Trying to understand health insurance can feel like you've been handed a dictionary in a foreign language. It's packed with confusing terms and jargon that seem designed to be complicated. This health insurance glossary is your pocket translator, created to give you the confidence to understand exactly what you're looking at. Knowing the language is the first real step to taking control of your healthcare and your finances.

Why You Need This Health Insurance Glossary

Let's be honest: choosing and using a health plan can be a headache, especially when you don't know the lingo. Words like deductibles, copayments, and networks aren't just vocabulary—they directly affect how much you pay out-of-pocket and which doctors you can see. We’ve designed this guide for quick answers and deep dives, so you can find what you need, when you need it. Getting these terms right is essential for picking a plan that actually works for you and your family.

This knowledge is more critical than ever. The global health insurance market is expected to balloon from USD 2.32 trillion in 2025 to USD 4.45 trillion by 2032, a sign of just how much healthcare costs are rising and how many more people are seeking coverage. You can dig into more of the data behind this massive growth over at Actupool.com.

Empowering Your Healthcare Decisions

This glossary puts you back in the driver's seat by giving you:

- Clear Definitions: We've ditched the corporate speak for simple, straightforward explanations.

- Practical Examples: You'll see real-world situations showing how these terms play out in your life.

- Easy Navigation: Everything is alphabetized, so you can find answers fast without getting lost.

When you truly understand what your policy says, you can budget better and finally say goodbye to those surprise medical bills. It also gets you ready for key deadlines, like the annual enrollment window. To get a head start, you can learn more about Open Enrollment and why it matters in our detailed guide.

A-H Health Insurance Terms Explained

Diving into the world of health insurance means learning its language. It can feel like alphabet soup at first, but once you get the hang of a few key terms, everything starts to click. This first section of our glossary will walk you through the essentials from A to H.

We’re not just giving you dry definitions. We’ll show you exactly how these concepts play out in the real world with practical, easy-to-understand examples.

Allowed Amount

The Allowed Amount is the maximum price your insurance company will pay for a covered service. Think of it as a pre-negotiated discount that your insurer has worked out with doctors and hospitals in their network. If you see a provider who is out-of-network, they haven't agreed to this special rate, which usually means you'll pay more.

This number is a big deal because it’s what all your costs are based on. When a doctor charges more than the allowed amount, you could get stuck paying the difference. This is a nasty surprise known as balance billing.

- In-Network Example: Let's say you see a specialist who's in your plan's network. They charge $250 for the appointment. Your insurer’s Allowed Amount for that visit is $200. Your deductible, copay, or coinsurance will be calculated based on that $200 figure, not the doctor's higher $250 bill.

- Out-of-Network Consequence: Now, if that same specialist was out-of-network, you would likely have to pay your normal share plus the $50 difference between the charged amount and the allowed amount.

Key Takeaway: The easiest way to save money is to stick with in-network providers. It protects you from balance billing and makes sure your costs are based on the lower, negotiated rate.

Appeal

An Appeal is your official request for your health insurance company to take a second look at a decision they made. If they denied payment for a service you believe should have been covered, you have the right to challenge it.

This isn’t just a complaint; it’s a formal process with strict deadlines and rules. It's your chance to arm them with more information, like a letter from your doctor explaining why a particular treatment is medically necessary for you.

Claim

A Claim is simply the bill sent to your insurance company. Either you or your doctor's office submits this request for payment after you've received medical care. It lists every service you received so the insurer can figure out how much they will pay and how much you owe.

These transactions happen on a massive scale. Globally, North America is the largest health insurance market, valued at around USD 800 billion in 2024. The U.S. market alone accounted for USD 612.98 billion of that in 2024 and is expected to grow to a staggering USD 1.26 trillion by 2034. You can dig into more insights into the growing health insurance market to see just how big it is.

After your insurer processes the claim, they’ll send you an Explanation of Benefits (EOB) that breaks down what they paid and what’s left for you to cover.

Deductible

The Deductible is the amount of money you have to pay out of your own pocket for medical services before your health plan starts pitching in. It’s your share of the costs for the year, and it resets annually.

So, if your plan has a $3,000 deductible, you’re on the hook for the first $3,000 of your covered medical bills. Once you’ve paid that amount, your insurance starts sharing the cost through features like copays and coinsurance.

One important thing to remember: your monthly premium payments do not count toward your deductible. However, many plans will cover certain preventive care services, like your annual check-up, at 100% before you’ve met your deductible.

