Think of catastrophic health insurance as your financial "break glass in case of emergency" kit. It’s designed to be a safety net for the absolute worst-case scenarios, offering low monthly premiums in return for a very high deductible.

These plans are really built for a specific type of person: generally healthy, under 30, who doesn't expect to need much medical care but wants protection from a major, bank-breaking event like a sudden illness or a serious accident. They aren't meant for covering your routine doctor's visits or prescriptions.

What Is a Catastrophic Health Insurance Plan?

Let's use an analogy. Your car insurance probably has a deductible. You wouldn't make a claim for a small scratch you could buff out yourself, but you’d be incredibly relieved you have coverage if you were in a major pile-up. That's exactly how catastrophic health plans work—they're a powerful shield against a medical disaster, not for life's little bumps and scrapes.

Because of this unique structure, these plans are meant for a pretty narrow audience. They boast some of the lowest monthly premiums you'll find on the Health Insurance Marketplace, which can be a huge relief if you're on a tight budget. But that affordability comes with a very big string attached.

Understanding the High-Deductible Trade-Off

The defining feature of a catastrophic plan is its sky-high deductible. For 2024, that deductible is a whopping $9,450 for an individual.

This means you are on the hook for all of your medical costs until you've paid that full amount out of your own pocket. It's a significant financial hurdle.

Think of the deductible as your share of the risk. Once you've paid it, your insurance company swoops in and typically covers 100% of your essential health benefits for the rest of the year.

This structure makes it a bit of a gamble. If you're young, healthy, and your doctor barely knows your name, paying a tiny premium for "just-in-case" coverage feels like a smart financial play. It protects you from the six-figure medical bills that can pop up after major surgery or a sudden, severe diagnosis.

Core Features and Benefits

Even with that massive deductible, these plans aren't totally bare-bones. Thanks to the Affordable Care Act (ACA), they have to cover certain essential health benefits, giving you a solid baseline of protection.

Here's what you still get:

- Preventive Care: Even before you hit your deductible, these plans cover a specific list of preventive services at no extra cost to you.

- Primary Care Visits: They're also required to cover at least three primary care visits per year, separate from the deductible.

- Financial Ruin Protection: This is the big one. The main benefit is saving you from financial devastation after an unexpected health crisis.

At their core, these plans exist to shield you from the astronomical costs of a major accident or illness. They've been part of the ACA since 2014, providing a minimum level of coverage while capping your out-of-pocket spending for those true catastrophes. It's no surprise that the vast majority of people enrolled in them are under 30.

Deciding if this trade-off makes sense for you means taking a hard, honest look at your personal health risks and your budget. For those who feel this might be too much of a gamble, you might want to check out our guide on finding budget-friendly health coverage with different kinds of cost-sharing.

How to Qualify for a Catastrophic Plan

Unlike most health plans on the Marketplace that anyone can buy, catastrophic plans aren't open to everyone. You can’t just decide you want one; you have to meet one of two specific requirements to even be allowed to enroll.

The most common way to qualify is based on your age. If you're under the age of 30 at the start of the plan year, you’re generally good to go. The thinking here is that younger people are, statistically speaking, healthier and less likely to need frequent, expensive medical care, which makes them a good fit for this kind of high-deductible safety net.

For many young adults, this is a way to secure a financial backstop, much like how they might evaluate other long-term protections. If you're weighing your options, it can be useful to explore questions like "is life insurance worth it if you're young" to get a fuller picture of your financial well-being.

But what if you’ve already celebrated your 30th birthday? Don't worry, there's still a path to eligibility—it just involves a few more steps.

Qualifying Through an Exemption

If you are 30 or older, your only ticket into a catastrophic plan is by securing a special exemption from the Health Insurance Marketplace. There are two types: a hardship exemption or an affordability exemption. These are designed for people whose life circumstances make it incredibly difficult, or even impossible, to afford standard health insurance coverage.

You can't just pick a catastrophic plan and claim an exemption later. You have to apply for and be granted one before you can purchase the plan.

Key Takeaway: You have to go through the official Marketplace application process to get an approved exemption certificate. Only then can you use that certificate to enroll in a catastrophic plan.

