Thinking about switching insurance companies can feel like a hassle, but it's simpler than you might think. It really comes down to a few key moves: take a hard look at your current policy, shop around for quotes that offer better value, and get your new coverage locked in before you say goodbye to your old plan.

The golden rule? Make sure your new policy is active before the old one ends. This way, you'll never have a gap in protection.

Knowing When It's Time for a Change

That renewal notice hits your inbox, and your premium has jumped. Again. An unexpected price hike is usually what gets people thinking about switching, but it's definitely not the only reason.

Smart money management means regularly checking in on your coverage to make sure it still fits your life and your budget. Sticking with the same insurer out of habit rarely pays off. In fact, that kind of loyalty could be costing you hundreds of dollars every single year.

And you're not alone in feeling this way. Market trends show that around 20-30% of insurance customers in places like the US think about changing providers each year. According to the latest global insurance market index, most people are hunting for better premiums, stronger coverage, or just plain better customer service.

To give you a clearer picture, here’s a quick overview of the process.

Your Quick Guide to Switching Insurance

Here’s a high-level look at the process so you know exactly what to expect from start to finish.

| Phase | Key Action | Primary Goal |

|---|---|---|

| 1. Review & Assess | Evaluate your current policy and identify your needs. | Understand what you have and what you're missing. |

| 2. Shop & Compare | Gather multiple quotes from different insurers. | Find the best combination of coverage and cost. |

| 3. Apply & Secure | Complete the application for your chosen policy. | Get your new coverage officially approved and active. |

| 4. Cancel & Confirm | Cancel your old policy and verify the end date. | Ensure a seamless transition with no coverage gaps. |

This simple four-phase approach keeps things organized and ensures you don't miss a beat.

Key Triggers for an Insurance Review

Certain moments in life are natural checkpoints for reevaluating your policies. Don't just call your agent to add a new car or update your address—use these opportunities as a reminder to shop the market.

Common triggers to look out for:

- Big Life Changes: Getting married, buying a house, or welcoming a baby completely changes your insurance needs. For example, bundling your new home and auto policies can unlock some serious discounts.

- A New Driver or Vehicle: Adding a teen driver to your auto policy or buying a new car will have a major impact on your rates. This is the perfect time to see who can give you the most competitive price for your new situation.

- Your Credit Score Improved: A big jump in your credit score can qualify you for much lower premiums. The catch? Your current insurer probably won't adjust your rate automatically—you have to ask or shop around.

Your insurance needs aren't set in stone. A policy that was a perfect fit two years ago might be leaving you underprotected or overcharged today. Reviewing your coverage isn't just a good idea; it's a core part of being financially savvy.

Finally, don't overlook a bad customer service experience. If filing a claim was a nightmare or you can never get a straight answer from your agent, it’s time to find a company that actually wants your business. The peace of mind that comes with a responsive, helpful insurer is often worth more than a few dollars in savings.

Getting to Grips With Your Current Insurance Policy

Before you even think about shopping around for a new policy, you’ve got to get a crystal-clear picture of what you already have.

It’s a bit like trying to buy a new car without knowing what features you need or what you’re driving now. Jumping the gun without this baseline knowledge is a recipe for confusion and, frankly, a bad deal. Your goal here is simple: create a benchmark so you can make a true apples-to-apples comparison.

Your policy’s declarations page is the place to start. This is usually just a one-page summary, but it’s the most valuable part of your insurance paperwork. It spells out exactly what you're paying for in a way that's relatively easy to digest.

What to Look For on Your Declarations Page

When you’re looking at this page, you’re hunting for a few key numbers that really define your financial safety net. The insurance lingo can feel a little intimidating, but don’t let it throw you off.

Here’s what really matters:

- Liability Limits: This is the absolute maximum your insurer will pay out if you’re found at-fault in an accident. For car insurance, you'll often see this written as three numbers (like 50/100/25). That translates to $50,000 for bodily injury per person, $100,000 per accident, and $25,000 for property damage.

- Deductibles: This is your part of the bill—the amount you have to pay out-of-pocket before your coverage starts paying. If you have a $1,000 deductible, you're responsible for that first grand on a claim.

- Endorsements: You might see these called "riders." They're the extra, optional coverages you’ve added to your policy, like roadside assistance or rental car reimbursement.

