Yes, you absolutely can use COBRA when you retire, but it’s crucial to understand that it's a temporary stopgap, not a permanent healthcare plan for your golden years. Think of COBRA for retirees as a short-term healthcare bridge. It lets you keep the exact same health plan you had with your employer, giving you some breathing room to transition to a more permanent solution like Medicare.

What Is COBRA and How Does It Help Retirees

Retirement is a huge life milestone, and with it comes the major task of sorting out your health insurance. This is where COBRA comes in. It’s not some new insurance company or a different kind of plan; it's a federal law that prevents you from suddenly losing coverage during big life changes.

Your retirement is what’s known as a “qualifying event.” This is the official trigger that makes you eligible for COBRA. Once that happens, you, your spouse, and any dependent children become “qualified beneficiaries,” which is just a formal way of saying you all have the right to choose this continuation coverage.

A Bridge to Your Next Health Plan

I like to think of COBRA as a sturdy bridge over what could otherwise be a scary gap in your healthcare journey. On one side, you have your job with its employer-subsidized benefits. On the other, you have your long-term retirement healthcare, which for most folks is Medicare. COBRA is the temporary path that gets you safely across without falling into a period of being uninsured.

This is a lifesaver if you decide to retire a few months—or even up to a year—before you turn 65 and become eligible for Medicare. It lets you keep your familiar doctors, prescriptions, and network while you get all your ducks in a row for the next chapter.

COBRA is all about continuity of care. It allows you to stick with the health plan you already know and trust, which can be a huge relief if you're in the middle of treatment or just don't want the hassle of finding new doctors right after retiring.

For a quick overview of how COBRA fits into the retirement puzzle, here's a simple breakdown.

COBRA for Retirees at a Glance

| Feature | What It Means for a Retiree |

|---|---|

| Coverage Type | Continuation of your exact former employer's health plan. |

| Eligibility Trigger | Retirement from your job is a "qualifying event." |

| Duration | Typically up to 18 months of continued coverage. |

| Cost | You pay the full premium plus a 2% administrative fee. |

| Best Use Case | A temporary bridge to Medicare or another long-term plan. |

This table highlights the key takeaway: COBRA is a fantastic short-term tool, but its cost and limited duration mean you need a long-term strategy.

Understanding the Financial Reality

While COBRA offers seamless coverage, it comes with a hefty price tag. This is often the biggest shock for new retirees. The law lets you keep your plan, but you're now responsible for 100% of the premium—including the share your employer used to pay—plus a small administrative fee.

Under the Consolidated Omnibus Budget Reconciliation Act of 1985, you can generally keep your coverage for up to 18 months by paying the full premium plus a 2% fee. This is why it’s so important to see COBRA as a short-term fix. As you map out your healthcare strategy, you have to weigh this expense against other options.

For many, the smart move is using COBRA for a few months while finalizing a solid Medicare plan. To get a head start on that, you might find our guide on the best Medicare Supplement Plan options helpful.

Navigating COBRA Eligibility and Enrollment Deadlines

When it comes to securing COBRA, understanding your eligibility and the strict deadlines is absolutely everything. Think of it like trying to catch a train that runs on a razor-thin schedule—if you miss your boarding window, that train is gone for good. There are no second chances, so getting a handle on the rules is non-negotiable.

So, who qualifies? The main requirement for a retiree is simple: you had to be an active participant in your company’s group health plan the day before you retired. You can't decide to join the plan after you’ve already packed up your desk.

It's also important to remember that the health plan itself has to stick around. If your former company goes out of business or cancels its health plan for all remaining employees, your COBRA lifeline disappears right along with it.

The Unforgiving 60-Day Clock

The COBRA process kicks off with a specific chain of events. First, your employer has 30 days after your retirement to tell the plan administrator about your departure. From there, the plan administrator has another 14 days to get the official COBRA election notice and paperwork in the mail to you.

Once that packet lands in your mailbox, the real countdown begins. You have a 60-day window to decide if you want COBRA and to send in your forms. This is a hard-and-fast deadline. If you miss it by a single day, you permanently lose your right to COBRA.

Key Takeaway: The 60-day election period is set in stone. Missing this deadline means you forfeit your COBRA rights entirely. Circle the date on your calendar and make it your top priority once you receive that notice.