Essential Health Benefits

Under the Affordable Care Act (ACA), all plans sold on the Health Insurance Marketplace must cover a specific set of 10 services. These are called Essential Health Benefits (EHBs), and they guarantee that even the most basic plans offer a solid foundation of coverage.

These 10 mandatory categories include:

- Outpatient care (the kind you get without being admitted to a hospital).

- Emergency room visits.

- Hospital stays, including for surgery.

- Maternity and newborn care.

- Mental health and substance use disorder services.

- Prescription drugs.

- Rehabilitative services and devices (to help you recover from an injury or illness).

- Lab tests.

- Preventive and wellness services.

- Pediatric services, including dental and vision for kids.

Formulary

A plan's Formulary is its official list of covered prescription drugs. Insurers often sort these drugs into different "tiers" based on cost. A drug in a lower tier will have a smaller copay than one in a higher, more expensive tier.

Example of a Drug Formulary Tier System:

| Tier Level | Drug Type | Your Typical Cost |

|---|---|---|

| Tier 1 | Generic Drugs | Lowest copayment (e.g., $10) |

| Tier 2 | Preferred Brand-Name Drugs | Medium copayment (e.g., $40) |

| Tier 3 | Non-Preferred Brand-Name Drugs | Higher copayment (e.g., $75) |

| Specialty Tier | High-Cost Specialty Drugs | Highest cost-sharing, often a percentage (e.g., 25% coinsurance) |

If your doctor prescribes a medication that isn't on your plan's formulary, you might have to pay the full price. In some situations, your doctor can ask the insurance company for an exception to get it covered.

Grace Period

A Grace Period is a short window of time after your premium is due when you can still make a payment without losing your coverage. The length of this period can vary depending on your plan.

For people with a Marketplace plan who get a tax credit to help pay for their premiums, the grace period is usually 90 days. But here's the catch: the insurer only has to pay for claims during the first 30 days of that period. If you don't catch up on all your payments, they can deny claims from the last 60 days. For plans without subsidies, the grace period is often much shorter.

HMO (Health Maintenance Organization)

An HMO is a type of health plan that creates a specific network of doctors, specialists, and hospitals you can use. To join, you typically need to live or work within the HMO’s service area.

Two things really define an HMO:

- You must have a Primary Care Physician (PCP). This doctor is your go-to for all your health needs and is chosen from the HMO's network.

- You need a referral to see a specialist. Want to see a cardiologist or a dermatologist? You almost always have to get a referral from your PCP first. If you don't, the HMO won't cover the visit.

The trade-off for these rules is that HMOs often have lower monthly premiums and out-of-pocket costs than other plans. But you give up flexibility—there's generally no coverage for out-of-network care unless it's a true life-or-death emergency.

I-P Health Insurance Terms Explained

As we move through our A-to-Z health insurance glossary, we've arrived at some of the most important terms that directly impact your wallet and your access to care. The concepts from I to P explain the mechanics of how your plan works—from the doctors you can see to the approvals you need before a procedure.

Understanding these terms, like the difference between a PPO and an HMO or what an Out-of-Pocket Maximum really protects you from, is what turns you from a confused patient into an empowered healthcare consumer. Let's dig into what these definitions actually mean in the real world.

In-Network Coinsurance

In-Network Coinsurance is your share of the cost for covered healthcare services after you’ve met your deductible. This percentage only applies when you see doctors and use facilities that are part of your plan’s approved network.

Think of it as a reward from your insurer for staying within their network. Your coinsurance percentage for in-network care will almost always be lower than what you'd pay for going out-of-network.

Real-World Example:

- Let's say your plan has a $2,000 deductible and 20% in-network coinsurance.

- You’ve already paid your full deductible for the year.

- You need a minor surgery at an in-network hospital, and the total allowed cost is $10,000.

- Your share (coinsurance) would be 20% of that $10,000, which comes out to $2,000. Your insurance company covers the remaining 80%, or $8,000.

Lifetime Limit

A Lifetime Limit used to be a cap on the total amount your insurance company would pay for your care over your entire life. Before the Affordable Care Act (ACA), many plans set these limits at around $1 million or $2 million.

Thankfully, the ACA made lifetime limits on most essential health benefits illegal. This was a massive win for consumers, as a single catastrophic illness or accident could easily burn through a lifetime limit, leaving a patient financially devastated. Just be aware that some non-ACA-compliant plans, like certain short-term policies, might still have them.

