Let’s cut right to the chase: Original Medicare (Part A and B) almost never covers adult diapers or other disposable incontinence products. For many people, this is a frustrating and often surprising piece of news, especially when these supplies feel absolutely essential for daily life.

Your Quick Guide to Medicare and Adult Diaper Coverage

So, why does Medicare deny coverage for something so critical? It all comes down to how Medicare classifies medical supplies. The decision isn't based on whether you need the item, but on whether it fits into a very specific category.

The official reason is that adult diapers are not considered durable medical equipment (DME). Think of DME as items that are reusable, like a wheelchair, a walker, or a hospital bed. Because diapers are disposable, Medicare lumps them into the same category as other personal care items like bandages or cotton swabs, which aren't covered.

What This Means for You

This can get a little confusing, so here’s an analogy that might help. Imagine you have a leaky pipe. Medicare is like an insurance policy that will pay for the plumber to come out, find the source of the leak, and fix the pipe (like your doctor visits and tests to diagnose incontinence). However, it won't pay for the stack of paper towels you use to mop up the water on the floor (the adult diapers).

While Part A (hospital insurance) and Part B (medical insurance) won't cover the diapers themselves, Part B will typically cover the doctor’s appointments and diagnostic tests needed to figure out why you're experiencing incontinence. You can learn more about these specific classifications by reading the official guidance on how Medicare handles incontinence supplies.

But this isn't the end of the story. There's a very important exception that offers a path forward for many people.

The most common way to get help paying for adult diapers is through a Medicare Advantage (Part C) plan. These plans are offered by private insurance companies and are known for including extra benefits that Original Medicare doesn't.

Many Medicare Advantage plans come with an over-the-counter (OTC) allowance. This is often a pre-loaded debit card or a quarterly credit that you can use to buy health-related products, which frequently includes adult diapers, pads, and other incontinence supplies. For most beneficiaries, this OTC benefit is the key to getting financial assistance for these crucial items.

Medicare Coverage for Adult Diapers at a Glance

To make it easier to see how this works, here's a quick summary of how the different parts of Medicare handle incontinence care.

| Medicare Part | Coverage for Adult Diapers | Coverage for Incontinence-Related Services |

|---|---|---|

| Part A | No. Does not cover personal care items like diapers, even during a covered hospital stay. | Yes. Covers inpatient care and diagnostic services in a hospital setting. |

| Part B | No. Classifies diapers as personal care items, not durable medical equipment (DME). | Yes. Covers doctor visits, lab tests, and other outpatient services to diagnose the cause of incontinence. |

| Part C (Advantage) | Often, yes. Many plans offer an over-the-counter (OTC) allowance that can be used for diapers. | Yes. Must cover everything Part A and B cover, and often includes additional benefits. |

| Part D | No. Only covers prescription drugs. Adult diapers are not considered prescription items. | Yes. May cover certain prescription drugs used to treat underlying causes of incontinence. |

As you can see, while Original Medicare falls short, Medicare Advantage plans are specifically designed to fill these gaps. This guide will walk you through these nuances, ensuring you know exactly where to look for help.

Why Original Medicare Doesn't Cover Incontinence Supplies

To get a real handle on your coverage options, it helps to understand the "why" behind Medicare's rules. The whole debate over whether Medicare covers adult diapers comes down to a very specific, and often frustrating, definition of something called Durable Medical Equipment (DME).

Here’s a simple way to think about it. Imagine you have a leaky pipe. Medicare might pay for the plumber to come out and figure out why it's leaking—that's like your doctor's visit to diagnose incontinence. But it won't pay for the stack of paper towels you use to mop up the mess on the floor. In this case, the paper towels are the disposable diapers.

Original Medicare, which includes Part A and Part B, classifies adult diapers, pads, and liners as disposable personal care items. They aren't considered reusable medical equipment. For something to qualify as DME, it has to be durable and able to stand up to repeated use. Since diapers are designed to be used once and thrown away, they just don't fit the bill.

The Focus Is on Diagnosis, Not Supplies

So, while Original Medicare won't pay for the supplies themselves, it absolutely plays a key part in getting to the root of the problem. Medicare Part B will cover the important stuff, like:

- Visits to your doctor to get a proper evaluation.

- Diagnostic tests to pinpoint the medical reason for the incontinence.

- Certain treatments or therapies that might actually fix the underlying issue.