So, what counts as a hardship? Here are some of the most common situations that might get you approved:

- You’re experiencing homelessness.

- You’re facing eviction or foreclosure in the near future.

- You've filed for bankruptcy in the last six months.

- You're carrying significant medical debt from the last 24 months.

- A natural or human-caused disaster (like a fire or flood) has substantially damaged your property.

- You were deemed ineligible for Medicaid only because your state did not expand its program.

An affordability exemption is a bit more straightforward. You can get one if the cheapest Bronze plan available to you would cost more than 7.97% of your household income. This rule exists to make sure people aren't priced out of coverage entirely. Just remember, enrollment usually happens during the annual Open Enrollment Period, so timing is everything.

What Your Plan Covers Before You Meet Your Deductible

Let's get practical. What does it actually feel like to have a catastrophic plan when life happens? Say you twist your ankle during a weekend soccer game or get knocked flat by a nasty flu. What’s the financial fallout?

With a catastrophic plan, you're on the hook for nearly all of your medical care at the start. That means the emergency room visit, the specialist appointment, the prescription drugs—the bills come directly to you. This goes on until you’ve paid enough out-of-pocket to hit your plan's towering annual deductible.

But it’s not all on you. Thanks to the Affordable Care Act (ACA), these plans have a crucial exception built right in, ensuring you get some basic care without paying a cent.

Free Preventive Care and Doctor Visits

Even with that huge deductible looming, your catastrophic plan is required to cover specific preventive health services at 100%. That’s right—completely free to you. This lets you get your annual physical, important health screenings, and immunizations without opening your wallet.

On top of that, these plans must cover at least three primary care visits per year before you've hit your deductible. This is a huge help. It gives you a lifeline for routine check-ups or when you have a minor health issue that doesn't warrant an ER trip. You can actually build a relationship with a primary care doctor, even on a “just-in-case” plan.

These free services offer a foundation of essential care, but it's vital to remember they are the exceptions. For anything more serious, you'll be paying out-of-pocket until you reach that financial tipping point.

