Congratulations on making it to early retirement! It’s a huge milestone, but it also brings up a critical question: what do you do for health insurance before Medicare kicks in?

The good news is you have options. Most people will end up choosing between continuing their old employer's coverage through COBRA, finding a new plan on the Affordable Care Act (ACA) Marketplace, or hopping onto a spouse's plan. Each path has its own price tag and set of rules, so it’s worth taking a moment to understand them. Your health and your hard-earned savings depend on it.

Navigating Healthcare Coverage Before Medicare

Leaving the workforce before you turn 65 means you’re also leaving behind your employer-sponsored health insurance. This creates a coverage gap you absolutely have to manage. The decisions you make now will have a real impact on your finances and your ability to get the care you need down the road.

Planning isn’t just a good idea—it’s a necessity. The days when companies offered generous healthcare benefits to their retirees are mostly gone. In fact, the landscape has shifted dramatically. By 2022, only about 12% to 21% of people over 65 still had access to employer-sponsored retiree health benefits. That's a massive drop from around 31% back in 2008.

Your Primary Insurance Pathways

This new reality means early retirees need to become smart healthcare shoppers. Fortunately, there are several solid paths you can take. Getting a handle on the key differences between them is the first step toward making a choice you feel good about.

To get you started, here’s a quick overview of the most common health insurance options available to you before you qualify for Medicare.

Quick Look at Early Retiree Health Insurance Pathways

| Insurance Option | Best For | Typical Duration | Key Consideration |

|---|---|---|---|

| COBRA Coverage | Short-term continuity with existing doctors and plans. | Up to 18 months | High premium costs, as you pay the full price plus an admin fee. |

| ACA Marketplace Plan | Retirees with modest incomes who may qualify for subsidies. | Yearly (renewable) | Income-based eligibility for premium tax credits can significantly lower costs. |

| Spouse's Health Plan | Individuals whose spouse is still employed with benefits. | Until the spouse retires or leaves their job. | Often the most affordable and comprehensive option if it's available. |

| Short-Term Insurance | Healthy individuals needing a temporary bridge for a few months. | Up to 12 months (varies by state) | Lower premiums but limited coverage and no protection for pre-existing conditions. |

At the end of the day, it's all about finding the right balance. You're weighing the cost of a plan against the comfort of keeping your current doctors and coverage.

The core challenge is balancing cost against continuity of care. While COBRA offers seamless access to your trusted doctors, the ACA Marketplace provides a critical financial safety net through income-based subsidies.

Your decision will really come down to your personal health needs, your budget, and exactly how long you need coverage for. For a deeper dive, check out our guide on securing health insurance before Medicare. It will walk you through everything you need to know to build a strategy that protects both your health and your financial future.

Comparing COBRA and ACA Marketplace Plans

When you first leave your job, you're faced with a big decision: how to handle health insurance. Two of the most common paths for early retirees are sticking with your old employer's plan through COBRA or finding a new one on the ACA Marketplace.

While both get you comprehensive medical coverage, they work in completely different ways financially. Your choice will almost always come down to a simple trade-off: keeping things the same versus saving money.

COBRA’s biggest advantage is continuity. You get to keep the exact same health plan you had—same doctors, same specialists, same everything. There's zero disruption to your care, which can be a huge relief. But that seamless transition comes with a hefty price tag.

You’re suddenly on the hook for the entire premium, plus a 2% administrative fee. Because most employers pay a big chunk of this cost for their employees, the new sticker price can be a real shock to the system.

Breaking Down the Cost Differences

This is where COBRA and the ACA are worlds apart. COBRA's cost is a fixed amount based on the group rate your old company negotiated. It has nothing to do with your personal income.

The ACA Marketplace, on the other hand, is built around your income. If you're retiring with a modest income, you could qualify for a Premium Tax Credit (what most people call a subsidy). This credit can slash your monthly payments, sometimes dramatically. It's the single most important financial difference between these two options.