Let's say you retire on June 30th. Here's how the timeline might unfold:

- Your Employer's Job: They have until July 30th to notify the plan administrator.

- The Administrator's Job: They have until August 13th to mail your election notice.

- Your Job: The moment you receive that notice, your personal 60-day clock starts ticking.

This sequence is designed to give you a fair shot at making a smart decision, but the ball is ultimately in your court.

Special Cases That Extend Coverage

While the standard COBRA runway is 18 months, certain situations can give you a bit more time—a critical detail for some retirees. The biggest extension is tied to disability.

If you, your spouse, or a dependent is deemed disabled by the Social Security Administration (SSA) within the first 60 days of starting COBRA, you might qualify for an 11-month extension. This brings your total potential coverage up to 29 months.

To get this extension, you have to notify the plan administrator of the SSA's disability determination within 60 days of receiving it. This longer coverage period can be an invaluable bridge for anyone who needs health insurance before Medicare kicks in, especially if a disability crops up right after retiring.

Making Your First Payment

Signing up for COBRA is just step one; you also have to pay for it. After you send in your election form, you have 45 days to make your first premium payment. This first check is retroactive, meaning it has to cover the time all the way back to when your employer's plan ended.

For example, if your company coverage ended June 30th and you officially elect COBRA on August 15th, that first payment will need to cover the premiums for both July and August. After that, your payments are due monthly. Missing a payment deadline is just as serious as missing the election deadline—it can get your coverage canceled, so stay on top of those due dates.

Understanding the True Cost of COBRA Coverage

When we talk about COBRA for retirees, the first thing that comes up—almost every single time—is the cost. It’s a real shock to the system for most people. While you were working, your paycheck probably showed a pretty reasonable deduction for health insurance. What you didn't see was the huge chunk your employer was paying on your behalf. That benefit vanishes the second you clock out for good.

Suddenly, you're on the hook for the entire premium. Let's say your plan's total monthly cost was $1,500. As an employee, maybe you only paid $400 of that, while your company generously picked up the remaining $1,100. With COBRA, that $1,100 subsidy disappears overnight, and the full bill lands squarely in your lap.

But wait, it gets a little worse. On top of covering the full premium, the law allows the plan administrator to tack on an extra 2% administrative fee. So you’re not just paying what your employer paid; you're paying a little bit more. This is exactly why COBRA has a reputation for being a very expensive, temporary bridge.

The sticker shock from COBRA comes down to one simple fact: you are now responsible for 102% of the total health insurance premium. That’s the full cost of the plan, plus that 2% fee for the trouble of administering it.

Putting the Cost into Perspective

Okay, let's move from theory to reality. What does this actually look like in dollars and cents? The price of COBRA coverage can be all over the map, depending on how rich your plan is, where you live, and if you’re covering just yourself or a whole family. The one constant, though, is that the price jump is always dramatic.

Here’s a pretty common scenario to illustrate the financial hit:

- What you paid as an employee (individual plan): $250 per month

- The actual total cost of the plan: $800 per month

- Your new COBRA premium: Up to $816 per month ($800 + the 2% fee)

And if you have a family plan, the increase is even more staggering:

- What you paid as an employee (family plan): $600 per month

- The actual total cost of the plan: $2,100 per month

- Your new COBRA premium: Up to $2,142 per month ($2,100 + the 2% fee)

Seeing those numbers in black and white makes it crystal clear why careful budgeting is non-negotiable. You have to be absolutely sure you can absorb this massive new expense into your retirement budget. It’s the main reason most people only lean on COBRA for a few months while they sort out a more permanent, affordable health plan.

A Silver Lining: The Health FSA Continuation

While the cost of the medical plan itself is sky-high, there’s a little-known feature of COBRA that can offer a bit of financial relief. If you were contributing to a Health Flexible Spending Account (FSA) at your job, you might be able to keep it going through COBRA. This is a fantastic way to use up those pre-tax dollars after you’ve already left your job.

As you probably know, an FSA lets you set aside money pre-tax to cover out-of-pocket medical expenses. The big catch with FSAs is the "use-it-or-lose-it" rule—if you don't spend the money by the end of the plan year, it's gone. If you retire in June, you could end up forfeiting hundreds or even thousands of dollars you already contributed.