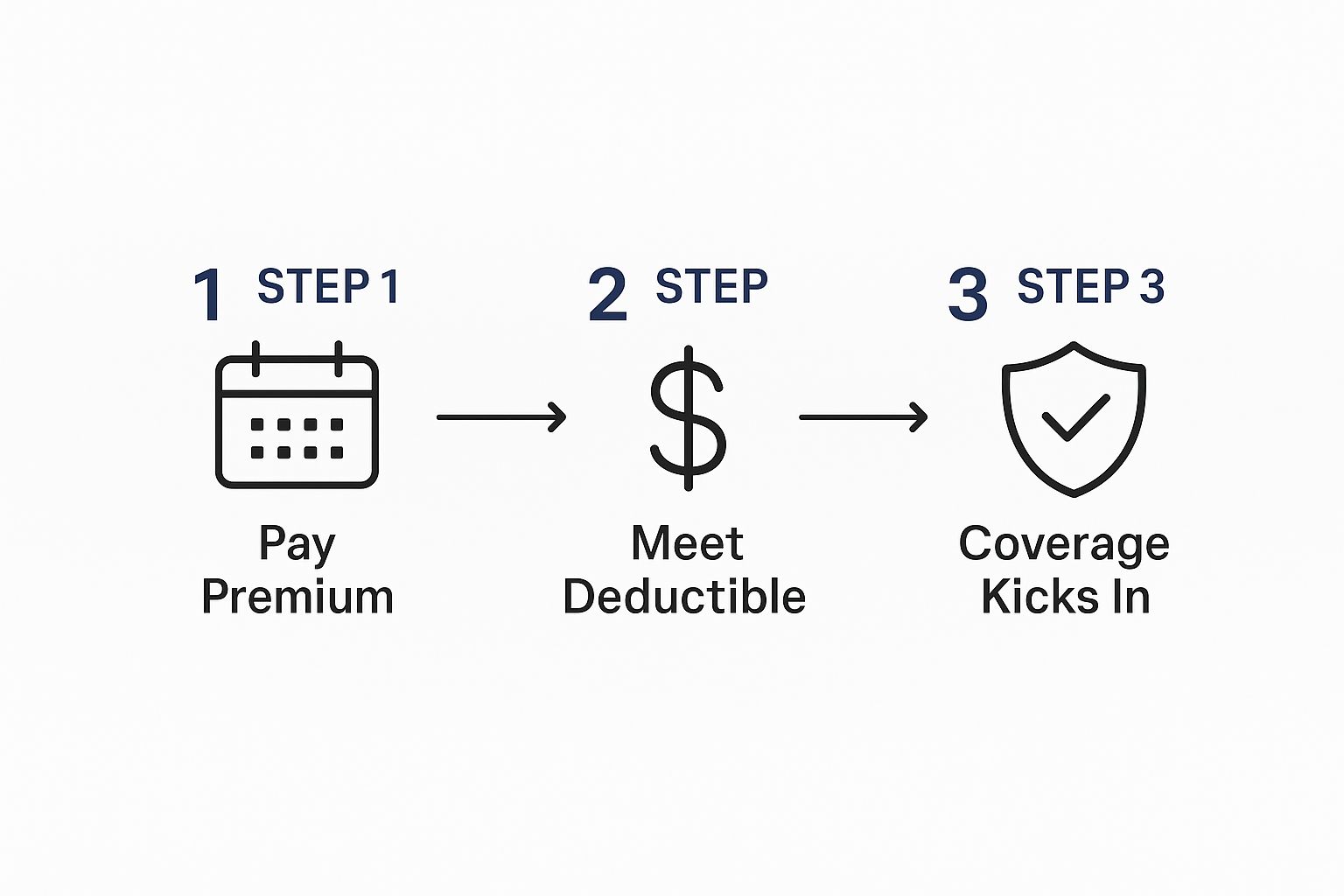

The cost flow is straightforward: you pay a monthly premium to keep the plan active, you cover your own medical bills until the deductible is met, and then your insurance swoops in to handle the rest.

This image lays out the basic financial journey you'd take with a catastrophic plan.

As you can see, that deductible is the main financial hurdle you have to clear before the real protection kicks in.

The Moment You Meet Your Deductible

So, what happens when the "catastrophe" in catastrophic health insurance actually strikes? This is the moment your medical bills pile up high enough to finally meet that deductible. For 2024, that magic number is $9,450 for an individual. Once you've officially paid that much for covered services, your financial reality does a complete 180.

To see this shift in action, let's look at how your costs change.

Your Costs Before and After the Deductible

| Medical Service | Your Cost (Before Deductible) | Your Cost (After Deductible) |

|---|---|---|

| Emergency Room Visit for a Broken Arm | You pay the full negotiated rate (e.g., $3,000) | $0 |

| MRI Scan | You pay the full negotiated rate (e.g., $1,500) | $0 |

| Surgery | You pay the full negotiated rate (e.g., $15,000) | $0 (after your initial $9,450 is met) |

| Prescription for an Infection | You pay the full drug cost (e.g., $50) | $0 |

This table shows just how dramatic the change is. Before meeting the deductible, you bear the full cost. Afterward, the plan takes over completely for covered services.

From that point forward for the rest of the year, your catastrophic plan pays 100% of the costs for all covered essential health benefits.

This is the entire point of the plan. It's your ultimate financial backstop. Whether you need a long hospital stay, a complex surgery, or expensive treatments for a major illness, you won’t pay another dime for covered care that year. You are shielded from the kind of medical debt that can derail a person's life.

Understanding this flow—from paying for most things yourself to having total coverage after a major health event—is the key to seeing both the risks and the powerful protection these plans provide.

The Pros and Cons of Catastrophic Coverage

Choosing a health plan often feels like walking a tightrope between what you can afford and what you’re covered for. Catastrophic health insurance plans sit at one end of that spectrum, offering a unique blend of benefits and some pretty significant drawbacks. So, is this high-risk, high-reward approach the right call for you?

Ultimately, this is a deeply personal financial decision. To make the right choice, you have to be brutally honest with yourself and weigh the upsides against the very real risks. Let's break down both sides of the coin.

