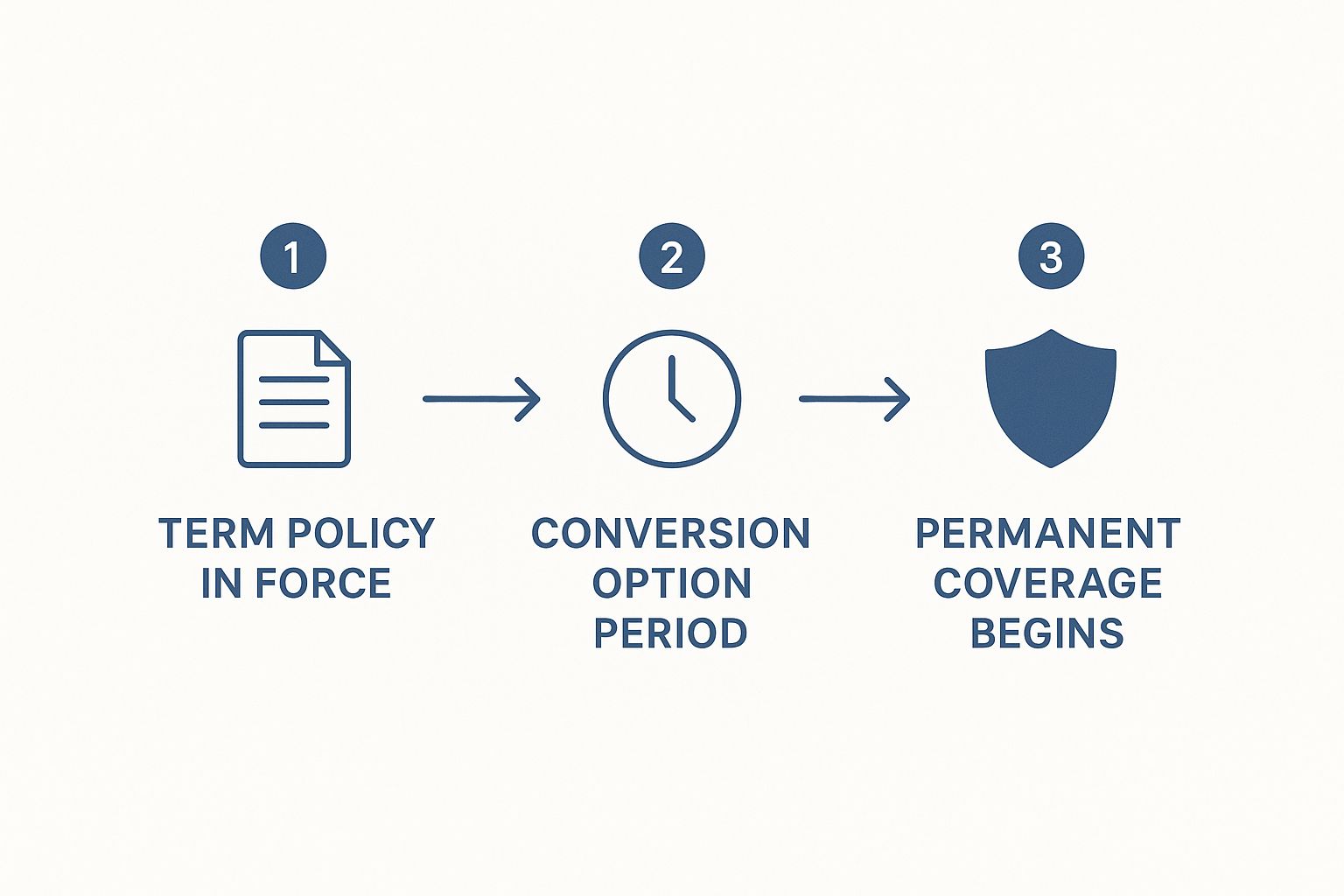

The first thing you need to pin down is your conversion window. This is a specific timeframe written into your policy that tells you exactly when you’re allowed to convert. It can be different depending on your insurer—some might give you the first 10 years of a 20-year term, while others might let you convert anytime up to age 70. It’s critical to know your dates, because if you miss this window, the option is gone for good.

This visual breaks down the journey from having a term policy to locking in permanent coverage.

The main takeaway here? Your conversion privilege doesn’t last forever. Acting within your window is everything.

The Step-by-Step Conversion Journey

Once you’ve decided to move forward and you’re within your conversion window, the process is pretty straightforward. Here’s what you can generally expect:

-

Call Your Insurer: Get in touch with your insurance agent or the company itself. Let them know you want to use the conversion feature on your term policy. They’ll get you the right forms and walk you through what’s next.

-

Pick Your Permanent Policy: This is the big decision. You’ll need to choose what kind of permanent insurance you want, like whole life or universal life. Your choice really depends on your long-term goals—are you looking for fixed premiums, cash value growth, or more flexible payments?

-

Handle the Paperwork: You'll have to fill out and sign the conversion application. But here’s the best part: no new medical exam is required. Your new policy is issued based on the same health rating you got when you first bought your term policy.

