Let’s be honest: trying to understand your health insurance can feel like reading the fine print on a contract you never wanted to sign. The phrase “health insurance gap in coverage” might sound like more confusing industry jargon, but it’s actually a really simple—and incredibly important—concept to get a handle on.

Think of your health insurance as a financial safety net. It’s supposed to be there to catch you if a sudden illness or accident happens. A coverage gap is a hole in that net. It's any period where you're not fully protected from sky-high medical bills, leaving you and your savings exposed.

Understanding Your Health Coverage Gaps

It’s easy to assume that a coverage gap just means you're completely uninsured. But that's only half the story. In reality, these gaps often show up in two very different, but equally risky, ways:

- Temporary Gaps: These are the short-term lapses in coverage that can sneak up on you during big life changes. Maybe it’s the time between leaving an old job and your new plan kicking in. Or it could be that first month after you turn 26 and can no longer stay on a parent's plan.

- Underinsurance Gaps: This one is trickier because you actually have an insurance card in your wallet. The problem is, the policy itself is full of holes. You might be facing a massive deductible you could never afford to meet, steep coinsurance payments, or a super-narrow network of doctors that makes finding care nearly impossible.

The Real-World Impact

A coverage gap, whether temporary or due to underinsurance, can turn a routine doctor's visit into a financial nightmare. A sudden injury or unexpected diagnosis can quickly lead to bills that feel impossible to pay.

This isn’t just a personal problem; it’s a global one. While the number of people lacking full health service coverage fell by about 15% between 2000 and 2021, progress has stalled. As of 2021, an eye-watering 4.5 billion people worldwide are still not fully covered, which shows just how massive this issue is.

To help you quickly identify these situations, here’s a simple breakdown of the most common types of coverage gaps and who they usually affect.

Quick Guide to Coverage Gaps

| Type of Gap | Description | Who It Affects |

|---|---|---|

| Temporary Lapse | A short-term period with no active insurance policy. | Job changers, recent graduates, people turning 26. |

| Underinsurance | A policy with high out-of-pocket costs (deductibles, copays) that make care unaffordable. | Individuals with high-deductible plans, low-income families. |

| Network Gap | A plan with a very limited or restrictive list of in-network doctors and hospitals. | People in rural areas, those with specialized health needs. |

| Service Exclusion | A policy that doesn’t cover specific types of care, like dental, vision, or mental health. | Anyone whose plan has limited benefits or specific exclusions. |

These gaps represent real risks, turning what should be a straightforward path to care into a confusing and costly maze.

The real danger of a coverage gap isn't just being uninsured. It’s the false sense of security you get from a bad policy. Thinking you’re protected when you’re actually vulnerable is a recipe for financial disaster.

Getting a firm grasp on these concepts is the first step toward protecting yourself. When you know what to look for, you can spot the holes in your own coverage. To learn more, you can explore our complete guide on the health insurance gap in coverage and see what steps you can take to build a solid, reliable plan for your future.

Why Coverage Gaps Happen to So Many People

Finding yourself without health insurance isn't something most people plan for. It’s a surprisingly common situation, and it almost never happens by choice. Instead, these gaps are usually the fallout from major life events that throw your routine—and your coverage—into chaos.

Think about the big transitions we all go through. A young adult turns 26 and suddenly ages out of their parent's plan. A divorce might mean one partner loses spousal coverage and has to navigate the individual market alone. Even a good thing, like moving to a new state for a dream job, can create a temporary gap if your old plan isn't accepted there.

Each of these moments creates a period of real vulnerability. One unexpected illness or accident could suddenly have devastating financial consequences.

When Policy Creates Gaps

It's not just personal life changes that leave people exposed. Sometimes, a gap in health insurance coverage is baked directly into policy decisions. The most glaring example is the "Medicaid coverage gap," which impacts adults in states that chose not to expand Medicaid under the Affordable Care Act (ACA).

In these states, many low-income workers earn too much to qualify for traditional Medicaid but not enough to get financial help for a plan on the ACA Marketplace. They're stuck in the middle with no affordable options.

As of early 2025, 10 states still haven't expanded Medicaid, leaving an estimated 1.4 million people in this exact bind. You can see the full picture by exploring the analysis of the Medicaid coverage gap from KFF.

The Underinsurance Trap

There’s another, sneakier way gaps appear: underinsurance. This is when you technically have a policy, but its limits are so high that you can't actually use it without facing huge bills. The main culprit? Sky-high deductibles.

Underinsurance is like having an umbrella full of holes during a storm. You have it with you, but when the rain starts, you realize it offers very little real protection from getting soaked by medical bills.

