When you’re self-employed, your most valuable asset isn’t your laptop, your office, or even your client list. It’s you—and your ability to show up and do the work. So, what happens if an injury or illness takes you out of the game?

That’s where disability insurance for self employed professionals comes in. It’s the single best way to protect your income. This coverage pays you a tax-free monthly benefit if you’re too sick or hurt to work, replacing a huge chunk of your lost earnings. Think of it as the financial backstop that keeps your life running smoothly, even when your health unexpectedly doesn't.

Your Essential Financial Safety Net

Let’s be honest. When you work for yourself, there’s no safety net unless you build it. No paid sick leave. No company benefits. If you can’t work, the business stops, and so does the money. You are the business.

A bad fall or a serious illness isn't just a minor hiccup; it can shut down your entire income stream in an instant.

Disability insurance is like having an emergency power generator for your income. When the main source—your ability to work—gets cut off, this policy kicks in. It delivers the cash you need to pay the mortgage, buy groceries, and handle your bills while you focus on getting better. Without it, you’d be left draining your savings, selling off assets, or racking up debt just to get by.

Protecting More Than Just Your Paycheck

This isn't just about covering your monthly expenses. It’s about protecting the very life and business you’ve poured your heart into building. For any freelancer or entrepreneur, this coverage can be the one thing that stands between a temporary health crisis and a permanent financial disaster.

This is especially true when you consider who makes up the self-employed community. It’s interesting to note that people with disabilities are often more likely to be their own boss. In 2019, about 10% of people with disabilities were self-employed, compared to just 5.9% of those without disabilities. This suggests a real need to create your own path, which makes protecting your income all the more critical. You can find more of these disability statistics at SimplyInsurance.com.

The real point of disability insurance isn’t just to protect you when you’re sick. It’s to protect everything you’ve built for those moments when an illness or injury threatens to tear it all down.

To help you get a clear picture, here's a quick breakdown of what makes this coverage so important for independent professionals.

Quick Guide to Self Employed Disability Insurance

| Key Aspect | Why It Matters for the Self Employed |

|---|---|

| Income Replacement | It directly replaces a portion of your lost earnings, so your personal and business bills get paid. |

| Financial Stability | Prevents you from having to dip into retirement funds or savings during a health crisis. |

| Business Continuity | Gives you the resources to keep your business afloat (or cover expenses) while you recover. |

| Peace of Mind | Lets you focus on your health without the added stress of a financial emergency. |

| Tax-Free Benefits | If you pay the premiums with after-tax dollars, the benefits you receive are typically tax-free. |

Ultimately, this table highlights one core idea: for the self-employed, income protection is not a luxury—it’s a foundational piece of a sound financial strategy.

An Indispensable Part of Your Financial Plan

Making sure your income is secure is just as fundamental as having health insurance. You wouldn't go without coverage for your medical bills, but that policy won’t pay your rent. Disability insurance for self employed professionals fills that crucial gap. While you're thinking about income protection, you might also find our guide on health insurance for the self employed useful.

It offers priceless peace of mind. Knowing a health issue won’t sink you financially frees you up to take smart business risks, invest in your growth, and plan for your future with confidence. This insurance isn't just another bill—it's a non-negotiable part of financial stability for any serious freelancer, contractor, or business owner.

How Your Disability Insurance Policy Actually Works

Trying to read an insurance policy can feel like translating a different language. The terms are confusing, the stakes are high, and it’s easy to get lost in the fine print. But when you’re self-employed, understanding exactly how your disability coverage works isn’t just smart—it’s essential for protecting your livelihood.

Let's break down the moving parts of a policy into simple, practical terms. At its heart, a policy is just a contract with a few key levers. These levers determine when you get paid, how much you receive, and for how long.

The Elimination Period: Your Financial Waiting Room

The first concept to get your head around is the elimination period. Think of it as a time-based deductible. It’s the length of time you have to be disabled and out of work before your benefit payments actually start.

You choose this waiting period when you buy your policy, and it can range anywhere from 30 to 365 days. The most common choices tend to be 90 or 180 days.

- A shorter elimination period (like 30 days) gets money in your hands faster, but it also means you’ll pay higher premiums.

- A longer elimination period (like 180 days) makes your premiums more affordable, but you’ll need a solid emergency fund to float yourself while you wait.

Choosing the right period is a balancing act between cost and your personal savings. Ask yourself: how long could I realistically cover my expenses before needing that insurance check?

The Benefit Period: How Long Your Payments Last

Next up is the benefit period. This one is pretty straightforward: it’s the maximum amount of time your policy will pay you benefits after your claim is approved and your elimination period ends.

