"No charge after deductible" is a phrase you’ll see in your health plan details, and it’s one of the best you can find. It means that once you’ve paid a certain amount out of your own pocket for medical care during the year (your deductible), your health insurance plan starts covering 100% of the costs for eligible, in-network services.

Think of it as a financial finish line. After you cross it, your insurance company takes over the bills for any covered care you need for the rest of that plan year.

Unpacking Your Health Insurance Safety Net

Trying to understand your health insurance can feel like learning a new language. The cornerstone of it all—the term you absolutely need to get—is the deductible. It’s the foundation of your financial protection.

Before you hit this key number, you’re responsible for paying most of your medical bills yourself. This is the phase where you pay directly for services until your total spending reaches that deductible amount. To get a better handle on this critical concept, check out our simple guide on what a deductible in insurance is and how it works.

For example, let's say your plan has a $1,500 deductible. This means you’ll pay the first $1,500 of your covered medical expenses. Once you’ve paid that amount, any covered care you receive afterward comes with no additional charge. Your insurer picks up the full tab from there.

Your Costs Before and After the Deductible

The switch in who pays for what is dramatic once you meet your deductible. It’s easily the most important milestone in your health coverage each year.

The moment you satisfy your deductible, your plan transforms. It goes from a cost-sharing tool to a powerful safety net that fully covers approved medical expenses, protecting you from major financial stress for the rest of the year.

This transition is what provides real peace of mind. To make it crystal clear, let's look at how your payment duties change for covered medical care before and after you hit that magic number.

Your Financial Responsibility Before vs After Meeting Your Deductible

Here’s a quick summary showing how your payment obligations for covered medical services change once your annual deductible is met.

| Scenario | Your Responsibility | Insurance Company's Responsibility |

|---|---|---|

| Before Deductible is Met | You pay 100% of the costs for most covered services (preventive care is usually an exception). | The insurance company typically pays $0 for these services. |

| After Deductible is Met | You pay $0 for all subsequent covered, in-network services. | The insurance company pays 100% of the costs. |

As you can see, meeting that deductible is the game-changer. It’s the point where your health plan truly steps up to shield you from high costs, letting you focus on your health instead of the bills.

Seeing Your Deductible Work in The Real World

Insurance terms can feel a bit abstract until you see them play out. Let’s make this crystal clear by walking through a real-world example of how a deductible works over the course of a year.

Meet Sarah. Her health plan has a $2,000 deductible. This is the magic number she needs to hit in out-of-pocket medical costs before her insurance company starts paying 100% for her covered care.

In February, Sarah sees a specialist for a persistent cough, and the visit costs $400. Since she hasn't put anything toward her deductible yet, she pays the full amount herself.

A few months later, in May, she needs some lab work that comes to $600. She pays this bill too. Now, she's paid a total of $1,000 ($400 + $600) toward her $2,000 deductible. She’s halfway there.

Reaching The Turning Point

Then, in August, Sarah has a minor outpatient procedure with a total bill of $1,500. This is where things get interesting. She only has $1,000 left to meet her annual deductible.

So, she pays that remaining $1,000. The moment she does, her plan's "no charge after deductible" feature kicks in. Her insurance company steps up and covers the final $500 of that procedure’s bill. Sarah has officially met her deductible for the year.

From this point on, any other covered, in-network medical care for the rest of the year is 100% paid for by her plan. For those services, Sarah will see no further charges.

This little story shows how every medical expense chips away at the deductible until it's gone. Understanding this milestone is more important than ever, especially with the rising cost of healthcare. In fact, the average deductible for employer-sponsored plans hit around $1,700 for individuals by 2022, shifting more of the initial financial burden to us.

It's also a smart idea to track these expenses. Some of your out-of-pocket costs might even qualify for tax breaks. To learn more, check out our guide on health insurance tax benefits and see how you might save.