Ultimately, the decision between COBRA and the ACA boils down to this: Are you willing to pay a high, fixed premium to keep your current network, or would you rather have a potentially much lower, income-based premium and choose a new plan?

A Tale of Two Retirees

Let’s look at how this plays out for two different early retirees.

Scenario 1: The Retiree Needing Continuity

Imagine a 62-year-old who is right in the middle of treatment for a chronic condition. They have a specific team of specialists they know and trust. For them, switching doctors or getting new approvals could be incredibly stressful and disruptive.

- Best Choice: COBRA is probably the right move here, even with its high cost.

- Reasoning: The peace of mind from uninterrupted access to a trusted medical team is worth more than the potential premium savings on the Marketplace. The high cost of COBRA is essentially an insurance policy against disrupting their care.

Scenario 2: The Healthy Retiree on a Budget

Now, think about a healthy 60-year-old couple planning to live on a retirement income of $60,000 a year. They don’t have any complex medical issues and feel comfortable finding new doctors within a plan's network.

- Best Choice: An ACA Marketplace plan is almost certainly the smarter financial decision.

- Reasoning: Their income would likely qualify them for significant subsidies, making their monthly costs far more manageable than the $1,500+ they might have to pay for COBRA.

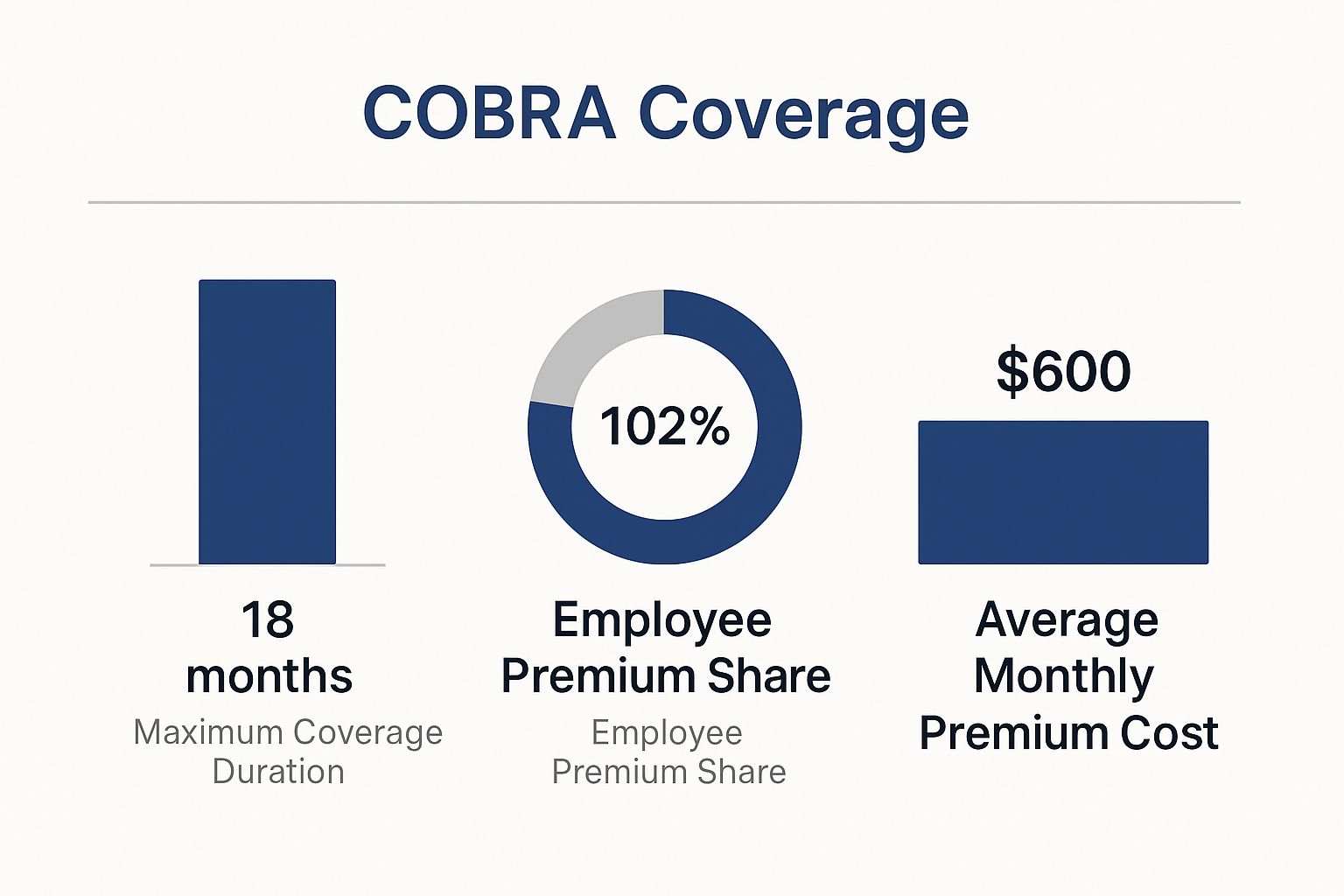

This infographic breaks down some of the key things to know about COBRA, like how long it lasts and what you'll be paying for.

As you can see, while COBRA is a solid bridge, the financial responsibility falls squarely on your shoulders.

Navigating Enrollment Periods

Timing is everything. Leaving your job kicks off a Special Enrollment Period (SEP), giving you a limited window to act for both COBRA and the ACA Marketplace.

- COBRA: You have a 60-day window to sign up.

- ACA Marketplace: You also have 60 days from the day you lose your job-based coverage to enroll in a new plan.

Don't let these deadlines slip by. A smart move is to explore both options at the same time. Many people apply for an ACA plan to see exactly what their subsidized cost would be before their 60-day COBRA window closes. For a more detailed look, our guide on using COBRA for retirees digs deeper into the rules and timelines.

