Welcome to your essential Medicare planning guide. The first step is realizing Medicare isn't one single program but a system of interconnected parts. Think of it like assembling a personalized healthcare toolkit for your retirement years.

Starting Your Medicare Planning Journey

Jumping into Medicare can feel like learning a new language. With all its different "Parts" and strict timelines, it’s easy to feel lost. But at its heart, the system is built to give you choices so you can find coverage that truly fits your life.

Your whole journey starts with one single, fundamental decision that shapes everything else.

Your Two Core Medicare Paths

This is the big fork in the road. You have to decide which of two main paths you'll take to get your health benefits. This choice is the cornerstone of your entire Medicare strategy.

The first path is Original Medicare. This is the traditional, government-run program made up of Part A (for hospital stays) and Part B (for doctor visits and medical services). This route gives you incredible freedom, letting you see any doctor or visit any hospital in the U.S. that accepts Medicare.

The second path is Medicare Advantage, which you might hear called Part C. These are all-in-one plans offered by private insurance companies that have Medicare's seal of approval. They bundle everything Original Medicare covers and usually add in prescription drug coverage (Part D) plus other perks like dental, vision, and hearing aids.

Think of it this way: Original Medicare is like an à la carte menu where you pick and choose your services. Medicare Advantage is more like a prix-fixe meal that bundles your appetizer, main course, and dessert into one convenient package.

Getting a handle on these two options is the most critical first step in any Medicare plan. Here’s a quick comparison to help you see the differences side-by-side.

A Quick Look at Your Two Medicare Paths

| Feature | Original Medicare (Parts A & B) | Medicare Advantage (Part C) |

|---|---|---|

| Provider Choice | Go to any doctor or hospital that accepts Medicare nationwide. | Must use doctors and hospitals within the plan’s network (HMO or PPO). |

| Core Components | Includes Part A (Hospital) and Part B (Medical). | Includes all benefits of Part A and Part B, usually with Part D. |

| Extra Benefits | Does not cover prescriptions, dental, or vision. Requires separate plans. | Often includes prescription drugs (Part D), dental, vision, and hearing. |

| Administration | Managed by the federal government. | Managed by private insurance companies. |

Choosing the right path comes down to what matters most to you—your personal health needs, your budget, and how you prefer to get your care.

Do you value the freedom to see any doctor you want, or do you prefer the simplicity and extra perks of a single, all-in-one plan? As we continue, we’ll dive deeper into how you can make this important decision with confidence.

Breaking Down the Medicare Alphabet

The world of Medicare can feel like a bowl of alphabet soup. With Parts A, B, C, and D all floating around, it’s easy to get turned around. But once you understand what each letter stands for, you’ll see it’s the foundation of any solid medicare planning guide—and much simpler than it looks.

Think of each part as a different tool in your healthcare toolkit, designed for a specific job. Some are essentials that everyone gets, while others are optional add-ons you can choose to build more complete coverage. Let’s decode this alphabet one letter at a time.

Part A: Your Hospital Insurance

Think of Part A as your hospital insurance. This is the piece of Medicare that has your back during major medical events that require an inpatient stay. For most people who have worked and paid Medicare taxes for at least 10 years, Part A comes without a monthly premium. It’s something you’ve already earned.

Its main job is to cover the costs that come with being formally admitted to a hospital or a skilled nursing facility. It doesn't cover the doctors' services you receive while you're there—that’s a different part of the alphabet we'll get to in a moment.

So, what does Part A typically cover?

- Inpatient Hospital Care: This includes your semi-private room, meals, nursing services, and drugs given as part of your inpatient treatment.

- Skilled Nursing Facility Care: This covers care in a facility after a qualifying hospital stay, but it’s not for long-term custodial care.

- Hospice Care: Provides comfort-focused care if you are terminally ill.

- Home Health Care: Limited coverage for skilled care at home that is medically necessary.

Part A is your safety net for those big, unexpected health events. It's the foundational coverage that protects you from the sky-high costs of hospital stays, making sure a serious health issue doesn’t turn into a financial catastrophe.

This part is the bedrock of your Medicare coverage, but it’s only one piece of the puzzle. To cover your more routine medical needs, you'll need the next letter.

