Usually, you can only sign up for health insurance during a specific window each year called Open Enrollment. But what happens when life takes an unexpected turn? Life event health insurance is the answer. It’s a critical exception that lets you get or change your coverage outside that normal timeframe if you go through a major change, like losing a job or getting married.

This ensures you aren't left unprotected when you need it most.

What Exactly Is Life Event Health Insurance?

Think of the standard health insurance system like a train that only leaves the station once a year during Open Enrollment season. If you miss it, you’re stuck waiting on the platform for another full year. This system helps keep the insurance market stable by preventing people from only buying a policy when they get sick.

But life doesn’t always stick to a schedule. It can throw you a curveball in the middle of April or September. This is where life event health insurance comes in—it’s your special ticket to get on board the health insurance train right when you need it, no matter the season.

The Role of Qualifying Life Events

A Qualifying Life Event (QLE) is a significant change in your life that unlocks a Special Enrollment Period (SEP). This SEP is your personal, limited-time window—usually 60 days—to sign up for a new health plan or change your current one outside of the yearly Open Enrollment.

It’s designed to be a safety net. The system recognizes that life is messy and unpredictable. Without it, someone who lost their job-based coverage in March would have to go without insurance until the next January, leaving them completely exposed to massive financial risk.

The whole point of a Special Enrollment Period is to prevent dangerous gaps in your health coverage. It makes sure you and your family can stay protected even when life changes in a big way.

Why This Exception Is So Important

This isn't just a minor convenience; it's a core part of how modern health insurance is designed to work. It offers flexibility and a lifeline for millions of Americans navigating common, yet totally life-altering, transitions.

Here’s why it matters so much:

- Continuity of Care: It allows you to get new coverage right away, so you don’t have to delay a doctor’s visit or skip filling a crucial prescription.

- Financial Protection: It shields you from the potentially devastating costs of a sudden accident or illness during a time you’d otherwise be uninsured.

- Adapting to New Needs: A QLE lets you pick a plan that actually fits your new situation—whether that means adding a new baby to your policy or finding your own coverage after a divorce.

The Events That Unlock Special Enrollment Periods

So, what exactly opens the door to buying health insurance outside of the usual sign-up window? The government has a specific list of what it calls Qualifying Life Events (QLEs). These aren’t just any random changes; they’re significant, often unavoidable moments that shake up your household, your current coverage, or even where you live.

Think of it like this: when your life’s circumstances fundamentally shift, your health insurance needs should be allowed to shift, too. It’s a commonsense rule that prevents a family from getting stuck with an outdated plan—or worse, no plan at all—after a major life change.

It's critical to know that most of these events kick off a strict 60-day window to make a move. This special exception is a lifeline, but the deadline is firm. Miss it, and you'll almost certainly have to wait for the next annual Open Enrollment. To get a better handle on the normal timeline, check out our guide on what Open Enrollment is and why it matters.

To make it easier, here’s a quick-reference table of the most common events that can grant you a Special Enrollment Period.

Common Qualifying Life Events at a Glance

| Event Category | Specific Examples | Typical Enrollment Window |

|---|---|---|

| Household Changes | Getting married, having a baby, adopting a child, getting divorced, death of a policyholder | 60 days from the date of the event |

| Loss of Coverage | Losing a job-based plan, turning 26 and aging off a parent's plan, COBRA expiring | 60 days from the date of coverage loss |

| Residential Moves | Moving to a new ZIP code or county where your current plan isn't offered | 60 days from the date of your move |

| Other | Becoming a U.S. citizen, leaving incarceration, changes in income affecting eligibility | Varies, but often 60 days |

This table is a great starting point, but let's dive into the details for each category.

Changes to Your Household

This is probably the most common reason people qualify for a Special Enrollment Period. These events change the very makeup of your family, creating an obvious and immediate need to rethink your health coverage.

Some of the most frequent triggers include:

- Getting married. Tying the knot is a huge one. It allows you and your new spouse to get on a plan together or for one of you to join the other's existing plan.

