Think of health insurance gap coverage as insurance for your health insurance. It’s a separate, supplemental policy you buy to help pay for the costs your main health plan leaves behind—things like high deductibles, copayments, and coinsurance. It's designed to be a financial backstop.

Understanding the Role of Gap Coverage

Let's use an analogy. Imagine your primary health insurance is a big, sturdy umbrella. It’s fantastic for protecting you from a major downpour, like a catastrophic surgery or a serious illness. But even with a great umbrella, you’re still going to get a bit wet from the splashes and puddles. Those are your out-of-pocket costs.

Health insurance gap coverage is like putting on a raincoat and a good pair of boots. It’s that second layer of protection that handles the smaller, but still frustrating, expenses your umbrella doesn't catch.

It's crucial to remember that these policies aren't a substitute for a real health plan. They're designed to work with it. This has become especially important with the rise of high-deductible health plans (HDHPs). While HDHPs can offer lower monthly premiums, the trade-off is that you have to pay a significant amount of money yourself before your insurance kicks in.

A sudden accident or unexpected diagnosis could easily stick you with a bill for thousands of dollars just to meet that deductible. That's exactly the “gap” this coverage is designed to fill.

What Problem Does Gap Coverage Solve?

At its core, gap coverage tackles the problem of financial risk. Even if you have a solid health insurance policy, the out-of-pocket maximum—the absolute most you can be forced to pay in a single year—can be intimidating. For 2024, that limit is $9,450 for an individual. For most people, getting hit with an unexpected bill that high would be a serious financial blow.

Gap coverage helps bridge the divide between what your insurance covers and what you are personally responsible for paying. It turns a potentially crippling medical bill into a manageable, predictable expense.

This financial cushion is particularly valuable during life transitions, like early retirement. If you're figuring out your options before becoming eligible for Medicare, it’s vital to know about every tool at your disposal. You can dive deeper into this topic in our guide on securing health insurance before Medicare.

To really see how this works in practice, let's break down who pays for what.

Primary Health Plan vs Gap Coverage Responsibilities

The table below shows a clear picture of what your main health plan typically handles versus the specific out-of-pocket costs that gap insurance is built to cover.

| Expense Type | Covered by Primary Health Insurance (After Deductible) | Typically Covered by Gap Insurance |

|---|---|---|

| Deductible | Not covered; this is your initial out-of-pocket cost. | Yes, helps pay down or eliminate your deductible. |

| Coinsurance | Covers the plan's share (e.g., 80% of the bill). | Yes, covers your share (e.g., the remaining 20%). |

| Copayments | Not covered; this is a fixed fee you pay per visit/service. | Yes, can reimburse you for copay amounts. |

| Hospital Stays | Covers a large portion of the cost after the deductible. | Yes, provides fixed cash benefits to cover your share. |

| Prescriptions | Covers a portion, depending on your plan's formulary. | Can help with high prescription copays or coinsurance. |

By stepping in to pay for these specific costs, health insurance gap coverage helps ensure that a medical problem doesn't spiral into a financial crisis. This lets you put your energy where it belongs: on getting better, not on worrying about how you'll pay the bills.

Do You Really Need Gap Coverage?

Trying to decide if you need another insurance policy can feel like a lot. But when it comes to health insurance gap coverage, the decision really boils down to one simple question: How much financial risk can you truly afford to take on? An honest answer here is the key to making the right choice for you and your family.

The most common reason people start looking into gap coverage is that they have a high-deductible health plan (HDHP). These plans are pretty popular because they keep your monthly premiums low, but that comes with a big catch. You’re on the hook for thousands of dollars out-of-pocket before your main insurance plan starts paying for much of anything.

Think about it this way: if you or a family member had a medical emergency tomorrow, do you have $5,000, $7,000, or even more sitting in a savings account, ready to go? If that thought makes you nervous, or if paying that bill would completely wreck your budget, then it’s time to seriously consider gap coverage.