This is a huge decision. It directly impacts how long your financial safety net will last if something serious happens. Common benefit periods are:

- Two years

- Five years

- Ten years

- To age 65 or 67

For truly comprehensive protection, a policy that pays until you reach retirement age (65 or 67) is the gold standard. A minor disability might only sideline you for a year, but a catastrophic illness could stop you from ever returning to your career. A long-term benefit period is what protects you from that worst-case scenario.

The Definition of Disability: The Most Important Choice You’ll Make

For any self-employed professional, this is the single most important part of your policy. The definition of disability spells out the exact conditions the insurer requires to consider you "disabled" and start paying benefits. There are two main types, and the difference is massive.

Any-Occupation: This is the strictest definition. It only considers you disabled if you’re unable to perform any job you’re reasonably suited for based on your education, training, or experience. For example, a trial lawyer who can no longer stand in court might get denied benefits if they could still work as a legal researcher.

Own-Occupation: This is, without a doubt, the better choice for most self-employed specialists. It defines disability as being unable to perform the key duties of your specific occupation.

An "own-occupation" policy protects your specialized income. If a surgeon injures their hand and can no longer operate, they receive benefits—even if they could pivot to teaching medicine. It protects the unique skills you've spent a lifetime building.

This distinction is everything. As an independent professional, your income is directly tied to what you do. An "own-occupation" policy recognizes and protects that specific value. It's no surprise that as awareness grows, so does the market. In fact, sales premiums for individual disability insurance saw an average annual growth of 6% between 2018 and 2024 as more people sought out this kind of robust coverage. You can explore additional insights into the disability insurance market to see these trends for yourself.

Choosing the right policy components isn't about ticking boxes; it's about building a shield that fits your life perfectly. It ensures your income—and your future—is protected when you need it most.

Customizing Your Coverage with Policy Riders

Think of a standard disability policy like a well-built house. It’s got a strong foundation and keeps you safe from the storm. But what about the features that make it feel like your home? That’s what policy riders do for your coverage.

Riders are basically upgrades you can add to your policy. They let you fine-tune your protection to fit the unique life of a freelancer or business owner. For anyone paving their own career path, a few smart riders can turn a good policy into your most powerful financial shield.

These aren’t just fancy extras; they are strategic tools for protecting your income for the long haul. Let’s look at the ones that matter most when you work for yourself.

The Inflation Shield: Cost of Living Adjustment (COLA)

Imagine you get disabled and start receiving benefits today. The monthly payment might cover all your bills perfectly right now. But what about five or ten years down the road? As costs rise, that fixed payment won't stretch as far, leaving you financially squeezed.

This is exactly why the Cost of Living Adjustment (COLA) rider is so crucial. Once you're on a claim, this rider automatically increases your monthly benefit each year, usually based on an official measure like the Consumer Price Index (CPI).

It acts like an annual raise for your benefits, making sure your income keeps up with inflation. If you’re facing a long-term disability, a COLA rider is a non-negotiable for maintaining your lifestyle.

The Growth Partner: Future Increase Option (FIO)

When you're self-employed, your goal is to grow your income, not keep it stagnant. The problem is, your initial disability policy is based on what you earn today. What happens when your business takes off and you're making double what you used to? Your original coverage will be way too low.

The Future Increase Option (FIO) rider is the perfect solution. Honestly, it's a game-changer for entrepreneurs.

This rider gives you the contractual right to buy more coverage later on without a new medical exam or health questions. All you have to do is show proof that your income has gone up.

A freelance web developer, for example, might start out earning $60,000 a year and get a policy based on that. Three years later, her client list has exploded, and she's now earning $120,000. Her FIO rider lets her easily boost her coverage to match her new success—even if she’s developed a new health issue since she first got the policy. It ensures her safety net grows right alongside her business.

Vital Coverage for Partial Disabilities

For a self-employed person, a disability isn’t always black and white. You might not be completely unable to work. What if an injury just slows you down, letting you work only half as much as you used to? This is where partial or residual disability riders are an absolute lifesaver. Most high-quality policies designed for disability insurance for self employed professionals will include them.

These riders pay you benefits in two common situations:

- Partial Disability: You can’t do one or more of your key job duties, which causes you to lose income. (Think of a photographer with a shoulder injury who can still edit photos but can no longer do physically demanding shoots).

- Residual Disability: You can still do all your duties, but your condition prevents you from working the same number of hours, leading to a drop in income.

These benefits usually kick in when your income falls by a set amount, like 15% or 20%, from what you were earning before. They provide a financial cushion when you’re not totally disabled but are still taking a hit—a very real scenario for freelancers trying to push through a health challenge.