Part B: Your Medical Insurance

If Part A is for the hospital, Part B is for the doctor. This is your day-to-day medical insurance, covering a huge range of outpatient services and supplies that are medically necessary to treat your health condition. Unlike Part A, almost everyone pays a monthly premium for Part B.

Part B is what you’ll use for regular check-ups, appointments with specialists, and other care you receive when you aren’t admitted to a hospital. For 2024, the standard Part B premium is $174.70, though this amount can be higher depending on your income.

Common services covered by Part B include:

- Doctor visits, including specialists

- Outpatient hospital care

- Ambulance services

- Durable medical equipment (like walkers or wheelchairs)

- Preventive shots and screenings

Together, Parts A and B are known as Original Medicare. They provide a strong foundation, but they do leave some important gaps—most notably, prescription drugs.

Part D: Your Prescription Drug Coverage

Finally, we get to Part D, your prescription drug coverage. This is a critical piece of the puzzle because Original Medicare (Parts A and B) does not cover most of the medications you’d pick up at a pharmacy.

You can get Part D coverage in one of two ways. You can either buy a standalone Prescription Drug Plan (PDP) from a private insurer to go alongside your Original Medicare, or you can enroll in a Medicare Advantage plan (Part C) that bundles everything—hospital, medical, and drug coverage—into one plan.

With an estimated 80.4% of all Medicare beneficiaries enrolled in some form of Part D, it’s clear this coverage has become essential.

Every Part D plan has its own formulary, which is just a fancy word for its list of covered drugs. Before you enroll, it's absolutely vital to check that list to make sure your specific medications are included. Getting this part of your medicare planning guide right is key to managing your health costs for the long haul.

Understanding Eligibility and Enrollment Deadlines

When it comes to Medicare, your calendar is your best friend. Missing a key deadline isn’t just a minor slip-up; it can lead to lifelong financial penalties and frustrating gaps in your health coverage. Let's make sure that doesn't happen.

Think of Medicare enrollment like catching a train. There are specific departure times, and if you miss your window, you might have to wait for the next one—and often pay a higher price for the delay. The first step is knowing when you can even get on board.

Who Is Eligible for Medicare?

The most common ticket to Medicare is turning 65. For most Americans, this birthday is the milestone that unlocks the program. If you or your spouse worked and paid Medicare taxes for at least 10 years, you'll likely get Part A without paying a monthly premium.

But age isn't the only way to qualify. You can also get Medicare, no matter your age, if you:

- Have received Social Security Disability Insurance (SSDI) benefits for 24 months.

- Have been diagnosed with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig's disease.

Once you know you're eligible, the next big question is when to sign up. This is where enrollment periods come in, and your first one is the most important of all.

Your Initial Enrollment Period

Your Initial Enrollment Period (IEP) is your personal, seven-month window to sign up for Medicare. It’s a one-time opportunity centered around your 65th birthday.

It starts three months before your birthday month, includes your birthday month, and ends three months after. So, if your birthday is in May, your IEP runs from February 1st all the way to August 31st.

This seven-month window is your golden opportunity. Signing up during your IEP helps you avoid the permanent late enrollment penalties that can be tacked onto your Part B premiums for life. It's the smoothest path to getting your coverage started right.

If you’re still working and have health insurance through your job, you might be able to delay enrollment without penalty. But it's critical to know the rules. For anyone needing short-term coverage, learning about health insurance before Medicare can fill that gap.

Other Key Enrollment Windows

Life happens. What if you miss your IEP or have a unique situation? Don't worry, Medicare has other specific times when you can enroll or adjust your coverage.

-

Special Enrollment Period (SEP): This is for people who keep working past 65 and have health coverage from an employer (or their spouse's). An SEP lets you sign up for Medicare later—usually within eight months of losing that coverage—without facing a penalty.

-

General Enrollment Period (GEP): If you missed your IEP and don't qualify for an SEP, this is your next chance. The GEP runs from January 1 to March 31 each year. But be careful: coverage doesn’t begin until July 1, and you'll almost certainly face late enrollment penalties.

-

Medicare Open Enrollment Period: This is your annual check-up for your coverage. From October 15 to December 7 every year, current Medicare members can switch plans, like moving from Original Medicare to a Medicare Advantage plan or changing a Part D drug plan. It's the perfect time to make sure your plan still fits your life.