This is where COBRA can be a lifesaver. The law doesn't just apply to health insurance; it also covers health-related FSAs. This means you can elect COBRA specifically for your FSA to keep it active. For example, say you put $1,000 into your FSA for the year but retired without making any claims. You could continue your FSA with COBRA. In one case study, the monthly premium was about $85, which allowed the retiree to spend down their remaining balance. You can get more details on how COBRA works with FSAs from newfront.com.

This can be a really savvy financial move. You pay a relatively small premium to keep the account open, giving you access to the rest of your pre-tax funds for qualified medical expenses. You're essentially recovering money you would have otherwise lost. Always read your COBRA notice carefully to see if this is an option for you.

Comparing COBRA Against Your Other Healthcare Options

Choosing your healthcare coverage after retiring isn't just another item on a checklist. It's a major financial decision that will shape your budget and peace of mind for years to come. You've got a few different paths you can take, and each has its own set of rules, costs, and perks. Figuring out how COBRA for retirees stacks up against the other big players is the first step to making a choice you feel good about.

For most folks heading into retirement, the main contenders are COBRA, Medicare, and plans from the Affordable Care Act (ACA) Marketplace. COBRA has the advantage of familiarity—letting you hang onto the same plan you had at work—but it’s almost always the priciest option and it's strictly temporary. That's why we need to compare them head-to-head.

The Big Three Healthcare Choices for Retirees

Let's lay these options out side-by-side to get a clear picture of what you're really dealing with. Think of it like choosing a car for the next chapter of your life. One might be a powerful but gas-guzzling truck (COBRA), another a reliable and efficient sedan (Medicare), and the third a flexible compact car that might come with a discount (ACA Marketplace).

- COBRA: This offers a seamless transition. You get to keep your doctors, your network, and your prescription coverage exactly as they were. The catch? You're on the hook for 102% of the full premium, which makes it a very expensive short-term bridge.

- Medicare: This is the cornerstone of healthcare for most Americans age 65 and older. It's a long-term, government-backed program with premiums that are typically much lower than COBRA, though you’ll still have your own deductibles and coinsurance to manage.

- ACA Marketplace Plans: If you retire before you hit 65, the ACA Marketplace is an essential lifeline. It allows you to shop for an individual plan, and depending on your retirement income, you could qualify for hefty subsidies that make your coverage way more affordable than COBRA.