This is a critical distinction to grasp. Medicare is set up to invest in finding and fixing the "leak," but it leaves the daily "cleanup" costs to you. This policy has a massive impact, especially when you consider that urinary incontinence affects roughly 50% of women at some point in their lives, and it's even more common in women over 50. While Medicare will help pay to find out why it's happening—whether it’s from weakened pelvic muscles or hormonal shifts—it draws a hard line at covering the absorbent products needed to manage it every day. You can learn more about this common issue by exploring insights on adult diapers and incontinence trends.

Key Takeaway: Original Medicare’s policy is strict and simple: it helps pay to diagnose and treat the medical condition causing incontinence, but it will not pay for the disposable supplies you use to manage it. That’s because adult diapers are considered personal hygiene items, not reusable Durable Medical Equipment (DME).

Navigating Your Insurance Before Medicare

Getting a firm grasp on these rules is particularly important for anyone planning their healthcare future. The coverage you have now can be worlds apart from what you'll have once you transition to Medicare. For people getting close to that milestone, it pays to know what’s coming. If you're currently figuring out your next steps, our guide on finding health insurance before Medicare can offer some really helpful context.

It's precisely because of this firm stance from Original Medicare that other options, like Medicare Advantage plans, have become so essential for many people. These private plans often step up to fill the exact coverage gaps that the federal program leaves behind.

How Medicare Advantage Plans Offer a Solution

While Original Medicare draws a firm line on incontinence supplies, the story is completely different with Medicare Advantage, also known as Part C. For most people wondering if Medicare covers adult diapers, this is where they find a real, practical answer. In fact, these plans are the most common way to get help with the costs.

Medicare Advantage plans are offered by private insurance companies that are approved by Medicare. They're legally required to cover everything that Original Medicare (Parts A and B) does. But to attract members, they almost always go a step further by including extra benefits you won't find in the standard government program.

The Over-the-Counter (OTC) Benefit

One of the most valuable extras many Part C plans include is an over-the-counter (OTC) allowance. It’s easiest to think of this as a stipend—a set amount of money the plan gives you each month or quarter to spend on health and wellness items. This benefit is specifically designed to help you pay for common products you’d normally buy yourself.

Often, this allowance comes pre-loaded onto a special debit card, which makes it incredibly easy to use. You can simply use the card at participating stores, which usually include major pharmacies, supermarkets, and even online retailers. And here's the best part: incontinence supplies like adult diapers, protective underwear, and bladder control pads are almost always on the list of approved items.

A Medicare Advantage plan’s OTC benefit is your direct path to getting help with the cost of adult diapers. Instead of direct coverage for the item, the plan gives you a flexible spending allowance that you can use to purchase them.

This setup gives you the freedom to pick the specific brands and product types that you prefer and that work best for your needs. You aren't stuck with a single supplier or a limited catalog. It’s a smart and practical way to fill a major gap left by Original Medicare.

How to Confirm Your Plan's Benefits

Finding out whether a particular Medicare Advantage plan includes this fantastic benefit is simple. The single most important document you need to check is the plan's Summary of Benefits. This document is your roadmap, clearly detailing all the extra perks the plan offers on top of standard Medicare coverage.

When you're looking at the Summary of Benefits, keep an eye out for a section titled something like:

- Over-the-Counter (OTC) Items

- Health and Wellness Products

- Quarterly Allowance for OTC Items

This section will spell out the exact dollar amount you get (for instance, $50 per quarter) and give examples of what you can buy with it. By checking this document before you enroll, you can be confident that the plan you choose will actually help you manage the recurring expense of incontinence supplies. It puts the power in your hands, allowing you to compare plans and find one that truly supports your daily life.

What If Medicare Isn't the Answer? Exploring Other Ways to Get Help

So, a Medicare Advantage plan might not be the right fit for you. Don't worry, that's far from the end of the road. While asking "does Medicare cover adult diapers?" often hits a wall with the original program, there are several other fantastic support systems designed to help with the cost of incontinence supplies.

The biggest one by far is Medicaid. It's crucial to understand how it differs from Medicare. While Medicare is a federal program with the same rules everywhere, Medicaid is a state-run program. This means coverage can change depending on where you live, but here's the good news: most state Medicaid programs do cover adult diapers and other supplies when a doctor says they're medically necessary.

To get this coverage, you'll need a prescription and a formal diagnosis from your doctor. This is the official proof that these supplies are essential for managing your health.