Choosing Between Original Medicare and Medicare Advantage

When you start planning for Medicare, one of the first big forks in the road you'll encounter is deciding how you want to get your coverage. This isn't just some minor paperwork detail. It’s a fundamental choice that will shape everything—which doctors you can see, what you’ll pay out-of-pocket, and how your healthcare works for years to come.

You have two main paths: Original Medicare or Medicare Advantage.

Think of it like this: Original Medicare is like a national park pass. It gives you the freedom to go almost anywhere in the country. Medicare Advantage, on the other hand, is more like an all-inclusive resort package—it bundles everything together for convenience but keeps you within its grounds.

Let's break down what this really means for you.

What Is Original Medicare

Original Medicare is the traditional health plan run by the federal government. It's made up of two parts: Part A (for hospital stays) and Part B (for doctor visits and medical services).

Its biggest selling point is freedom. Pure and simple. With Original Medicare, you can go to any doctor or hospital in the U.S. that accepts Medicare. No networks, no gatekeepers. If you travel a lot or have a specialist you refuse to give up, this is a huge deal.

But that freedom comes with some pretty big holes. Original Medicare covers a lot, but it has deductibles and coinsurance with no annual cap on what you could spend. That means one bad health year could be financially devastating. It also doesn't cover most prescription drugs, routine dental work, or vision care.

To plug these gaps, most people on Original Medicare add two more pieces to their coverage:

- A standalone Medicare Part D plan to cover their prescriptions.

- A Medicare Supplement Insurance plan, also known as Medigap.

A Medigap policy helps pay for the costs that Original Medicare leaves behind, like your deductibles and the 20% coinsurance. If this sounds like the right path for you, it’s worth exploring the best Medicare Supplement plan to create predictable, manageable healthcare costs.

What Is Medicare Advantage

Medicare Advantage, also called Part C, is a totally different way to get your benefits. These are all-in-one plans offered by private insurance companies that are approved by Medicare. They have to cover everything Original Medicare does, but they deliver it through a managed care network, similar to an HMO or PPO you might have had from an employer.

The main attraction here is convenience and extra perks. Most Medicare Advantage plans roll prescription drug coverage (Part D) right in. Plus, they often include benefits that Original Medicare won’t touch, like:

- Routine dental, vision, and hearing care

- Gym memberships and wellness programs

- Allowances for over-the-counter items

In exchange for these extras and often very low monthly premiums (some even have a $0 premium beyond what you pay for Part B), you agree to use their network of doctors and hospitals. This structure helps control costs. A huge safety net with these plans is the annual out-of-pocket maximum, which puts a firm ceiling on your medical spending each year.

The Big Shift: For the first time ever, more than half of all eligible Americans—50.4% of the 67.3 million people on Medicare—have chosen a Medicare Advantage plan. Enrollment in these private plans has more than doubled since 2013, showing a massive trend toward the all-in-one model. You can see the full breakdown of this major shift on YourFMO.com.

This trend really highlights how appealing that simple, bundled approach has become for millions of retirees.