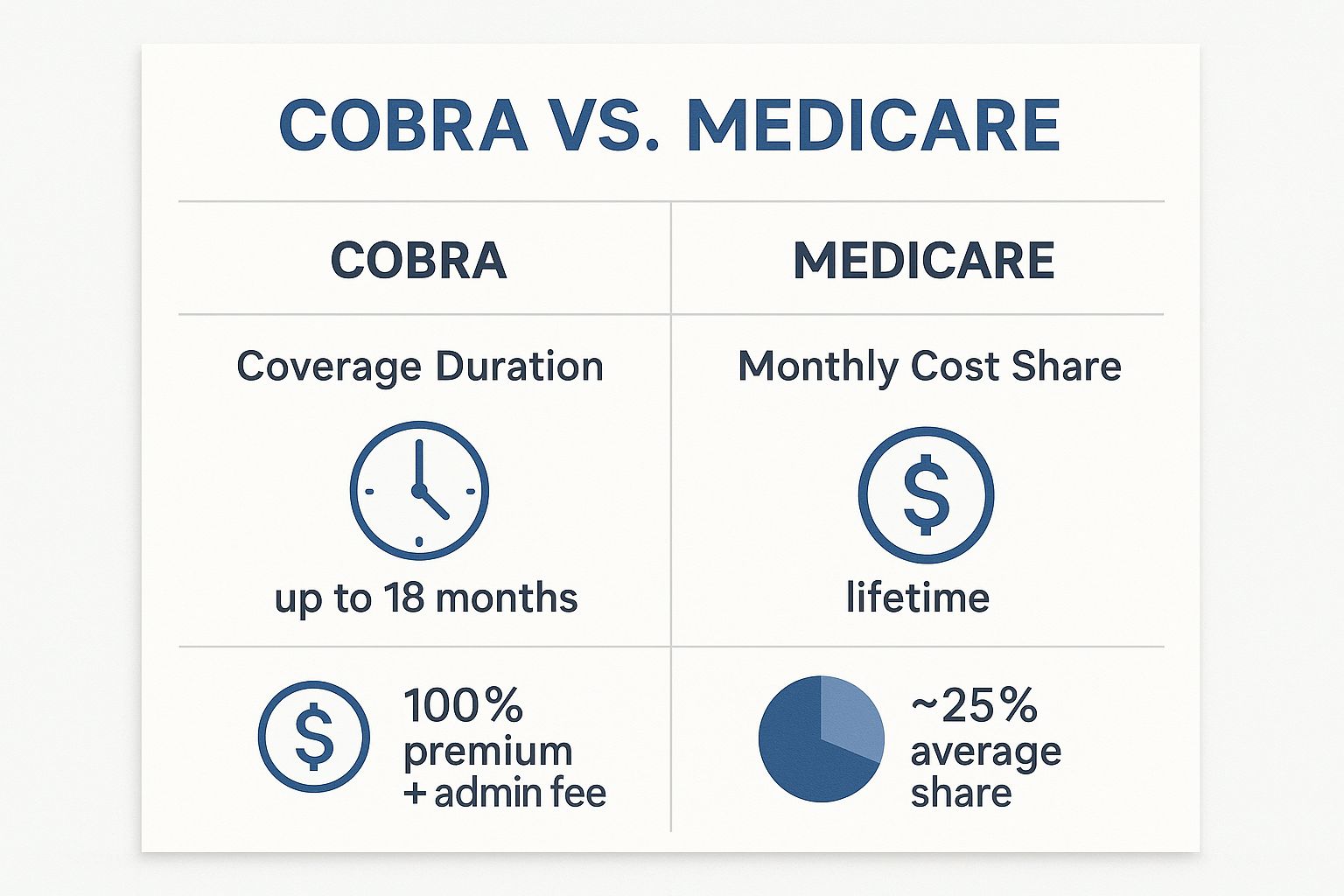

This chart really drives home the fundamental differences in cost and how long each option lasts.

As you can see, COBRA is a short-term, high-cost fix. Once you're eligible, Medicare provides a much more affordable and permanent solution.

To help you sort through these crucial differences, we've put together a table that breaks down how each option compares on key factors.

COBRA vs Medicare vs ACA Marketplace Plans

| Factor | COBRA | Medicare | ACA Marketplace Plan |

|---|---|---|---|

| Eligibility | Loss of job-based coverage (qualifying event). Not age-dependent. | U.S. citizen or legal resident, age 65 or older, or with certain disabilities. | Any U.S. citizen or legal resident. Not based on age. Ideal for early retirees under 65. |

| Cost | Highest cost. You pay 100% of the premium plus a 2% admin fee. No subsidies. | Lower cost. Part A is often premium-free. Part B has a standard monthly premium. | Cost varies. Premiums can be significantly reduced by income-based subsidies. |

| Coverage Continuity | Excellent. You keep the exact same plan you had with your employer. | Requires new plan selection. You must choose Parts, potentially a Medigap or Advantage plan. May require changing doctors. | Requires new plan selection. You choose a new plan from the Marketplace. You may need to change doctors or networks. |

| Duration | Temporary. Typically lasts for 18 months, sometimes up to 36 months for dependents. | Lifelong. Provides permanent coverage for as long as you are eligible. | Ongoing. Coverage continues as long as you pay premiums. Ideal for bridging the gap to Medicare. |

This comparison makes it clear that while COBRA offers convenience, its high cost and temporary nature make it a specialized tool rather than a long-term strategy for most retirees.

The Critical Interaction Between COBRA and Medicare

Okay, this is where things get tricky, and where a lot of retirees accidentally make a very costly mistake. You absolutely have to understand how COBRA and Medicare work together—or rather, how they don't. Getting the timing wrong can trigger some serious, lifelong financial penalties.

Here’s the most important thing to remember: Medicare does not view your COBRA coverage as the same as active employer coverage.

This little technicality has massive consequences. When you turn 65, you get a seven-month Initial Enrollment Period to sign up for Medicare Part B. If you decide to stick with COBRA instead and put off enrolling in Part B, you could get slapped with a lifelong late enrollment penalty when you finally do sign up. That penalty is tacked onto your Part B premium for the rest of your life.