The Upside of Catastrophic Plans

The biggest draw of a catastrophic plan comes down to one thing: very low monthly premiums. This can free up hundreds of dollars in your monthly budget, which is a massive win if you’re young, healthy, and watching every penny.

But it’s not just about the monthly savings. You also get a different kind of financial breathing room—peace of mind. You’re on the hook for routine stuff, sure, but you’re protected from the single greatest threat in the American healthcare system: medical bankruptcy.

A catastrophic plan acts as your ultimate financial backstop. You know that no matter what unexpected health crisis comes your way, there is a hard ceiling on your medical spending for the year.

This protection is invaluable. A bad car accident or a sudden, serious illness can easily rack up six-figure medical bills. Having a catastrophic plan in your back pocket means one terrible day won’t completely derail your financial future. It’s a powerful safety net for true worst-case scenarios.

The Downside and Its Significant Risks

Now for the flip side, and the trade-offs here are steep. The most glaring drawback is that massive deductible. For 2024, this is set at $9,450. You have to pay this entire amount out of your own pocket before your insurance covers anything beyond those few free primary care visits and preventive screenings.

This means you’re essentially self-insuring for every routine or moderate health issue. A broken arm, a nasty bout of pneumonia, or needing to see a specialist could set you back thousands of dollars before your plan’s real protection kicks in. This high barrier can, unfortunately, lead people to put off necessary medical care just to avoid the cost.

Another major disadvantage is the lack of financial help. This is a critical point that many people miss:

- No Premium Tax Credits: You cannot use Marketplace subsidies (also called Premium Tax Credits) to lower the monthly premium on a catastrophic plan.

- No Cost-Sharing Reductions: You’re also locked out of cost-sharing reductions, which are special subsidies that lower deductibles and copays on Silver-tier plans.

This is a huge deal. Depending on your income, you might discover that a subsidized Bronze or Silver plan is actually cheaper than a full-price catastrophic plan once you factor in the available financial aid. Many people are surprised by the ways health insurance can interact with their finances, and you can explore more about health insurance tax benefits that might apply to other types of plans.

In the end, choosing a catastrophic plan is a calculated gamble. You're betting that you'll stay healthy enough to avoid hitting that sky-high deductible, all while enjoying the low monthly premium. For the right person, it’s a savvy financial move. For the wrong person, it can be a very costly mistake.

Calculating the True Cost of Your Plan

The super-low monthly premium is what draws most people to catastrophic health insurance. It looks like a bargain, but that number is only the tip of the iceberg. To really know what you're signing up for, you have to look past that initial price tag and figure out your total financial exposure for the year.

This is more critical than ever, with medical costs always seeming to climb. One recent report, the 2025 WTW Global Medical Trends Survey, projects that medical expenses in North America will jump by an estimated 8.7% in 2025. This steady rise is exactly why understanding the full picture of a high-deductible plan is so important.

The Total Exposure Formula

Thinking about your plan's cost isn't just about what you pay each month. It's about what you could be on the hook for in a worst-case scenario. It's a simple bit of math, but it's one of the most important calculations you can make.

Here’s the straightforward formula to find your total potential out-of-pocket cost for the year:

(Monthly Premium x 12) + Plan’s Out-of-Pocket Maximum = Your Total Annual Financial Risk

Let's walk through an example. Say your catastrophic plan has a $250 per month premium and the 2024 out-of-pocket maximum of $9,450. Here's how it breaks down:

- Annual Premiums: $250 x 12 = $3,000

- Maximum Out-of-Pocket: $9,450

- Total Potential Cost: $3,000 + $9,450 = $12,450

That $12,450 is the absolute most you would have to spend on healthcare for the entire year, combining what you pay to have the plan and what you pay for care. It's a big number, for sure, but knowing it is the first step to responsible financial planning. This helps you honestly assess if you have the savings to cover that massive deductible before your insurance kicks in. To explore this trade-off further, check out our guide on health insurance vs. personal savings.

Catastrophic vs. a Subsidized Bronze Plan

Now, here’s where things get really interesting. Catastrophic plans aren't eligible for the premium tax credits (subsidies) offered through the Health Insurance Marketplace. But you know what is? Bronze plans.