- Having a baby or adopting. Welcoming a child into your family is a classic QLE. Your new coverage can often be backdated to the day the child was born or adopted, which is a huge relief.

- Getting divorced or legally separated. If the separation means you lose the health insurance you had through your ex-spouse, you qualify for an SEP to find your own plan.

- A death in the family. If the person whose policy you were on passes away, you won't be left without options. This event allows you to enroll in new coverage.

Each of these moments directly changes who needs to be on your policy, making an immediate update not just a good idea, but a necessity.

Loss of Health Coverage

Losing your health insurance for reasons you couldn't control is another critical QLE. This is a crucial protection that ensures you aren't left vulnerable just because of a job change or another shift in your eligibility.

Think of this as a safety net. It’s specifically for the involuntary loss of coverage—not for situations where you choose to drop your plan or forget to pay your premiums.

Here are the scenarios where this applies:

- Losing employer-sponsored insurance. This could happen if you quit, were laid off, or your boss reduced your hours, making you ineligible for the company plan.

- Turning 26. When young adults on a parent’s plan celebrate their 26th birthday, they "age out" of that coverage. This gives them a window to find their own policy.

- Losing eligibility for Medicaid or CHIP. If your income changes and you no longer qualify for these government programs, you get an SEP to buy a plan on the Marketplace.

- Your COBRA coverage expires. Once your COBRA continuation coverage runs out, you get another shot to enroll in a new plan without waiting.

Changes to Your Residence

Believe it or not, sometimes just moving can be enough to qualify you for a Special Enrollment Period. This is because most health insurance plans are tied to specific geographic areas—think counties or even ZIP codes.

If you move somewhere your current plan doesn't operate, you get an SEP. This also applies to students moving to or from campus or seasonal workers who relocate for a job. This rule is practical; it makes sure you can always find a plan with a network of local doctors and hospitals you can actually get to.

How to Navigate Your Special Enrollment Period

Think of a qualifying life event as the starting pistol for a race. Once it goes off, a 60-day countdown begins, and you're officially in what's called a Special Enrollment Period (SEP). This is your limited-time pass to get health coverage outside the normal sign-up window, so acting quickly is key.

This period is your chance to find a new plan or adjust your current one to fit your new reality. Your main destination for this is the Health Insurance Marketplace, the official hub for comparing and enrolling in plans. If you're new to it, you can get a better feel for the platform by reading our guide on understanding the HealthCare Marketplace.

To make the whole thing less stressful, a little prep work goes a long way.

Your Pre-Enrollment Checklist

Getting your ducks in a row beforehand can turn a potentially confusing process into a simple one. Before you even log on to the Marketplace, try to have these details ready for yourself and anyone in your household who needs coverage:

- Basic Personal Info: This means full names, birth dates, and Social Security numbers for everyone on the application.

- Proof of Your Life Event: This is a must-have. Grab your marriage certificate, a baby's birth certificate, or that official letter from your old job confirming you lost your health benefits.

- Income Details: Pull together recent pay stubs, W-2s, or any other documents that show your estimated household income for the year. This is super important because it determines if you can get help paying for your plan.

- Current Insurance Policy: If you already have a plan, keep the details handy.

