When you're self-employed, you wear a lot of hats. But one of the biggest challenges is finding affordable healthcare without an employer chipping in. That’s where the self-employed health insurance deduction comes in.

This isn’t just a small write-off. It’s a game-changer that allows you to deduct 100% of what you pay for health insurance premiums right off your gross income, which directly lowers your tax bill. Think of it as the tax code’s way of leveling the playing field for entrepreneurs.

Understanding This Powerful Tax Tool

If you've ever worked a traditional job, you know that health insurance premiums are often paid with pre-tax dollars. The self-employed health insurance deduction gives freelancers, contractors, and small business owners that same powerful advantage.

Best of all, this is what’s known as an “above-the-line” deduction. That’s a fancy way of saying you can claim it without having to itemize. It directly reduces your Adjusted Gross Income (AGI) on Schedule 1 of your Form 1040, whether you take the standard deduction or not.

The Core Concept Explained

Imagine your business income is a big bucket of water. Every dollar you spend on health insurance premiums gets scooped out before the IRS even looks inside. A lower water level means less income to tax. Simple, right?

This deduction lets you subtract the full cost of your medical, dental, and even qualified long-term care insurance premiums. And it’s not just for you—it covers your spouse and any dependents, too.

The real magic is that by lowering your AGI, you might also qualify for other tax credits and deductions you weren't eligible for before. Making sense of your self-employment health insurance options is the first step to unlocking these massive savings.

This isn't just a minor write-off; it’s one of the most significant tax advantages available to the self-employed, directly impacting your bottom line and making essential health coverage more financially manageable.

To give you a clearer picture, here’s a quick summary of what this deduction is all about.

Deduction at a Glance Key Rules and Benefits

| Feature | Description |

|---|---|

| Deduction Amount | You can deduct 100% of the premiums you paid for medical, dental, and long-term care insurance. |

| Who It Covers | The deduction applies to coverage for yourself, your spouse, and your dependents (under age 27). |

| Deduction Type | It’s an "above-the-line" deduction, so it lowers your Adjusted Gross Income (AGI). |

| Who Can Claim It | Self-employed individuals with a net profit, partners in a partnership, and S corp shareholders. |

| Key Limitation | The deduction cannot exceed your business's net profit for the year. |

| Where to Claim It | Reported on Schedule 1 of your Form 1040. |

This table boils it down, but the key takeaway is simple: if you work for yourself and pay for your own health insurance, the IRS offers a way to make it more affordable.

Who Actually Qualifies for This Tax Break

So, who gets to claim this awesome tax break? The IRS has a few rules, but they’re a lot simpler than they sound. Think of it as passing a quick two-part test.

First up, your business absolutely must have a net profit for the year. This is a hard-and-fast rule. You can’t deduct more in health insurance premiums than your business actually earned.

Essentially, you can't use this deduction to report a business loss. Let’s say your freelance design business brought in a $6,000 net profit, but you paid $8,000 in premiums. Your deduction is capped at $6,000. It’s a simple way to make sure the tax break is tied directly to your self-employment income.

The Most Common Disqualifier

The second hurdle is the one that trips most people up. You are not eligible if you could have participated in an employer-sponsored health plan. That includes a plan from your own side job or one available through your spouse's work.

It doesn't matter if you actually sign up for that plan. Just having the option is enough to disqualify you. For example, if your spouse’s company offers family coverage but you turn it down to buy your own plan, you can’t take the self-employed health insurance deduction.

There is a small exception, though. If you're only eligible for a spouse's plan for part of the year, you can still claim the deduction for the months you weren't eligible.

How Your Business Structure Affects Eligibility

The rules are pretty consistent across the board, but how your business is set up does matter a little. And no, this isn't just for sole proprietors.

- Sole Proprietors and Independent Contractors: You're good to go as long as you report a net profit on your Schedule C and meet the other rules.

- Partners in a Partnership: You can claim premiums the partnership paid for you. These show up as guaranteed payments on your Schedule K-1.

- S Corporation Shareholders: If you own more than 2% of an S corp, the company can pay your premiums and report them as wages. You can then deduct that amount on your personal return.

The key takeaway here is that the insurance plan has to be established under your business. The only time it can be in your own name is if you're a sole proprietor.

Of course, picking the right policy is just as important as meeting the tax requirements. We’ve put together a detailed breakdown of your options in our complete guide to health insurance for the self-employed. It’s a great resource for comparing plans to make sure you get the best coverage and the biggest tax benefit.