How Medicaid Fills the Gaps

Medicaid is a lifeline for over 74 million Americans. It's the country's single largest source of health coverage, helping low-income adults, people with disabilities, and seniors get care for things Medicare often won't touch.

When it comes to incontinence, most state Medicaid plans will cover a whole range of products. Think of things like:

- Adult diapers, the kind with tabs, often called briefs

- Protective underwear, which are the pull-on style

- Bladder control pads and liners

- Underpads (you might know them as "chux") to protect beds and chairs

The trick is making sure you meet your state's specific rules for eligibility, which usually come down to your income and your medical needs. The journey typically starts by applying through your state's Medicaid office and getting an assessment from your doctor. If you're working but have a limited income, it's a good idea to look into all your options. Our guide on health insurance for low-income workers can point you in the right direction.

Key Takeaway: If you're "dual-eligible" (meaning you have both Medicare and Medicaid), your path is much simpler. In nearly every case, Medicaid will pick up the tab for the incontinence supplies that Medicare denies.

Tapping into Veteran and Community Support

Beyond the big government programs, don't overlook the incredible resources available right in your own community. It really pays to check every possible avenue for help.

Department of Veterans Affairs (VA)

For our nation's veterans, the VA healthcare system is a phenomenal resource. If you're enrolled for VA health care, your doctor can prescribe adult diapers and other necessary products, often at little to no cost to you.

Local Community Programs

Your local community is often home to organizations whose entire mission is to help residents get essential supplies. Here are a couple of places to start your search:

- Diaper Banks: You might think they're just for babies, but many have expanded their services to help adults, too. The National Diaper Bank Network is a great starting point for finding a local bank that provides free adult incontinence products.

- Area Agencies on Aging (AAA): These nonprofit agencies are a treasure trove of information for seniors. They can connect you with local programs, support groups, and services that might offer financial aid or free supplies.

These alternatives act as a critical safety net. They ensure that even if Medicare itself doesn't provide a direct solution, you still have real, practical ways to get the supplies you need.

Your Step-by-Step Action Plan to Find Coverage

When you’re facing the ongoing expense of incontinence supplies, figuring out how to get financial help can feel overwhelming. Let’s cut through the confusion. I'm going to walk you through a clear, practical process to explore every possible option so you can get the supplies you need with confidence.