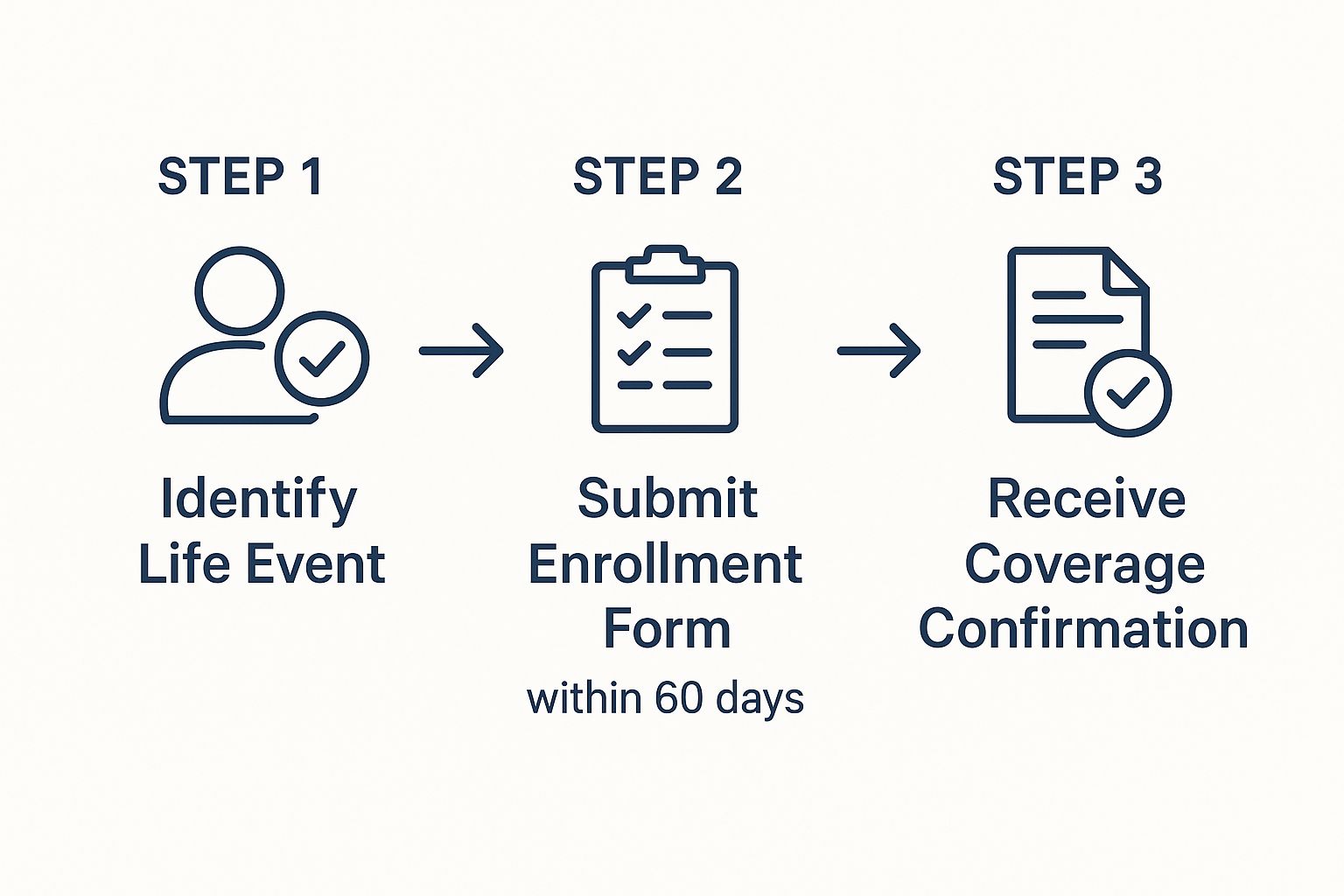

This simple visual breaks down the key steps you'll take during your 60-day window.

As you can see, the most urgent parts are identifying your event and getting that application in before the deadline.

Taking Action, Step-By-Step

Once you have your info ready, the path forward is pretty clear. The goal is to get from "I think I qualify" to "I have an active policy" without any hiccups.

Here's a pro tip: You don't need to have every single document perfect just to start looking. You can actually begin the application on the Marketplace, pick a plan you like, and then upload your verification documents within 30 days of your selection.

Here’s how the journey usually unfolds:

- Visit the Marketplace: Head over to HealthCare.gov or your state’s own exchange website.

- Create an Account: If you're new to the site, you'll need to set up a profile first.

- Fill Out the Application: The site will walk you through questions about your household, income, and the specific life event that makes you eligible for an SEP.

- Compare and Choose: The system will then show you all the plans available to you. You can sort and compare them based on things like the monthly cost (premium), what you pay out-of-pocket (deductible), and which doctors are in-network.

- Finalize and Pay: Once you've made your choice, you’ll finalize the enrollment and make your first premium payment. Remember, your coverage doesn't actually start until that first payment goes through.