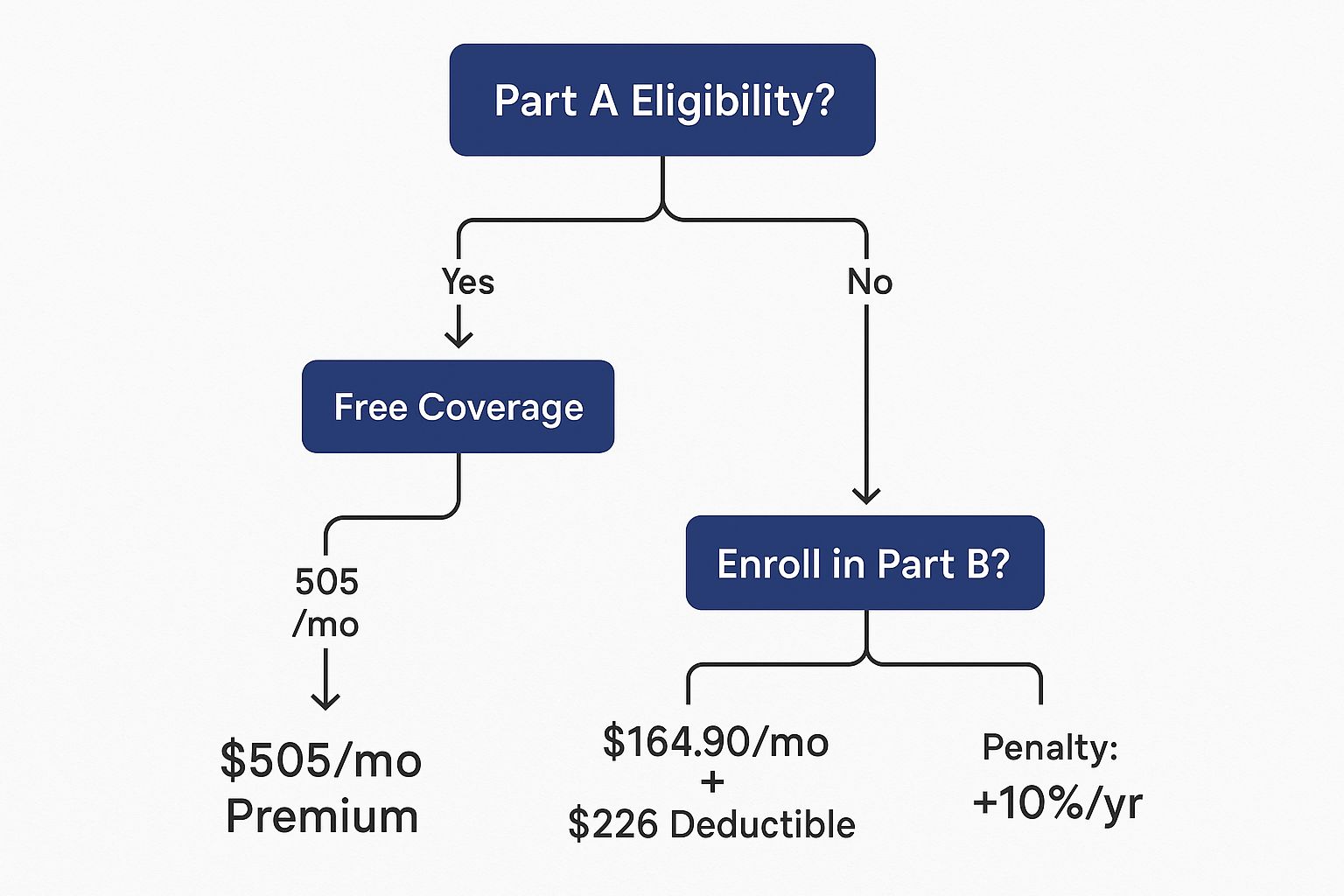

The chart below shows some of the basic costs you’ll face right from the start, which will be the foundation for either path you choose.

These initial costs are just the beginning, but they set the stage for your total healthcare spending.

Comparing Your Two Main Options

So, which way should you go? It really comes down to what you value most. Is it total freedom to choose any doctor, or the simplicity and financial protection of an all-in-one plan?

Let's put them head-to-head.

| Feature | Original Medicare (+ Medigap & Part D) | Medicare Advantage (Part C) |

|---|---|---|

| Doctor Choice | Freedom to see almost any doctor or hospital in the U.S. that accepts Medicare. | Must stay within the plan’s network (HMO or PPO) to get the lowest costs. |

| Monthly Premiums | You’ll pay separate premiums for Part B, a Part D plan, and a Medigap policy. | You pay your Part B premium, plus the plan’s premium (which can be $0). |

| Extra Benefits | Does not cover routine dental, vision, or hearing aids. | Often includes dental, vision, hearing, and wellness perks. |

| Out-of-Pocket Cap | No annual limit on your medical costs (unless your Medigap plan covers it). | Includes a yearly limit on what you’ll spend on medical care. |

| Referrals | You don’t need a referral to see a specialist. | You may need a referral to see a specialist, depending on the plan. |

Ultimately, this choice is a personal trade-off between flexibility and cost management. Original Medicare gives you unparalleled freedom, while Medicare Advantage offers a simpler, bundled package with built-in financial safety nets.

