Think of contractor insurance requirements as the non-negotiable ground rules of your trade. These are the specific policies, like General Liability or Workers' Comp, that you’re legally and contractually required to have. They're not suggestions—they're the financial safety net mandated by clients and state licensing boards to protect everyone from accidents, injuries, and property damage.

What Are Contractor Insurance Requirements

So, what exactly are contractor insurance requirements? They're the minimum types and amounts of coverage you must carry to work legally and land jobs. These rules are set by two main groups: government agencies (think state or city licensing boards) and your clients (especially general contractors or commercial property owners).

Imagine trying to build a house without a solid foundation. Sure, the walls might go up, but the first storm could bring it all crashing down. Your insurance is that foundation for your business.

It makes sure that if a ladder slips and damages a client’s brand-new hardwood floors, or an employee gets hurt on-site, there’s a dedicated source of money to cover the costs. This is what prevents a single bad day from turning into a lawsuit that could wipe out your company.

The most common requirements are all about protecting others from your work and taking care of your own team. Getting a handle on which policies are mandatory is the first step to building a professional and resilient business.

Common Contractor Insurance at a Glance

To give you a clearer picture, let's break down the policies you'll run into most often. The table below gives you a quick snapshot of what each type of insurance does and who usually requires it. Think of this as your starting point before we dive deeper into each one.

| Insurance Type | What It Covers | Typically Required By |

|---|---|---|

| General Liability | Third-party property damage, bodily injury, and advertising injury caused by your work. | Nearly all clients and state licensing boards. |

| Workers' Compensation | Medical expenses and lost wages for employees injured on the job. | State law for any business with one or more employees. |

| Commercial Auto | Liability and physical damage for vehicles used for business purposes. | State law for business-owned vehicles; clients if you drive on their site. |

| Professional Liability | Financial losses from errors, omissions, or faulty advice in your professional services. | Clients in design-build, consulting, or architectural roles. |

This table shows how each policy plays a unique role in protecting your business from different angles.

The real reason for these requirements comes down to one thing: risk transfer. A client or state government wants to know that if something goes wrong, the financial hit gets transferred to an insurance company—not back onto them or your personal bank account.

Getting the right coverage isn't just about checking a box. It's smart financial management. A lot of contractors don't realize they're paying more than they need to simply because they haven't shopped around or really understood their policy details. If you've ever wondered how much are you overpaying on insurance, having a specialist review your policies can uncover some serious savings. This proactive approach ensures you meet all contractor insurance requirements without breaking the bank.

Why This Insurance Is a Pillar of Your Business

It’s tempting to look at contractor insurance requirements as just another bureaucratic hoop to jump through—a line item on your budget that feels more like a chore than a choice. But seeing it this way is a massive mistake.

Your coverage is so much more than a cost of doing business. It’s the very foundation that lets you build with confidence.

Think about it. Your skills, your crew, and your tools are what you use to create something great. Your insurance is what guarantees you can keep creating when a project goes sideways. In this business, a single lawsuit or an unexpected accident on-site can wipe you out financially.

Without a solid insurance policy, your business and even your personal assets are completely exposed. It’s your financial shield, the one thing that stands between a simple mistake and losing everything you’ve worked for.

Build Trust, Win Bigger Jobs

Beyond just protecting you, the right insurance is one of your most powerful tools for earning trust. When you can hand over a Certificate of Insurance (COI) without hesitation, you’re not just giving a client a piece of paper.

You’re sending them a clear message: you’re a pro. You’re reliable, financially responsible, and you’ve planned for the what-ifs. For most clients—especially the big commercial and government ones—this isn't optional. It’s the bare minimum for even getting a foot in the door.

A strong insurance portfolio isn't a cost center; it's a growth engine. It’s what separates the small-time operator from the contractor ready to take on six-figure projects. It opens doors that would otherwise remain firmly closed.

This credibility directly fuels your growth. Just look at the advantages:

- Access to Bigger Jobs: Forget about bidding on major projects without it. General contractors and commercial clients won’t even look at a bid from an uninsured contractor.

