Picture this: going without health insurance feels like walking a tightrope without a safety net. One tiny slip, and you're in free fall. A gap in medical insurance coverage isn't just about being totally uninsured for years. It's any period—even just a few weeks between jobs—where that protective net is gone.

This lapse, however short, opens you up to some serious financial and health risks.

Why a Gap in Medical Insurance Coverage Is So Risky

Let's stick with that safety net idea. Most days, you don't even think about it. You just go about your life, confident it's there. But when a coverage gap happens, the net disappears. Suddenly, a simple stumble becomes a potential disaster.

This gap could be that awkward month between leaving one job and starting another. It might be the period after you turn 26 and can no longer stay on a parent’s plan. It can even happen when your current policy is so weak it barely covers anything—a situation called being underinsured.

The most immediate threat is financial. Without insurance, you're on the hook for 100% of your medical costs. A simple check-up can feel pricey, but a real emergency? That can lead to crippling debt. A single trip to the ER can easily run you thousands of dollars. A serious accident or illness that requires a hospital stay? We're talking tens of thousands, or even more.

The Hidden Health Consequences

Beyond the sticker shock of a medical bill, a coverage gap can quietly damage your long-term health. When you know every visit means paying out of pocket, you start putting things off.

What kind of care gets skipped?

- Preventive Screenings: Those routine check-ups that catch things like cancer or heart disease early on? They often get pushed to the back burner.

- Chronic Condition Management: For people with conditions like diabetes or asthma, skipping appointments or trying to stretch out expensive medications can have devastating consequences.

- Mental Health Support: Therapy and psychiatric care are often unaffordable without insurance, leaving critical mental health needs completely unmet.

Delaying care doesn't solve a health problem. It just lets it grow bigger, more complicated, and more expensive to treat later. What might have been a small, manageable issue can spiral into a life-changing crisis.

A gap in coverage creates a scary reality: immediate care for those who can afford to pay, and a dangerous waiting game for everyone else. That delay can have a massive impact on both your financial security and your physical health down the road.

At the end of the day, a gap in medical insurance forces you to bet against your own health—and that's a gamble you can't afford to lose. In this guide, we’ll break down why these gaps happen and, more importantly, give you clear, practical steps to make sure that safety net is always there to catch you.

The Life Events That Cause Coverage Gaps

A gap in medical insurance coverage is almost never something you plan for. It’s usually the unwelcome side effect of a major life change—one that’s already stressful enough without throwing your healthcare into question.

These big moments can easily disrupt your health plan, leaving you and your family exposed when you least expect it.

Most of us get our health insurance through a job, which is why career changes are the number one reason people lose coverage. Whether you’re starting a new position, getting laid off, or jumping into the freelance world, your connection to your old health plan gets cut. This often starts the clock on a waiting period before a new plan kicks in.

Knowing what triggers these gaps is the first step in avoiding one. When you can see the vulnerable moments coming, you can make a plan to keep yourself protected.

Navigating Job Transitions and Employment Changes

In the U.S., our jobs and our health insurance are tightly linked. So, when your employment status shifts, your coverage almost always does, too. It’s a fragile connection that can leave you uninsured in the blink of an eye.

Take Marcus, who just got laid off from a company he’d been with for eight years. His health insurance was set to expire at the end of the month, leaving him with a tough decision. Should he pay the steep price for COBRA to keep his family on their old plan, or risk going without coverage while he looked for a new job?

This is an incredibly common story. Here are a few ways it happens:

- Losing a Job: A layoff usually means your employer-sponsored coverage ends almost immediately.

- Starting a New Job: Most companies have a waiting period, often 30 to 90 days, before new employees can get on the health plan.

- Switching to Freelance or Gig Work: Going independent means you’re suddenly 100% responsible for finding and funding your own health insurance.

Aging Out of a Parent’s Health Plan

For young adults, turning 26 is a huge milestone. It’s a sign of independence, but it also means they’re no longer eligible to stay on their parent’s health insurance plan.