Medically Necessary

Medically Necessary is the standard your insurance company uses to decide if a treatment, service, or medical supply is appropriate and essential for diagnosing or treating your health condition. For a claim to be approved, the service must meet the insurer's definition of being medically necessary.

So, what does that usually mean? The care must be:

- Consistent with your diagnosis.

- In line with accepted standards of medical practice.

- Not just for the convenience of you or your doctor.

If an insurer determines a service isn't medically necessary, they can deny the claim. This is a primary trigger for an Appeal, where your doctor will likely need to step in and provide more information to justify the treatment.

Network

A plan’s Network is the collection of doctors, hospitals, specialists, and other healthcare providers that have a contract with your insurance company. This contract allows them to provide care to you at pre-negotiated, discounted rates. These are your "in-network" providers.

Any provider without a contract is considered "out-of-network." Sticking with in-network providers is the single best way to control your healthcare costs. The rules for using your network depend heavily on your plan type, like an HMO or PPO.

This system of networks is part of a massive global industry. The Allianz Global Insurance Report 2025 highlighted that the insurance market grew by 8.6% in 2024, with total worldwide premiums hitting about EUR 7 trillion. You can read more about the findings in the full Allianz report to see the bigger picture.

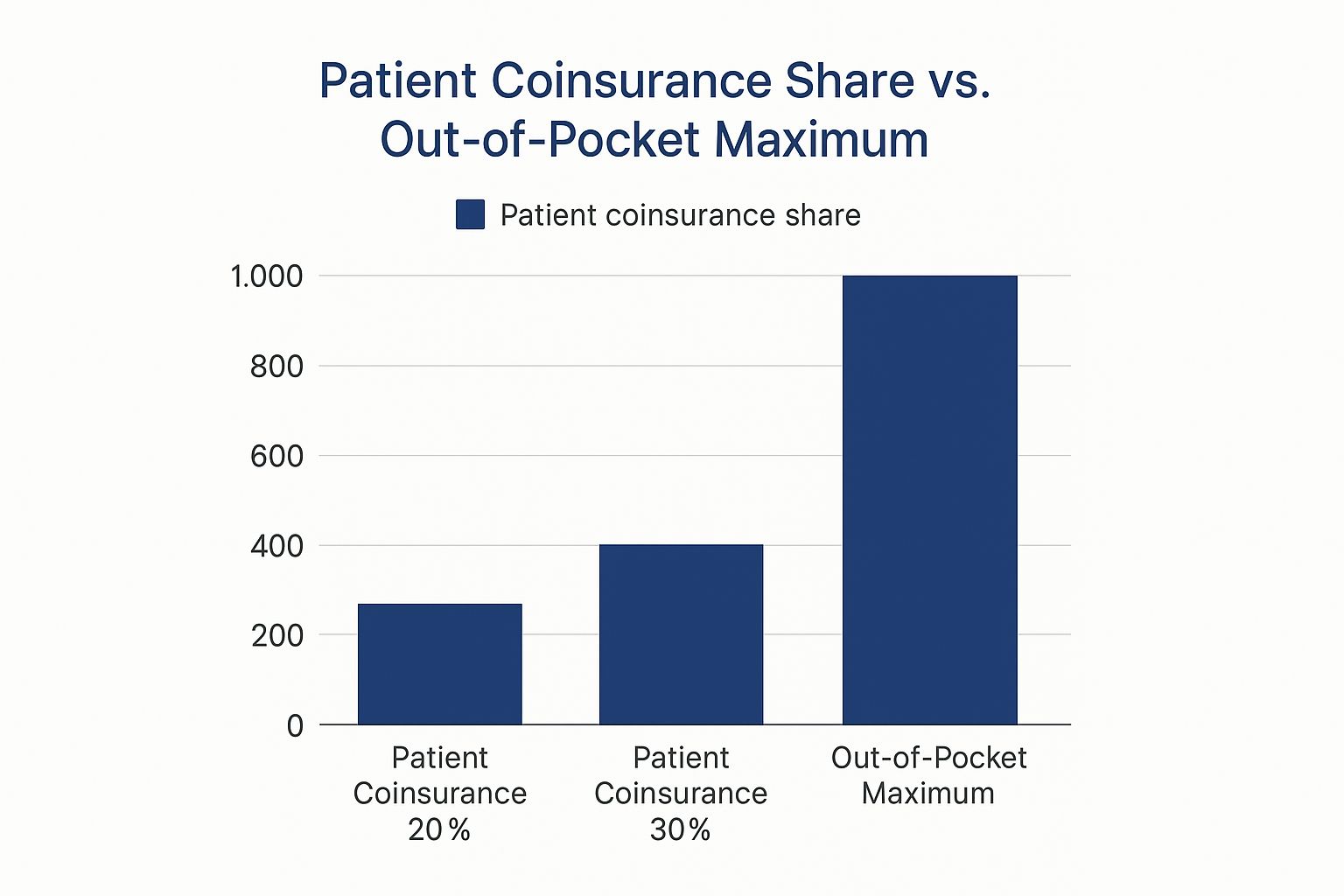

Out-of-Pocket Maximum

The Out-of-Pocket Maximum (also called the Out-of-Pocket Limit) is the absolute most you will have to pay for covered services in a single plan year. Once you’ve spent this amount on your deductibles, copayments, and coinsurance for in-network care, your health plan steps in and pays 100% of the costs for covered benefits.

This limit is your financial safety net. It's designed to protect you from financial ruin if you face a serious illness or major accident.

Crucial Distinction: Your monthly premium payments do not count toward your out-of-pocket maximum. Costs for out-of-network care or any services your plan doesn’t cover also typically don't count.

For 2025, the federal government has set the maximum out-of-pocket limits for ACA-compliant plans at $9,200 for an individual and $18,400 for a family. Many plans offer limits that are even lower than these caps.

PPO (Preferred Provider Organization)

A PPO, or Preferred Provider Organization, is a very common type of health plan that gives you more flexibility than an HMO. While it has a network of "preferred" providers, it also allows you to see doctors and specialists who are outside of that network.