- Stronger Client Relationships: Clients sleep better at night knowing you’re covered. That peace of mind builds deep trust and makes for a much smoother project.

- Competitive Advantage: Put two bids side-by-side. If one contractor is fully insured and the other isn't, who do you think gets the job? Your policy can be the tiebreaker that lands you the contract.

A Smart Move in a Growing Market

This need for financial protection isn’t just a local thing; it's a global reality. The insurance industry is booming because businesses everywhere understand that managing risk is crucial for survival.

In 2024, the global insurance industry’s premium income hit EUR 7.0 trillion, an 8.6% jump from the previous year. The Property and Casualty (P&C) sector—which is where most contractor policies live—grew by 7.7%. This trend sends a powerful message: smart business owners don’t gamble. You can dig deeper into this data in the 2024 Global Insurance Report.

At the end of the day, meeting contractor insurance requirements is just the starting line. The real win comes from viewing your coverage as a strategic asset—one that protects your business today and helps it grow for years to come.

The Four Core Contractor Insurance Policies

Trying to figure out insurance can feel like you're trying to read a blueprint in a foreign language. But here's the good news: you don't need to be a policy expert to meet contractor insurance requirements. You just need to get familiar with the four main policies that will have your back.

Think of these as your personal crew of defenders. Each one is designed to protect you from a specific, real-world risk you face every single day. Let's break down what they are, what they do, and why you can’t run your business without them.

General Liability: Your 'Slip-and-Fall' Shield

This is the big one. General Liability (GL) insurance is the absolute foundation of your coverage. It's your first line of defense if your work accidentally causes property damage or bodily injury to a third party—like a client, a delivery person, or just someone walking by your job site.

If a lawsuit pops up, this policy is what stands between you and financial disaster. For instance, if one of your guys accidentally drops a tool and shatters a priceless antique vase, GL steps in to cover the replacement cost. It keeps a simple mistake from turning into a business-ending expense.

Here’s a quick look at what General Liability handles:

- Third-Party Bodily Injury: Covers medical bills if a non-employee gets hurt because of your work.

- Third-Party Property Damage: Pays to fix or replace someone else's property that your team damaged.

- Advertising Injury: Protects you if you're accused of things like slander or copyright infringement in your marketing.

One crucial thing to remember: GL doesn't cover your own employees' injuries or damage to your equipment. That’s what the next policies are for.

Workers' Compensation: Your Employee Safety Net

If you have employees—even just one—your state almost certainly requires you to carry Workers' Compensation insurance. This isn't just a good idea; it's the law. It’s a vital pact between you, your crew, and the state.

Workers' Comp is designed to be the "exclusive remedy" for on-the-job injuries. This means when an employee gets hurt, the policy pays for their medical care and lost wages. In return, they generally can't sue your business over the incident. It’s protection for everyone involved.

A single serious injury on site can easily rack up hundreds of thousands of dollars in medical bills and lost wages. Without Workers' Comp, that bill could land squarely on your business, and that’s a cost very few can survive.

This policy covers:

- Medical treatment for the injured worker.

- A portion of their lost income while they recover.

- Rehabilitation services and disability benefits.

For sole proprietors, managing your own well-being is just as important. Our guide on self-employment health insurance offers key insights into personal coverage that falls outside of business liability.

Commercial Auto: Your Workhorse on Wheels

Heads up: your personal auto policy won't cover you for business use. It's a common misconception, but most personal policies have specific exclusions for it. If you use any vehicle—truck, van, or even your personal car—to haul tools, transport materials, or get your crew to a site, you need a Commercial Auto policy.

This is a non-negotiable part of meeting contractor insurance requirements. It protects your work vehicles from accidents, theft, or other damage. More importantly, it provides liability coverage if you or an employee are at fault in an accident that injures someone or damages their property.

Professional Liability: Your Safeguard for Advice

Also known as Errors & Omissions (E&O), this policy is completely different from General Liability. It doesn't cover physical damage; it covers financial losses a client suffers because of a mistake in your professional services or advice.