Since you get to skip the health questions and exams, the life insurance underwriting process for a conversion is incredibly simple.

Understanding the New Premiums

The most important change you’ll see is in your premiums. Your new rate will be based on your attained age—that’s your age when you convert, not the age you were when you first bought the policy.

Let’s look at an example: Sarah bought a 20-year convertible term policy at age 30. Fifteen years later, at age 45, she gets a big promotion and also receives a new health diagnosis. She decides it's time to convert. Her new permanent policy premiums will be calculated for a 45-year-old, but—and this is key—they will use her original "healthy-at-30" risk class. This move saves her from facing sky-high rates or even being denied coverage altogether because of her new health condition.

The Strategic Benefits of a Convertible Policy

Choosing a convertible term policy isn't just about buying insurance—it’s a strategic move that builds a powerful safety net for your future. The benefits run much deeper than a simple death benefit, giving you a level of flexibility and security that a standard term policy just can't offer.

The biggest win here is something called insurability protection.

Think of it like this: you lock in your health rating today, while you’re young and feeling great. This decision essentially freezes your insurability in time. If you develop a health issue down the road—like high blood pressure or diabetes—it won’t stand in the way of you getting permanent coverage. You've already guaranteed your right to convert, with no new health questions asked.

This protection is invaluable. Without it, a new health diagnosis could make permanent insurance incredibly expensive or, even worse, put it completely out of reach.

Future-Proofing Your Financial Plan

Life rarely stays still, and a convertible policy is designed to adapt right alongside you. Its greatest strength is its ability to evolve as you hit major life milestones and your financial needs change.

-

Growing Your Family: A young couple can start with affordable term insurance to cover big-ticket items like a mortgage and childcare. Later on, after a promotion or when they have more room in their budget, they can convert a piece of that policy to permanent coverage to create a lasting legacy for their kids.

-

Building a Business: An entrepreneur might secure a large, low-cost term policy during those lean startup years. As the business grows and succeeds, they can convert the policy to fund a buy-sell agreement or key person insurance, protecting the company's future.

-

Planning Your Estate: As you get closer to retirement, your focus often shifts from replacing income to legacy planning. Converting your policy ensures your heirs have the funds they need for final expenses or inheritance taxes, preserving the assets you worked a lifetime to build.

It’s this built-in adaptability that makes convertible term insurance such a smart play.

The real magic of a convertible policy is its promise of flexibility. It allows your life insurance to grow with you—from a temporary shield into a lifelong financial tool—perfectly aligning with your needs and goals as life unfolds.

This flexibility means you get to make crucial decisions based on your life circumstances, not on the whims of your future health. For a deeper dive into your options, a detailed term life insurance comparison can help you see which features best fit your long-term strategy.

Ultimately, a convertible policy delivers two essential things: financial security for your loved ones today and the priceless peace of mind that comes from knowing you have guaranteed options for tomorrow. It’s a forward-thinking approach that prepares you for all of life’s chapters.

Who Is This For, Anyway?

So, who actually needs convertible term insurance? It's not for everyone, but for certain people, it’s a game-changer. Think of it as a financial bridge connecting where you are today with where you want to be tomorrow.

It’s perfect for people who need a ton of coverage right now for a low price, but also know their life, income—or even their health—is likely to change down the road. It’s for the forward-thinkers who want to lock in their insurability today to avoid getting locked out tomorrow.

Young Professionals and Growing Families

When you’re just starting your career or a family, your budget is probably tight. But at the same time, your financial responsibilities are huge. You've got a mortgage, maybe some student loans, and the costs of raising kids. You need serious protection, but a pricey permanent policy just isn't in the cards yet.

This is where convertible term insurance comes in. You get a massive death benefit for a small premium, making sure your family is covered during these crucial years. That conversion option? It’s basically a placeholder for your future success. As your income grows, you have the guaranteed right to switch to a permanent policy for lifelong goals, like estate planning, without having to pass another medical exam.

Entrepreneurs and Business Owners

Launching a business is an all-in kind of venture. Founders often sink their personal savings into the company, which doesn’t leave much room for big insurance premiums. But the need for coverage is massive—both to protect their family and to secure things like business loans or fund buy-sell agreements.

A convertible policy is the perfect solution. It offers a cost-effective safety net during those unpredictable startup years. Later, once the business is stable and profitable, the owner can convert that policy into a permanent one. This new policy can then serve critical business needs, like key person insurance or providing cash for a succession plan, all without needing to prove you're still in good health.

Crucial Takeaway: A convertible policy lets your insurance strategy grow with your success. You get the protection you need today with the flexibility your business will demand tomorrow.

Anyone with a Family History of Health Issues

If your family tree includes conditions like heart disease, cancer, or diabetes, you know that your future health isn't guaranteed. You might feel fantastic now, but what happens in 10 or 20 years? If a hereditary condition pops up, getting insured could become incredibly difficult or expensive.

This is where convertible term insurance is a true lifesaver. By buying a policy while you're young and healthy, you lock in that great health rating for good. The conversion privilege becomes your ultimate safety net. If your health takes a turn later on, you can still switch to permanent, lifelong coverage at the same health classification you got years ago. That single move could save you thousands and give you priceless peace of mind.

