Think of a copay as a simple, flat fee you pay for a specific medical service—like your regular doctor's visit or picking up a prescription. It’s a straightforward way to share costs with your health insurance plan. You pay your part, and they handle the rest.

This predictable cost makes budgeting for routine healthcare a whole lot easier. No surprises, no complicated math.

What Exactly Is a Copay?

A copay, short for copayment, is one of the clearest parts of your health insurance. It’s a set dollar amount, not a percentage, that you pay directly to your doctor's office or pharmacy when you receive care.

Your insurance plan determines these amounts, and they often change depending on the service. For example, your plan might have a $30 copay for a visit to your primary care doctor but a $60 copay for seeing a specialist, like a cardiologist. This structure helps keep the healthcare system balanced by sharing the expenses between you and your insurer. You can find more details on how global healthcare is funded at hrw.org.

The best thing about a copay is its predictability. You know exactly what you owe for an appointment before you even walk through the door, which takes the guesswork out of managing your health expenses.

How Copays Apply to Different Services

So, where will you actually run into a copay? It’s not for every single medical bill, but you'll see it pop up for the most common, routine services. It’s a system designed to keep payments simple for everyone involved.

Here’s a quick look at where you can expect to pay a copay:

- Primary Care Visits: Your standard check-ups and sick visits with your family doctor.

- Specialist Visits: Appointments with doctors who have specialized training, which usually come with a higher copay.

- Prescription Drugs: Medication copays are often tiered. Generic drugs will have the lowest fee, while brand-name drugs cost more.

- Urgent Care Visits: For those times when you need care right away but it’s not a life-threatening emergency.

To make it even clearer, here’s a quick breakdown of what you might pay for different services.

Common Copay Scenarios at a Glance

This table shows some typical copay amounts for various medical services, illustrating the fixed fee you're responsible for versus what your insurance company covers.

| Medical Service | Your Typical Copay | What Your Insurance Covers |

|---|---|---|

| Primary Care Doctor Visit | $25 – $40 | The rest of the visit's cost |

| Specialist Visit (e.g., Cardiologist) | $50 – $75 | The rest of the visit's cost |

| Generic Prescription Drug | $10 – $20 | The rest of the drug's cost |

| Urgent Care Visit | $50 – $100 | The rest of the visit's cost |

| Emergency Room Visit | $150 – $300 | The rest of the ER bill |

As you can see, the copay is just your small, fixed portion of a much larger bill, which is a huge relief when you need care.

Copay vs Deductible vs Coinsurance

Trying to understand health insurance costs can feel like you’re learning a whole new language. Three terms almost always cause confusion: copay, deductible, and coinsurance.

The easiest way to make sense of them is to think of them as steps you take in a specific order throughout your plan year. Let’s break it down.

First up, your copay is a simple, fixed fee you pay for routine services right from the start. Think of it like a cover charge for visiting the doctor or picking up a prescription. It's a predictable amount you pay at the time of service, and it applies whether you’ve met any other out-of-pocket costs or not.

The Role of Your Deductible

Next in line is the deductible. This is the total amount you must pay yourself for certain covered services before your insurance plan starts to share the costs. For example, if your plan has a $2,000 deductible, you’re on the hook for the first $2,000 of your medical bills for things like hospital stays or surgeries.

It's important to know that your routine copays usually do not count toward meeting this deductible. They are totally separate payments for different kinds of care.

When Coinsurance Kicks In

Once you’ve paid your full deductible, you enter the coinsurance phase. Now, instead of a fixed fee, you pay a percentage of the bill for any covered services. Your plan might have an 80/20 coinsurance split, for instance.

This means that after your deductible is met, your insurance company picks up 80% of the tab, and you are responsible for the remaining 20%. This cost-sharing continues until you eventually hit your out-of-pocket maximum for the year.