This is a must-have for contractors who do design-build work, consulting, or project management. Say you recommend a specific building material that ends up failing and costs the client a fortune to replace. Professional Liability is what covers the fallout from that faulty advice. It protects your expertise just as much as your handiwork.

How Requirements Change by State and Client

Think of contractor insurance requirements like local building codes. What’s mandatory in one town could be totally different just a few miles down the road. It’s the same with your insurance. The coverage you need is never a one-size-fits-all solution; it’s a moving target that shifts based on where you work and who you work for.

Your state’s licensing board sets the absolute floor—the bare minimum you need to operate legally. Some states, like California and Florida, have very strict, clearly defined rules for things like General Liability and Workers' Comp. Other states are far more relaxed, especially if you’re a solo operator with no employees. This patchwork of regulations means you can never just assume. You have to check the rules every single time you cross a state line to work.

State Minimums Versus Client Demands

Meeting the state’s legal baseline is just the first hurdle. The real requirements come from your clients.

If you’re working for large general contractors, big commercial developers, or government agencies, their insurance demands will almost always be much, much stricter than the state’s. They’re managing enormous amounts of risk, and they push that need for financial protection down to every single subcontractor on the job.

So while your state might only mandate a $300,000 General Liability policy, a major commercial client could easily demand a $2 million policy, plus an umbrella policy on top of that. They’ll also want specific endorsements that name them as an “additional insured” on your policy. This is where things get complicated. You’re no longer just satisfying the law; you're satisfying the risk tolerance of your most important customers.