At the end of the day, it all boils down to two things: making sure your business is profitable and confirming you don’t have access to another employer’s plan. Once you’ve cleared those checks, you're on your way to saving some serious money on your taxes.

Which Insurance Premiums You Can Deduct

Alright, you've confirmed you're eligible. Now for the good part: figuring out exactly what you can write off. The self-employed health insurance deduction is more than just your main medical plan. The IRS actually lets you deduct premiums for several types of coverage, turning more of your healthcare dollars into tax savings.

You can deduct premiums for medical, dental, and even vision insurance. The policies just need to be established under your business name. If you're a sole proprietor, having it in your personal name works too. The main thing is that the plan is set up to cover you, the self-employed individual.

Unpacking Long-Term Care Insurance

Here’s a big one that people often miss: long-term care (LTC) insurance. You can deduct these premiums too, but there’s a small catch. Unlike your regular health insurance, the deductible amount for LTC is capped based on your age.

Think of it as the IRS giving you a bigger break as you get older. The limits are designed to reflect the reality that the need for long-term care increases with age. So, the older you are, the more you can deduct. It's a smart way to make planning for future care a little easier on your wallet.

The LTC premium deduction is like a tiered benefit that grows with you. It acknowledges that healthcare costs change as we age, and it gives you a bigger tax advantage right when you need it most.

This makes it a powerful tool for long-range financial planning. And while we're focused on health insurance here, it's always a good idea to look into a wider range of self-employed tax deductions to build a truly solid financial strategy for your business.

Age-Based Limits for Long-Term Care Premiums

So, how do these age limits work? Instead of deducting your full LTC premium, your write-off is capped based on your age at the end of the tax year. The IRS adjusts these numbers from time to time to keep up with inflation.

To make it simple, here’s a table that breaks down the maximum you can deduct for long-term care premiums this year.

Deductible Limits for Long-Term Care Premiums

| Age of Taxpayer | Maximum Deductible Amount |

|---|---|

| 40 or under | The maximum you can deduct is a specific, lower amount. |

| 41 to 50 | The deductible limit increases for this age bracket. |

| 51 to 60 | You can deduct a significantly higher amount in these years. |

| 61 to 70 | The limit continues to climb, reflecting higher potential care costs. |

| Over 70 | This bracket has the highest allowable deduction. |

Keep in mind, these limits are per person. If both you and your spouse are self-employed and have your own LTC policies, you can each claim a deduction up to the limit for your age group. That could potentially double the tax benefit for your family, which is why understanding these details is so important for maximizing your return.

How to Calculate Your Maximum Deduction

Okay, we’ve covered the rules. But let's be honest—it’s seeing the numbers in action that really makes the self-employed health insurance deduction click.

So, let's walk through a few real-world scenarios to show you exactly how this works. The math itself is simple. The whole game is just figuring out which number is your ceiling: your total insurance premiums or your business's net profit.