Imagine your plan has an $8,000 deductible. Your monthly premium might be affordable, but you're on the hook for the first $8,000 of medical care out-of-pocket before your insurance pays a dime. For most families, that's simply not manageable.

So what happens? You might put off a necessary doctor's visit or skip filling a prescription because the upfront cost is just too high. This is a coverage gap in practice, even if it’s not one on paper, and it highlights why you have to look beyond the monthly premium.

The True Cost of a Gap in Health Coverage

A health insurance gap in coverage isn't just a minor inconvenience or a bit of paperwork you missed. It's a genuine risk to both your finances and your health, with ripple effects that can touch every part of your life.

The first and most obvious hit is financial. All it takes is one accident or a sudden illness to find yourself buried under a mountain of medical debt. For someone without a plan, a simple broken arm can run into the thousands. A serious diagnosis? That could easily lead to six-figure bills, pushing a family to the brink of bankruptcy.

The Hidden Health Consequences

Beyond the shocking price tags are the health consequences, which are often quieter but just as damaging. When you're constantly worried about the cost, you start putting off the care you need. That routine check-up gets rescheduled. A new, nagging symptom gets ignored, hoping it just goes away on its own.

This isn't a small thing. Delaying care can turn a manageable condition into a full-blown health crisis that’s far more complex, dangerous, and expensive to treat down the road.

The real danger of a coverage gap is that it forces you to gamble with your health. Every decision to delay care becomes a bet against your future well-being, a risk no one should have to take.

It’s a vicious cycle: you avoid the doctor to save money, your health gets worse, and you end up with even bigger medical bills later. This is exactly why finding a plan that actually fits your budget is so important. If you're looking for options, our guide on affordable health insurance is a great place to start.

The Psychological Burden of Being Unprotected

Finally, you can't ignore the sheer mental and emotional toll of living without a safety net. The constant, low-grade anxiety about what could happen—a car accident, a sudden sickness—is exhausting.

This strain doesn’t just affect you; it impacts your whole family. Every decision gets filtered through a lens of "what if?"

- Can we really afford to let our kid play sports?

- What happens if I get sick and can't work for a month?

- How would we possibly handle a trip to the emergency room?

That constant worry chips away at your quality of life and makes it almost impossible to feel secure. Closing a health insurance gap isn’t just a smart financial move. It's about giving yourself and your family back your peace of mind.

How Systemic Failures Create Coverage Gaps

Sometimes, the gap in your health coverage has nothing to do with the card in your wallet. It’s about whether that card actually connects you to the care you need. Even with a fantastic plan, you can fall into an "access gap"—a frustrating dead end where the healthcare system itself lets you down.

This proves a crucial point: these aren't always individual problems. They’re often systemic failures.

Imagine you have a top-tier insurance plan but live in an area where the closest in-network specialist is a three-hour drive away. Your policy says you're covered, but geography and a simple lack of available doctors say otherwise. This is a very real problem called a service availability gap, and it’s quietly growing across the country.

At its core, this issue is driven by major healthcare workforce shortages. When there just aren't enough doctors, nurses, or mental health professionals to go around, your insurance policy can start to feel like a piece of plastic with only theoretical value. On paper, you’re protected. In the real world, care is out of reach.

The Impact of Workforce Shortages

The strain of these shortages is felt everywhere. It’s in bustling cities struggling to fill hospital staff roles and in rural communities that have become "care deserts," where quality medical help is miles away. For patients, this means long waits for appointments, a real struggle to find specialized care, and an overall dip in the quality of health services.

This isn't just a local issue; it's a global crisis. The World Health Organization is predicting a shocking shortfall of 10 million healthcare workers worldwide by 2030. As Deloitte's global healthcare outlook highlights, this problem severely limits a health system's ability to serve its population—even for those with insurance.

For individuals and families, this systemic failure creates a dangerous canyon between having a policy and actually receiving care.

A health plan is only as good as the system that supports it. When there are no doctors to see or hospitals to visit, your policy’s promises of protection can quickly ring hollow, leaving you vulnerable despite your best efforts to stay insured.

The connection is crystal clear: true healthcare security depends on a fully functioning system. This means that a stable workforce and strong medical infrastructure are just as vital as the plan you choose. A gap created by a lack of doctors can be just as financially devastating as being completely uninsured, especially during medical emergencies without insurance or adequate access.

Understanding this bigger picture is key. It shows that closing the health insurance gap requires more than just smart individual planning—it demands we take a hard look at the health of our entire medical system.