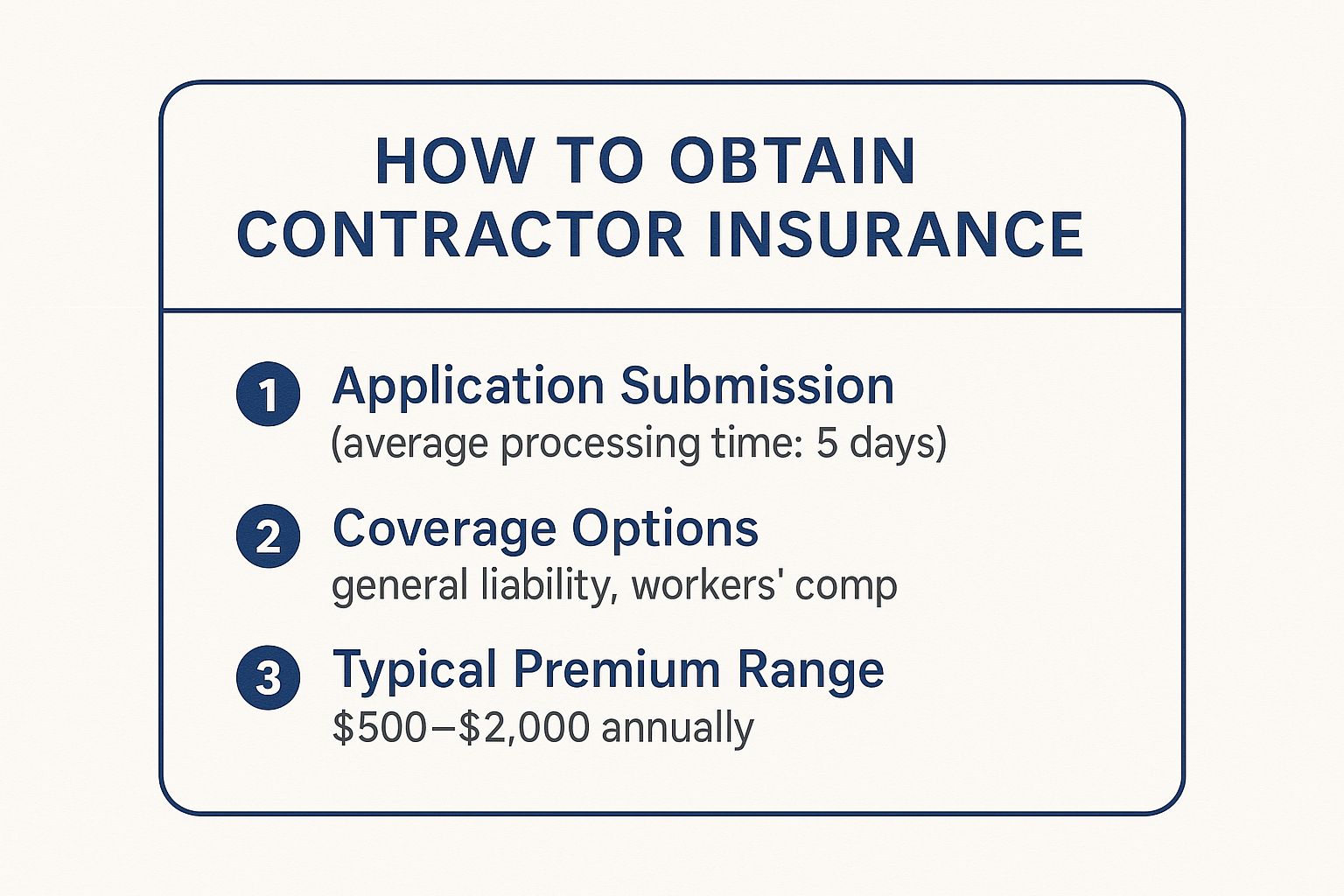

To get a handle on this, it helps to visualize the steps involved in securing coverage. This process is something you'll get very familiar with as your business grows and its needs change.

As you can see, the process itself is straightforward. What’s not so simple are the specifics—the coverage limits, endorsements, and premiums. Nailing this down is key to staying compliant and winning bigger jobs.

Why Your Insurance Needs Are Always in Motion

The difference between projects can be night and day. A contractor’s risk profile changes dramatically depending on the client and the scope of work.

To illustrate, let’s look at how the same contractor might face wildly different insurance requirements for two separate jobs.

Example Insurance Requirement Differences by Project Type

| Requirement | Residential Remodel Project | Large Commercial Construction Project |

|---|---|---|

| Client | Individual Homeowner | Major Real Estate Developer |

| General Liability | $1M per occurrence | $2M per occurrence / $4M aggregate |

| Auto Liability | $500,000 Combined Single Limit | $1M Combined Single Limit |

| Umbrella Policy | Not Required | $5M minimum |

| "Additional Insured" | Not typically requested | Mandatory, with specific wording |

| Waiver of Subrogation | Rarely needed | Standard requirement |

This table shows exactly why you can't have a "set it and forget it" attitude. The insurance that was perfect for a kitchen remodel is completely inadequate for a new office building. You have to adapt your coverage for every single project.

The Impact of Market Conditions

It’s not just about your state or your client, either. Broader market trends have a real impact on your premiums and what coverage is even available.

The casualty insurance market—which includes the liability policies all contractors need—has been getting tighter. Recent global insurance market analysis from Marsh shows that while property insurance rates actually fell, casualty insurance rates went up by 4%. In the US, that jump was even higher at 8%.

What does that mean for you? Insurers are getting more cautious because of a rise in massive claims and jury verdicts. They're reducing how much risk they'll take on, which makes coverage more expensive and sometimes harder to get, especially in certain regions. A contractor in a state known for high-dollar lawsuits will face much steeper premiums than one doing the exact same work in a less litigious area.

The most critical skill a contractor can develop is the ability to read and understand a contract's insurance clause. It's where the project's true financial risks are revealed, and it dictates the exact coverage you need to secure the job.

At the end of the day, your insurance needs are a direct reflection of your work. A residential roofer working for a homeowner has a completely different risk profile than that same roofer working on a new corporate headquarters for a major developer. Carefully reading every contract and staying on top of local and state rules isn’t just good practice—it's essential for survival.