That flexibility does come at a cost. Your out-of-pocket expenses will always be lowest when you use in-network providers. If you decide to go out-of-network, you'll face a separate, much higher deductible and coinsurance, and you won’t be protected from balance billing by the provider.

Comparing PPO vs. HMO Rules

| Feature | PPO (Preferred Provider Organization) | HMO (Health Maintenance Organization) |

|---|---|---|

| Primary Care Physician (PCP) | Not required. You can go straight to a specialist. | Required. Your PCP is your main point of contact. |

| Referrals for Specialists | Not needed. | Required from your PCP to see most specialists. |

| Out-of-Network Care | Covered, but you'll pay significantly more. | Not covered at all, except in a true emergency. |

| Premiums | Tend to be higher than HMOs. | Tend to be lower than PPOs. |

Preauthorization

Preauthorization—also called prior authorization or precertification—is a green light from your health insurer confirming that a service, treatment, prescription drug, or piece of medical equipment is medically necessary. It’s a formal approval process you have to go through before you get certain kinds of care.

Your plan might require preauthorization for things like:

- Major surgeries

- Expensive imaging tests like MRIs or PET scans

- Inpatient hospital stays

- Certain high-cost prescription medications

If you skip getting a required preauthorization, your insurance company has the right to deny the claim, which means you could be stuck paying the entire bill yourself. Always double-check your plan documents or call your insurer to find out if a service needs prior approval.

Premium

Your Premium is the fixed amount you pay on a regular basis—usually monthly—to the insurance company to keep your health plan active. You have to pay your premium on time every month, whether you use your insurance or not.

Think of it as your subscription fee for health coverage. This payment does not count toward your Deductible or your Out-of-Pocket Maximum. It’s easy to get fixated on finding the lowest premium when shopping, but remember that a low premium often means a high deductible and more cost-sharing. It's crucial to look at the whole financial picture.

Q-Z Health Insurance Terms Explained

We're at the home stretch of our health insurance glossary, tackling the essential terms from Q through Z. These definitions aren't just extra details—they cover special situations and documents that can have a huge impact on your coverage, your costs, and your ability to get care when you need it most.

Understanding what a Qualifying Life Event (QLE) is or when a Special Enrollment Period kicks in can be a lifesaver when things don't go according to plan. Likewise, knowing how to use an SBC to compare plans or when to choose Urgent Care over an ER will help you make smarter, more cost-effective decisions for your family.