This forces them to find their own coverage for the very first time, a process that can feel totally overwhelming. If they miss the deadline to sign up for a new plan, they’re left with a serious coverage gap.

The weeks right after a 26th birthday are a critical window. Missing the enrollment deadline can leave a young adult uninsured for months until the next Open Enrollment period.

This is exactly what happened to Elena. She was a freelance graphic designer, so when she was removed from her family’s plan after her birthday, there was no employer plan waiting for her. She had to figure out the Health Insurance Marketplace all on her own, trying to avoid a lapse in coverage that could have wrecked her finances.

Other Significant Life Changes

It’s not just about jobs and birthdays. Plenty of other life events can knock your health coverage off track, and each one requires you to take action to stay insured.

The good news is that these situations are often considered qualifying life events. This triggers a Special Enrollment Period (SEP), which gives you a small window—usually 60 days—to get a new health plan outside of the normal Open Enrollment season. You can learn more about how a special enrollment period for a life event works to your advantage.

Here are a few other common life changes that can cause a coverage gap:

- Divorce or Legal Separation: If you were on your spouse's plan, a divorce will end your eligibility.

- Moving: A move to a new state or even a new zip code can make your old plan unavailable, forcing you to find a new one.

- Changes in Household Income: A big drop in income might qualify you for Medicaid, while a big raise could make you ineligible for the subsidies you were getting.

- Marriage or Having a Baby: These happy events are a perfect time to add family members to your plan, but they’re also a crucial moment to review your coverage and make sure it meets your new needs.

Each of these moments is a fork in the road. Being prepared helps you choose the path of continuous coverage instead of ending up on the dangerous road of being uninsured.

The Real-World Consequences of Being Uninsured

It’s one thing to know what a gap in medical insurance coverage is. It’s another thing entirely to feel its impact.

Going without a health plan, even for a little while, isn’t just a small oversight. It’s a massive gamble. The stakes are your financial stability and, more importantly, your physical well-being. The risks aren't abstract—they’re real, and they can upend your entire life with one single, unexpected event.

The Staggering Financial Risks

When you don’t have health insurance, you are on the hook for 100% of your medical bills. A routine check-up might be manageable, but a true medical emergency can be financially devastating.

Imagine something as simple as slipping on ice and breaking your leg. The ambulance ride, the ER visit, the X-rays, and the surgery can easily pile up to tens of thousands of dollars. Without an insurance company to negotiate those rates and cover the lion’s share, that entire debt lands squarely on you.

This isn’t some far-fetched scenario. Medical debt is a leading cause of bankruptcy in America. Even families with healthy savings can see them wiped out by a single illness or accident. It’s why you have to understand that medical emergencies without insurance can ruin you financially.

"A gap in coverage is like driving without car insurance. You might be fine for a while, but one collision can total your finances, leaving you with a debt that follows you for years."

The financial pain doesn't stop with the initial bill, either. It creates a ripple effect: damaged credit scores, endless calls from collections, and the constant stress of debt. All of this can make it harder to get a loan, buy a house, or even rent an apartment.

The Hidden Health Consequences

Beyond the sticker shock of medical bills, a coverage gap quietly chips away at your long-term health. It’s a simple, unfortunate truth: when every doctor's visit has a big price tag, people put off getting the care they need.

This avoidance creates a dangerous domino effect. Small, easily managed problems are left to fester until they explode into serious, life-altering crises.

What kind of care gets ignored?

- Preventive Screenings: Those routine check-ups that catch things like cancer or heart disease early on? They’re often the first to go.

- Chronic Condition Management: For someone with diabetes or high blood pressure, a coverage gap means losing consistent access to doctors and essential medications.

- Mental Health Support: Therapy and psychiatric care become unaffordable luxuries, leaving critical mental health needs completely unmet.