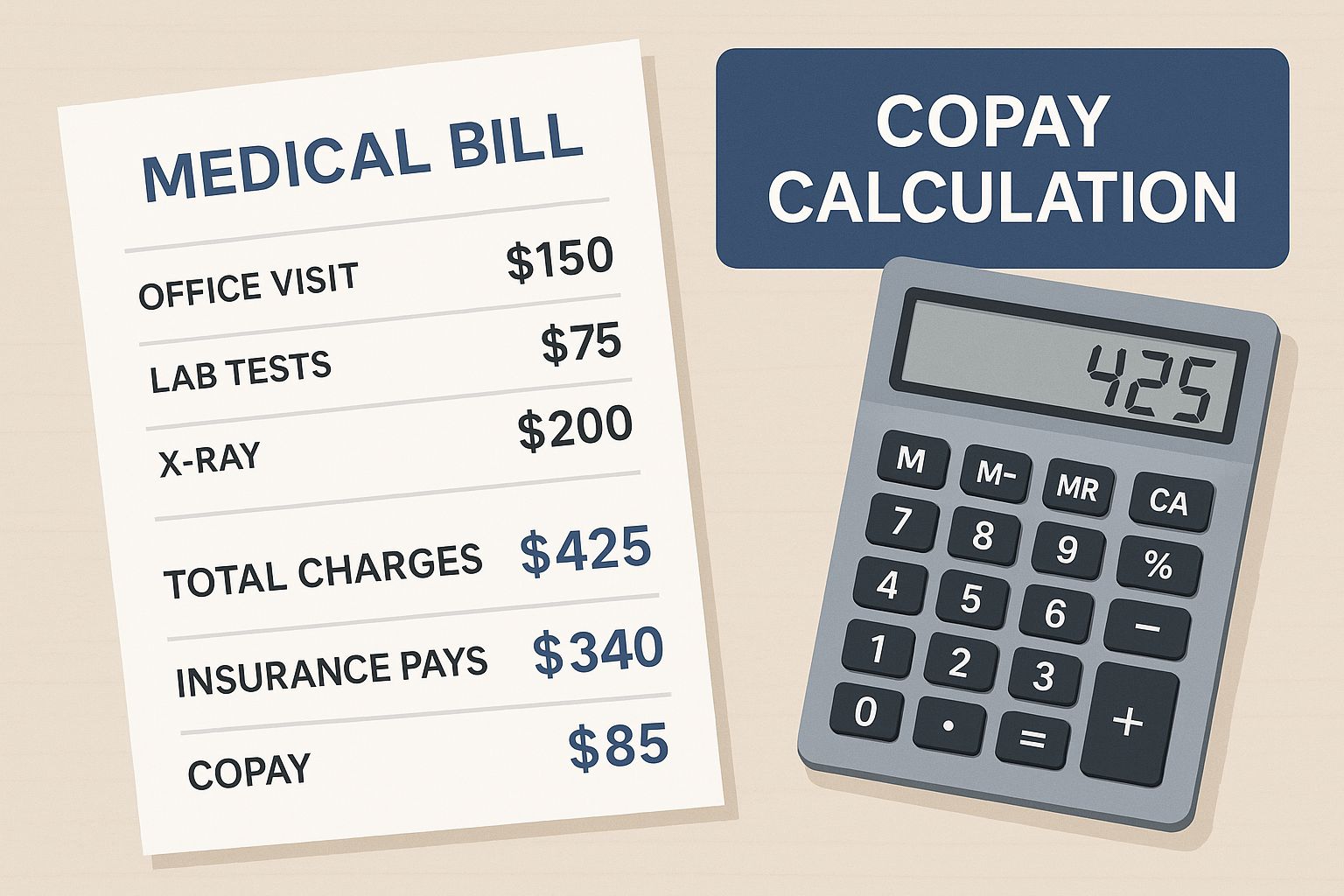

This image breaks down how these costs are calculated, showing the distinct roles of copays, deductibles, and coinsurance.

As the visual shows, a copay is a fixed, predictable fee, while deductibles and coinsurance handle the larger, more variable costs.

To bring it all together, let’s look at a quick side-by-side comparison of these three key costs. If you want to dive even deeper, you can learn more about the specific differences between coinsurance vs copay on our blog.

Copay vs Deductible vs Coinsurance

| Cost Type | What It Is | When You Pay It | Example |

|---|---|---|---|

| Copay | A fixed, flat fee for a specific service. | At the time of service, from day one of your plan. | $30 for a primary care visit. |

| Deductible | The total amount you must pay before insurance starts sharing costs. | Before your plan begins to pay for non-copay services. | The first $2,000 of a hospital bill. |

| Coinsurance | A percentage of the cost you pay for a service. | After you have met your annual deductible. | You pay 20% of a $500 bill ($100). |

Each of these costs plays a different role in how much you pay for healthcare. Understanding how they work together is the first step toward making your health plan work for you.

How Your Health Plan Sets Your Copay Amount

Ever wondered why your copay is $25 for a check-up, but your friend pays $50 for a similar visit? Those numbers aren’t just pulled out of a hat. They’re a direct reflection of the specific health plan you chose.