How to Prove Your Qualifying Life Event

So, you’ve confirmed your life change qualifies. Great! The next step is proving it to the Health Insurance Marketplace. This might feel like just more paperwork, but it’s actually a critical step that keeps the entire insurance system working fairly.

Why the extra step? It’s all about making sure Special Enrollment Periods are used for what they’re designed for—genuine, unexpected life changes.

Think of it this way: if anyone could sign up anytime without proof, many would wait until they were sick to get coverage. That would cause costs to skyrocket for everyone. Requiring a little bit of documentation ensures the system stays stable and affordable for all of us.

The good news is that providing proof is usually pretty simple once you know what they’re looking for. The key is to match your documents directly to your specific life event.

Common Documents for Top Life Events

The proof you need depends entirely on why you qualify. Losing your job requires different papers than getting married or moving. My advice? Get digital copies of these documents ready before you even start. It will make the whole process feel much smoother.

Here’s a quick guide to what you’ll likely need for the most common life event health insurance triggers:

For Loss of Health Coverage:

- A letter from your old job. It needs to be on official company letterhead and clearly state the date your health coverage ended (or will end).

- A notice from your old insurer. This could be a formal termination letter or a notice explaining your COBRA eligibility.

- Pay stubs. Your final pay stub showing that health insurance deductions have stopped can also work as solid proof.

For a Change in Household (Marriage, Birth):

- Marriage certificate. This is the gold standard for adding a spouse or getting a new family plan.

- Birth certificate or adoption records. To add a new little one to your plan, you’ll need their birth certificate or the official adoption/foster care placement papers.

For a Change of Residence:

- Utility bills. A recent gas, electric, or water bill with your name and new address is perfect.

- Lease or mortgage documents. A signed lease agreement or the mortgage paperwork for your new place works just as well.

- An updated driver's license or state ID. A government-issued ID showing your new address is also strong proof.

Making the Submission Process Easier

The Marketplace understands you might need a minute to gather everything. After you pick a plan, they typically give you 30 days to upload your documents. This grace period lets you track down any missing paperwork without stressing or delaying your plan selection.

Key Takeaway: Don’t wait until you have every single document before you start shopping. You can start the application, choose your coverage, and then upload the proof within that 30-day window.

By getting these documents ready ahead of time, you can breeze through this final step with confidence. It’s the last little hurdle to jump before locking in the health coverage that fits your new life.

Choosing the Best Health Plan for Your New Life

Getting that Special Enrollment Period is a huge sigh of relief, but it’s really just opening the door. Now, the real work starts: picking a health plan that actually fits your new reality. The plan that made sense before might be totally wrong for the life you’re living now.

This isn’t just about ticking a box and getting covered. It's about being strategic. A life event health insurance window is your chance to hit the reset button and align your coverage with your new budget, priorities, and healthcare needs. You have to think about your life today, not the one you had yesterday.

Tailoring Your Choice to Your Event

Every life event brings its own unique set of needs, so a one-size-fits-all plan just won't cut it. Let’s walk through how to think about your decision based on what’s just happened in your life.

Scenario 1: You Just Welcomed a Baby

Your entire world just shifted, and your focus is now on this tiny new person. You need a plan that’s strong on pediatric and family benefits.

- Prioritize Pediatric Care: Hunt for plans with great coverage for well-child visits, immunizations, and a solid network of pediatricians you can trust.

- Check Emergency Services: Kids are nothing if not unpredictable. Make sure your plan has your back with robust coverage for urgent care and ER visits.

- Review Prescription Coverage: From unexpected antibiotics to other medications, look at the plan’s drug list (formulary) to see how it covers common childhood prescriptions.

Scenario 2: You Just Got Married

Congratulations! Now comes the big conversation: should you merge your health insurance? It’s not always as simple as it sounds.

- Compare the Costs: Get out a calculator and do the math. Is it cheaper for one of you to join the other's employer plan, or should you find a new family plan together on the Marketplace?