How Different Health Plans Change The Game

The path to hitting your deductible—and unlocking that amazing "no charge after deductible" perk—isn't the same for everyone. The kind of health plan you pick can completely change how fast you get to that financial finish line.

Different plans, often sorted into metal tiers like Bronze, Silver, Gold, and Platinum, are all about balancing what you pay each month (your premium) with what you pay when you actually need care. It’s a classic trade-off.

A Bronze or Silver plan, for example, usually has a lower monthly premium. Great for the budget, right? But here's the catch: they often come with a massive deductible, meaning you'll pay a lot more out-of-pocket before your insurance really kicks in.

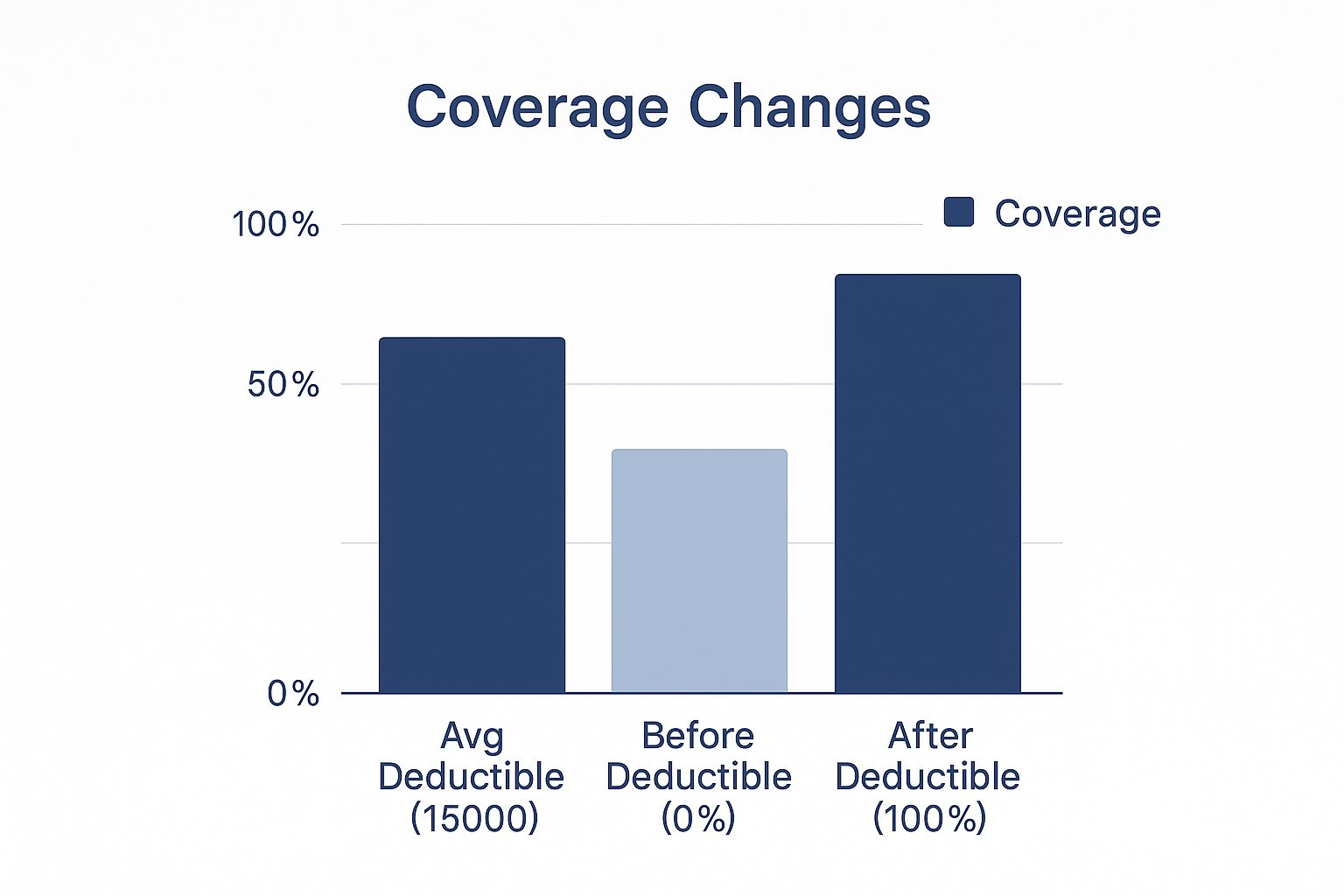

The image below gives you a clear picture of how dramatically things shift once you've met your deductible.