Think of it like a seesaw. On one end, you have your monthly premium. On the other, you have your out-of-pocket costs, like copays. If you choose a plan with a higher monthly premium, your copays will likely be lower. On the flip side, a plan with a lower monthly premium usually means you’ll pay more when you actually go to the doctor.

It’s all about finding the right balance for your budget and your health needs.

Factors That Shape Your Copay

A few key things work together to determine what you’ll pay at the doctor's office or pharmacy. Getting a handle on these can save you from sticker shock down the road. If you need a hand with this, our guide on https://mypolicyquote.com/2025/08/10/how-to-compare-health-insurance-plans/ is a great place to start.

Here's what really moves the needle:

- Plan "Metal" Tier: Marketplace plans are sorted into tiers: Bronze, Silver, Gold, and Platinum. Bronze plans have the lowest monthly premiums but the highest copays. Platinum plans are the opposite—highest premiums, but the lowest costs when you need care.

- Provider Type: You'll almost always pay less to see your primary care physician (PCP) than you will for a specialist like a cardiologist or a dermatologist.

- Network Status: This one is huge. Staying inside your plan’s network of approved doctors is the key to keeping costs down. If you go out-of-network, your insurance pays a lot less, and you’re left holding a much bigger bill.

At the end of the day, your copay is just one piece of the puzzle. It's also smart to be aware that for certain treatments or procedures, you might have to go through the process of preauthorization to make sure your plan will cover it.

Seeing Your Copay in Action with Real Examples

Insurance terms can feel a little abstract until you see them play out in real life. So, let’s walk through a few common situations to connect the dots between the numbers on your insurance card and what you actually pay at the counter.

Example 1: The Simple Doctor Visit

Imagine you wake up feeling awful—sore throat, fever, the works. You book an appointment with your primary care physician (PCP). Your health plan says you have a $30 copay for PCP visits.

When you get to the doctor’s office, you’ll pay that $30 right at the front desk. That’s it. Even if the total cost for the visit is $150, your part is done. Your insurance company takes care of the remaining $120 directly with the provider. Simple and predictable.

Example 2: Visiting a Specialist

Now, let's say that sore throat turned into a nagging cough, and your PCP refers you to a lung specialist (a pulmonologist). Specialist visits almost always have a different, higher copay. For this example, it's $60.

Just like with your PCP, you pay your $60 copay when you check in for your appointment. The specialist’s bill might be $250, but your financial responsibility is still just that fixed $60. Your insurance handles the other $190. This tiered copay system is incredibly common because specialized care simply costs more.

Example 3: The Emergency Room Trip

Okay, this is where things get a bit more complex. Picture this: you slip on some ice, break your arm, and end up in the emergency room. Your plan has a $250 ER copay and a $1,500 annual deductible.

Here’s how all the pieces fit together:

- ER Copay: The first thing you’ll pay is your $250 copay. This is your fixed fee for walking through the ER doors.

- Meeting the Deductible: Let’s say the total bill comes to $3,000. After your copay, $2,750 is left. Now, your $1,500 deductible kicks in. You have to pay this amount out-of-pocket before your insurance starts sharing the costs.

- Coinsurance: After your deductible is paid, the remaining bill is $1,250 ($2,750 – $1,500). If your plan has 80/20 coinsurance, your insurer pays 80% ($1,000), and you pay the last 20% ($250).

So, for this one ER visit, your total out-of-pocket cost would be $2,000. That's your $250 copay + $1,500 deductible + $250 coinsurance. This scenario really shows how all your cost-sharing elements work together when something serious happens.

It’s crucial to understand these layers. If you need a refresher, we break it all down in our guide on what a deductible is in insurance.

How Your Out-of-Pocket Maximum Protects You

Your copays, deductible, and coinsurance are your share of the costs, but thankfully, they don't go on forever. Every health plan has a built-in financial safety net called the out-of-pocket maximum.

Think of it as the absolute ceiling on what you’ll have to pay for covered medical care in a single year. It’s your ultimate protection against the kind of catastrophic bills that can turn life upside down.

Once the money you’ve spent on your deductible, copays, and coinsurance adds up to this limit, you’re done. Your financial responsibility for covered, in-network care is over for the rest of the plan year.

From that point on, your insurance company steps in and covers 100% of your eligible medical costs. This is what provides true peace of mind, especially if you’re dealing with a serious illness or a sudden accident that needs a lot of treatment.

What Counts Toward the Limit?