Nailing down these details is the crucial first step to stop overpaying for insurance and find a policy that genuinely fits your life.

Think of your current policy as the measuring stick. Once you know your exact coverage levels and costs, you can confidently compare new quotes and spot a genuinely better deal, ensuring you don’t accidentally downgrade your protection just to save a few dollars.

With this info in hand, you're ready to build a clear profile of what you truly need.

Finding and Comparing a Better Deal

Now that you’ve got a handle on your current coverage, it’s time to see what else is out there. This is where you can unlock some serious savings, and it’s the most important part of learning how to switch insurance companies. Don't worry, gathering quotes doesn't have to be a full-time job.

You have a few great ways to collect quotes:

- Work with an independent insurance agent. They can shop multiple carriers for you, which saves a ton of time.

- Go directly to insurer websites. If you have specific companies you’re interested in, this is a straightforward approach.

- Use online comparison tools. These platforms can pull quotes from several insurers at once, giving you a quick overview.

No matter which path you choose, having your information ready will make the process incredibly smooth. Keep your current policy's declarations page handy, along with the Vehicle Identification Numbers (VINs) for your cars and the driver's license numbers for everyone on your policy.

Creating a True Apples-to-Apples Comparison

The cheapest quote isn't always the best deal. A low monthly premium might be hiding a dangerously high deductible or skimpy coverage that could leave you financially exposed after an accident. To make a smart choice, you have to compare policies on equal footing.

Start by matching the liability limits and deductibles from your current policy. For example, if you have 100/300/50 liability coverage and a $500 collision deductible right now, get quotes for those exact same numbers. This creates a clear baseline, so you know you're comparing prices fairly.

Only after you have this direct comparison should you start tweaking the numbers. See how much you could save by raising your deductible to $1,000, or what it would cost to increase your liability protection. This structured approach helps you make a decision based on real value, not just the lowest price tag.

A better deal isn't just about paying less each month. It’s about finding a policy that delivers robust financial protection from a reputable company, all at a competitive price. Your goal is to maximize value, not just minimize cost.

Looking Beyond the Numbers

Price is a huge factor, but so is an insurer's reputation. Before you commit to anything, do a quick search for customer reviews and check their financial strength rating from agencies like AM Best. A great price means very little if the company is a nightmare to deal with when you actually need to file a claim.

The global insurance market is incredibly competitive. As the Allianz Global Insurance Report points out, this competition creates massive opportunities for consumers who are willing to shop around.

Comparing Insurance Quotes Beyond Price

Use this checklist to evaluate different insurance offers and find the best fit for your needs.

| Evaluation Factor | What to Look For in Insurer A | What to Look For in Insurer B |

|---|---|---|

| Customer Service Reviews | Are customers happy with claim handling? Is it easy to get help? | How do their reviews compare? Are there common complaints? |

| Financial Strength (AM Best) | Do they have a high rating (A- or better)? | Is their financial stability strong and reliable? |

| Included Perks & Discounts | Do they offer accident forgiveness, vanishing deductibles, or bundling options? | Are there any unique benefits that fit my lifestyle? |

| Ease of Use | Is their website/app easy to use for payments and claims? | How easy is it to manage the policy online or by phone? |

| Claim Payout Speed | How quickly do they typically process and pay out claims? | Are there reports of delays or hassles with payouts? |

Ultimately, the goal is to find a company that's both affordable and reliable. For more on finding affordable options, check out our top tips for finding budget-friendly health coverage.

Making a Seamless Switch Without Gaps

Alright, you've found a better policy. The final hurdle is managing the switch itself. This is where a lot of people make a costly mistake, so let's get it right.

The absolute golden rule? Never cancel your old policy until your new one is officially active. I can't stress this enough.

Have your new insurance card or proof of coverage in your hand—or at least confirmed in your inbox—before you even think about calling your old provider. This one simple move guarantees you're never without protection, not even for a minute. A car accident or a pipe bursting in your home during a coverage gap could be financially devastating.

Executing the Cancellation Properly

When you're 100% ready to make the change, don't just stop paying the bill. That can lead to a messy cancellation and even affect your credit. You need to formally cancel the policy to create a clean paper trail.