Actionable Strategies to Bridge Your Coverage Gap

Staring down a gap in your health insurance can feel like standing on the edge of a cliff. It's stressful, confusing, and the stakes feel incredibly high. But you're not out of options. There are several solid ways to build a bridge to your next long-term plan, and figuring out which one fits you is the first step toward getting that peace of mind back.

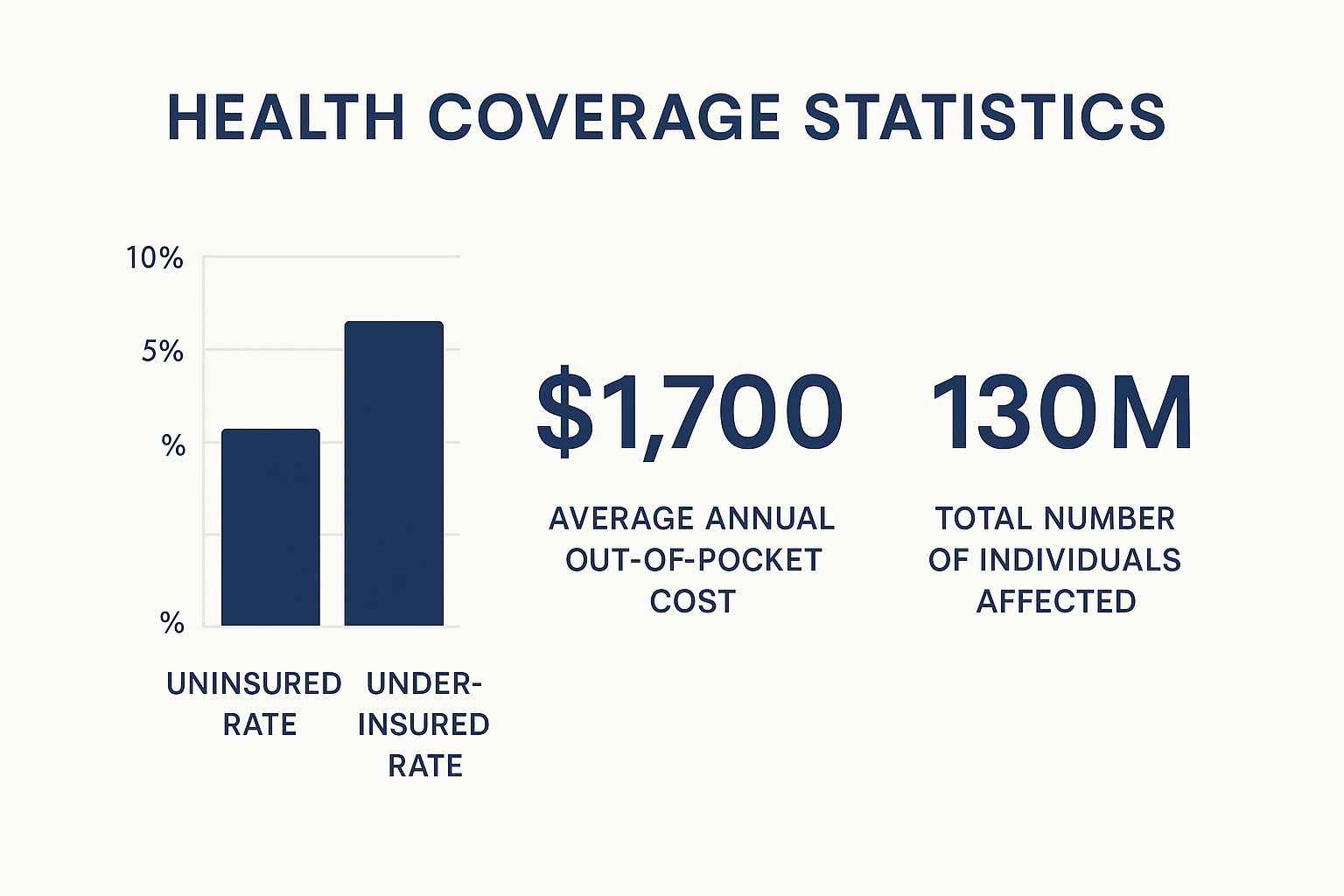

This isn’t just a theoretical problem. The financial risk of being underinsured can be almost as devastating as having no insurance at all, as this data shows.

The message is clear: whether you’re uninsured or your plan is full of holes, you can be on the hook for massive out-of-pocket costs. That's why finding a plan that truly protects you is so important.