The Downward Spiral of Delayed Care

Here’s the thing about health issues: ignoring them doesn’t make them disappear. It just gives them time to get worse, more complicated, and far more expensive to treat later on. A nagging cough that could have been fixed with antibiotics can turn into pneumonia that requires a long, costly hospital stay.

This cycle is especially brutal for people with chronic conditions. When someone with asthma can't afford their inhaler, they're at risk of a severe attack that lands them in the ER. A manageable condition becomes a life-threatening emergency, all because of a temporary gap in coverage.

Ultimately, being uninsured forces you into an impossible choice between your health and your finances. It creates a reality where your well-being is dictated by what you can afford out-of-pocket—a terrifying place for anyone to be.

Understanding the Medicaid Coverage Gap

Sometimes, a gap in medical insurance coverage isn’t caused by something personal, like changing jobs. It’s caused by a confusing crack in the system itself. This is the tough reality for millions of low-income adults who find themselves stuck in what’s known as the Medicaid coverage gap.

Think of it like a highway with two levels. The lower level is traditional Medicaid, built for people with very little income. The upper level is the Affordable Care Act (ACA) Marketplace, where you can get help buying a plan if you earn a bit more.

The Medicaid coverage gap is the broken on-ramp between them. In some states, it simply doesn’t exist.

This problem hits adults hardest in states that chose not to expand their Medicaid programs. In those places, the income rules for Medicaid are incredibly strict, but you still need to earn a certain amount to get help on the Marketplace.

It creates a painful middle ground. You can earn too much for Medicaid but not enough to get financial aid for another plan. You’re left with no affordable options at all.

How the Federal Poverty Level Creates This Gap

To really get what’s happening, you have to know about the Federal Poverty Level (FPL). It’s a number the government sets each year to figure out who qualifies for programs like Medicaid and ACA subsidies.

Here’s how it’s supposed to work:

- In states that expanded Medicaid: Adults earning up to 138% of the FPL can get Medicaid.

- For Marketplace subsidies: You need an income of at least 100% of the FPL to get financial help.

In those expansion states, it’s a smooth handoff. If you’re below 138%, you get Medicaid. If you’re above that, you can get help on the Marketplace. No gaps.

But in states that didn't expand Medicaid, the rules are much tougher. Many of these states won’t even cover adults without children, no matter how low their income is.

A Real-World Example of the Gap

Let's imagine Maria, a part-time worker in a state that didn't expand Medicaid. She’s single, has no kids, and earns $15,000 a year.

- Her Income vs. the FPL: The FPL for a single person in 2024 is $15,060. Maria’s income is about 99.6% of that.

- Trying for Marketplace Help: Because she earns less than 100% of the FPL, she does not qualify for subsidies to help her buy a plan.

- Trying for Medicaid: Her state’s income limit for an adult without kids is only 50% of the FPL. She earns way too much to qualify.

Maria is completely trapped. She makes too much for her state's Medicaid program but too little for federal help. It’s a frustrating and dangerous gap in medical insurance coverage. If you think you might be in a similar spot, it’s worth looking into health insurance gap coverage to understand your options.

The Medicaid coverage gap is a policy-driven problem that leaves the most vulnerable workers without a safety net. It creates a system where a small pay raise could be the difference between having coverage and having nothing at all.

This isn’t just a theoretical problem; it has huge consequences. As of early 2025, 1.4 million uninsured people are stuck in this gap across the ten states that haven't expanded Medicaid. According to KFF, uninsured rates in these states are nearly double those in expansion states (14.1% vs. 7.6%).

The result? Nearly one in four uninsured adults in those states ends up skipping needed medical care because they just can't afford it. You can see the full findings on the coverage gap from KFF for yourself.

Your Action Plan for Bridging a Coverage Gap

Realizing you have a gap in medical insurance coverage is stressful, but it's a problem you can solve. You have more control than you might think. This is your practical playbook for building a bridge to protect your health and finances until your next long-term plan kicks in.