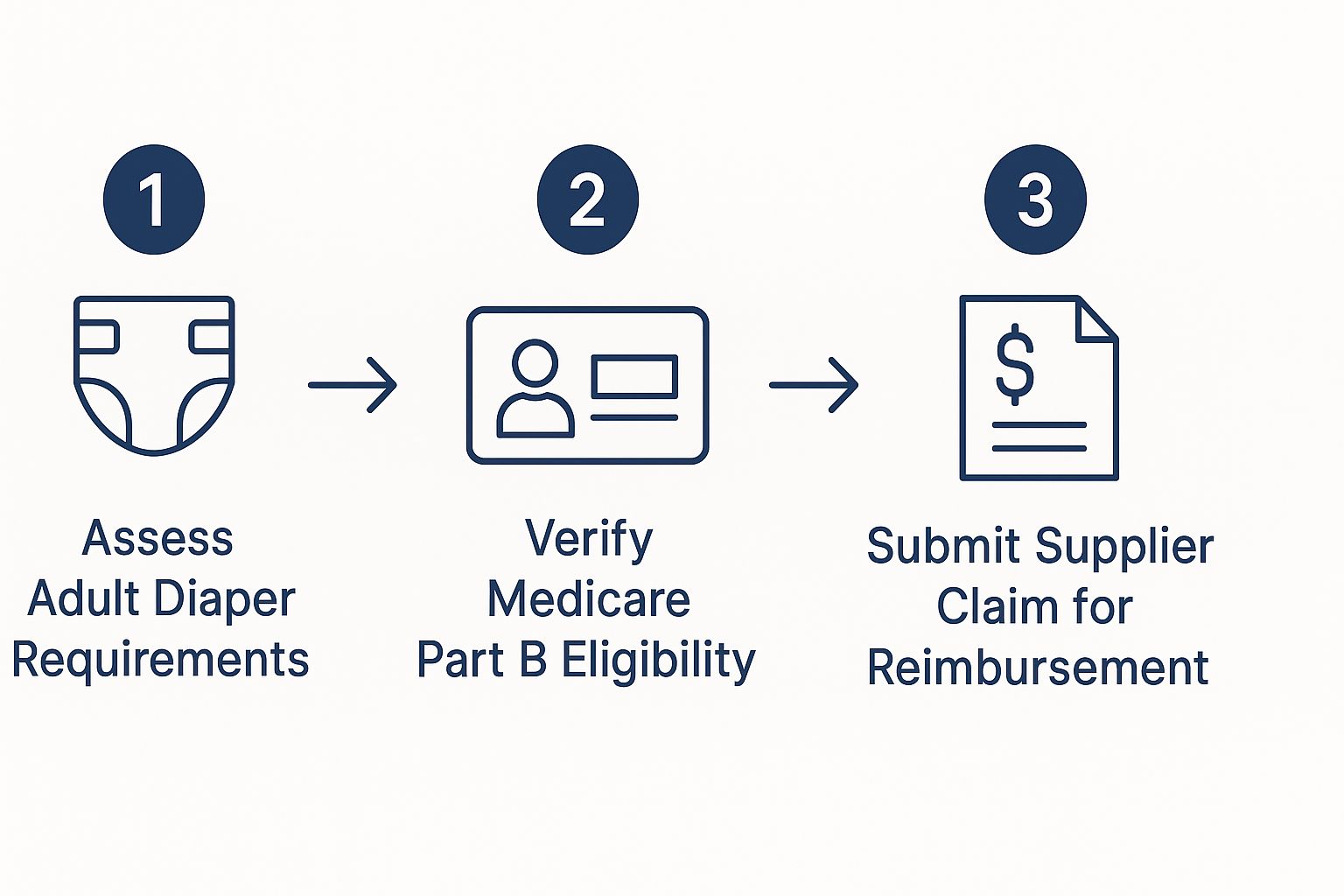

This visual guide gives you a bird's-eye view of the path to securing incontinence supplies.

As you can see, it all starts with a medical assessment. From there, you verify your eligibility and then submit a claim—it simplifies what can often feel like a complicated journey.

Step 1: Confirm Your Current Plan Type

First things first, you have to know exactly what kind of Medicare coverage you have. Are you enrolled in Original Medicare, which includes Part A and Part B? Or did you opt for a Medicare Advantage (Part C) plan offered by a private insurance company? This one detail is the fork in the road and determines your next move.

If you have Original Medicare, your search will focus on outside assistance programs, because it simply doesn't cover these items. If you have a Medicare Advantage plan, it’s time to dig into the specifics of your policy.

Step 2: Investigate Your Plan's Benefits

For anyone with a Medicare Advantage plan, your most valuable tool is the Summary of Benefits document. Scan it for a section titled "Over-the-Counter (OTC) Allowance." This is where you'll find out if your plan gives you a monthly or quarterly stipend to spend on health products, which very often includes adult diapers.

If the document isn't crystal clear, don't waste time guessing. Pick up the phone and call the member services number on the back of your insurance card. Ask them point-blank: "Does my plan include an OTC benefit, and can I use it for incontinence supplies?"

Step 3: Use the Medicare Plan Finder

What if your current plan comes up short, or you’re on Original Medicare and ready to explore other options? The official Medicare Plan Finder tool is your best friend. This free government website lets you compare every single Medicare Advantage plan available in your zip code.

You can actually filter the search results to show only plans that offer specific extras, like an OTC allowance. It’s the single most effective way to shop for a Part C plan that directly meets your needs for diaper coverage.

Pro Tip: The Annual Enrollment Period (which runs from October 15 to December 7) is your golden opportunity. During this window, you can switch from Original Medicare to a Medicare Advantage plan or change from one Part C plan to another. It's the perfect time to find a policy with a strong OTC benefit.

Step 4: Research Your State's Medicaid Rules

If a Medicare Advantage plan isn't a good fit, your next major avenue is Medicaid. Because Medicaid is administered at the state level, the rules for who qualifies and what’s covered can vary quite a bit.

Head to your state’s official Medicaid website. There, you'll find the income limits for eligibility and instructions on how to apply. The good news is that most states do cover adult diapers as long as a doctor confirms they are medically necessary. This means you'll need a prescription and a formal diagnosis to get approved, but it's a vital safety net for millions.

Step 5: Locate Community and Veteran Resources

Finally, don't underestimate the power of local support. Many communities have programs specifically designed to fill these kinds of gaps in coverage.