It’s a stark contrast. You go from covering 100% of the costs yourself to having your plan cover 100%. That's why hitting your deductible is such a huge milestone.

Choosing Your Financial Path

On the other side of the coin, you have Gold and Platinum plans. These plans have much higher monthly premiums, but they balance that out with significantly lower deductibles.

With a Platinum plan, you might meet your deductible after just one or two doctor visits. Suddenly, your "no charge" benefit is active for most of the year. This approach gives you far more predictable healthcare spending.

The table below breaks down how these trade-offs typically look across the most common plan types available on the marketplace.

Deductible Comparison Across Common Plan Types

| Plan Tier | Typical Monthly Premium | Average Annual Deductible | Best For |

|---|---|---|---|

| Bronze | Low | Very High | Healthy individuals who want protection against major medical events. |

| Silver | Moderate | High | People who expect average healthcare needs and may qualify for cost-sharing reductions. |

| Gold | High | Low | Those who anticipate needing regular medical care or prescriptions. |

| Platinum | Very High | Very Low | Individuals with chronic conditions or who want maximum predictability. |

As you can see, what you pay upfront each month has a direct impact on how much you'll pay when you seek care.

The key is to match your plan to your life. If you know you'll need frequent medical care, a lower deductible plan could actually save you a ton of money in the long run, even with the higher monthly payment.

Data from 2023 really shows how wide this gap can be. The average marketplace deductible was $7,481 for Bronze plans and $4,890 for Silver plans. Meanwhile, Gold plans averaged $1,650, and Platinum plans could be as low as $45.

This huge variation makes it clear: what you pay per month is directly tied to how much you pay when you need that care. If you want to dive deeper, you can find more insights on how deductibles vary across health plans on HealthMarkets.com.

Navigating Other Key Insurance Terms

Understanding your deductible is a massive first step, but it doesn't exist in a vacuum. To really get a handle on your health plan, you have to see how all the pieces connect—especially the other key terms that decide what you actually pay for care.

Think of your deductible as the first hurdle you need to clear. Once you’ve paid that amount, your plan’s "no charge after deductible" feature might kick in. But that's not always the end of the story. You also need to know about copays and coinsurance.

Copay vs Coinsurance

Even with a "no charge" plan, some policies will still ask for a copay for certain services, like a quick doctor's visit or picking up a prescription. A copay is just a small, fixed fee you pay on the spot—say, $25 for a specialist appointment.

Coinsurance, on the other hand, is a percentage. After you’ve met your deductible, some plans shift into a coinsurance phase where you pay a share of the bill (like 20%) while your insurer covers the rest (80%). Plans with a true "no charge after deductible" feature skip this step completely.

The Ultimate Financial Safety Net

The last and most important term to know is your out-of-pocket maximum. This is the absolute most you will have to pay for covered, in-network medical care in a single year.

Your out-of-pocket maximum is your financial shield. It’s the ceiling on your medical spending, ensuring that even in a worst-case scenario, there is a firm limit to your financial responsibility.

Everything you pay—your deductible, your copays, and any coinsurance—all adds up and counts toward this number. Once you hit that maximum, your insurance company pays 100% for all covered services for the rest of the year. No exceptions.

This progression is key:

- First, you pay everything out-of-pocket until you meet your deductible.

- Next, you might pay copays or coinsurance for services.

- Finally, you reach the out-of-pocket maximum, and your spending for the year stops.