The right move really depends on your life situation—why you lost coverage, how long you expect the gap to be, and what your budget looks like. Let's walk through the main options so you can choose the best path forward.

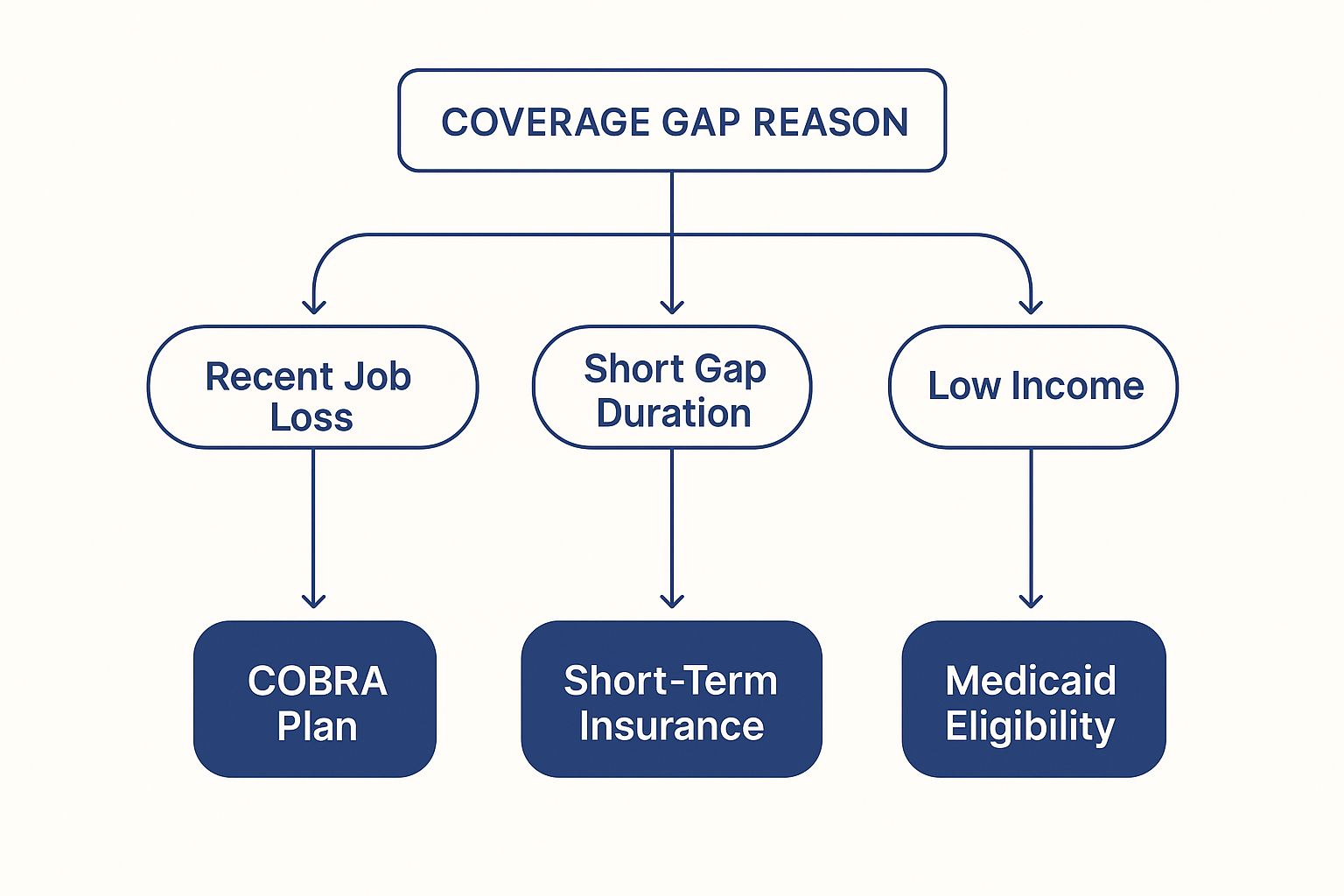

This decision tree gives you a quick visual of the paths available based on what's happening in your life.