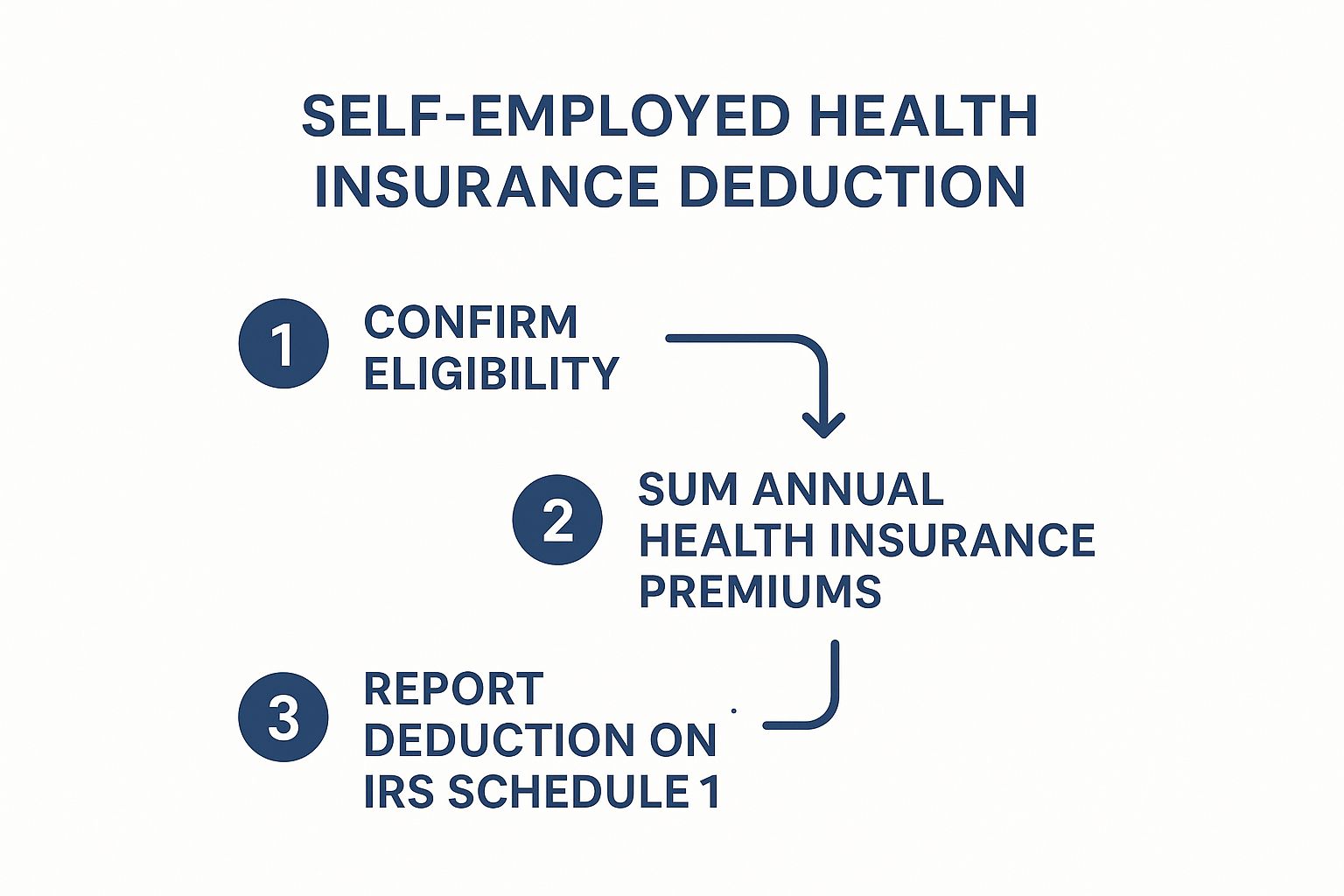

This quick visual breaks down the process.

As you can see, it’s a straight line from confirming you’re eligible, to adding up what you paid, and then claiming the right amount when you file.

Example 1: The Profitable Freelancer

Let’s start with Alex, a freelance graphic designer who’s having a good year.

- Business Net Profit (Schedule C): $75,000

- Annual Health Insurance Premiums Paid: $7,200 ($600 per month)

To figure out Alex’s maximum deduction, we just compare those two numbers. The deduction is always the lesser of the two.

In this case, Alex’s $7,200 in premiums is way less than the $75,000 profit. Easy. Alex gets to deduct the full $7,200.

Example 2: When Business Income Limits the Deduction

Now for the big one—the rule that trips people up the most. What happens when your business profit is lower than what you paid for insurance?

Meet Maria, a new consultant whose business is just starting to grow.

- Business Net Profit (Schedule C): $8,000

- Annual Health & Dental Premiums Paid: $9,600 ($800 per month)

See the problem? Maria’s premiums ($9,600) are higher than her net profit ($8,000). Because the deduction can't be more than what the business earned, her write-off gets capped.

Maria’s maximum deduction is limited to $8,000. She can't deduct that extra $1,600 in premiums. This is an important backstop that prevents freelancers from using this deduction to create a business loss on paper.

Example 3: Including Premiums for a Family

Finally, let's see how this plays out when you’re covering your whole family. Good news: premiums for your spouse and dependents count, too.

Meet David, a self-employed carpenter who covers his spouse and child.

- Business Net Profit (Schedule C): $90,000

- Premiums for David: $7,000 per year

- Premiums for Spouse & Child: $10,000 per year

First, we need to add up everything David paid for health coverage.

- Calculate Total Premiums: $7,000 (David) + $10,000 (Spouse/Child) = $17,000

- Compare to Net Profit: The total premiums ($17,000) are well below his business profit ($90,000).

Since his premiums don't exceed his business income, David can deduct the full $17,000. This shows just how powerful the deduction can be for families. Making sure you pick the right plan is key, and it helps to understand how to compare health insurance plans to get the most from your coverage and your tax benefits.