Sizing Up Your Personal Risk

There's no one-size-fits-all answer here. Your personal risk profile is a unique mix of your health, lifestyle, and financial situation. This is where you have to get real with yourself and look at your household’s specific vulnerabilities.

What kind of situations might put you more at risk? Here are a few common ones:

- You're self-employed or work freelance. When your income isn't always predictable, a huge medical bill can be a knockout punch. Gap coverage can act as a reliable financial backstop when you need it most.

- You have an active family. Between kids in sports, a love for adventurous hobbies, or just the everyday tumbles of life, the odds of a trip to the emergency room for stitches or a broken bone go up.

- You're planning on having a baby. A new child is wonderful, but it also means a flurry of doctor's appointments, delivery costs, and follow-up care—all of which chip away at (or completely devour) your deductible.

- You're getting close to retirement. The transition from your job's insurance to Medicare can create some tricky temporary gaps or new cost structures. For more on navigating this specific time, you can check out our guide on COBRA for retirees.

The point of this exercise isn't to make you worry. It's to give you a clear, realistic view of where you might be exposed financially so you can put a plan in place to protect your hard-earned savings.

When the Math Makes the Decision For You

Let's put the what-ifs aside and just look at the numbers. Your out-of-pocket maximum is the absolute most you would have to pay for covered healthcare in a single year. For a lot of people, that number is surprisingly high, often topping $9,000 for an individual.

Now, weigh that potential hit against the cost of a gap plan, which can be as little as $50 a month. Does paying a small, predictable premium feel smarter than facing a potential five-figure bill you can't afford? For most people in this boat, the answer is a resounding yes. You’re essentially trading a small, known cost for peace of mind against a large, unknown one.

It’s also helpful to see the bigger picture. While gap insurance plugs holes in your out-of-pocket costs, another "coverage gap" affects millions of Americans who earn too much for Medicaid but not enough for marketplace subsidies. In the 10 states that haven’t expanded Medicaid, a staggering 1.4 million people are stuck in this gap. This larger issue, explored in data from KFF.org, shows just how easy it is to fall through the cracks of our healthcare system, making personal financial safeguards even more vital.

So, if you have an HDHP, don't have a robust emergency fund, or have a lifestyle that makes medical care more likely, health insurance gap coverage is less of a luxury and more of a crucial financial shield.

Comparing the Different Types of Gap Insurance

Trying to make sense of health insurance gap coverage can feel overwhelming at first, but it really just boils down to a few different types, each built for a specific purpose. Not all gap plans are the same. Think of them as specialized tools designed to shield you from different kinds of financial surprises. Figuring out these differences is the first step to picking the one that's right for you.

You wouldn't use a hammer to turn a screw, right? In the same way, you need the right kind of gap policy to cover your specific worries, whether that’s a sudden hospital stay, a serious diagnosis, or an unexpected injury.

Let's break down the main players: hospital indemnity, critical illness, and accident insurance. Each one pays out under different circumstances, and understanding how they work is crucial.

Hospital Indemnity Plans

A hospital indemnity plan is probably the most straightforward type of gap coverage out there. Its job is simple: it pays you a fixed, predetermined cash amount for each day you’re admitted to a hospital. For example, your policy might pay you $200 per day.

This plan doesn't get into the weeds of what specific medical services you received. It only cares about how long you were there. So, if your policy pays $200 a day and you're in the hospital for five days, you’ll get a check for $1,000. You can use that money for anything—medical bills, groceries, rent, you name it.

- Best for: Individuals or families worried about the high costs of an inpatient hospital stay, which can quickly burn through a deductible.

- Use Case: Someone with a high-deductible health plan (HDHP) gets hospitalized for pneumonia for four days. Their gap plan pays them a set daily benefit, giving them immediate cash to help pay the hospital's bill and meet their deductible.

Critical Illness Insurance

Next up is critical illness insurance. This policy works a bit differently. Instead of paying you daily, it gives you a one-time, lump-sum cash payment if you're diagnosed with a major illness specified in your policy.