As you can see, the reason for your gap points you toward the right solution. Job loss, a change in income, or just a short wait between jobs—each has a best-fit answer, whether it's COBRA, a new Marketplace plan, or something else entirely.

Continuing Your Old Plan with COBRA

If you just left a job at a company with 20 or more employees, your first and most direct option is probably COBRA. The Consolidated Omnibus Budget Reconciliation Act (COBRA) lets you keep the exact same health plan you had with your old employer, usually for up to 18 months.

This is a huge deal if you value continuity. You keep your doctors, your network, and your prescription coverage without missing a beat.

Who is this for?

COBRA is a lifesaver for people with ongoing medical needs, those in the middle of a treatment plan, or anyone who simply can't imagine switching doctors right now. If keeping your plan exactly as-is is your top priority, COBRA is your answer.

What are the limitations?

Here's the catch: the cost. Your employer is no longer paying their share, so you're on the hook for 100% of the premium, plus a small administrative fee (up to 2%). This often makes COBRA the most expensive choice, sometimes running into hundreds or even thousands of dollars a month.

Exploring the ACA Health Insurance Marketplace

Losing your job-based health insurance is what's known as a Qualifying Life Event. This is great news, because it opens up a Special Enrollment Period for you. You get a 60-day window to sign up for a new plan through the Affordable Care Act (ACA) Marketplace.

This is your go-to alternative if COBRA is just too expensive. Marketplace plans are comprehensive, and here's the best part: depending on your estimated income for the year, you might qualify for some serious financial help.

Don't just assume a Marketplace plan is out of reach. Losing your job means your income drops, which could make you eligible for premium tax credits that dramatically slash your monthly costs.

These subsidies can make a really solid plan surprisingly affordable. For a deeper dive into all your options, understanding the different types of health insurance gap in coverage can give you even more clarity.

Using Short-Term Health Insurance as a Temporary Fix

What if you only need coverage for a month or two? A short-term health plan might look tempting. These plans are basically a low-cost safety net designed to protect you from a major, unexpected medical disaster.

They are almost always cheaper than COBRA or an unsubsidized Marketplace plan. But that lower price tag comes with some major trade-offs.

Key things to know about short-term plans:

- They are not ACA-compliant. This means they don't have to cover the 10 essential health benefits, like maternity care or mental health services.

- They can—and frequently do—deny coverage for pre-existing conditions.

- They have strict caps on what they’ll pay out, which could leave you with massive bills if you need serious medical care.

Think of short-term insurance as "catastrophic-only" coverage. It’s definitely better than having nothing in an emergency, but it is not a substitute for a real, comprehensive health plan.

Comparing Your Health Insurance Gap Options

To make a confident choice, it helps to see everything laid out side-by-side. Each solution for a gap in medical coverage has its own pros and cons when it comes to cost, quality, and who can get it.

This table breaks down the key features of your primary choices to help you decide.

| Option | Best For | Typical Cost | Key Benefit | Main Drawback |

|---|---|---|---|---|

| COBRA | People who need to keep their exact plan and doctors. | High (Full premium + 2% fee) | Perfect continuity of care with no network changes. | Can be incredibly expensive without an employer's help. |

| ACA Marketplace | Anyone who needs affordable, comprehensive coverage. | Varies (Subsidies available based on income) | Covers pre-existing conditions and all essential benefits. | You might have to switch doctors if yours isn't in the new network. |

| Short-Term Insurance | Healthy people needing a temporary, low-cost safety net. | Low (Limited benefits) | Enrolls quickly and offers basic emergency protection. | Doesn't cover pre-existing conditions or essential care. |

By weighing these factors against your own needs, you can pick the right plan to close your coverage gap and stay protected.