While disability insurance protects your income, don't forget that your health insurance is the other half of the equation. You can learn more by checking out our guide on navigating self-employment health insurance.

What Determines Your Insurance Premium Cost

Figuring out what you'll pay for disability insurance for self employed professionals can sometimes feel like a guessing game. But it’s not. Your premium isn't just a random number; it’s a personalized investment in your financial safety, and you have more control over the final cost than you might think.

Insurance companies are really just assessing risk—the odds that you’ll need to use the policy. It all boils down to a handful of key factors that, when combined, determine your monthly rate. Let's break them down so you know exactly what you're paying for.

Your Personal Profile

First things first, insurers look at you. Your age, gender, and health history create the foundation for your premium.

- Age and Health: The younger and healthier you are, the lower your rates will be. It's simple statistics: you're less likely to become disabled than someone older or with existing health issues. This is why locking in a policy when you're in great health is one of the smartest things you can do for your future.

- Tobacco Use: This one’s a biggie. Smokers and other tobacco users will always pay more for coverage. The health risks are just too well-documented to ignore.

While you can’t change your age, the next factor—your job—plays a huge role, especially when you work for yourself.

Your Occupation and Income

What you do all day is a massive piece of the puzzle. Insurers group jobs into different occupation classes based on how risky they are. A self-employed graphic designer working from a quiet home office is in a very different risk category than a self-employed carpenter on an active job site.

Think of it this way: a consultant working from an office is seen as a lower risk and will pay less than a plumber for the same amount of coverage. The insurance company sees a much higher chance of an injury-related claim for the plumber.