Qualifying Life Event (QLE)

A Qualifying Life Event (QLE) is a major change in your life that lets you change your health insurance plan outside the yearly Open Enrollment Period. Think of it as a special permission slip to get coverage when something big and unexpected happens.

These events open up what's called a Special Enrollment Period—usually a 60-day window to pick a new plan or adjust your current one. Without a QLE, you're pretty much stuck waiting for the next Open Enrollment window to make changes.

So, what counts as a QLE? Here are the most common ones:

- Getting married or divorced: This lets you join your new spouse's plan, get your own, or drop an ex-spouse.

- Having or adopting a child: You can add your new little one to your existing family plan.

- Losing other health coverage: This could be from a job loss, turning 26 and aging off a parent's plan, or other situations where you lose coverage involuntarily.

- Moving to a new zip code or county: If your move puts you in an area with different plan options, you can switch.

These life changes often mean you need to take a whole new look at your family's healthcare needs. For a deeper dive, check out our guide on what you need to know about family health insurance in 2025.

Referral

A Referral is basically a permission slip from your Primary Care Physician (PCP) to go see a specialist or get certain medical services. You'll run into this requirement most often with HMO plans, though some POS plans use them, too.

Why the extra step? The referral system is designed to keep costs down by making sure a specialist visit is truly necessary. If your plan requires one and you skip it, you're setting yourself up for a denied claim, meaning you'll be on the hook for the entire bill.

Real-World Scenario: Let's say you have an HMO and a nagging skin rash you want a dermatologist to check. First, you have to book an appointment with your PCP. If they agree you need an expert's opinion, they'll issue a formal referral to an in-network dermatologist.

Special Enrollment Period (SEP)

A Special Enrollment Period (SEP) is that crucial, limited window of time outside of the standard Open Enrollment Period when you can sign up for health insurance. As we covered above, you can only get an SEP if you've experienced a Qualifying Life Event (QLE).

This system is a critical safety net. It ensures you aren't left uninsured after a major life change. Most SEPs last for 60 days from the date of the event, so you have to act fast. If you miss that window, you’ll probably have to wait for the next Open Enrollment to secure coverage.

One key thing to remember: the end of a short-term health plan does not usually trigger a Special Enrollment Period for a comprehensive ACA plan. It's an important distinction that separates temporary stop-gap coverage from major medical insurance.

Summary of Benefits and Coverage (SBC)

The Summary of Benefits and Coverage (SBC) is a standardized document that all insurance companies are required by law to provide. Its job is to lay out plan details in a clear, easy-to-read format, making it much simpler to compare different health plans.

Think of it as the "nutrition label" for health insurance. Because every SBC follows the same template, you can finally make a true apples-to-apples comparison when you're shopping for a policy.

Here’s what you'll find on every SBC:

- Key costs at a glance, like the Deductible, Out-of-Pocket Maximum, and Copayments.

- Straightforward answers to common questions like, "What is the overall deductible?"

- Coverage examples for two common scenarios: having a baby and managing type 2 diabetes. This gives you a real-world estimate of your costs under that plan.

- A direct link to the plan's Formulary (its list of covered prescription drugs).

Urgent Care

Urgent Care centers fill that important gap between your family doctor and the hospital emergency room. They’re the right choice for illnesses and injuries that need immediate attention but aren't life-threatening.

Going to an urgent care clinic is almost always cheaper and quicker than an ER visit for a non-emergency. An urgent care copay is typically a fraction of what you'd pay for an ER visit—often saving you hundreds of dollars.

When to Choose Urgent Care vs. the ER

| Go to Urgent Care For | Go to the Emergency Room For |

|---|---|

| Colds, flu, and fevers | Chest pain or signs of a stroke |

| Minor cuts that need stitches | Severe burns or uncontrollable bleeding |

| Sprains and minor broken bones | Difficulty breathing |

| Vomiting or diarrhea | Head injuries or loss of consciousness |

| Urinary tract infections (UTIs) | Seizures |

Choosing the right place for care is a huge part of managing your healthcare budget. Knowing when a trip to urgent care will do the trick can save you a ton of time, stress, and money.

How to Compare Different Health Plan Types

The alphabet soup of acronyms on your health insurance card—HMO, PPO, EPO—is more than just jargon. It's the blueprint that dictates how you can use your coverage, where you can get care, and how much you'll pay out-of-pocket. Getting this choice right is all about finding the perfect balance between cost and freedom for your specific needs.