- Diaper Banks: Use the National Diaper Bank Network's website to find a diaper bank near you. Many of them have expanded to provide adult incontinence products for free.

- Area Agencies on Aging (AAA): Get in touch with your local AAA. These organizations are experts at connecting older adults with regional programs and financial aid.

- Veterans Affairs (VA): If you are a veteran enrolled in VA healthcare, talk to your doctor. The VA frequently provides incontinence supplies at little to no cost as part of its comprehensive benefits package.

To help you stay organized, here's a simple checklist you can follow as you work through these options.

Action Plan for Securing Incontinence Supplies

| Step | Action Item | Key Considerations |

|---|---|---|

| 1 | Identify Your Plan | Is it Original Medicare or Medicare Advantage (Part C)? This is your starting point. |

| 2 | Check Part C Benefits | Review your "Summary of Benefits" for an OTC allowance. Call member services to confirm. |

| 3 | Compare Plans | Use the Medicare Plan Finder tool to shop for Part C plans with an OTC benefit, especially during Annual Enrollment. |

| 4 | Explore Medicaid | Visit your state's Medicaid site to check income eligibility. A doctor's prescription is required. |

| 5 | Find Local Help | Contact local Diaper Banks, Area Agencies on Aging, and the VA if you're a veteran. |

Working through these steps methodically is the best way to find a solution that works for your budget and your health needs.

Effectively managing these costs is a huge part of your financial well-being after you stop working. For a more comprehensive look at this subject, be sure to read our guide on securing the right retirement health insurance.

Answering Your Top Questions About Adult Diaper Coverage

When you're trying to figure out insurance, the details can get tricky. Even when you know the basic rules, you're often left wondering, "Okay, but what does that mean for me?" Let's walk through some of the most common questions people ask about getting help paying for adult diapers.

Does a Doctor's Prescription Change Anything?

This is one of the first questions most people ask, and it makes perfect sense. If your doctor officially prescribes adult diapers, surely Original Medicare has to cover them, right?

Unfortunately, the answer is still no. Even with a doctor's signed prescription, Original Medicare (Part A and Part B) won't budge on this. They still classify adult diapers as disposable personal hygiene products, not as Durable Medical Equipment (DME). It doesn't matter how medically necessary they are for you; their classification is what prevents coverage.

But don't toss that prescription! It’s still incredibly important. If you're looking for help through a state Medicaid program, that prescription is usually a non-negotiable requirement. It’s the official proof of medical need that those programs require.

Are There Specific Brands I Have to Use?

If you're lucky enough to have a Medicare Advantage plan with an over-the-counter (OTC) benefit, you might worry about being stuck with a brand you don't like.

Good news: most of these plans don't force you to use specific brands. Instead, they give you a spending allowance, usually loaded onto a special debit card each quarter. You can then walk into a participating pharmacy or supermarket and buy the brand of diapers or pads that works best for you. As long as the store's system flags the product as an eligible OTC health item, you’re good to go.

Key Insight: This flexibility is a huge plus. The OTC benefit card puts the power back in your hands, letting you choose products based on fit, comfort, and absorbency—not what some company dictates from a limited catalog.

What if I am in a Skilled Nursing Facility?

Here’s a major exception where the rules are completely different. If you’re staying in a skilled nursing facility (SNF) and Medicare is covering that stay (like after you've been in the hospital), the facility has to provide all the medical supplies you need. And yes, that absolutely includes adult diapers.

The same logic can apply if a Medicare-certified home health agency is managing your care. They might provide diapers as part of your overall care plan. It’s not a guarantee, though, and those supplies aren't billed separately to Medicare Part B. It's important to remember this applies to skilled care; for long-term custodial care, you're usually back to paying for these items yourself. For those exploring different avenues for healthcare, our guide to low-cost health insurance options can offer some useful perspective.

Can I Use an FSA or HSA to Pay for Diapers?

Yes, you absolutely can! This is a fantastic strategy for saving some money. Adult diapers, pads, and other incontinence supplies are considered qualified medical expenses.

This means you can use the pre-tax money in your Flexible Spending Account (FSA) or Health Savings Account (HSA) to buy them. By doing this, you're essentially getting a discount equal to your income tax rate, which can add up to very real savings throughout the year.

Trying to make sense of insurance policies can feel overwhelming, but you're not on your own. The team at My Policy Quote can help you sort through the clutter, compare plans, and find coverage that truly fits your life. Get your free, no-obligation quote today!