Navigating Your Short-Term Options

When you need temporary coverage, you have a few different paths you can take. Each has its own set of rules, price tags, and protections, so it’s crucial to weigh them against what you actually need.

-

Short-Term Health Plans: Think of these as a temporary band-aid. They're usually cheaper and you can sign up anytime, making them a fast fix if you're between jobs. But here's the catch: they aren't ACA-compliant. This means they can turn you down for pre-existing conditions and often skip essential benefits like maternity care or mental health services.

-

COBRA Coverage: If you just left a job with a great health plan, COBRA lets you keep that exact same coverage. The best part? No change to your network of doctors. The downside is the sticker shock—you'll pay 100% of the premium yourself, plus a small administrative fee. It can get very expensive, very fast.

-

ACA Marketplace Plans: Did you lose your job or have another major life change? You might qualify for a Special Enrollment Period on the ACA Marketplace. These plans are the real deal—they're comprehensive, must cover pre-existing conditions, and you could even get subsidies to bring down your monthly premium.

Choosing the right temporary plan isn't just about finding the cheapest monthly premium. It’s about balancing the risk you're comfortable with against the quality of coverage you'll have during a time when you might feel pretty vulnerable.

Comparing Your Solutions Side-by-Side

Making the right call means looking at your options clearly. The best choice for a healthy 27-year-old in-between jobs is probably very different from what a 55-year-old with a chronic illness needs. To help simplify things, we've got a guide with more top tips for finding budget-friendly health coverage designed for different situations.

To help you decide, let's put the most common solutions for bridging a health insurance gap next to each other.

Comparing Options to Bridge a Coverage Gap

| Solution | Best For | Typical Cost | Key Benefit | Main Drawback |

|---|---|---|---|---|

| Short-Term Plan | Healthy individuals needing coverage for 1-12 months. | Low | Quick approval and lower premiums. | Doesn't cover pre-existing conditions; limited benefits. |

| COBRA | Individuals who want to keep their exact employer plan and doctor network. | High | Comprehensive, continuous coverage. | Extremely expensive premiums. |

| ACA Marketplace | Anyone who qualifies for a Special Enrollment Period and needs robust coverage. | Varies (subsidies available) | Comprehensive benefits and guaranteed coverage. | Can only enroll during specific periods. |

| Catastrophic Plan | Healthy adults under 30 looking for a low-premium safety net. | Low | Protects against major medical events. | Very high deductible must be met first. |

By taking a hard look at these options and measuring them against your personal health needs and budget, you can confidently close that health insurance gap and make sure you stay protected, no matter what.

Building Your Financial and Health Security

The absolute best way to deal with a health insurance gap in coverage is to make sure it never happens in the first place. Instead of waiting for a crisis to hit, you can build a solid foundation of financial and health security right now. It’s about turning that nagging anxiety about the unknown into a confident, forward-thinking strategy.

Think of your health plan like your car—it needs regular maintenance to keep running smoothly. An annual "health plan check-up" is your chance to pop the hood and make sure your coverage still fits your life. A quick review of your deductibles, network, and benefits can help you spot hidden weaknesses before they turn into major problems on the road.

Prepare for Life's Transitions

Big life changes are the number one reason people unexpectedly lose their coverage. Knowing this gives you a huge advantage. Whether you’re getting ready to change jobs, get married, or celebrate a milestone birthday, a little prep work ensures you’re never caught off guard.

A few months before a big event, start exploring your options. It's simpler than it sounds:

- Turning 26: Don't wait until the last minute. Start looking into ACA Marketplace plans or your own employer's coverage well before your birthday.

- New Job: Always ask about the waiting period for health benefits. Have a short-term plan or COBRA ready to bridge that gap.

- Marriage or Divorce: Understand how this changes your eligibility for a spouse's plan and know the special enrollment deadlines.

Building an emergency health savings fund is your ultimate financial backstop. It's the safety net you control, ready to deploy for unexpected deductibles or copays, ensuring a medical issue doesn't become a financial catastrophe.

This fund is your personal buffer. It’s what gives you the power to handle out-of-pocket costs without derailing your budget or your peace of mind. Even a small, dedicated savings account can make all the difference when you need it most.

When you adopt a forward-looking mindset, you transform uncertainty into empowerment. By checking in on your plan, planning for life's milestones, and building a financial safety net, you create a system that delivers continuous, reliable health coverage for you and your family, year after year.

Navigating all these insurance options can feel like a maze, but you don't have to find your way through it alone. At My Policy Quote, we specialize in helping individuals and families find the perfect plan to close any coverage gap. Explore your options and get a free quote today.