Choosing between these two powerful options requires an honest look at your health needs and your financial picture. Calculate your potential ACA subsidy, think hard about your healthcare priorities, and then pick the path that best protects both your health and your retirement savings.

Exploring Alternative and Niche Insurance Options

While most early retirees lean on COBRA or the ACA Marketplace, those aren't your only paths. Other, more niche options exist that can fill very specific needs, especially if your situation is a little unconventional.

Think of these not as direct replacements for comprehensive medical insurance, but as potential bridges or lower-cost workarounds. But—and this is important—you have to understand their significant trade-offs.

These alternatives often operate outside of the strict ACA rulebook. That means they don't offer the same consumer protections, which adds a layer of risk. For the right person at the right time, though, they can be a smart piece of your healthcare puzzle.

Short-Term Health Insurance

Imagine you just need a temporary safety net. That’s exactly what short-term health insurance is for. These plans offer catastrophic coverage for a limited time—usually a few months up to a year, depending on your state. They are absolutely not a long-term solution.

- Best Use Case: You’re a healthy retiree who just missed the ACA enrollment window. Maybe you retired in August and need something to hold you over until your new ACA plan kicks in on January 1st. This is where a short-term plan shines.

- Key Warning: These plans almost never cover pre-existing conditions. They also skip essential benefits like maternity care, mental health services, and routine preventive checkups. Their entire purpose is to protect you from the financial devastation of a sudden, major accident or illness.

Because the coverage is so limited, the premiums are often much lower than comprehensive plans. But you're trading that lower cost for a lot less protection.

Critical Insight: Short-term plans are a stopgap, not a solution. They should only be on your radar for brief, specific periods when you have a solid plan to move to ACA-compliant coverage right after.

Health Care Sharing Ministries

Now for something completely different. Health care sharing ministries are not insurance. They are faith-based communities where members contribute monthly "shares" to a collective pot of money. That fund is then used to help pay for other members' qualifying medical expenses.