Claiming the Deduction on Your Tax Return

Alright, you’ve done the hard part—you’ve confirmed you’re eligible and figured out exactly how much you can write off. So, how do you actually claim it?

It all happens on Schedule 1 of your Form 1040. This is what’s known as an “above-the-line” deduction, and that placement is a huge win. Why? Because it lowers your Adjusted Gross Income (AGI) before you even get to the standard vs. itemized deduction choice.

Think of it as the first move in your tax strategy. A lower AGI can unlock other valuable tax credits and deductions that have income limits. It's a small step that can set you up for bigger savings down the line.

The process itself isn’t complicated, but getting the numbers right is everything. Many business owners lean on tax software like TurboTax to make filing easier. These programs are great at walking you through the steps and asking the right questions to make sure your deduction lands in the right spot.

Keeping Your Records Straight

The IRS has a simple rule: if you claim it, you have to be able to prove it. For this deduction, good records are your best friend and your shield against any potential audits. You don’t have to send in your paperwork when you file, but you absolutely need it ready if they ask.

Make sure you have a folder—digital or physical—with these key documents:

- Proof of Premiums Paid: Every single monthly statement from your insurance company.

- Proof of Payment: Bank statements, cleared checks, or credit card bills showing you paid those premiums.

- Business Income Records: A clean profit and loss statement proving your business had a net profit for the year.

Think of your records as the foundation of your deduction. Without a solid paper trail, even a legitimate claim can be questioned. Keeping organized files ensures you can confidently justify your numbers.

Maximizing Your Savings with an HSA

Want to take your healthcare savings to the next level? Pair the self-employed health insurance deduction with a Health Savings Account (HSA). An HSA lets you put away pre-tax money just for medical expenses.

It’s like getting a double tax break. You deduct your premiums, and you also get to contribute to your HSA tax-free.

For the 2025 tax year, you can contribute up to $4,300 for an individual plan or $8,550 for a family plan if you have a qualifying high-deductible health plan. This combo is one of the most powerful financial tools for entrepreneurs.

Understanding all the available health insurance tax benefits is a game-changer for anyone running their own business and looking to keep more of their hard-earned money.

Common Questions About the Deduction

Navigating the self-employed health insurance deduction can feel like a maze. You get the basics down, but then the "what if" scenarios pop up. Let's clear the air on some of the trickiest questions we hear all the time.

What if My Spouse Has a Health Plan I Can Join?

This is easily the biggest snag for freelancers and entrepreneurs. The rule is brutally simple: you cannot take this deduction if you are eligible to get coverage under an employer’s plan. That includes your spouse's plan.

It doesn’t matter if you politely decline their offer. It doesn’t matter if their plan is more expensive or has worse coverage. The mere option to enroll makes you ineligible for the deduction for any month that option was on the table.

Now, if your spouse's employer only offers enrollment at certain times of the year, you can claim the deduction for any month you weren't eligible for their plan. But once that open enrollment window opens, your eligibility for the deduction closes.

What Happens if My Business Has a Net Loss for the Year?

This one is a hard-and-fast rule. The deduction is tied directly to your business’s bottom line. If your business ends the year with a net loss, you simply cannot claim the self-employed health insurance deduction.

Your deduction is capped at your business's net profit. Think of it this way: if you paid $8,000 in health insurance premiums, but your business only brought in $5,000 in profit, your deduction is limited to $5,000. You can't use the deduction to push your business into a loss or make an existing loss even bigger.

The income limit is a core principle of this deduction. It's designed to lower the taxes on your self-employment profits, not to create a paper loss. Your business has to earn enough to "cover" the premiums before you can deduct them.

Can I Deduct Premiums for My Marketplace (ACA) Plan?

Yes, absolutely. You can deduct the premiums you pay for a Marketplace plan purchased through the Affordable Care Act (ACA). But there's a critical detail you can't miss: the Premium Tax Credit (PTC).

You can only deduct the amount you actually pay out of your own pocket.

Let's say your full premium is $700 a month, but you get a $500 monthly tax credit that gets paid directly to the insurer. That means you only pay $200. In this case, only that $200 counts toward your deduction. The IRS won't let you double-dip by deducting the portion the government already subsidized.

Making sense of these rules is much easier when you have the right partner. At My Policy Quote, we specialize in finding health insurance that fits the unique world of the self-employed. Let us help you find the perfect plan to maximize your coverage and your tax savings.