Securing Your Business Against Emerging Risks

The ground is shifting under our feet—both literally and financially. For contractors, the risks you face today aren't the same ones you worried about five years ago. Yesterday's standard insurance policy might leave you dangerously exposed to tomorrow's biggest threats, especially as climate-related events like wildfires and floods become the new normal.

If you want your business to survive and thrive, you have to adapt your insurance strategy right along with it.

It's no longer a question of if a severe storm or wildfire will happen, but when and how often. This reality is forcing insurance carriers to completely rewrite their playbooks. They're adding new exclusions for climate-related damage or, in some cases, requiring specialized coverage just to work in areas they now consider high-risk.

The Widening Protection Gap

There’s a growing concern in the industry that we call the "protection gap." It’s the massive difference between the total financial cost of a disaster and the amount insurance actually pays out. When that gap is wide, it’s contractors, homeowners, and communities left holding the bag for devastating recovery costs.

And climate change is making it worse. We're seeing insured losses from natural disasters climb steadily. Between 2014 and 2023, high-severity events saw a compound annual growth rate of 4.1%. Medium-severity events grew even faster at 7.1%. Even with those increases, the global protection gap is enormous, with around 60% of all disaster-related losses worldwide going uninsured. You can dig into more of the data on how natural catastrophes impact insurance outlooks.

For a contractor, this means you can't afford to be reactive. You have to get ahead of these emerging risks and make sure your policies are built for the world we live in now.

Believing your standard General Liability policy will cover an environmental incident is one of the most dangerous assumptions you can make in today's market. An uncovered pollution claim can sink a business overnight.

Future-Proofing with Specialized Policies

As clients become more aware and regulations get stricter, some policies are quickly moving from "nice-to-have" to "non-negotiable." At the top of that list is Pollution Liability Insurance.

This policy is designed to cover the cleanup costs and damages from pollutants, something a standard GL policy almost always excludes. Just think about the everyday materials on your job site:

- Paints, solvents, and glues

- Diesel, oil, and lubricants for your equipment

- Asbestos or lead you uncover during a demolition

- Even silt and soil runoff that clouds a nearby stream

If any of these things cause contamination, the legal and financial fallout can be catastrophic. A solid pollution liability policy is the only real way to shield your business. Ignoring this can lead to serious trouble, so it’s critical to understand what happens if you don't have the required insurance when an accident happens.

Securing the right coverage isn't just about ticking a box; it's a strategic move to future-proof your business against the very real challenges of the modern construction world.

Your Action Plan for Getting the Right Coverage

Alright, so you know you need insurance. But where do you even begin? Feeling confident about contractor insurance requirements isn’t about hoping you get it right; it's about having a clear, step-by-step plan. Let’s walk through it together.

This isn’t about just checking a box. It’s a deliberate process to make sure you’re properly protected without draining your bank account. Think of it as your blueprint for building a solid financial safety net for your business.

You wouldn't start a job without a plan, right? The same goes for buying insurance. You need a strategy before you start shopping.

Step 1: Assess Your Specific Risks

First things first: you need to get a handle on what you’re actually insuring against. Your risks are unique to your trade, the kinds of projects you handle, and whether you have a crew. A roofer's daily risks look completely different from those of an electrician or a painter.

Ask yourself a few honest questions:

- What’s the most likely way my work could cause property damage?

- Do my guys work at dangerous heights or operate heavy machinery?

- Am I just doing the physical work, or am I also giving design advice?

- Are my work trucks parked on client property all day or driving on busy roads?

Answering these questions helps you pinpoint which policies are absolute must-haves and what coverage limits make sense for your day-to-day operations. This quick self-audit is the bedrock of a smart insurance strategy.

Step 2: Gather Your Essential Documents

Insurance companies need specific information to give you an accurate quote. Getting your paperwork in order ahead of time makes the whole process faster and smoother. Frankly, it also shows them you're a serious, organized professional.

Here's what you'll usually need to have handy:

- Business License and Registration: This is your proof that you're a legitimate business.

- Annual Revenue and Payroll Records: These numbers are crucial for calculating premiums for General Liability and Workers' Comp.