This creates a scenario where, for some people, a subsidized Bronze plan could actually be cheaper and provide better coverage from day one.

Key Insight: Always compare a full-price catastrophic plan against a subsidized Bronze plan. The "cheapest" plan isn't always the one with the lowest sticker price.

Think about it. What if your income qualifies you for a subsidy that drops a Bronze plan's premium to just $150 per month? Even if its deductible is a bit lower, your total annual cost could easily come in under the catastrophic plan's total risk. The lesson is clear: you have to look beyond the premium to see your true financial picture and make the smartest choice for your wallet.

Your Top Questions About Catastrophic Plans, Answered

Even with all the details laid out, catastrophic plans can still feel a bit confusing. They’re a pretty specific tool in the healthcare world, and it’s completely normal to have some lingering questions before you commit.

Let’s clear the air and tackle the most common things people ask. My goal here is to give you straight, practical answers so you can figure out if this high-deductible safety net is truly the right move for you.

Can You Use an HSA With a Catastrophic Plan?

This is a big one, and the answer is a straightforward no. You are not allowed to contribute to a Health Savings Account (HSA) if your only health coverage is a catastrophic plan.

While it seems like they should go together—they both involve high deductibles, after all—the IRS has very specific rules. To be “HSA-eligible,” a health plan must be officially classified as a High-Deductible Health Plan (HDHP). Catastrophic plans, for all their similarities, just don't have that official designation.

This is a major trade-off to consider. If having an HSA to save pre-tax money for medical bills is a top priority for you, you'll need to skip the catastrophic plan and look for a qualifying Bronze or Silver HDHP instead.

Are Catastrophic and High-Deductible Plans the Same Thing?

It’s easy to get these two mixed up, but they are definitely not the same. They share the key feature of a high deductible, but that’s where the similarities end.

Think of it this way: all catastrophic plans are high-deductible plans, but not all high-deductible plans are catastrophic plans.

Here’s the real difference:

- Catastrophic Plans: A special category with very strict eligibility rules (you must be under 30 or have a hardship exemption). They are also never eligible for premium tax credits. The deductible is always pegged to the maximum out-of-pocket limit for the year.

- High-Deductible Health Plans (HDHPs): This is a much broader category of plans, often found at the Bronze or Silver metal levels. Anyone can buy an HDHP, they are often eligible for subsidies, and many of them are compatible with HSAs.

The distinction really matters because you might find a standard HDHP that gives you more flexibility or even costs you less out-of-pocket once government subsidies are factored in.

What Happens When You Turn 30?

This is a huge point of anxiety for young adults who rely on a catastrophic plan. The good news? Your plan won't suddenly vanish on your 30th birthday. If you qualified based on your age, you get to keep that plan for the entire calendar year.

Once that plan year is over, though, you can no longer sign up for another catastrophic plan based on your age.

When the next Open Enrollment period rolls around, you’ll have a choice to make. You’ll either need to qualify for a hardship or affordability exemption to get another catastrophic plan or switch to a different kind of coverage, like a traditional Bronze or Silver plan.

Your 30th birthday really acts as a trigger to take a fresh look at your health insurance needs and budget.

Is a Catastrophic Plan Better Than Being Uninsured?

From a financial safety perspective, the answer here is a loud and clear yes.

Going without any health insurance is one of the most dangerous financial gambles you can take. A single bad fall, a car accident, or an unexpected diagnosis can bury you in medical bills that could follow you for the rest of your life.

A catastrophic plan is your financial backstop. It puts a hard, predictable ceiling on how much you could possibly spend on medical care in a year. Yes, you have to cover your own costs until you hit that high deductible, but you are completely protected from the kind of six-figure bills that lead to bankruptcy.

It’s a critical safety net that prevents a worst-case health emergency from turning into a lifelong financial disaster.

Navigating the world of health insurance can be complex, but you don't have to do it alone. At My Policy Quote, we specialize in helping individuals and families find the right coverage for their unique needs and budget. Whether you're self-employed, an early retiree, or just looking for a better option, we can help you compare plans and make a confident choice. Find your personalized insurance quote today on mypolicyquote.com.