When The System Itself Is The Problem

That gap in your medical insurance might feel like a personal failure, but more often than not, it’s a symptom of a much bigger issue. Beyond individual life changes, there are powerful economic and regulatory forces at play, making it harder for everyone to find and keep good, affordable health insurance.

These systemic pressures are squeezing both families and the insurance companies, creating new and wider gaps for everyone.

One of the biggest culprits? The never-ending rise in healthcare costs. As groundbreaking (and expensive) new drugs and treatments become the norm, the price tag for care just keeps climbing. This puts a massive strain on insurance companies, leaving them with little choice but to pass those costs down the line to you and me.

It creates a vicious cycle. Insurers are forced to raise premiums and deductibles just to stay afloat. But that creates a whole different kind of gap: underinsurance. Sure, you might have a policy, but with a deductible of several thousand dollars, going to the doctor can feel just as impossible as having no insurance at all.

Economic and Regulatory Squeeze

For health plans, the financial balancing act is getting trickier every year. Looking ahead to 2025, for instance, major insurers are already anticipating that the premiums they collect won't be enough to cover the soaring costs of care. This is happening mostly because of high-cost specialty drugs and the addition of new benefits that members need.

This financial pressure is only made worse by major regulatory changes. The recent Medicaid redetermination process, for example, threw coverage into chaos for millions as states re-evaluated who was eligible for the first time in years. You can see a full breakdown in this analysis of issues facing health plans from Alvarez & Marsal.

These large-scale shake-ups don't just threaten the stability of the insurance companies; they ripple outward, affecting their ability to offer affordable, comprehensive plans to everyone else.

When the healthcare system itself is under stress, the burden gets pushed downward. The result is higher costs, stricter rules, and fewer good options for the average person just trying to stay covered.

These big-picture problems create an environment where just holding onto meaningful coverage feels like a constant battle. It’s important to understand these forces are at work—it shows that the fight for stable health insurance isn’t just your personal struggle. It’s a shared challenge, rooted in a complex and strained system that impacts millions.

Common Questions About Medical Coverage Gaps

Finding yourself without health insurance, even for a short time, can bring up a lot of urgent, real-world questions. Let's walk through some of the most common concerns and get you the clear answers you need.

How Long Can I Go Without Insurance Before I Get a Penalty?

Right now, there’s no federal tax penalty for being uninsured. That rule changed a few years back, so you don’t have to worry about a penalty from the IRS if you have a gap in coverage.

But—and this is a big one—some states do things differently. Places like California, Massachusetts, and New Jersey have their own state-level rules. If you live there, going too long without insurance could lead to a state tax penalty. It's always a good idea to check the laws right where you live.

Is Short-Term Insurance a Good Enough Replacement?

Think of short-term insurance as a bandage, not a long-term solution. It’s designed to be a temporary safety net, but it comes with some serious trade-offs. These plans don't have to follow the rules of the Affordable Care Act (ACA), which means they can leave out a lot.

Short-term plans often won't cover pre-existing conditions, maternity care, or mental health services. They're really just there for unexpected, catastrophic events and should only be used for the shortest time possible while you lock in a real, comprehensive plan.

What if I Lost My Job and COBRA Is Too Expensive?

This is a really common situation. COBRA can be a shock to the system because you're suddenly responsible for 100% of the premium, and that cost is often way too high for someone who just lost their income.

Here’s the good news: you have a much better alternative. Losing your job-based health coverage is considered a Qualifying Life Event. This opens a 60-day window called a Special Enrollment Period on the ACA Health Insurance Marketplace. You can sign up for a new plan, and based on your new, lower income, you'll most likely qualify for subsidies that make a Marketplace plan way more affordable than COBRA ever could be.

A gap in coverage can feel risky, but you don't have to navigate it alone. At My Policy Quote, we’re here to help you find an affordable health insurance plan that keeps you and your family protected. Explore your options today and get the peace of mind you deserve.