So, which payments actually get you closer to hitting that cap? The good news is that pretty much every dollar you spend on care that your plan covers gets you one step closer to the finish line.

These are the expenses that chip away at your out-of-pocket max:

- Your Deductible: The full amount you pay before your plan really starts to kick in.

- All Your Copayments: Every single fixed fee you pay for doctor visits, prescriptions, and specialist appointments adds up.

- Your Coinsurance Payments: Your share of the bill (that percentage you pay) after your deductible is met.

Just remember, your monthly premiums don't count toward this limit. Neither do payments for out-of-network care or any services your plan doesn’t cover in the first place.

Understanding how do copays work alongside your deductible and out-of-pocket maximum is the key to truly managing your healthcare budget. This protective feature ensures that even in a worst-case scenario, your financial liability is capped. It’s one of the biggest ways your health insurance delivers real value and security when you need it most.

Why Your Copays and Other Health Costs Keep Rising

If it feels like your healthcare costs are always inching up, you’re not just imagining it. The amount you pay for a copay isn’t some random number your insurer dreamed up; it’s directly tied to the rising tide of medical expenses across the entire country.

When the price of providing care goes up for hospitals and doctors, insurers have to adjust. They tweak premiums, deductibles, and, yes, your copays to keep the whole system balanced. That fixed fee you pay for a doctor’s visit is a small piece of a much larger, and constantly shifting, economic puzzle.

What’s Pushing These Costs Higher?

A few powerful forces are driving healthcare spending up, and the impact trickles all the way down to what you pay at the pharmacy counter.

These are the big ones:

- Sky-High Specialty Drugs: Breakthrough medications are changing lives, but they come with jaw-dropping price tags. Think of new cell and gene therapies or the incredibly popular GLP-1 drugs used for diabetes and weight loss.

- Cutting-Edge Medical Tech: New diagnostic tools, surgical robots, and other innovative treatments are incredible medical advancements, but that innovation doesn’t come cheap.

- An Increase in Catastrophic Claims: We're seeing more high-cost medical events, like complex surgeries or long-term treatments for major illnesses. When insurers have to pay out more for these big claims, it affects everyone.

You can think of it like a ripple effect. As the total cost of care rises for the insurer, they have no choice but to pass a portion of that increase on to members through higher cost-sharing—including your copays.

This trend isn't slowing down anytime soon. In fact, U.S. employers are bracing for an 8% jump in health care costs for 2025, mostly fueled by the massive price of specialty prescription drugs. You can get a deeper look into these projections and the other health insurance industry challenges that shape what you pay.

Understanding how do copays work in this larger system is key. Your copay might feel small, but it’s a direct reflection of these bigger financial pressures that are reshaping the entire healthcare world.

A Few Lingering Questions About Copays

Even with the basics down, a few questions always seem to pop up when you're trying to figure out how copays work in the real world. Let’s tackle some of the most common points of confusion head-on.

Do My Copays Count Toward My Deductible?

In almost every case, the answer is no.

It helps to think of your copays and your deductible as two separate buckets. Copays are those fixed, predictable fees for everyday things like a routine doctor’s visit. Your deductible, on the other hand, is the amount you have to pay for bigger-ticket care—like a hospital stay—before your insurance starts chipping in.

Because they cover different kinds of costs, the money you spend on copays usually doesn't count toward lowering your deductible.

What if I Can’t Afford My Copay Right Now?

If you show up for an appointment and realize you can’t cover the copay, don't panic. Many clinics will still see you and simply bill you for the amount later.

Your best bet is to call the office ahead of time. Just explain your situation and ask what their policy is. They might even have payment options available.

Never, ever skip necessary medical care because you can't pay the copay on the spot. Your health comes first, and most medical offices are willing to work with you.

Why Do Some Visits Have No Copay at All?

You’ve probably noticed that certain preventive services—like your annual physical or a flu shot—often have a $0 copay. This isn't just a nice perk; it’s often a requirement under the Affordable Care Act (ACA).

The goal is to encourage everyone to stay on top of their health and catch potential problems early, so these essential preventive services are covered at no cost to you on most plans.

Prescription drugs can also get a little complicated. They often work on a tier system. Generic drugs (Tier 1) will have the lowest copay, while brand-name (Tier 2) and specialty drugs (Tier 3 or 4) will cost you significantly more.

Navigating the world of health insurance can feel like a maze, but you don't have to find your way alone. The experts at My Policy Quote are here to help you find a plan that actually fits your life and your budget. Explore your options today at mypolicyquote.com.