This community-focused model can lead to much lower monthly payments than traditional insurance premiums. But the trade-offs are huge and require a high tolerance for risk.

- Membership Requirements: Most ministries require you to agree to a statement of faith and live by certain principles, which often means no tobacco use or excessive drinking.

- Payment Is Not Guaranteed: This is the big one. Because these aren't regulated insurance products, there is no legal guarantee your bills will be paid. You have no legal recourse if a claim is denied, even if most ministries operate in good faith.

- Coverage Limitations: They usually have strict rules about pre-existing conditions and may not cover certain types of care at all.

This path is really only for healthy folks who align with the ministry’s faith requirements and are comfortable with the financial uncertainty.

Private and Global Health Plans

What if your retirement income is too high to get ACA subsidies? You can look at private plans sold directly by an insurer or broker. Many of these are identical to what you'd find on the ACA exchange, but some are "off-exchange" plans.

A more distinct option is international health insurance, built for retirees who live or spend a lot of time abroad.

These global plans are becoming more flexible to meet the needs of expats. Take the Cigna Global Medical Plan for example—it has no age limit for new applicants and offers lifetime coverage if you sign up before you turn 65. This lets you pick and choose specific benefits and coverage areas, helping you control costs while living overseas. You can learn more about these kinds of flexible global plans for retirees on InternationalInsurance.com.

Strategic Ways to Secure Your Coverage

Beyond the usual suspects like COBRA and the ACA Marketplace, there are two powerful, forward-thinking strategies that can lock in excellent coverage and give you real financial stability. One involves leaning on a resource you might already have—your spouse's job—while the other is all about carefully mapping out your transition to Medicare.

These approaches take a bit more planning upfront, but they often lead to the most seamless and affordable outcomes for early retirees. By getting a handle on how each one works, you can build a solid bridge that protects you now and simplifies your healthcare journey down the road.

Joining a Spouse's Health Plan

If your spouse is still working and has access to an employer-sponsored health plan, this is often the best health insurance option you’ll find. It usually delivers comprehensive coverage at a group rate, which is almost always more affordable than shouldering the full, unsubsidized cost of COBRA.

Losing your own job-based health coverage is considered a Qualifying Life Event (QLE). This is a big deal because it opens up a Special Enrollment Period (SEP), giving you a golden ticket to join your spouse's plan outside of their company's regular open enrollment season.

Here’s what you need to do and think about:

- Act Quickly: You typically only have 30 to 60 days from the day your old coverage ends to make the switch. Your spouse should get in touch with their HR department right away to get the ball rolling.

- Cost Analysis: Do the math. Compare what it costs to add you to their family plan against your other options. While it’s often cheaper than COBRA, it might be more expensive than a subsidized ACA plan if your retirement income is on the lower side.

- Plan Details: Get a good look at your spouse's plan. Make sure its network includes your doctors and that its prescription drug formulary covers any medications you rely on.

This strategy brings stability and high-quality coverage, making it a top-tier choice for many early retirees.

The real takeaway here is that losing your job isn't just a hurdle; it's an opportunity. That Special Enrollment Period it creates is a powerful tool that can unlock more affordable, high-quality coverage through a spouse's plan—often beating COBRA in both cost and convenience.

Building Your Bridge to Medicare

For those of you getting closer to age 65, the final stretch of early retirement demands a different kind of planning. Your goal isn't just to find coverage anymore—it's to guarantee a smooth, penalty-free slide into Medicare. This means picking a pre-65 plan with one eye on your future enrollment.

Your Initial Enrollment Period (IEP) for Medicare is a crucial seven-month window you can’t afford to miss. It starts three months before the month you turn 65, includes your birth month, and closes three months after. Signing up on time is absolutely essential to avoid lifelong late-enrollment penalties for Part B.