- List of Services: A clear, detailed description of the work you actually perform.

- Previous Insurance History: This includes any claims you’ve filed in the past.

Finding an insurance broker who specializes in the construction industry is arguably the most important decision you'll make. A generalist might find you a policy, but a specialist understands the unique endorsements and exclusions that can make or break a contractor's coverage.

Step 3: Compare Quotes Beyond the Price Tag

When the quotes start rolling in, it's tempting to just grab the cheapest one. Don't do it. A low price often comes with a hidden cost, like dangerously low limits, a sky-high deductible, or exclusions that leave you wide open to risk.

You have to compare policies on an apples-to-apples basis. Look closely at the coverage limits (the absolute maximum the insurer will pay) and the deductible (what you pay out-of-pocket before insurance kicks in). A policy with a $5,000 deductible might have a lower premium, but that’s a painful hit to take if you need to file a claim.

Finally, make it a habit to review your policies every single year. Your business grows and changes, and your insurance needs to keep up. As you hire more people, buy new equipment, or take on bigger projects, your coverage has to evolve with you. This annual check-up ensures you stay protected, compliant, and ready for whatever comes next.

Common Questions About Contractor Insurance

Once you get a handle on the basic policies, the real-world questions start popping up. Let's be honest, navigating the ins and outs of contractor insurance requirements is all about handling the unique curveballs that clients, subs, and your own business setup throw at you.

Here are some quick, no-nonsense answers to the questions we hear from contractors all the time.

What Happens If My Subcontractor Is Uninsured?

This is a massive red flag you just can't afford to ignore.

If you hire a sub who doesn't have their own insurance and they cause property damage or an injury on your site, guess where that liability goes? Straight up the ladder to you. Your General Liability or Workers' Comp policy could end up footing the entire bill, which almost always leads to a painful spike in your premiums or even a non-renewal notice from your carrier.

It has to be a non-negotiable part of your process: collect a Certificate of Insurance (COI) from every single subcontractor before they step foot on your job site. For rock-solid protection, insist on being named as an "additional insured" on their policy.

Can I Get Insurance as a Sole Proprietor?

Absolutely, and in most cases, you’ll have to. Even if you're a one-person show with zero employees, clients are going to demand you have General Liability insurance before you can start work. It’s their way of protecting their property from any accidents you might cause.

And while your state might not legally require you to carry Workers' Compensation for yourself, many general contractors will still make it a deal-breaker in their contracts. It ensures everyone on the job site is covered, period. In some states, a "ghost policy" can be a smart, affordable workaround that satisfies this contractual need without providing actual benefits to you.

How Much Does Contractor Insurance Usually Cost?

There's no single, simple answer here. The cost of your insurance can swing wildly based on your trade, where you work, your yearly revenue, your claims history, and the coverage limits you pick.

A low-risk handyman might find a basic policy for around $400-$600 a year. On the other hand, a roofer working in a major city—a much higher-risk trade—could easily pay several thousand dollars for the same level of coverage. The only real way to know your number is to get quotes built specifically for your business.

What Is an Additional Insured Versus a Certificate Holder?

People mix these up all the time, but the difference is huge.

- Certificate Holder: This is just someone who gets a copy of your COI as proof that you're insured. It's like showing them your driver's license—it proves you can drive, but it doesn't let them drive your car. It gives them zero coverage under your policy.

- Additional Insured: This is a much bigger deal. It actually extends coverage from your policy to another party (like the property owner or general contractor) for the work you're doing for them. It gives them real, direct protection.

You should always, always ask to be named as an additional insured on your subcontractors' policies. It’s a critical layer of defense for your business.

Want to dive deeper into other common questions? Feel free to check out our complete contractor insurance FAQ.

Getting the right answers—and the right coverage—is what protects your livelihood from falling apart. The experts at My Policy Quote are here to help you compare policies from the best carriers, making sure you meet every requirement without paying a dollar more than you need to. Get a personalized quote today at https://mypolicyquote.com.