Making Sense of Medicare Part D Drug Plans

For a lot of people heading into retirement, the potential cost of prescription drugs is one of their biggest worries. That’s because Original Medicare (Parts A and B) leaves a pretty big hole—it doesn’t cover most of the everyday medications you pick up from the pharmacy.

This is where Medicare Part D comes in. Think of it as the missing piece that offers a vital safety net for your wallet.

Part D isn’t a one-size-fits-all government plan. Instead, it’s a program offered through private insurance companies that are approved by Medicare. You can get this crucial coverage in two main ways: either as a standalone Prescription Drug Plan (PDP) that you add to Original Medicare, or as part of a Medicare Advantage plan (often called an MA-PD). Both paths do the same thing: help you afford the medications you need.

Understanding Your Plan's Formulary and Tiers

If there’s one word you need to know in the Part D world, it’s formulary. It sounds complicated, but it’s not. A formulary is just the list of drugs a specific plan agrees to cover.

No two formularies are identical, which is why simply picking the plan with the lowest premium can be a costly mistake. To make it easier to understand, plans group their covered drugs into different "tiers," which are basically just price levels.

- Tier 1: This is usually where you'll find preferred generic drugs. They have the lowest copayments.

- Tier 2: Next up are non-preferred generic drugs, which will cost you a bit more.

- Tier 3: This tier is for preferred brand-name drugs, which come with a higher copay.

- Tier 4 & 5: These top tiers are for non-preferred brand-name drugs and specialty medications. These have the highest out-of-pocket costs.

Checking that your specific medications are on a plan’s formulary—and seeing which tier they’re in—is the single best thing you can do to predict your drug costs for the year. A cheap monthly premium means nothing if your most important medication isn't covered at all.

The New Out-of-Pocket Spending Cap

This is a big one. A groundbreaking change is on the horizon that will bring massive financial relief to many. It’s no surprise that 80.4% of all Medicare beneficiaries are enrolled in a Part D plan—people know they need this coverage.

For 2025, a new $2,000 out-of-pocket spending cap on prescription drugs is being introduced, and it’s a total game-changer for anyone with high medication costs. You can read more details about these important Part D changes at KFF.org.

What does this mean for you? Once your spending on covered drugs hits $2,000 for the year, you’ll pay nothing more for your prescriptions for the rest of that year. This creates a solid financial ceiling, protecting you from the crushing costs that can come with expensive specialty drugs.

This new rule gets rid of the infamous "donut hole" (or coverage gap) that used to leave people exposed to huge costs after they hit a certain spending limit. It makes the whole system simpler and provides some much-needed peace of mind.

How to Compare and Choose a Part D Plan

With hundreds of plans out there, each with its own premium, deductible, and formulary, how on earth do you find the right one? The secret is to ignore the noise and focus on what you personally need.

-

List Your Prescriptions: Before you do anything else, make a list. Write down the exact name and dosage of every single medication you take regularly. This is your personal shopping list.

-

Use the Medicare Plan Finder: This official tool on Medicare.gov is your best friend in this process. You can enter your list of medications and your favorite pharmacies, and the tool will calculate your estimated total annual costs for every single plan available in your zip code.

-

Look Beyond the Premium: A plan with a $0 monthly premium might catch your eye, but it could have a sky-high deductible or put your most-needed drugs in the most expensive tiers. The Plan Finder tool cuts through the marketing and shows you the full picture—premiums, deductibles, and copayments—to find the plan with the lowest total cost for you.

And remember, don't just set it and forget it. Formularies, premiums, and other costs can and do change every year. Get into the habit of reviewing your Part D plan during the Fall Open Enrollment period to make sure you still have the best, most cost-effective coverage for your needs.

Creating Your Personal Medicare Action Plan

You’ve learned the ropes—the different parts, the plans, the pathways. Now it's time to put that knowledge into action. This is where you create a concrete strategy, a personalized Medicare planning guide that acts as your roadmap.

Don't worry, building this plan isn't as complicated as it sounds. It’s really about gathering a few key pieces of personal information so you can make a choice that truly fits your life. Think of it like packing for a trip. You wouldn’t just throw things in a suitcase without knowing where you're going. Your Medicare action plan makes sure you have exactly what you need for the journey ahead.