- Analyze the Networks: This is a big one. Make sure both of your favorite doctors and go-to hospitals are in-network for any joint plan you’re considering. Losing a doctor you trust is a regret we hear all too often.

- Look at Total Out-of-Pocket Costs: A plan with a nice, low premium might hide a shockingly high family deductible. Think about your combined health needs and which cost structure truly works for you.

A life event doesn’t just give you permission to get insured—it gives you the opportunity to get the right insurance. It's a reset button for your healthcare strategy.

Navigating Plan Tiers After Job Loss

Losing a job usually means your budget gets a lot tighter. This makes the choice between plan tiers—Bronze, Silver, Gold, and Platinum—more important than ever. Your decision needs to balance what you pay each month with how much medical care you think you'll actually need.

- Bronze Plans: These have the lowest monthly payments but the highest costs when you need care. Think of them as a safety net for a major medical crisis, but they won't help much with routine appointments.

- Silver Plans: Often the sweet spot, especially if you qualify for Cost-Sharing Reductions (CSRs), which directly lower your deductible and copays. They offer a solid middle ground.

- Gold/Platinum Plans: With the highest monthly premiums come the lowest out-of-pocket costs. These are smart if you know you’ll need frequent medical care or have ongoing prescriptions.

We’ve seen a major shift in how people think about financial protection lately. In the wake of the pandemic, individual life insurance premiums soared to a record $15.9 billion in 2024. It shows a real public focus on building a financial safety net for uncertain times. As you shop for life event health insurance, think of it as a vital part of that same protective strategy for your family.

Making a careful choice is so important, especially when money is a concern. To help you feel more confident, we put together our top tips for finding budget-friendly health coverage to walk you through it.

Common Questions About Life Event Health Insurance

It’s totally normal to have questions when you’re dealing with a Special Enrollment Period. The rules can feel a little confusing at first, and getting straight answers is the best way to feel confident about the coverage you’re choosing.

Let's clear up some of the most common things people ask when life throws them a curveball.

What Happens If I Miss My 60-Day Window?

This is probably the most important rule to remember. If you let your 60-day special enrollment window close without signing up, you’ll almost certainly have to wait for the next annual Open Enrollment Period.

That’s why you have to act fast once your qualifying life event happens. The deadline is firm, and exceptions are incredibly rare. The only other options would be year-round programs like Medicaid or CHIP, but those have specific income requirements you have to meet.

Can I Use a Special Enrollment Period to Change My Current Plan?

Yes, absolutely! A Special Enrollment Period isn't just for people who are uninsured. It's an opportunity to either enroll in a new plan or switch your current Marketplace plan for one that better fits your new reality.

For example, if you get married, you can use your SEP to move from an individual plan to a family plan that covers both you and your new spouse. The whole point is to make sure your health coverage keeps up with your life.

Remember, a QLE isn’t just for getting coverage—it’s for getting the right coverage. It’s a chance to reassess and make sure your plan still makes sense for you and your family.

When Does My New Health Coverage Actually Start?

This can vary, so you'll want to pay close attention when you enroll. As a general rule, if you sign up for a plan by the 15th of the month, your coverage will kick in on the first day of the next month.

But there are some exceptions. For big events like having a baby, your new coverage can often be backdated to the actual date of birth. This is huge because it ensures your newborn is covered from day one. Always double-check your official start date when you're finalizing everything.

Does Voluntarily Canceling My Health Plan Count?

No, this one's a common misconception. Choosing to drop your health plan on your own doesn’t count as a qualifying life event. For a loss of coverage to trigger a Special Enrollment Period, that loss has to be involuntary.

Here’s what that looks like:

- Losing your job and the health benefits that came with it? That qualifies you.

- Deciding to stop paying your premiums and letting the plan lapse? That does not qualify you.

It's smart to know how your insurance decisions affect your bottom line. For a deeper dive, you can explore the various health insurance tax benefits that might be available to you.

Navigating life events is complex enough without worrying about insurance. My Policy Quote is here to simplify the process, helping you find the right plan with confidence and clarity. Get your free, no-obligation quote today!