Warning: Choosing to keep COBRA instead of enrolling in Medicare Part B when you first become eligible at 65 can trigger permanent late enrollment penalties. Losing your COBRA coverage later does not grant you a Special Enrollment Period to sign up for Part B penalty-free.

For example, say you turn 65 and become eligible for Medicare, but you really like your current plan and decide to keep it through COBRA for 18 months. When that COBRA runs out, you’ve blown past your initial window to get Medicare Part B. You'll now have to wait for the next General Enrollment Period and will almost certainly pay a higher premium forever.

Considering a Spouse's Coverage

Another piece of the puzzle is your spouse's situation. If you're 65 but your spouse is younger—say, 61—your healthcare decision has a direct impact on them. Your enrollment in Medicare counts as a qualifying life event, which can allow your spouse to stay on COBRA for up to 36 months. This can be a smart, strategic move to bridge their coverage gap until they become eligible for Medicare themselves.

This is a complex area, and mapping out the best path requires careful planning. If you want a deeper dive into the fundamentals of picking a plan, check out our guide on how to choose health insurance for smart coverage. It provides a solid framework for weighing your options based on your personal needs and budget, helping you prevent expensive headaches down the road.

Your Personal COBRA Decision Checklist

Alright, let's get practical. Moving from knowing what COBRA is to deciding if it's right for you requires a hard look at your own situation. There's no single right answer here; it all comes down to how this temporary coverage fits into your specific retirement plan.

Think of this as your pre-flight check before you launch into retirement. By walking through your health, your finances, and your family's needs one by one, you can make a confident call on whether COBRA for retirees is a smart tactical move or if another path makes more sense right from the start.

Assess Your Health and Medical Needs

First things first: be honest about your current and future health needs. This is where COBRA’s biggest perk—keeping your exact same insurance—can be a total game-changer, but only if it matches your reality.

Are you or your spouse in the middle of treatment with a team of doctors you trust? If the answer is yes, then switching to a new insurance plan with a different network could be a massive headache. In that case, paying the steep COBRA premium for a few months might be a small price to pay for seamless medical care.

The number one reason retirees bite the bullet on costly COBRA coverage is to keep their specific doctors and continue ongoing treatments. Sometimes, the value of uninterrupted care simply outweighs the sticker shock of the monthly premium, especially for a short-term bridge.

On the other hand, if you and your family are in good health with no big medical issues on the radar, that high COBRA price tag becomes much harder to swallow. You could be paying top dollar for access and networks you don't even need, which makes an ACA Marketplace plan a much more sensible and affordable way to bridge the gap to Medicare.

Evaluate Your Financial Runway

Let's talk money, because your budget is the single biggest factor here. As we've seen, COBRA premiums can be a real shock to the system, easily hitting $800 a month for one person or over $2,000 for a family. You need to know for sure if your retirement savings can handle that kind of hit without throwing your long-term financial plans off course.

This is especially important because health spending can be a real wildcard in early retirement. Data shows that about 60% of new retirees see big swings in their spending during the first three years. According to J.P. Morgan's comprehensive retirement guide, that volatility doesn't always go away, with about half of seniors aged 75 to 80 still facing unpredictable year-to-year costs.

To make a solid decision, run the numbers:

- Calculate the Total Cost: Find out your exact monthly COBRA premium and multiply it by how many months you'll need it.

- Review Your Retirement Budget: Can you truly afford this new, large expense, or will it force you to drain your nest egg faster than you planned?

- Compare Against Alternatives: How does that total COBRA cost look when you put it next to a subsidized ACA plan or what you’d pay for Medicare?

Consider Your Age and Medicare Timeline

Your age is a huge piece of the puzzle because it determines your options. The decision looks completely different for someone retiring at 62 than it does for someone hanging it up at 66.

- Retiring Before 65: If you're an early retiree, your main choice is between COBRA and an ACA Marketplace plan. It’s a classic cost-versus-convenience showdown. If your retirement income is low enough to qualify for ACA subsidies, it’s almost guaranteed to be the cheaper route.

- Retiring at or After 65: For those already eligible for Medicare, the choice is pretty clear. You need to sign up for Medicare Part B during your Initial Enrollment Period. Choosing COBRA instead is a classic mistake that can lead to permanent late enrollment penalties—a costly and totally avoidable error.