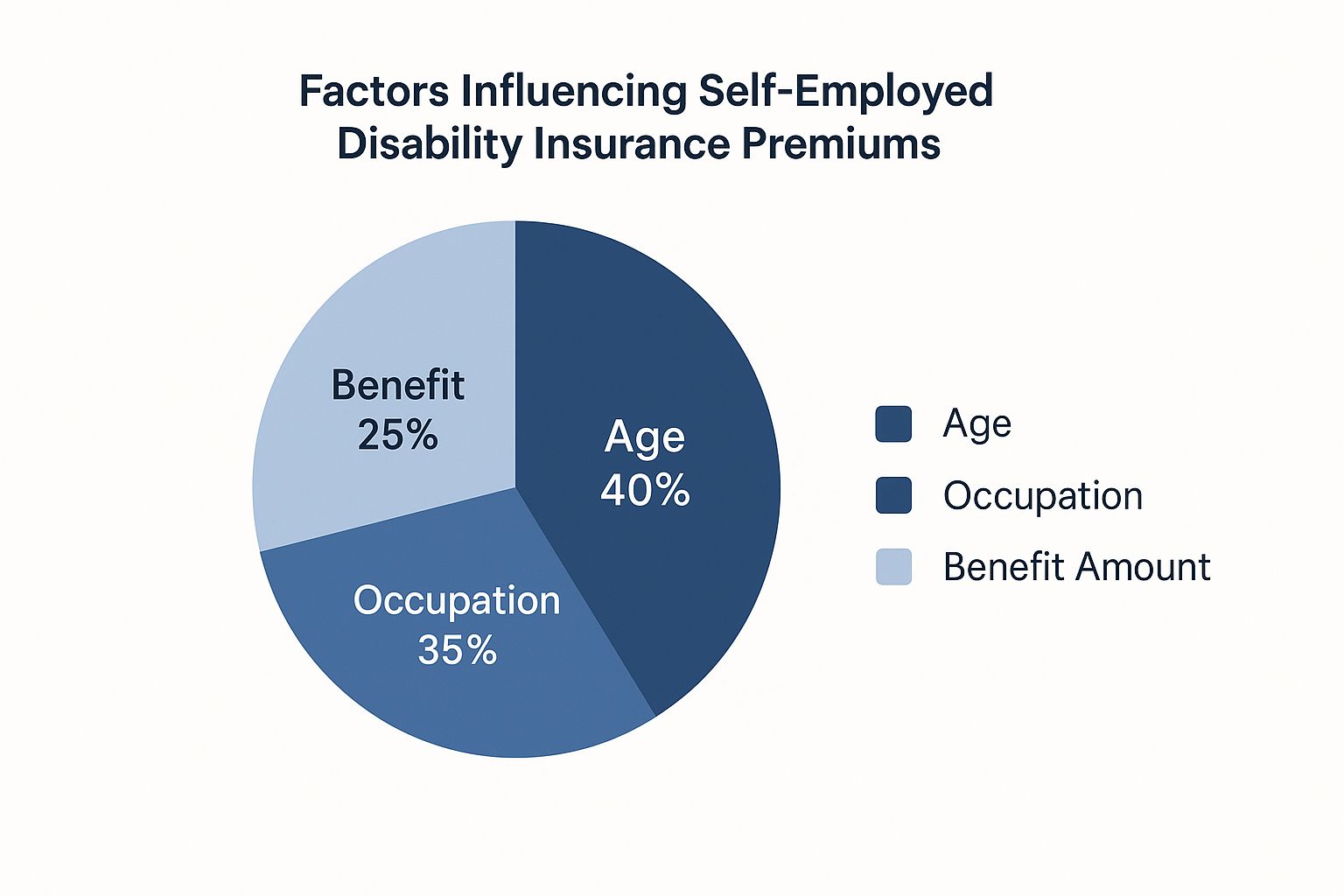

This image really drives home how your personal and professional life, along with the benefit you choose, all come together to shape your premium.

As you can see, your age and what you do for a living carry the most weight. It really highlights how personal and professional risks are at the heart of the cost.

More and more self-employed professionals are catching on. In 2023, disability insurance ownership among the self-employed climbed to 29%. And among high-income earners (over $100,000 a year), a full 68% have a policy. It shows that the more you have to protect, the more critical this safety net becomes.

Your Policy Choices

This is where you get to sit in the driver's seat. The specific features you select for your policy directly impact your monthly premium, giving you the power to dial the cost up or down to fit your budget.

Below is a quick look at the main factors you can adjust and how they influence what you pay.

Factors Influencing Your Disability Insurance Premium

| Factor | Impact on Premium | Example |

|---|---|---|

| Benefit Amount | Higher benefit = Higher premium | A $5,000/month benefit costs more than a $3,000/month benefit. |

| Benefit Period | Longer period = Higher premium | A policy paying until age 67 is pricier than one that pays for just 5 years. |

| Elimination Period | Shorter wait = Higher premium | A 30-day waiting period costs more than a 90-day or 180-day wait. |

| Definition of Disability | Broader definition = Higher premium | A strong "own-occupation" policy is more expensive but offers better protection. |

| Optional Riders | Adding riders = Higher premium | A Cost-of-Living Adjustment (COLA) rider adds cost but also significant long-term value. |

By tweaking these "levers," you can build a policy that gives you robust protection without breaking the bank.

If you’re looking for other ways to keep your insurance costs in check, our guide on how to stop overpaying for insurance has some great practical tips. It's all about finding that sweet spot where your coverage is both effective and affordable.

A Guide to the Application and Underwriting Process

Applying for disability insurance can feel like a huge task, especially when your income isn't a simple, predictable paycheck. But here's the good news: the process is much more straightforward than you probably think. It’s really just about giving the insurer a clear picture of your finances and your health.

This whole process, from the moment you apply to the day your policy is approved, is called underwriting. Think of it as the insurance company doing its homework. They’re simply trying to understand the level of risk they’re taking on by protecting your ability to earn an income.

For a self-employed professional, this usually breaks down into two key parts: financial underwriting and medical underwriting. Let’s walk through what to expect with each one so you can go into it feeling confident and prepared.

Proving Your Income as a Business Owner

This is often the biggest source of stress for freelancers and entrepreneurs, but it doesn't need to be. Insurers are very familiar with non-traditional incomes. Your only job is to clearly and consistently document how much you make.

You'll generally need to provide proof of your income from the last two to three years. This helps the underwriter see a stable earning history, not just a one-off great month.

Here are the most common documents you'll need to pull together:

- Tax Returns: Your federal tax returns are the gold standard. The Schedule C (Profit or Loss from Business) is especially important for showing your net earnings.

- Bank Statements: Your business and personal bank statements can back up your claims with evidence of consistent cash flow.

- Financial Statements: A profit and loss (P&L) statement, whether you prepare it yourself or have an accountant do it, adds another layer of clarity.

The real key here is consistency. Underwriters want to see a stable or growing income. If your earnings jump around a lot, just be ready to explain why. A clean, organized financial story makes their job easier and your application much stronger.

Navigating the Medical Underwriting

The second piece of the puzzle is medical underwriting, where the insurer gets a snapshot of your health. This part is pretty much the same for everyone, whether you’re self-employed or work for a large company. It's a professional and completely confidential process.

The medical underwriting isn't a pass/fail exam. It's about creating a picture of your health right now so the insurer can accurately price your policy based on your current health profile.