Your Step-by-Step Checklist

Let's start by getting organized. This prep work is the most important part of the entire process because it gives you the real-world data you need to compare plans honestly.

-

List Your Providers: Make a complete list of every doctor, specialist, and hospital you want to keep. This is a deal-breaker if you're looking at a Medicare Advantage plan, since you'll need to confirm they are all in-network.

-

List Your Prescriptions: Write down the exact name and dosage for every single medication you take regularly. This info is absolutely critical for comparing Part D plans and making sure you don't get hit with massive, unexpected costs at the pharmacy.

-

Estimate Your Budget: Get real about what you can comfortably afford. How much can you handle for monthly premiums? And what could you realistically pay out-of-pocket for copays and other services? This helps you decide between Original Medicare with a Medigap plan (higher premiums, lower out-of-pocket) and an Advantage plan (often lower premiums, but higher copays when you need care).

Once you have all this information gathered, you can confidently use Medicare’s official Plan Finder tool to see which options truly match your needs.

The Importance of an Annual Review

Here’s a secret many people miss: choosing a Medicare plan isn't a "one-and-done" decision. Your health can change. The plans themselves can change. And costs definitely change from one year to the next.

Think of your Medicare plan like a subscription service. You wouldn't keep paying for something that no longer gives you what you need, right? The Open Enrollment period, from October 15 to December 7 each year, is your chance to review your coverage and switch if you find a better fit.

This annual check-up is a powerful tool for managing your retirement health insurance. It gives you the power to adapt to life's changes, keep your healthcare costs in check, and move forward with total confidence.

Frequently Asked Questions About Medicare

Even after you've done your homework, a few specific questions always seem to pop up. Think of this as your go-to spot for quick, clear answers to those common Medicare sticking points. We'll help you get unstuck so you can move forward with confidence.

Can I Have Both Medigap and Medicare Advantage?

No, you can't have both at the same time. In fact, it's illegal for an insurance company to sell you a Medigap policy if you're already in a Medicare Advantage plan (unless you're in the process of switching back to Original Medicare).

It helps to see them as two completely different roads. Medigap is built to work with Original Medicare, filling in the financial gaps. Medicare Advantage, on the other hand, is a total replacement for Original Medicare. You have to pick one path or the other.

What Happens If I Miss My Initial Part B Enrollment?

Missing your sign-up window for Part B can come with some serious, long-term costs, especially if you don't have other qualifying health coverage (like a plan from your current job). You'll most likely get hit with a late enrollment penalty.

This isn't just a one-time slap on the wrist. The penalty is a permanent surcharge tacked onto your monthly Part B premium for as long as you have it. It’s calculated as an extra 10% for every full 12-month period you were eligible for Part B but didn't sign up.

How Do I Check If My Prescriptions Are Covered?

The single best way to know if a Part D plan covers your specific medications is by using the official Medicare Plan Finder tool on Medicare.gov. Every single drug plan has its own unique list of covered drugs, which is called a formulary.

When you enter your exact prescriptions and dosages into the tool, you can see a direct comparison of how different plans will cover your meds and what your out-of-pocket costs will look like. Never choose a plan based on the premium alone—always, always check your drug coverage first.

Do I Need to Sign Up for Medicare If I Am Still Working at 65?

This is a classic question, and the honest answer is: it depends entirely on your employer's health plan.

- If your company has 20 or more employees: You can usually delay signing up for Part B without getting penalized later. In this setup, your employer's plan is your primary insurance.

- If your company has fewer than 20 employees: You will almost certainly need to sign up for Part B. For smaller companies, Medicare becomes the primary payer, and not enrolling can leave you with huge gaps in coverage and those pesky penalties.

It’s also smart to understand what Medicare does and doesn't pay for, as some of the rules might surprise you. For example, people often ask about certain medical supplies, and you can learn more about whether Medicare covers adult diapers in our detailed guide. It's always a good idea to confirm the rules with your company's benefits administrator to make the right call.

Trying to piece together the Medicare puzzle can feel overwhelming, but you don't have to figure it all out by yourself. The experts at My Policy Quote are here to help you compare your options and find the perfect plan for your healthcare needs and your budget. Visit My Policy Quote to get started today.