Here’s how to make a clean break:

- Write a Simple Cancellation Letter. Just draft a brief letter or email. Include your name, policy number, and the exact date you want the coverage to end. Make sure this date is on or after your new policy’s official start date.

- Follow Up with a Phone Call. A day or two after sending your notice, give them a quick call. Confirm they received it and are processing your request. This helps avoid any "lost in the mail" headaches.

- Confirm the Cancellation in Writing. Ask them to send you written confirmation that your policy has been terminated. Keep this document filed away. It’s your proof if any future billing disputes pop up.

If you have questions about things like whether you can switch insurance mid-policy, this is the perfect time to ask. You might even be due a refund for any prepaid premiums.

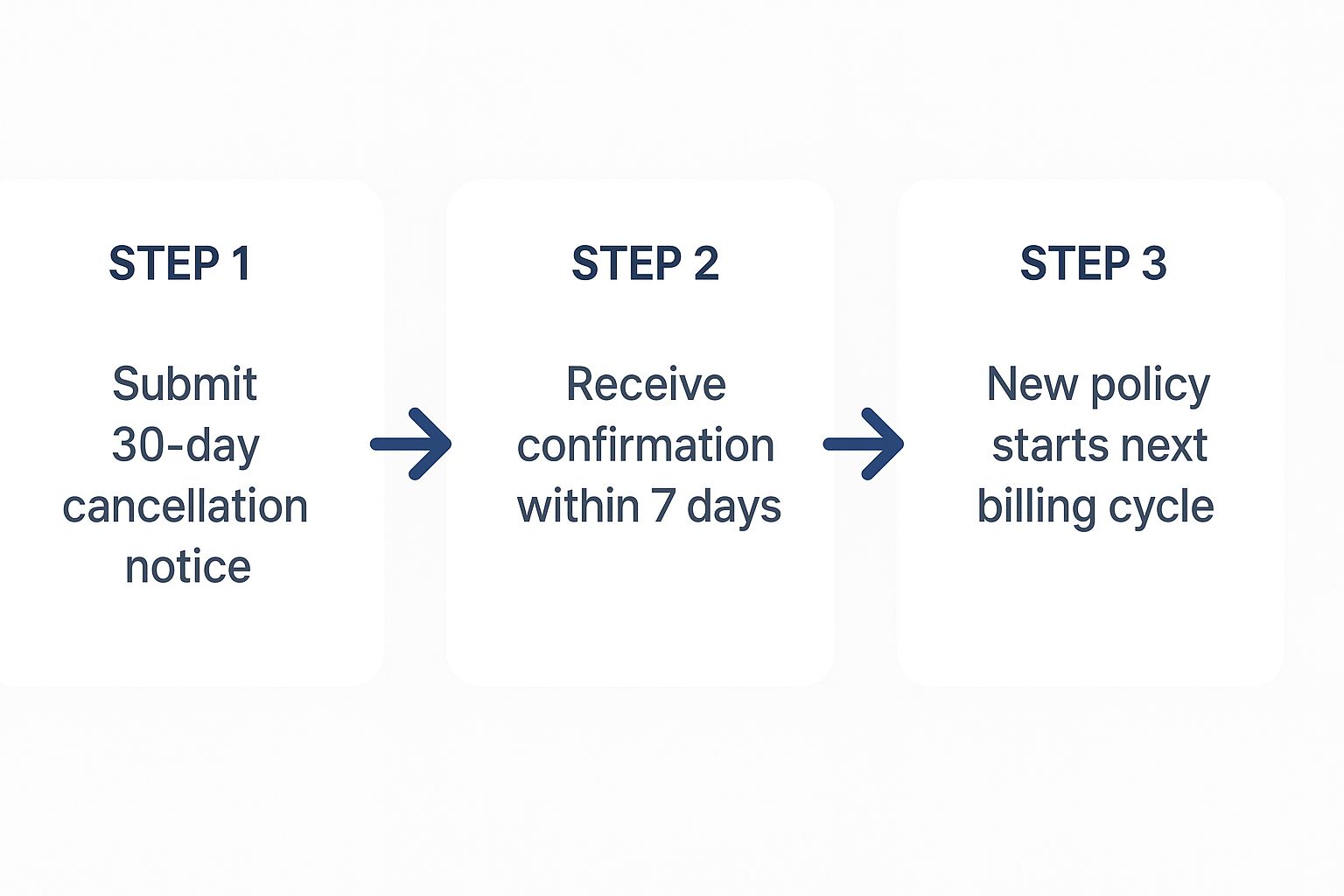

Here's a quick visual of what that process looks like.