A poorly timed transition can be a costly mistake. For instance, if you hang onto an ACA plan for too long after you're eligible for Medicare, you could face tax penalties for taking subsidies you no longer qualify for. Even worse, delaying your Part B enrollment can saddle you with a permanent premium penalty.

To make this transition as smooth as possible, use this checklist as your 65th birthday approaches. For a deeper dive, exploring a comprehensive overview of insurance for early retirement can offer even more clarity.

Medicare Transition Checklist:

- Mark Your Calendar: Pinpoint your seven-month Initial Enrollment Period. Plan to enroll in Medicare about three months before you turn 65 to make sure your coverage kicks in without a gap.

- Apply for Medicare: Head to the Social Security Administration's website to sign up for Medicare Parts A and B. Even if you have other insurance, signing up for Part A (which is typically free) is a smart move.

- Confirm Your Start Date: Once you're enrolled, you'll get your Medicare card in the mail along with a confirmation of your official coverage start date.

- Terminate Your Old Plan: This is a critical final step. Call your current insurance provider—whether it's an ACA plan, COBRA, or private insurance—and schedule your coverage to end the day before your Medicare begins. This prevents overlapping coverage and future billing headaches.

Building Your Healthcare Financial Strategy

Choosing a health plan is so much more than just picking insurance. It's one of the most critical parts of your retirement's entire financial structure. Why? Because healthcare will likely be one of the largest and most unpredictable expenses you face after leaving the workforce.

To protect your nest egg, you need a change in perspective. Stop thinking about "finding insurance" and start thinking about "building a healthcare financial strategy." This means looking beyond just the monthly premium to see the whole picture—deductibles, out-of-pocket maximums, and everything in between. A smart approach ensures that a sudden medical issue won't threaten the retirement you worked so hard for.

The Power of a Health Savings Account

For many early retirees, the single most powerful tool for handling medical costs is a Health Savings Account (HSA). When you pair an HSA with a High-Deductible Health Plan (HDHP), you unlock a triple tax advantage that no other retirement account can match. It’s an exceptional way to save.

Your contributions are tax-deductible. The money grows tax-deferred. And every dollar you withdraw for qualified medical expenses is completely tax-free. Think about that—it’s a benefit you won’t find with a 401(k) or an IRA.

The real brilliance of an HSA in early retirement is its flexibility. It acts as a dedicated, tax-free war chest for everything from routine doctor visits and prescription drugs to dental work and vision care, all while your invested funds continue to grow.

Once you enroll in Medicare, you can no longer contribute to your HSA. But all the money you’ve already saved is yours to keep and use, tax-free, for medical costs for the rest of your life. It's the perfect way to bridge the gap before you turn 65 and a fantastic supplement to Medicare later on.

Choosing Your Financial Path HDHP vs Traditional Plans

The choice between a High-Deductible Health Plan (HDHP) with its HSA partner and a traditional, higher-premium plan like a Gold or Platinum PPO is a core financial decision. You're essentially making a calculated bet on your future health needs.

- The HDHP and HSA Route: This path means you’ll pay lower monthly premiums but face higher out-of-pocket costs until you hit your deductible. It’s a great fit for relatively healthy retirees who can comfortably cover that deductible and want to maximize the HSA's tax-advantaged growth.

- The Traditional Plan Route: This approach gives you predictability. You pay higher monthly premiums but get lower deductibles and copays in return. This can bring real peace of mind, especially if you have chronic conditions or just prefer knowing your exact costs each month.

It’s no secret that healthcare costs are climbing, and you have to plan for that inflation. We're seeing this trend everywhere, even in large, established programs. For example, premium hikes for some UN-administered retiree health plans are projected to rise between 2% and 18% in mid-2025. You can dig into the numbers yourself in the UN's renewal program documentation, which really drives home the need for a solid financial game plan.