The most common plans you'll run into are HMOs (Health Maintenance Organizations) and PPOs (Preferred Provider Organizations). Think of it as a trade-off. HMOs typically come with lower monthly premiums, but they require you to stay within their network of doctors and hospitals. You'll also need a referral from your Primary Care Physician (PCP) to see a specialist. PPOs, on the other hand, offer the freedom to see providers both in and out of their network, but that flexibility comes at a higher price.

This image really drives home how your share of the costs can add up.

As you can see, even a seemingly small 20% coinsurance can quickly lead to significant expenses. That’s why your out-of-pocket maximum is so important—it’s the financial safety net that caps your spending for the year, protecting you from catastrophic costs.

Comparing Health Plan Types HMO vs PPO vs EPO

So, how do you decide which plan type is right for you? It really boils down to your personal priorities. Are you trying to keep your monthly payments as low as possible? Or is it more important that you have the freedom to see any doctor you choose? The table below breaks down the key differences between the major plan types to help you see how they stack up.

| Feature | HMO (Health Maintenance Organization) | PPO (Preferred Provider Organization) | EPO (Exclusive Provider Organization) |

|---|---|---|---|

| Primary Care Physician (PCP) Required? | Usually, yes. Your PCP coordinates your care. | No. You can see specialists directly. | No. Direct access to specialists is allowed. |

| Referrals to See Specialists? | Yes, you almost always need a referral from your PCP. | No, referrals aren't needed. | No, referrals aren't needed. |

| Out-of-Network Coverage? | No, except for true emergencies. All care is in-network. | Yes, but you'll pay a lot more for it. | No, except for true emergencies. |

| Cost | Generally lower premiums and out-of-pocket costs. | Higher premiums and deductibles for more flexibility. | A middle-ground option, often cheaper than a PPO. |

| Best For You If… | You want predictable costs and don't mind staying in-network. | You want maximum flexibility and are willing to pay for it. | You want the freedom of a PPO but are okay with staying in-network to save money. |

Ultimately, there’s no single "best" plan—only the best plan for you. Understanding these structures gives you the power to pick coverage that truly fits your life and budget.

Key Differences at a Glance

Choosing the right structure is a personal decision. It all depends on what matters most to you and your family.

- HMO (Health Maintenance Organization): A fantastic choice if you're budget-conscious and comfortable with a more structured approach to your healthcare, including getting referrals for specialists.

- PPO (Preferred Provider Organization): Perfect for anyone who values flexibility. If you want the freedom to see specialists without a referral or to visit an out-of-network doctor, a PPO is likely your best bet.

If you're ready for a deeper dive, you can learn how to choose health insurance with our simple guide for smart coverage. It walks you through the entire process, step-by-step, so you can make a choice you feel confident about.

Common Questions About Health Insurance Terms

Even with a full glossary, some health insurance questions come up over and over again. It's totally normal. Let's walk through a few of the most common sticking points so you can feel more confident navigating your plan.

A big one is the difference between a deductible and an out-of-pocket maximum. They sound similar, but they do very different jobs.

Think of your deductible as the first hurdle you have to clear. It’s the amount you must pay for covered services yourself before your insurance company starts to chip in. Once you've hit that number, you're not done, but the financial load gets lighter.

The out-of-pocket maximum is your ultimate financial safety net for the year. After your total spending on deductibles, copayments, and coinsurance reaches this limit, your plan steps in to pay 100% of covered, in-network costs for the rest of the policy year. It's the absolute most you'll have to pay.

Making Sense of Your Plan in Action

Another question I hear all the time is, "How do I really know if my doctor is in-network?" This is a crucial one to get right.

The safest bet is always to check directly with your insurance provider. You can either call the member services number on your ID card or use the provider lookup tool on their official website. Don't just take the doctor's office's word for it—their information can sometimes be out of date, and you don't want a surprise bill.

Finally, what’s the deal with preauthorization? It’s essentially getting permission from your insurer before you get a specific non-emergency service, like a planned surgery or an MRI. If your plan requires it and you skip this step, the insurance company can deny the claim, potentially leaving you on the hook for the entire cost.

Understanding these practical details is just as important as knowing the definitions. For a lot of people, this brings up the bigger question of health insurance vs. personal savings and the best way to plan for medical bills.

At My Policy Quote, we believe everyone deserves to understand their health coverage. Find a plan that fits your life and budget with our easy-to-use tools. https://mypolicyquote.com