Covered conditions are typically the big ones, like a heart attack, stroke, cancer, or a major organ transplant. The payout—which could be $10,000, $25,000, or even more—is meant to provide a serious financial cushion while you recover. That money is yours to use for non-medical expenses, too, like modifying your home for accessibility or covering lost income.

- Best for: Anyone with a family history of major illnesses or those who want peace of mind knowing they can handle a life-altering diagnosis without draining their savings.

- Use Case: A 50-year-old is diagnosed with a covered form of cancer. Their critical illness policy pays them a $20,000 lump sum. They use it to pay for experimental treatments their main insurance won't cover and to handle mortgage payments while they're out of work.

Accident Insurance

Finally, there’s accident insurance, which is built to cover the costs that pop up after an accidental injury. It's similar to critical illness insurance in that it pays cash benefits directly to you, but the trigger is a mishap, not a sickness.

These policies pay set benefit amounts for specific injuries and the care they require. You might get $500 for a broken arm, $150 for an emergency room visit, or $50 for an X-ray. It's all about helping with the immediate out-of-pocket expenses that follow an unexpected accident.

These plans are especially popular with active people and families with kids, since the risk of an injury from sports or just everyday life is naturally a bit higher.

Ultimately, choosing the right kind of health insurance gap coverage comes down to your personal health, lifestyle, and financial situation. By understanding how these options differ, you can pinpoint the policy that truly fits your needs and gives you the most valuable protection.

Understanding the Real Cost of Gap Coverage

When you're looking into gap coverage for your health insurance, the first question on your mind is probably, "How much is this going to cost me?" It’s a fair question, but there’s no one-size-fits-all answer. The price tag is tailored to you, based on a few key factors insurers look at.

Think of it this way: the premium isn't some random number. It’s a calculated reflection of your personal situation and how much financial protection you’re looking to buy. Getting a handle on these elements is the first step toward figuring out if a gap policy makes sense for your budget.