While we're focused on health insurance here, this concept is fundamental to other types of coverage. For example, understanding how deductibles work in auto insurance can give you a broader perspective on managing costs. For a complete A-to-Z list of insurance terms, check out our detailed health insurance glossary.

Common Misconceptions That Can Cost You Money

Getting the rules of your health plan wrong can lead to some truly shocking, unexpected bills. The phrase "no charge after deductible" sounds like a magic key, but it’s surrounded by costly myths that can easily trip you up.

The most dangerous one? Believing that everything is free once you’ve hit your deductible. It’s just not true. This amazing benefit only kicks in for covered services you get from doctors and hospitals within your plan’s network.

Going out-of-network is a classic mistake, and it can completely wipe out this benefit. If you see a doctor outside your network, you could be on the hook for the entire bill—almost as if you never met your deductible at all. Your insurance company has special pre-negotiated rates with its in-network partners, and those financial protections vanish the moment you step outside that circle.

Pitfalls to Avoid

Besides the big in-network rule, a few other common slip-ups can lead to surprise costs. Staying aware of them is one of the best ways to manage your healthcare spending.

- Forgetting the Annual Reset: Your deductible isn't a one-and-done achievement. It resets back to zero at the start of every plan year, which for most people is January 1st.

- Ignoring Preventive Care: So many plans cover preventive services—like your annual physical or certain screenings—at 100%, even before you’ve touched your deductible. Don't skip important care because you assume you have to pay for it.

- Confusing Premiums with Care Costs: Your monthly premium is the fee you pay just to keep your insurance active. It never counts toward meeting your deductible.

Think of your deductible as a separate bucket. You only fill it with payments for actual medical services you receive. Your monthly premium is just the price of admission—it keeps the lights on but doesn’t chip away at your out-of-pocket costs for care.

Getting these rules straight is a huge part of staying financially healthy. When you know what counts and what doesn't, you can make smarter choices and dodge those nasty surprises. For more ideas, our guide on how to reduce insurance premiums offers extra tips for keeping your overall costs down.

Still Have Questions? Let's Clear Things Up

Even when you think you’ve got it all figured out, a few specific questions always pop up. It’s totally normal. Here are some quick, straightforward answers to the things people ask most about "no charge after deductible."

Do My Monthly Premiums Count Toward My Deductible?

Nope, they don't. It's a common point of confusion, but the two are completely separate.

Think of your monthly premium like a gym membership fee—you pay it every month just to keep your access active. Your deductible, on the other hand, is only paid when you actually use the services, like paying for a doctor's visit or a prescription.

How Do Family Plan Deductibles Work?

Family plans have an extra layer, but the logic is pretty simple. Most have two kinds of deductibles working at the same time: one for each individual and a bigger one for the entire family.

- Individual Deductible: If one person in your family gets sick and meets their personal deductible, the insurance starts paying for their care right away.

- Family Deductible: If several family members need care, their costs add up. Once the family's total medical spending hits the family deductible, the plan starts paying for everyone's care—even for family members who haven't hit their own individual limits yet.

It’s a great safety net. It ensures that one person's major medical event doesn't leave the rest of the family financially exposed.

Is "No Charge After Deductible" The Same As My Out-Of-Pocket Max?

Not quite, but they’re related. Think of them as two different finish lines in your health plan's year.

Meeting your deductible is the first big milestone. Hitting your out-of-pocket maximum is the final, absolute finish line for your spending.

Your out-of-pocket maximum is the total cap on what you'll spend on covered care in a year. It includes everything you paid for your deductible, plus all the copayments and coinsurance you paid afterward. Once you hit that number, you’re done spending for the year. Your plan pays 100% after that.

Navigating the world of health insurance can feel like a puzzle, but you don't have to solve it alone. My Policy Quote specializes in finding clear, affordable plans that actually make sense for your life. Get a free, no-obligation quote today at https://mypolicyquote.com and feel the confidence that comes with knowing you’re properly covered.