Situational Recommendations for Early Retirees

Deciding on a plan can feel overwhelming, so let's break it down based on different life situations. The "best" option is always the one that fits your specific circumstances.

| Your Situation | Primary Recommendation | Secondary Option | Key Factor to Consider |

|---|---|---|---|

| Healthy & Financially Secure | HDHP with HSA | Gold ACA Plan | Maximize tax-free growth while you can. |

| Managing Chronic Conditions | Gold or Platinum ACA Plan | Spouse's Plan | Predictable costs are more important than savings potential. |

| Need Short-Term Coverage (1-3 years) | Short-Term Plan | COBRA | Perfect for bridging a specific gap, but check for exclusions. |

| Lost Job, Need Immediate Coverage | COBRA | ACA Marketplace Plan | COBRA is seamless but expensive; the ACA offers subsidies. |

| Approaching Age 65 | ACA Marketplace Plan | Short-Term Plan | A solid ACA plan can easily bridge the final years to Medicare. |

Ultimately, this choice comes down to an honest look at your personal risk tolerance and your cash flow. If you go with a plan that has high out-of-pocket costs, you absolutely need a safety net. If you find yourself in a tight spot, it helps to know what to do when you have a health insurance gap.

By weighing these options carefully, you can build a sustainable financial strategy that protects both your health and your retirement lifestyle.

Common Questions About Early Retiree Health Insurance

Stepping into early retirement is exciting, but let's be real—figuring out health insurance can bring up a lot of questions. Getting straight answers is the first step to building a plan you can feel good about.

Let’s tackle some of the most common worries to help you move forward with confidence.

What Is the Most Affordable Health Insurance for an Early Retiree?

There’s no magic bullet here. The "most affordable" option is deeply personal and really depends on your income, your health, and what you value most in a plan. For a lot of early retirees, the ACA Marketplace is the answer. If your post-work income is on the lower side, you could qualify for premium tax credits that slash your monthly costs.

But "affordable" isn't just about the monthly premium. Imagine you have a complex health issue and a team of doctors you trust. In that case, paying higher COBRA premiums to keep that team might actually be more affordable than switching to a new plan and facing huge out-of-network bills. Your first move? Use an official ACA subsidy calculator to get a real sense of what you might pay.

Can I Use My HSA After I Retire Early?

Absolutely. That money in your Health Savings Account (HSA) is yours, period. You can use it, tax-free, for qualified medical expenses for the rest of your life. It’s a fantastic tool for covering deductibles, copays, dental work, or new glasses before you hit 65.

The only catch is that you can only add new money to your HSA while you're covered by a qualifying High-Deductible Health Plan (HDHP). Once you leave that job or switch to a different kind of plan (like most ACA plans or Medicare), you can’t contribute anymore. But the money you've already saved? It’s still there, waiting to help.

Think of your HSA as your personal healthcare trust fund. Even after you stop contributing, it remains a dedicated, tax-free resource you can deploy for medical costs, making it one of the most valuable assets for bridging the healthcare gap in early retirement.

How Do I Avoid a Coverage Gap When Transitioning to Medicare?

A smooth transition to Medicare is all about timing. The key is to start early and pay close attention to Medicare's Initial Enrollment Period (IEP). This is a crucial seven-month window that opens three months before the month you turn 65 and closes three months after.

To make sure you don't have a single day without coverage:

- Enroll Early: Sign up for Medicare Parts A and B about two to three months before your 65th birthday. This gives the Social Security Administration plenty of time to get everything processed so your coverage starts on day one of your birth month.

- Confirm Your Start Date: You'll get your Medicare card in the mail along with confirmation of your official coverage start date.

- Cancel Your Old Plan: This part is critical. Once your Medicare is locked in, call your current insurer (whether it's an ACA plan or COBRA) and tell them to end your policy. You'll want it to end the day before your Medicare kicks in. This avoids paying for two plans at once and prevents any issues with tax credits.

It's a lot to sort through, but you don’t have to do it on your own. The experts at My Policy Quote are here to help you compare plans and find the perfect fit for your new life in retirement. Explore your options at https://mypolicyquote.com.