Navigating Policy Limits and Potential Downsides

While the flexibility of convertible term insurance is a huge plus, it’s not a free-for-all. Think of it less like an open invitation and more like a limited-time offer with a few ground rules. Understanding these trade-offs is what separates a smart move from a missed opportunity.

The most important rule is the conversion deadline. This isn't something you can put off forever. Your policy will have a specific "conversion period," which is your window to make the switch. If you miss that deadline, your right to get permanent coverage without another medical exam vanishes. Poof. Gone for good.

The Fine Print You Cannot Ignore

Every policy is a little different, so digging into your documents is non-negotiable. The conversion window can be defined in a couple of key ways, and you need to know exactly which one applies to you.

- A Specific Timeframe: Many policies only let you convert within the first 5, 10, or 15 years. So, even if you have a 20-year term policy, the option to convert might only be available for the first half of it.

- An Age Limit: Other insurers draw a line in the sand based on age, often around 65 or 70. Once you hit that birthday, the option is off the table, no matter how many years are left on your term.

It’s on you to know these dates. Seriously, mark them on your calendar, set a reminder on your phone—do whatever it takes so this incredibly valuable opportunity doesn’t just slip through your fingers.

The Reality of Higher Premiums

This is where a lot of people get tripped up. While you get to skip the medical exam and lock in your original health rating, you don't get to keep your original premium. This is the biggest financial reality check of converting your policy.

Your new premium for the permanent policy is based on your attained age—that’s your age the day you convert. It makes sense, right? A 45-year-old will naturally pay more for permanent coverage than a 30-year-old, even if they’re in the exact same health.

Key Takeaway: Converting your policy guarantees your insurability, not your old premium. You're essentially buying a new, lifelong policy at your current age, and the price will reflect that.

This jump in cost is the trade-off. You pay more, but in exchange, you get lifelong coverage that will never expire, the potential to build cash value, and the peace of mind that comes with it.

It’s also a good time to review any riders on your policy. For example, a spouse term rider might be handled differently during conversion. Talking these details over with your agent will give you the full financial picture before you make the switch, so you can move forward with total confidence.

Still Have Questions? We Have Answers.

Digging into the details of any insurance policy can bring up a few questions. And with something as flexible as convertible term insurance, it's totally normal to wonder about the finer points. Let's clear up some of the most common things people ask.

Getting these answers straight helps you make a confident decision, so you can use your policy's best features without any surprises down the road.

Does Converting My Term Policy Cost Extra?

Great question. There isn't a separate "conversion fee" you have to pay upfront to make the switch. Think of the conversion privilege as a feature that was already baked into the price of your original policy.

However, your payments will absolutely change. Once you convert, your premiums for the new permanent policy will be higher. Why? Because permanent insurance is designed to last your entire life and usually builds cash value, making it a different kind of financial tool than temporary term coverage. The new, higher premium is calculated based on your age at the time you convert, not your age when you first bought the policy.

The Bottom Line: While you skip a one-time conversion fee, you should definitely plan for a significant and permanent increase in your monthly premium payments after making the switch.

Can I Convert Only a Portion of My Term Policy?

Yes, and this is a fantastic strategy. In most cases, insurers allow for a partial conversion, which lets you find the perfect balance between your budget and your need for lifelong coverage.

For example, let's say you have a $1 million convertible term policy. As you get older, you might realize you only need $250,000 in permanent coverage for final expenses or a small inheritance. You could convert just that amount to a whole life policy and let the remaining $750,000 ride out as term coverage until it expires.

This blended approach is a smart move for a few reasons:

- You lock in permanent coverage that will never go away.

- You keep a large amount of affordable term protection for the years you need it most.

- The smaller permanent policy makes the premium jump much more manageable.

What Happens If I Miss My Conversion Deadline?

This is one of the most important things to get right. If you let your conversion period expire without taking action, you lose the right to convert your policy without a new medical exam. Poof. The option is gone for good.

Your policy doesn't just cancel—it will continue as a regular term life policy until its original term is up. But once that term ends, your coverage stops. Completely.

If you still need life insurance at that point, you’re back at square one. You'll have to apply for a brand-new policy, which means going through the whole medical underwriting process again. Your new premiums will be based on your current age and any health issues you’ve developed over the years. This is why keeping an eye on that deadline is so critical—missing it can be a costly mistake.

Are All Term Life Insurance Policies Convertible?

No, they definitely are not. Convertibility is a special feature, often called a conversion privilege or a conversion rider. It has to be written into your policy contract from day one.

You can't just assume a term policy is convertible when you're shopping around. In fact, many of the cheapest, bare-bones term policies on the market are non-convertible. They offer straightforward protection for a set period, and that's it. If you want the freedom to switch to permanent coverage later, you have to specifically look for and confirm the policy includes this valuable feature. It might cost a little more upfront, but the long-term security it offers is often well worth the small difference.

At My Policy Quote, we specialize in helping you find flexible insurance that can grow and change right along with you. Let's explore your options and lock in your future insurability today. Get a personalized quote at https://mypolicyquote.com.