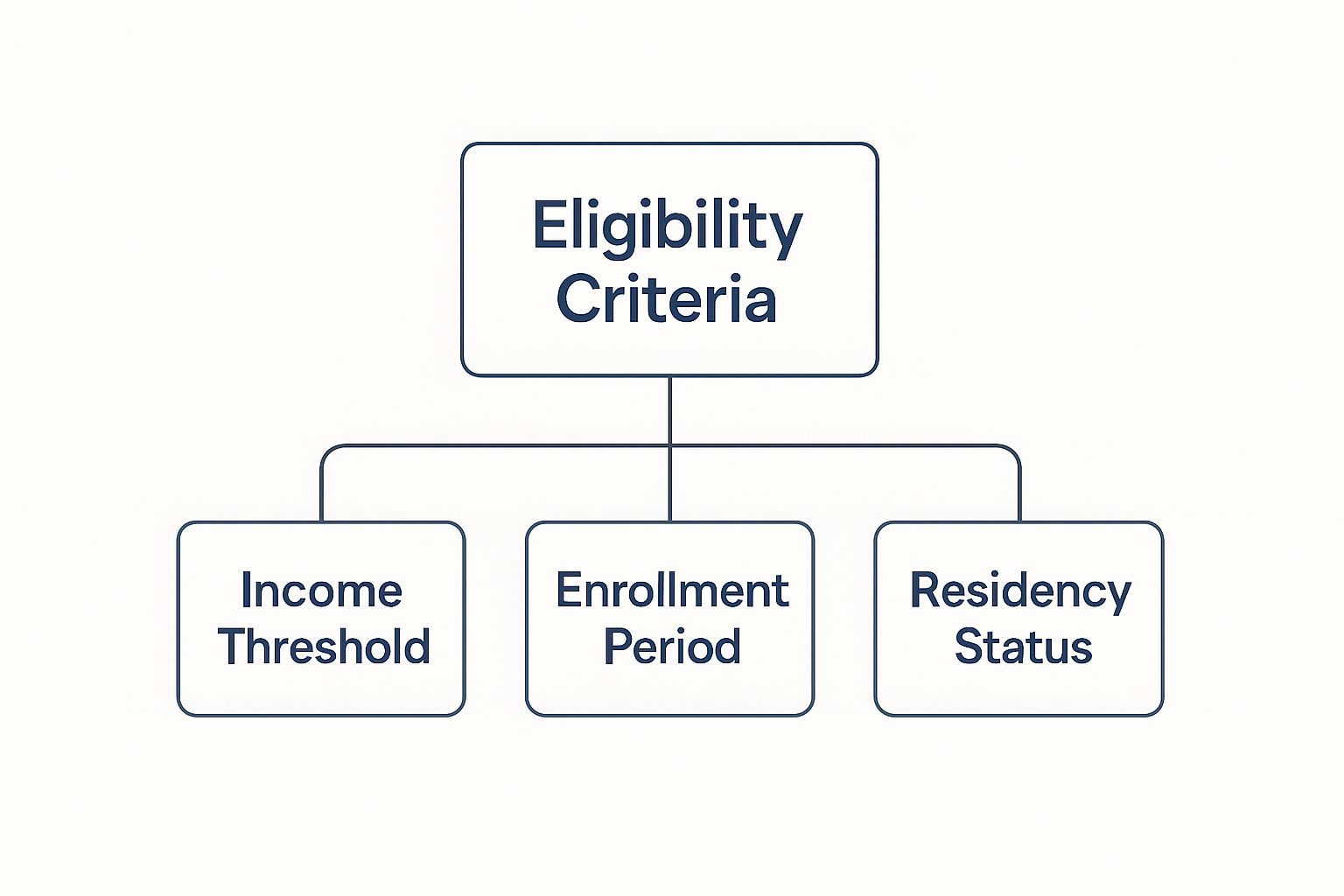

What Determines Your Premium

So, what exactly goes into that calculation? Insurers primarily focus on three things to set your premium: your age, your overall health, and the amount of coverage you choose. Each one helps them gauge the likelihood you'll need to use the policy.

-

Your Age: It’s a simple fact of insurance—younger people generally pay less. Statistically, they're less likely to experience a major health issue, so the risk for the insurer is lower.

-

Your Health: Gap insurance isn't bound by the same rules as ACA plans. This means providers use medical underwriting, where they’ll ask about your health history. Pre-existing conditions can lead to higher premiums or even a denial of coverage.

-

Your Coverage Level: This one is straightforward. A policy that pays out a $20,000 benefit for a critical illness will cost more than one with a $5,000 benefit. The more risk the insurer takes on, the higher your monthly payment will be.

For example, a healthy 30-year-old will likely get a much lower quote for a $10,000 critical illness policy than a 50-year-old with a couple of chronic conditions. The price difference is all about the insurer's calculated risk.

Weighing Cost Against Benefit

The real math here isn't just about the monthly premium. It’s about weighing that small, predictable expense against a potentially huge, unexpected medical bill. Is it worth paying a manageable fee each month to avoid getting hit with a bill that could wipe out your savings?

The true value of health insurance gap coverage lies in its ability to transform a potential financial catastrophe into a manageable, planned expense. It's an investment in your financial security and peace of mind.

This kind of financial protection is becoming more and more necessary. The World Health Organization) reports that nearly 2 billion people globally face severe financial hardship because of healthcare costs. Many are pushed into poverty by a single catastrophic medical event. Recent global disruptions to health services have only made this coverage gap wider and more obvious.

Ultimately, whether gap coverage is right for you boils down to your personal finances and how much risk you're comfortable with. If a surprise medical bill in the thousands would be a serious blow, then the monthly premium for a gap plan could be one of the smartest investments you make. Pairing it with your main plan is a strategic move, especially if you’re trying to find low-cost health insurance options for every budget.

How to Find and Apply for the Right Policy

Finding the right health insurance gap coverage doesn't need to be a major headache. If you break it down into a few simple steps, you can confidently navigate the process and land on a policy that actually fits your life and your budget. Think of this as your playbook for getting from research to approval.