As you can see, a proactive, documented approach ensures your cancellation is handled correctly and your new policy begins without a single gap.

A seamless transition isn’t accidental—it’s the result of careful timing. Your new policy must be live and confirmed before you sever ties with your old insurer. This single action protects you from the significant financial risk of a coverage gap.

One last thing—don't forget to notify any relevant third parties. If you have a car loan or a mortgage, your lender will need proof of your new insurance to know their asset is still protected. A quick email with your new policy declaration page is usually all it takes.

Avoiding Common Insurance Switching Mistakes

When you’re learning how to switch insurance companies, it’s easy to get tunnel vision. The biggest mistake people make? Focusing only on finding the absolute lowest premium.

Sure, a cheaper policy sounds great, but it might come with a sky-high deductible you can't realistically afford. Or worse, it could strip away essential coverages, leaving you dangerously exposed when you need it most.

Your goal shouldn't be finding the cheapest price, but the best value. That means balancing a competitive premium with strong coverage, reasonable deductibles, and a company you can actually count on. Sometimes paying a little more for a policy from a highly-rated insurer is the smartest financial move you can make.

Not Checking the Insurer's Reputation

Imagine saving $20 a month only to find your new insurer is impossible to reach after an accident. Suddenly, that savings doesn't feel worth the headache. Before you sign anything, spend a few minutes digging into the company's reputation.

Look at their claims process and customer satisfaction ratings. A great price from a company known for denying claims or giving you the runaround is a bad deal just waiting to happen.

Another common pitfall is canceling your old policy too soon.

The most critical mistake you can make is creating a gap in your coverage. Always wait until you have written confirmation that your new policy is active before you notify your old insurer of your intent to cancel.

Ignoring Your Actual Coverage Needs

Finally, don't just blindly duplicate your old policy. Life changes, and your coverage should change with it. This is the perfect time to stop and ask if you truly have the right amount of protection.

A quick review can show you if you're underinsured or even paying for coverage you don’t need anymore. For a deeper look, check out our guide to help you avoid over-insuring and get the coverage you need.

Avoiding these simple mistakes will make sure your switch is both smooth and financially smart.

Your Questions About Switching Insurance Answered

Even with a solid plan, a few nagging questions can still pop up. We get it—when it comes to your money and your protection, the small details matter most.

Let's clear up some of the most common worries people have when they’re thinking about making a switch.

Will I Get a Refund if I Switch Mid-Policy?

Yes, you almost always will. If you’ve paid your premium upfront for a six-month or twelve-month term, your old insurer owes you a prorated refund for the unused time.

So, if you cancel three months into a six-month policy, you should get roughly half your money back. Just keep in mind that some companies charge a small cancellation fee, sometimes called a "short-rate" penalty. It's always a good idea to ask your old provider about their specific rules so you can factor that into your savings.

Does Switching Insurance Companies Hurt My Credit Score?

Nope. Switching your insurance provider won't directly ding your credit score. When you apply for a new policy, insurers will run a "soft inquiry" on your credit report to help figure out your premium.

Soft inquiries are only visible to you and don’t affect your credit score. They’re completely different from the "hard inquiries" you see when you apply for a new credit card or loan. Feel free to shop around for as many quotes as you need—it won’t hurt your score.

When Is the Best Time to Switch Car Insurance?

You can technically switch whenever you want, but the cleanest and easiest time is right at the end of your current policy term. This helps you dodge any cancellation fees and keeps the paperwork simple.

Other great times to shop around include:

- After a big life event, like getting married or buying a house.

- If your premium suddenly shoots up at renewal time for no clear reason.

- When you’ve seen a significant improvement in your credit score.

One quick tip: It’s usually best to avoid switching right after you’ve filed a claim. That can sometimes make the process a little more complicated than it needs to be.

Ready to find a policy that actually fits your life and budget? My Policy Quote makes it simple to compare quotes from top insurers, so you know you're getting the best value.