Factor in Your Spouse and Dependents

Finally, remember this decision isn't just about you; it impacts your whole family. If you have a younger spouse or dependent kids on your plan, COBRA can be a brilliant strategic tool to keep them covered. This is a critical piece of planning your retirement health insurance.

For example, imagine you turn 65 and enroll in Medicare, but your spouse is only 62. They can often use COBRA for up to 36 months, giving them a stable, familiar health plan until they're old enough for Medicare. Using COBRA this way can be the perfect solution to close a tricky coverage gap for a spouse who isn't yet eligible.

Frequently Asked Questions About Retiree COBRA

Even with a good grasp of the basics, navigating the specifics of COBRA for retirees can bring up a lot of questions. It's one thing to understand the concept, but it's another to apply it to your unique situation.

This section tackles the most common questions we hear from retirees. Think of it as a quick-reference guide to help you clear up those nagging doubts and make confident decisions without getting bogged down in confusing jargon.

Can I Choose COBRA for Dental and Vision Only?

Yes, in many cases, you can—and it can be a really smart financial move. If your former employer offered dental and vision as separate, standalone plans, you can typically elect to continue just those benefits through COBRA.

This is a fantastic strategy if you’re moving onto Medicare for your primary health needs but don't want to lose your dental or vision coverage. You get to keep the benefits you want without paying the hefty premium for a full medical plan you no longer need.

The key detail is whether the plans were "bundled." If your dental and vision were simply part of one comprehensive health package, you usually can't cherry-pick. It’s an all-or-nothing deal. Your COBRA election notice is the final word here; it will spell out exactly which benefits you can elect individually.

What Happens to My COBRA When I Turn 65?

This is a critical question where timing is everything. The moment you enroll in Medicare (either Part A or Part B), your eligibility for COBRA usually ends. For the insurance world, Medicare becomes your primary coverage, and that enrollment event terminates your COBRA.

It's absolutely vital to enroll in Medicare as soon as you're eligible around your 65th birthday. If you decide to stick with COBRA and delay signing up for Medicare Part B, you risk getting hit with permanent late enrollment penalties down the road. Why? Because losing COBRA later on does not give you a Special Enrollment Period for Part B.

A common and costly mistake is thinking COBRA counts as "creditable coverage" that lets you delay Medicare Part B without penalty. It does not. To avoid lifelong penalties, you must enroll in Medicare during your Initial Enrollment Period, even if you have COBRA.

There is a silver lining for your family, though. If your spouse or dependents are on your COBRA plan, their coverage can often continue even after you’ve switched to Medicare. They may be able to stay on that COBRA plan for up to 36 months from your retirement date, giving them a much longer runway to find their own coverage.

What if My Old Company Goes Out of Business?

This is an unfortunate situation, but it's important to know how it works. Your COBRA coverage is simply a continuation of your old employer's group health plan. If that company goes out of business and cancels its health plan for everyone, your COBRA coverage will disappear along with it.

COBRA can't exist without an active plan to continue. If the company and its benefits are gone, so is your COBRA.

The good news is you won't be left completely high and dry. The loss of your COBRA coverage because the company plan was terminated is a "qualifying life event." This triggers a Special Enrollment Period (SEP), which gives you a window to buy a new plan on the ACA Marketplace, even if it's outside the normal open enrollment season.

Can I Cancel My COBRA Coverage at Any Time?

Yes, you can drop your COBRA coverage whenever you want. All you need to do is notify your plan administrator in writing that you wish to end your plan.

Be careful with this, though. If you voluntarily cancel your COBRA plan and it's not during a recognized enrollment period (like the annual ACA Open Enrollment), you could create a serious coverage gap for yourself with no way to get a new plan right away.

Generally, you can only move to an ACA plan penalty-free when your standard 18-month COBRA term officially ends. The natural expiration of your COBRA coverage gives you a Special Enrollment Period, allowing you to transition smoothly to a Marketplace plan without any lapse in health insurance.

Navigating these healthcare decisions is a major part of a successful retirement plan. The expert advisors at My Policy Quote are here to help you compare all your options—from Medicare to individual plans—to find the coverage that fits your life and budget. Explore your personalized health insurance options with My Policy Quote today.