Your first move is figuring out where to even look for these plans. Unlike major medical insurance that's usually tied to your job or the ACA Marketplace, gap coverage is much more flexible. You've got a few different avenues to explore, and each has its own upsides.

Step 1: Start Your Search

Before you even think about filling out an application, you need to know where the good options live. The great news is you have more than one path to take to find a policy that will shore up your financial defenses.

Here are your main options:

- Directly from Insurance Companies: Many of the big-name insurers offer gap policies, like accident or critical illness plans, directly to consumers. Going this route puts you in the driver's seat, but it also means you’re on your own to compare all the different quotes and policy details.

- Through an Insurance Broker or Agent: A licensed agent can be a fantastic guide. They have relationships with multiple insurance carriers, so they can do the comparison shopping for you and help you make sense of the fine print. This can save a ton of time.

- As a Voluntary Benefit Through Your Employer: Check with your HR department. Some companies offer gap coverage as an optional benefit you can elect during your enrollment period. It’s incredibly convenient, and the premiums are often deducted right from your paycheck.

Step 2: Gather Your Documentation

Once you've zeroed in on a few promising providers, it’s time to get your paperwork in order. Gap insurance usually requires medical underwriting—which is just the insurer's way of assessing your health risks—so you'll need to share some personal info.

Be prepared to provide details on:

- Your Primary Health Insurance: The insurer will need to see proof that you already have a qualifying major medical plan.

- Your Personal and Health History: You’ll have to fill out a health questionnaire covering your past and present medical conditions. Be totally honest here. Any inaccuracies could cause a claim to be denied later.

The underwriting for gap coverage is a bit more involved than for a standard ACA plan. Insurers can use your age and health status to set your eligibility and premiums, so having all your information ready makes the whole process go much more smoothly.

Step 3: Navigate the Application Process

Applying is usually pretty straightforward and can often be done entirely online. You'll fill out the application, answer those health questions, and upload any necessary documents. From there, the insurance company’s underwriting team takes over, reviewing your information to decide if they can approve your policy and at what price.

This stage is more important than you might think. While the uninsured rate in the U.S. has hit a historic low of 9.5%, things could change. The enhanced Marketplace subsidies are set to expire after 2025, which could leave an estimated 3.8 million more people uninsured each year. You can dig into the latest data on the uninsured population to see the trends. These potential shifts make having a personal financial safety net like gap coverage a very smart move.

Step 4: Ask the Right Questions

Before you sign anything, you have to be your own best advocate. Don't be shy about asking your agent or the insurance company some tough questions. The goal is to make sure there are no surprises waiting for you down the road.

Here’s a quick checklist of must-ask questions:

- What is the waiting period for pre-existing conditions?

- Are any specific illnesses or types of accidents excluded from coverage?

- How does the claims process actually work, and how fast are benefits paid out?

- Can I keep this policy if I switch to a different primary health insurance plan?

Nailing down these details is crucial. Remember, one of the best things about health insurance gap coverage is that you can typically buy it anytime—you aren't restricted to the normal enrollment periods. For a deeper dive into how that works, take a look at our guide on what open enrollment is and why it matters. Follow these steps, and you’ll be in a great position to choose a policy that gives you real peace of mind.

Common Questions About Gap Coverage

Even after walking through the basics of health insurance gap coverage, it's completely normal to have a few more questions rattling around. The world of insurance is notoriously full of fine print and confusing terms, so getting clear answers is a must before you commit. This section tackles the most frequent questions we hear from people trying to make sense of it all.

We’re going to dig into the tricky "what-ifs" and clear up the distinctions that often trip people up. Think of this as the final once-over, giving you the confidence to decide if a gap policy is the right addition to your financial safety net. Let's get these last uncertainties sorted out.

Is Gap Coverage the Same as Secondary Insurance?

This is a fantastic question because, on the surface, they sound almost identical. While both gap coverage and traditional secondary insurance add another layer of financial protection, they go about it in completely different ways. Getting this distinction right is crucial.