The process follows a few predictable steps:

- The Application: You’ll fill out a detailed questionnaire covering your health history, lifestyle habits, and your family’s medical history. Honesty and thoroughness are your best friends here.

- The Phone Interview: An underwriter or someone from a third-party service will call you to go over your answers and ask a few follow-up questions. This usually only takes about 20-30 minutes.

- The Medical Exam: For most policies, a medical professional will conduct a simple health exam at a time and place that works for you—like your home or office. It typically involves measuring your height and weight, taking your blood pressure, and collecting quick blood and urine samples.

While this might sound like a lot, it’s designed to be as smooth as possible. Remember, a detailed underwriting process ensures you get a fairly priced policy that will actually be there for you when you need it most. And while disability insurance protects your income, having a solid health plan is just as critical. You can explore our guide on finding the right health insurance for the self employed to make sure all your bases are covered.

By getting your documents in order and knowing what’s coming, you can turn this seemingly complex process into a few manageable steps—and get that much closer to securing the income protection you deserve.

Common Questions from Self Employed Professionals

Even after you get the hang of disability insurance, a few nagging questions always pop up—especially when you’re a freelancer, contractor, or business owner. Your world is different, and you need straight answers to feel confident about protecting your income.

This is where we tackle those questions head-on. Let's clear up any confusion and fill in the gaps so you can move forward with total clarity.

How Much Disability Coverage Do I Really Need as a Freelancer?

This is one of the most important questions, and the answer is rooted in your real-world finances. The goal isn’t to replace every last penny of your income. It's about securing enough to keep your financial life stable while you recover.

A solid rule of thumb is to get coverage for 60-70% of your gross monthly income.

That number might seem a little low at first, but there's a brilliant reason for it. When you pay for your policy with after-tax money, any benefits you receive are completely tax-free.

That tax-free status means a 60% benefit often feels a lot like your normal take-home pay. It’s designed to handle the essentials—your mortgage, utilities, groceries, and other non-negotiable bills—without forcing you to drain your savings. The idea is to keep your world turning, not to fund luxury spending.

Can I Deduct My Disability Insurance Premiums on My Taxes?

When you’re self-employed and buy your own individual disability policy, the answer is usually no. You pay the premiums with your personal, after-tax money, so you can't write them off as a business expense.

But hold on—this comes with a huge silver lining that makes it more than worth it.

Because you paid those premiums with money that’s already been taxed, any benefits paid out to you are 100% tax-free. This is a massive advantage. It gives you a clean, predictable income stream at a time when financial simplicity is exactly what you need. As always, it’s a good idea to chat with a tax pro to confirm how this applies to your specific business setup.

The trade-off is simple but powerful: You give up a small annual tax deduction on your premiums in exchange for potentially years of completely tax-free income if you ever need to make a claim.

What Happens If My Income Changes After I Buy a Policy?

As a self-employed pro, income swings are just part of the game. The money you make this year might be totally different from what you earn in three years. A good policy is built for that reality.

This is where a Future Increase Option (FIO) rider is a lifesaver. We mentioned it earlier, but it’s worth repeating: this is your key to making sure your coverage grows with your success.

The FIO rider gives you the contractual right to buy more coverage on specific dates—usually every few years or after a big life event. The best part? You don’t have to go through another medical exam or answer a bunch of health questions. You just have to show proof that your income went up.

But what if your income goes down? If your earnings take a permanent or long-term dip, you can simply work with your insurance advisor to lower your benefit amount. This will bring your monthly premium down to a more comfortable level.

What Are the Best Insurance Companies for Self Employed People?

While there's no single "best" company for everyone, a handful of carriers consistently stand out for their excellent individual disability policies—the kind that are perfect for self-employed professionals. The secret is to look past the brand name and focus on two things: financial muscle and how they define "disability."

First, you need a company with rock-solid financial strength ratings (like A++ or A+ from an agency like AM Best). This is your assurance that they'll be around to pay your claim, even if it's decades from now.

Just as important is finding a policy with a true "own-occupation" definition of disability. This is what protects you in your specific job, not just any job.

Based on those criteria, some of the companies that are consistently top contenders include:

- Guardian

- Principal

- Ameritas

- MassMutual

- The Standard

An independent broker can be your best ally here. They can help you compare quotes and policy details from these carriers and others, finding the one that offers the strongest protection for your unique career and financial picture.

Ready to secure your most valuable asset—your ability to earn an income? At My Policy Quote, we make it easy for self-employed professionals to compare quotes from top-rated insurance carriers and find the perfect policy for their needs. Protect your financial future today. Get Your Free Disability Insurance Quote at My Policy Quote.