Think of secondary insurance as your primary health plan’s direct partner. It works behind the scenes, coordinating with your main insurer to help cover leftover costs like copayments and coinsurance. The process is usually integrated, with payments flowing between the insurance companies and your doctor's office or hospital.

Gap coverage, on the other hand, is a whole different animal. It operates independently. When a covered event happens—like a specific diagnosis or a hospital stay—the gap plan pays a fixed cash benefit directly to you.

The key difference is who gets the money and how you can use it. Secondary insurance pays the doctors and hospitals. Gap insurance pays you, giving you the freedom to use the cash for whatever you need most, whether that’s medical deductibles, your mortgage, or even childcare while you recover.

This flexibility is a huge plus. A serious medical issue often brings a wave of non-medical expenses, and that lump-sum payment from a gap plan can be a true financial lifeline, offering help far beyond what traditional secondary insurance is designed to do.

Can I Be Denied for a Pre-existing Condition?

Yes, you can be. This is one of the biggest differences between health insurance gap coverage and the major medical plans you get through the ACA marketplace. The Affordable Care Act (ACA) made it illegal for primary health insurers to deny you or charge you more because of your health history.

Gap insurance, however, doesn't fall under those same ACA rules. Insurers are allowed to use a process called medical underwriting. This just means they’ll ask you a series of health questions to figure out how much of a risk you are to insure.

Based on your medical history, an insurer might:

- Approve your policy with no strings attached.

- Approve your policy but exclude coverage for a specific pre-existing condition.

- Impose a waiting period, meaning the policy won’t cover costs related to that condition for a set time, often 6 to 12 months.

- Deny your application entirely.

Because of this, being upfront and honest on your application is absolutely critical. If you don't disclose a condition and later file a claim for it, that claim will likely be denied, leaving you without the protection you were counting on. Always read the policy's exclusion clauses so you know exactly how your health history impacts your coverage.

How Does Gap Insurance Work with My HSA?

Pairing gap insurance with a Health Savings Account (HSA) can be a really smart financial strategy. They aren't mutually exclusive—in fact, they complement each other perfectly. Together, they create a powerful, two-pronged defense against high medical bills, especially if you have a high-deductible health plan (HDHP).

An HSA is your tax-advantaged savings account for qualified medical expenses. The money you put in is pre-tax, it grows tax-free, and any withdrawals for medical costs are also tax-free. It's a triple-win.

Here’s how they work together seamlessly:

- Paying Premiums: You can actually use your HSA funds to pay your health insurance gap coverage premiums. This lets you pay for your extra protection with pre-tax dollars, saving you money right off the bat.

- Protecting Your Savings: If a covered medical event happens, your gap policy pays its cash benefit directly to you. You can then use that payout to handle your high deductible and other out-of-pocket costs.

- Preserving Your Funds: By using the gap insurance money to absorb the immediate financial shock, you can leave your HSA funds untouched. This lets your HSA balance continue to grow tax-free, preserving it for future needs or even as a nest egg for retirement.

This combination allows your HSA to do what it does best—act as a long-term savings and investment tool—while your gap policy stands on the front lines, defending against sudden, high-cost events.

What Happens if I Change My Primary Health Plan?

One of the best things about most health insurance gap coverage policies is their portability. Your employer-sponsored health plan disappears when you leave your job, but your gap policy is yours to keep because you own it directly. It isn't tied to your job or a specific primary health plan.

This means that if you switch jobs, go freelance, or pick a new major medical plan during open enrollment, your gap coverage typically comes right along with you. As long as you keep paying the premiums, your protection remains in place without a hitch.

This portability gives you a consistent, reliable safety net. Life is unpredictable, and your healthcare needs can change in a heartbeat. Knowing your supplemental coverage is always there, regardless of your job or primary insurer, offers incredible peace of mind. It ensures a critical piece of your financial protection is ready to fill the gaps whenever you need it.

Navigating the complexities of health insurance can be challenging, but you don't have to do it alone. At My Policy Quote, we specialize in helping individuals and families find the right coverage to fit their unique needs and budget. Explore your options and get a personalized quote today at https://mypolicyquote.com.